Courtesy of Declan

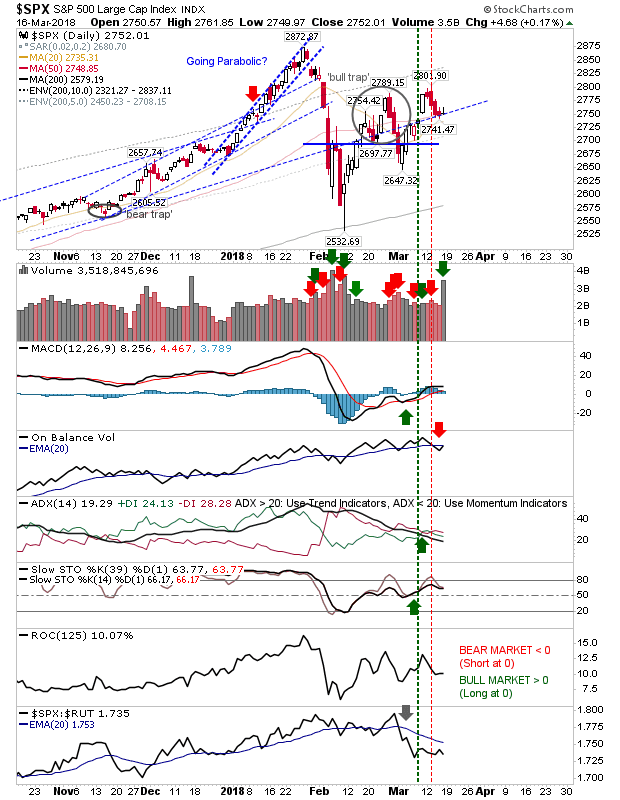

There wasn't much to be said about the gains or losses from Friday but volume spiked which disguised the intention of either bulls or bears. Friday's flat action probably best suits bulls as it marks a stall in selling losses.

The S&P is resting on rising support with just On-Balance-Volume on a 'sell' trigger.

The Nasdaq is on a 'bull trap' but it's close enough to suggest it hasn't yet fully confirmed the 'bull trap'. Buyers have a decent opportunity with stops (risk measure) going on a loss of 7,463.

The Nasdaq 100 took a small loss but it too sits on support – support which is also a convergence with former channel resistance now support.

The Semiconductor Index hasn't the same vulnerabilities as either the Nasdaq or Nasdaq 100 but is well above nearest support and may offer an entry opportunity for bulls. Ideally, I would like to see the index at 1,393 before committing but swing trading a break of Friday's high/low with a stop on the flip side covers both sides of the trade.

The Russell 2000 looks to have mapped an excellent pullback with Friday's gain offering the best of the day's action. Relative performance is on the verge of a new 'buy' signal which fits nicely with other bullish technicals.

Keep an eye on the ratio of new highs to new lows. The past month has been a bit of a speed wobble but if this is building to a workable swing low then more losses are required.

For tomorrow, watch for a bounce play in the indices but if things go pear shaped then hard-and-fast would be best to build a more sustainable bottom.