What an exciting rally!

What an exciting rally!

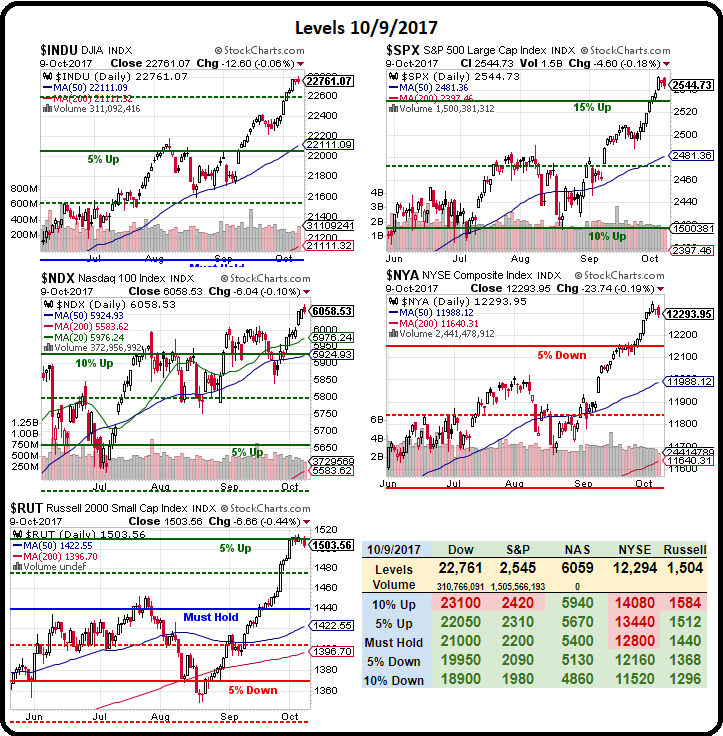

As you can see from our Big Chart, our indexes are up about 5% in the past 6 weeks and, so far, no sign of slowing down despite declining volumes. The Russell (small caps) is our leader, with a 10% move in 6 weeks and only the one little pullback in early Sept – before a solid 7.5% move straight up since.

As I noted on Thursday, we pressed our Russell (IWM) short positions using the Ultra-Short ETF (TZA) with Nov $12 calls, which were $1.35 at the time and are now $1.45. Per our fabulous 5% Rule™, we expect a 2% (weak) retrace of the 10% run from 1,368 to 1,512, which was 54 points so 11-points back we'll call the 1,500 line and a stronger retrace of 4% would take us back to 1,490 (rounding again).

We weren't too far off yesterday, bottoming out at 1,503 but we're pretty confident we'll hit our goal as the other indexes are at their 5% lines and not looking like they won't pull back a bit (1%) as well. Not yet though, because tomorrow we get the Fed Minutes, which will tell us nothing new but will still be a good excuse to rally back a bit. Also, the Dollar has dropped 1% since Friday and that is supportive of the indexes – as well as commodities and oil above $50 boosts the Energy Sector, which boosts the S&P, etc…

Anoter way to manipulate the markets is to throw out a bunch of upgrades like BAC upgrading Apple (AAPL) to $180. AAPL is a major market-mover and BAC timed their report to come out on a very slow day, maximizing the impact of their report. The reasoning is as bogus as the timing as BAC apparently JUST found out that AAPL will be able to repatriate some of it's cash from overseas at a low tax rate. As I noted in our Live Member Chat Room this morning:

AAPL/Maya – If that isn't baked in by now, people are idiots. Also, it's not true that AAPL somehow can't access their cash – obviously, since they assemble their IPhones in China, they could simply use their overseas cash to pay for the IPhones and keep their US money in the bank. Keep in mind AAPL sold 80M IPhones LAST QUARTER – Chinese assembly alone is about $115/phone so there's $9.2Bn/qtr that can be "washed" by paying China from overseas funds and then collecting USD for phones sold stateside. Then, of course, there's the parts that go into them, mostly from overseas too.

When you are a company with $250Bn in global sales, probably more than half overseas, then what is so strange about having $150Bn overseas – where your customers are and where your stores are and where your inventory is and where you manufacture your product and where you do business?

What this tells me, more than anything else, is that BAC employs analysts who don't actually have a clue of how international business and finance operates and then they don't even have editors who understand (or care) enough to correct reports that make them look like idiots. Hell, they don't even read Bloomberg the same week they are writing a post on the subject:

A Lot of Apple's Overseas Cash Is Already in the U.S. – Bloomberg

Not that it’s necessarily so far away. While a tax accountant might label the cash foreign, a lot of it is already deployed in the U.S. economy. Corporations have collectively amassed trillions of dollars in overseas profits, but much of that money has been invested in securities such as U.S. Treasuries and corporate bonds. “Just because money is technically outside the U.S. doesn’t mean it can’t be used in the U.S.,” says Megan Greene, chief economist for Manulife Asset Management Ltd.

