Courtesy of Declan

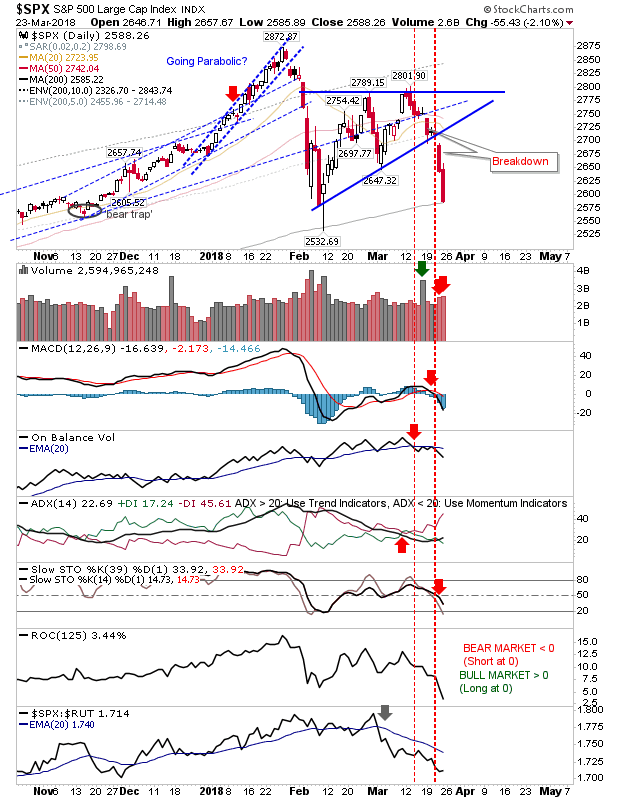

Thursday and Friday left no doubt as to which side had control of the market. Rallies are now likely to be sold into given the distance from highs. At this stage, the tone for November's mid-terms has likely been set with January highs unlikely to be tested prior to the elections.

However, it's not all bad news for longs. The S&P finished right on its 200-day MA. The likelihood is there will be some follow through lower but if buyers can bid this back up to the close of business (creating a doji or 'bullish hammer') then there is a good chance for a swing low. The best example is the S&P.

The Dow Jones Industrial average finished very close to its 200-day MA but hasn't yet rolled in. Ironically, weakness in this average has converted to a relative performance advantage against the Nasdaq 100.

The Nasdaq and Nasdaq 100 cut below their respective March swing lows leaving the February spike low and the 200-day MA as next targets.

While Tech averages lost March swing lows, the Russell 2000 finished the day bang on its March swing low. The March tweezer low may still hold but I would expect a test on Monday and the 200-day MA may be tested along with it.

The Volatility Index is picking up a head of steam. With just a few days left in the month there is a steady build-up in volatility yet plenty of room to go before it reaches levels associated with prior tops. After an extended period of weakness we may be looking at a shift back towards higher volatility. With Trump in power it's not hard to believe uncertainty is taking over the market but a major crash here is unlikely to undo much of the 2009-18 rally.

For Monday, look for long opportunities in the S&P, Dow Jones and Russell 2000. Shorts can tighten stops or monitor for additional losses.