Courtesy of Declan

After yesterday's selling today's late recovery was a chance for bulls to catch some breadth.

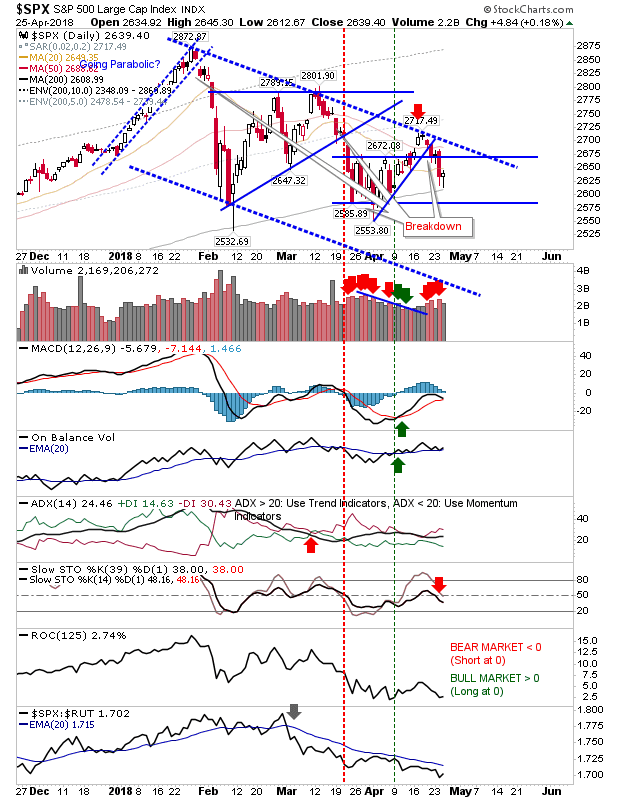

The S&P came close to tagging the 200-day MA on the intraday low. The index is on a path to the lower channel. There was no technical change and relative performance remains weak.

The Nasdaq stalled mid-decline. Today's doji did not appear at a natural support level and the 200-day MA still looks the better support test but aggressive longs may try fish for a position here with a stop on a loss of 6,926.

The Russell 2000 spent a second-day trading at 20-day and 50-day MAs. There may be a chance to catch shorts on the hop if there is a move above 1,555 given the expectation for a move to triangle support.

Interesting mix of bullish and bearish signals. The Dow finished with a tweezer low just inside the downward channel; this is typically a bullish set-up but is countered by a return to net bearish technicals.

Even the Semiconductor Index did enough to hang on to its 200-day MA. Longs can also look for opportunities here.

For tomorrow, look for long opportunities in the Semiconductor Index, Russell 2000, S&P and Dow Jones Industrial Average.