By Steve Blumenthal. Originally published at ValueWalk.

“Over the long term, what raises living standards is productivity—the amount that is produced per person—which increases

from coming up with new ideas and implementing ways of producing efficiently. Productivity evolves slowly,

so it doesn’t drive big economic and market moves, though it adds up to what matters most over the long run.”

This is one of the more important pieces I’m sharing with you. It’s a candid look at where we are in the economic cycle and what that likely means for the global markets. Today, you’ll find Ray Dalio’s most recent “Observations” as shared by him in a recent LinkedIn post.

Dalio concludes that the “near term looks good but the long term looks scary.” He takes us on an economic/investment opportunity tour across much of the world. The significant problems are debt and low productivity. As he calls it, a “beautiful” debt deleveraging or an “ugly” deleveraging remains to be seen. I particularly like his direct and candid way. I also like that this information comes not from a Wall Street research department but from the largest hedge fund manager in the world. He has $150 billion of real skin in the game. To me, that’s a view I want to hear.

So, without further ado, let’s jump right in and see what Ray has to teach us. Grab a coffee and find your favorite chair. It’s to the point with supporting charts. I believe worth your time.

When you click through, you’ll find a link to Trade Signals and I conclude with a dad’s proud story about his son… “It’s All About Team.” I hope you find On My Radar helpful for you and your work with your clients. And please feel free to reach out to me if you have any questions.

? If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here. ?

Included in this week’s On My Radar:

- Ray Dalio — Big picture, the near term looks good and the longer term looks scary

- Charts of the Week — Recession Watch Charts

- Trade Signals — S&P 500 2,400, The Trend Remains Bullish for Stocks and Bonds

- Personal Note — It’s All About Team

Ray Dalio — Big Picture, The Near Term Looks Good and The Longer Term Looks Scary

Most of what Ray shared this past week in a LinkedIn post can be summed up in the title above. But I do encourage you to review the entire piece.

If you are not familiar with Ray Dalio, he runs the world’s largest hedge fund – Bridgewater Associates. He is a macro investment manager who looks for opportunities globally. Ray’s been on a mission to teach the world “How the Economic Machine Works.” It is the base template he has used to guide his investment decisions that has lead to his success. He is one of the brightest investment minds I know.

I recommend that your children click the link above and watch the short video. Then, ask them to forward it to their social studies or economics teachers. At the very least, they/we and our largely financially under-educated (said nicely) politicians should learn how the economic system works. Ok, enough preaching on my part… What follows is from Dalio’s LinkedIn post:

Near term looks good, longer term looks scary. That is because:

The economy is now at or near its best, and we see no major economic risks on the horizon for the next year or two.

- There are significant long-term problems (e.g., high debt and non-debt obligations, limited abilities by central banks to stimulate, etc.) that are likely to create a squeeze,

- Social and political conflicts are near their worst for the last number of decades, and

- Conflicts get worse when economies worsen.

So while we have no near-term economic worries for the economy as a whole, we worry about what these conflicts will become like when the economy has its next downturn.

The next few pages go through our picture of the world as a whole, followed by a look at each of the major economies. We recommend that you read the first part on the world picture and look at the others on individual countries if you’re so inclined.

Where We Are Within Our Template

To help clarify, we will repeat our template (see www.economicprinciples.org) and put where we are within that context.

There are three big forces that drive economies: there’s the normal business/short-term debt cycle that typically takes 5 to 10 years, there’s the long-term debt cycle, and there’s productivity. There are two levers to control them: monetary policy and fiscal policy. And there are the risk premiums of assets that vary as a function of changes in monetary and fiscal policies to drive the wealth effect.

The major economies right now are in the middle of their short-term debt cycles, and growth rates are about average. In other words, the world economy is in the Goldilocks part of the cycle (i.e., neither too hot nor too cold). As a result, volatility is low now, as it typically is during such times. Regarding this cycle, we don’t see any classic storm clouds on the horizon. Unlike in 2007/08, we don’t now see big unsustainable debt flows or a lot of debts maturing that can’t be serviced, and we don’t see monetary policy as a threat. At most, there will be a little touching the brakes by the Fed to slow moderate growth a smidgen. So all looks good for the next year or two, barring some geopolitical shock.

At the same time, the longer-term picture is concerning because we have a lot of debt and a lot of non-debt obligations (pensions, healthcare entitlements, social security, etc.) coming due, which will increasingly create a “squeeze”; this squeeze will come gradually, not as a shock, and will hurt those who are now most in distress the hardest.

