Courtesy of Declan.

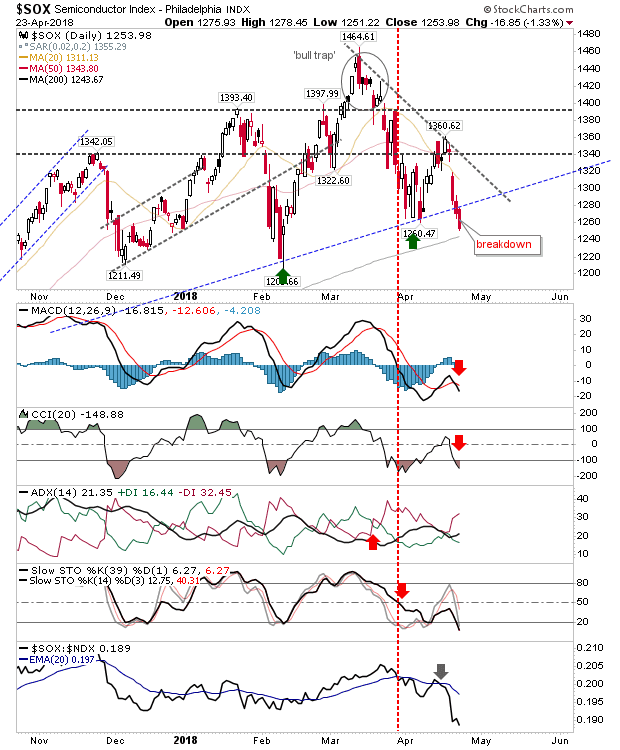

There were modest losses today with most indices holding the status quo from Friday. The one exception was the Semiconductor Index as it lost over 1% in a confirmed break of support. However, it does have the 200-day MA for a likely test tomorrow. All technicals are negative and relative performance took another step lower but no change there.

The Nasdaq broke bearish wedge support but is resting on a minor support level. Today saw a new On-Balance-Volume ‘sell’ trigger but the 6,800/7,500 trading range is more important than any technical measure at this time; at the moment, the index looks ready to test 6,800 support.

The DowJones is still holding its breakout in a hat-tip to longs – one of the few bullish setups at the moment.

The Russell 2000 is resting on a bearish wedge support. If it follows action of the Nasdaq there should be a similar breakdown and a move down to (triangle) support.

The S&P may be the sleeper long play. It’s trading inside its downward channel following a break of internal channel support; however, it’s resting on a horizontal support level just below channel resistance. Technicals are more bullish than negative and 20-day and 50-day MAs are also nearby. A strong day tomorrow could see a rally up to and past channel resistance in a new breakout.

For tomorrow, aggressive longs can look to buy a Semiconductor test of the 200-day MA or the mini-pullback in the Dow Jones. Shorts can look to the wedge breakdown in the Nasdaq. However, the best play for tomorrow may prove to be a buy of the S&P.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.