Don't get me wrong, I love AAPL – it was our Stock of the Year in 2013, 2014 and 2015 and, of course, we still have AAPL stock as a major part of all of our Member Portfolios so I don't disagree with BAC's target – just their reasoning and timing. Much more despicable than BAC puming up AAPL so they can dump their other stocks is Morgan Stanley's (MS) self-dealing upgrade of Tesla (TSLA), raising their target to $379 the day after the company is accused of defruading investors with knowingly false claims of production targets that they KNEW could never be met. I, for one, would rather give Elon Musk the benefit of the doubt and assume it's just incompetence….

Of course that doesn't stop Nomura from raising their price target on TSLA to $500 – forecasting $58Bn in revenue in 2021 from $10Bn this year. If they double this year and double again in 2020 – they will barely be on track for that prediction but why not make the call – who's going to remember to check in 4 years? Analysts are the enablers of bubbles and, even worse, they may have motives that have nothing at all to do with what a stock is really worth.

Morgan Stanley, for example, just helped Tesla raise $1.8Bn in debt and got a fat fee – so of course they have a strong interest in continuing that relationship and promoting Tesla's price. While they were pumping the stock price, MS was dumping the actual stock, getting rid of 60% of their shares in Q2 alone. Strange behavior for people who profess to love TSLA stock soooooooooooooo much, right? In fact, 10.2M shares of TSLA stock were transferred from Insitutional to Retail investors in Q2 – while the upgrades continued all around. Yet no arrests will be made!

We may have been early with my May 4th PSW Report titled: "Tesla’s Earnings Miss – Emperor Musk has no Clothes!" as far as the PRICE of TSLA's stock had been concerned ($320 at the time) but not the VALUE, which is still well below $300. As I said at the time:

A month ago, on April 4th, I wrote: "Tuesday Turmoil – Tesla Valuation Reaches Peak Insanity" in which I noted how ridiculous it was to value Tesla (TSLA), who struggle to make and sell 25,000 cars in a quarter, at the same price as GM (GM) or Ford (F), who each make 25,000 cars PER DAY, (that's 90 times more). The companies are not even playing in the same ballpark (though they are playing the same game, so investors get confused) – it's like betting your son's undefeated little league team can take on the Yankees – there are other factors involved than just their record against other children.

Taking that statement to it's logical conclustion, we came up with this substitute play in the auto space:

Meanwhile, General Motors (GM), a company that MADE $2.6 BILLION in PROFITS in Q1 (that's right, TSLA's entire sales, in profits alone!) is still being valued lower than TSLA and it's just as ridiculous today as it was a month ago when I laid out the following bullish GM options spread idea:

- Sell 10 GM 2019 $32 puts for $4.25 ($4,250)

- Buy 25 GM 2019 $28 calls for $7.25 ($18,125)

- Sell 25 GM 2019 $35 calls for $3.60 ($9,000)

Needless to say, GM was a way better place to park money than TSLA over the summer and already the 2019 $32 puts have fallen to $1 ($1,000) while the $28/35 bull call spread is now $6.25 ($15,625) which is net $14,625 and that's up $9,750 (200%) from our net $4,875 entry in less than 6 months. You can see why our Options Opportunity Portfolio has been having such a good summer!

There are plenty of values to be had in this market – even if they are only relative values. Coming into earnings, for example, we still like Bed Bath and Beyond (BBBY), Macy's (M), Limited Brands (LB) and Target (TGT) in the Retail Space and Supervalue (SVU), which we discussed last night. Qualcom (QCOM) is still on sale, as is GE (GE), who just cut their dividends.

We're not rushing into them yet, I'm just saying how, even in a toppy market, we can make a nice little Buy List and then look for the earnings reports and decide who to grab AFTER we get more facts. We called a general bottom on Retail (XRT) back in August and we nailed it, perhaps because we called it – kind of hard to say these days as we're getting more influential.

Anyway, our trade idea then (also for the OOP) was:

- Sell 10 XRT Jan $36 puts for $1 ($1,000)

- Buy 10 XRT Jan $37 calls for $3.40 ($3,400)

- Sell 10 XRT Jan $42 calls for $0.850 ($850)

That's net $1,550 on the $5,000 spread that's $3,500 in the money to start. Upside potential at $42 is $3,450 (222%) in 148 days – not too shabby.

Just 47 days later, XRT is at our goal already and the Jan $36 puts are down to 0.38 ($380) while the $37/42 bull call spread is now $3.35 ($3,350) for net $2,970, which is up a quick $1,420 (92%) and still another $2,030 (68%) left to gain for you cheapskate readers who live off our Members' scraps. We've left the trade on into earnings – hopefully we won't regret that!

We're not expecting much movement until after the Fed tomorrow.