By Maj Soueidan. Originally published at ValueWalk.

Active vs Passive investing strategy is a hot topic of discussion within the investment community. Passive investment strategies such as the classical market-weighted indexing are gaining in popularity. Since John Bogle started The Vanguard Group in 1974, its assets have grown so substantially that index funds are forecasted to surpass actively managed funds by 2024 according to Moody’s Investor Services.

Vanguard’s John Bogle is praised by Warren Buffett and others as a savior of the system, and there is a case to be made that the index system has left billions of dollars in the pockets of retail investors instead of Wall Street agents. Buffett, a stock picker himself, has also taken a public bet against active management, which he seems to be winning for a variety of reasons.

Recent discussions surrounding active management have focused on the 2-20 fee model (barely exists anymore) for hedge funds and many LPs demand lower fees for active management. The flow into passive strategies has been rapid and seems to be accelerating.

Amid Predictions Revenue Could Tank 50%, Asset Managers Still Unprepared For Mifid II

But what do “active” and “passive” actually mean? There are conflating definitions and, as we will uncover, they mean very different things.

What are the implications of this shift to passive investing, especially for active money managers? Make no mistake about it, if you are an active money manager, especially with sizable assets, passive strategies pose a terrible problem for you because they simply seem to be (and probably are) a better alternative for your clients. This article is an attempt, from an active manager’s point of view, to study the opponent’s patterns and position for outperformance.

The Passive Investing Players

Passive investment strategies come in many forms and can be employed using many different vehicles. Definitions of “passive investments” differ. For example, Investopedia defines passive investing in a much broader sense than Wikipedia, and passive is sometimes equated to “low portfolio turnover” or “buy and hold”. Often times it is arguable if a quantitative strategy is active or passive, and it might be tough to draw a line. Shockingly, many discussions on active vs passive management do not even bother to define the terms. Clearly, the terms have to be defined before a sensible discussion can take place. A sensible definition has to focus on the process by which decisions are made, rather than derivatives of the process, such as trading pace and costs.

When you narrow it down, there are really two ways to contrast active and passive investing and they don’t conceptually overlap. At first, it might be useful to separate them before looking at them in combination.

One could say that passive investing is:

“An investment strategy that attempts to reflect a chosen market’s return on a risk-adjusted basis.”

In contrast to active investing:

“An investment strategy that attempts to achieve better risk-adjusted returns than a benchmark or does not have a benchmark.”

On the other hand, quite literally interpreted, passive investing can be defined as:

“An investment strategy that attempts to minimize costs.”

In contrast to:

“An investment strategy that incurs a lot of costs.”

What is the right definition, and can we combine these two perspectives? We will find out that the first aspect laid ground for passive investing strategies, but the secret to net outperformance might lay in the latter.

While the first definition is general and should always be applicable, the second definition is really a derivative of the trade-offs that passive investment strategies have to make when aspiring to replicate a market’s performance. We will find that the two ideas actually have offsetting forces. For the purposes of this article, we apply the first definition and passive investing to index investing.

Active Managers as a Group Never Had a Chance against the Indices

- “Active managers have underperformed their benchmark index in three out of the last 5 years.”

- “Alpha in active management is cyclical”

- “Active managers navigate value regimes better than growth regimes”

The three statements above are examples of a lot of the discussion currently surrounding active and passive management. One does not have to think hard to reveal these statements as either based on imprecise definitions, bad measurement, or just a lack of understanding of basic arithmetic.

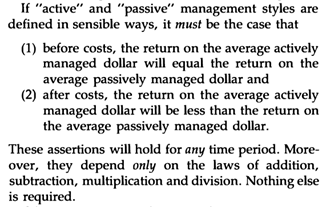

William Sharpe amply explains an often overlooked, but simple fact about active and passive management in his 1991 paper “The Arithmetic of Active Management”.

Of course, this idea is extremely normative and has several challenges in reality, which should give hope to the active investment community and might give some credibility to the three statements above (although I am not sure their authors understand this). First of all, there needs to be one market in which participants act. In reality, even public markets are hugely fragmented into different securities, market capitalization, nations, and there is not a market weighted index for all global securities.

Second, the idea only holds valid if passive investors are able to hold each security in the manner as the market. For instance, if a security represents 3% of the market capitalization of the market at any given moment, passive investors will have 3% of their portfolio invested in this security. In practice, there is an implementation shortfall and perfect replication is not possible in a market where trading costs still exist. These, among other factors, might explain the results of several studies on active vs. passive management that seem to violate the basic laws of arithmetic. Mostly, I think these studies are simply based on bad definitions of active and passive, incomplete data, often mixed with a clear research bias. In short, they are useless to the serious practitioner.

Despite being normative, William Sharpe’s insight generally holds true, especially in regard to money managers operating in efficient, heavily trafficked markets like the S&P. In aggregate, after fees, active managers will be losing to passive market weighted investment funds.

Note, however, that in order for this statement to hold true, passive managers need to ensure two things: (1) do a decent job replicating the benchmark and (2) don’t incur meaningful frictional costs along the way that would make net performance suffer. This is in insight we will revisit later as they might give a clue to beating passive managers. Frictional costs include all kinds of costs that a fund incurs to get its desired portfolio, including research costs, trading costs, and all costs related to maintaining the infrastructure and paying the staff.

Sharpe’s idea is not only applicable to classic market index funds, but also to any tracking strategy. If, for example, a hedge fund index that tracks a certain group of funds was able to hold any given security in the same proportion as the hedge funds as a group, then by definition the index would receive, before fees, the same returns as the hedge fund group. Because the index will charge lower fees, the active managers will lose net of fees to their index. Again, several practical challenges, such as the replication problem and frictional costs, are

The post Active Vs Passive Investing: What It Means And How Active Managers Can Compete appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.