Central banks’ powers to rectify these problems are more limited than normal, which adds to the downside risks. Central banks’ powers to ease are less than normal because they have limited abilities to lower interest rates from where they are and because increased QE would be less effective than normal with risk premiums where they are. Similarly, effective fiscal policy help is more elusive because of political fragmentation.

So we fear that whatever the magnitude of the downturn that eventually comes, whenever it eventually comes, it will likely produce much greater social and political conflict than currently exists.

The “World” Picture in Charts

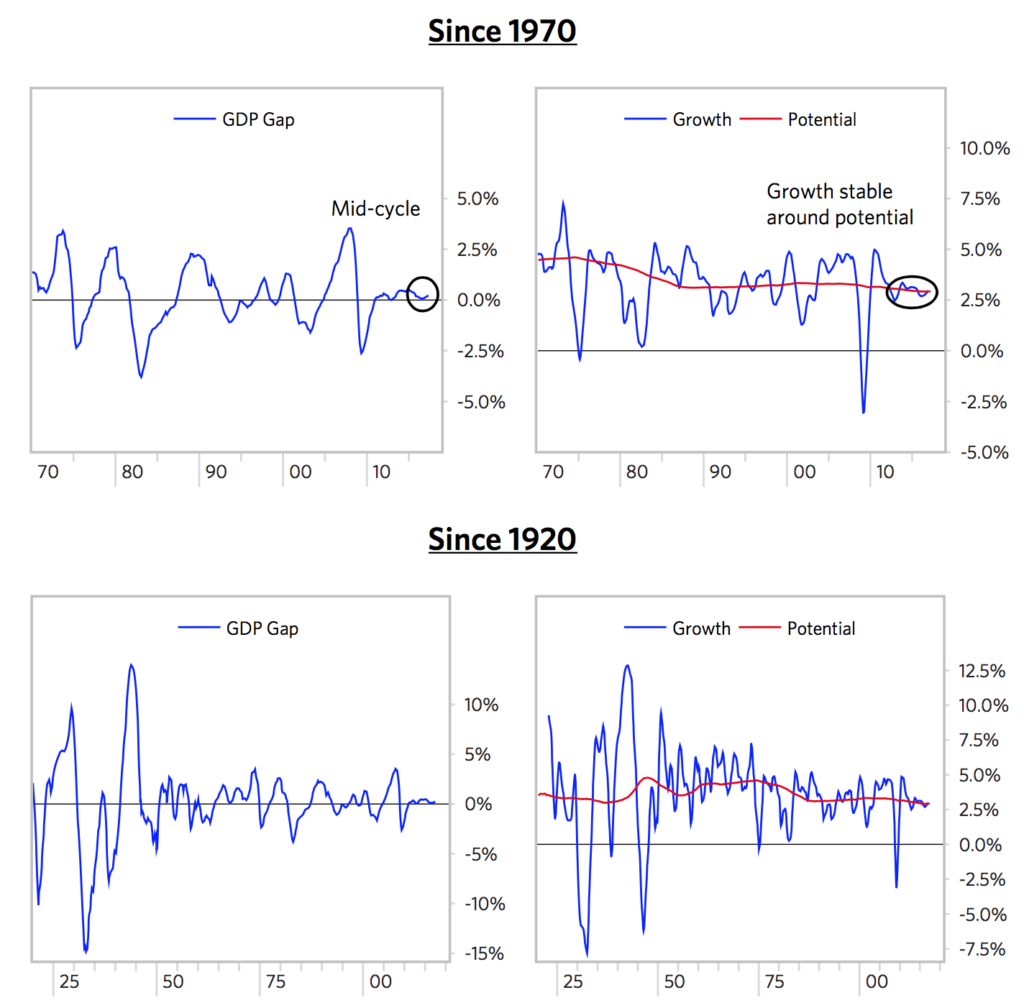

The following section fleshes out what was previously said by showing where the “world economy” is as a whole. It is followed by a section that shows the same charts for each of the major economies. These charts go back to both 1970 and 1920 in order to provide you with ample perspective.

1) Short-Term Debt/Economic Conditions Are Good

As shown below, both the amount of slack in the world economy and the rate of growth in the world economy are as close as they get to normal levels. In other words, overall, the global economy is at equilibrium.

2) Assets Are Pricing In About Average Risk Premiums (Returns Above Cash), Though They Will

The post Ray Dalio —The Longer Term Looks Scary appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.