Courtesy of Declan.

Tuesday’s round of buying didn’t last long as sellers took another swing at pushing prices lower yesterday. However, today’s buying was a little more appetizing for bulls.

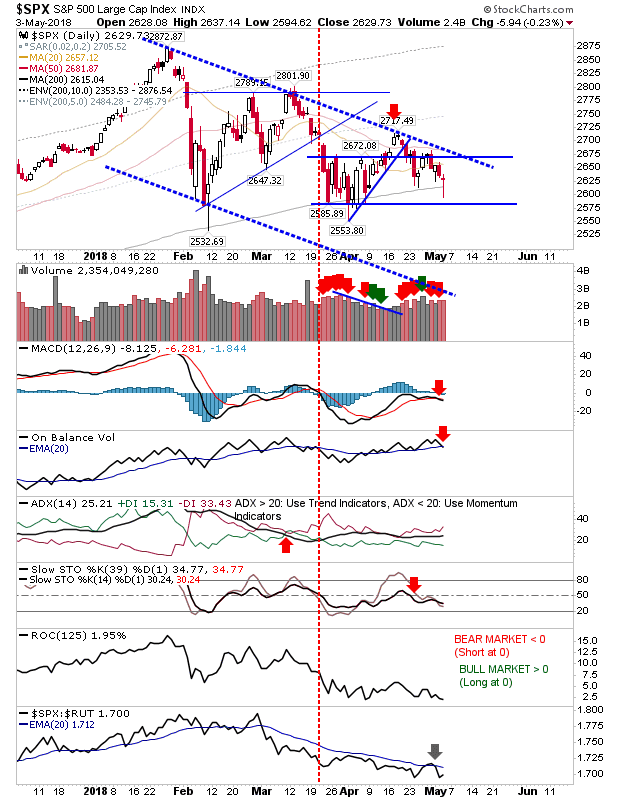

The S&P generated another spike low, this time with a doji at the 200-day MA. Technicals did turn net bearish and relative performance has remained weak since the larger triangle/wedge breakdown in March.

The Nasdaq experienced a greater level of price clustering around resistance. Today’s small bullish ‘hammer’ didn’t occur at a swing low but the bullish opportunity will emerge if declining resistance can be breached. Selling volume climbed to register as distribution although price action didn’t really fit with this thesis.

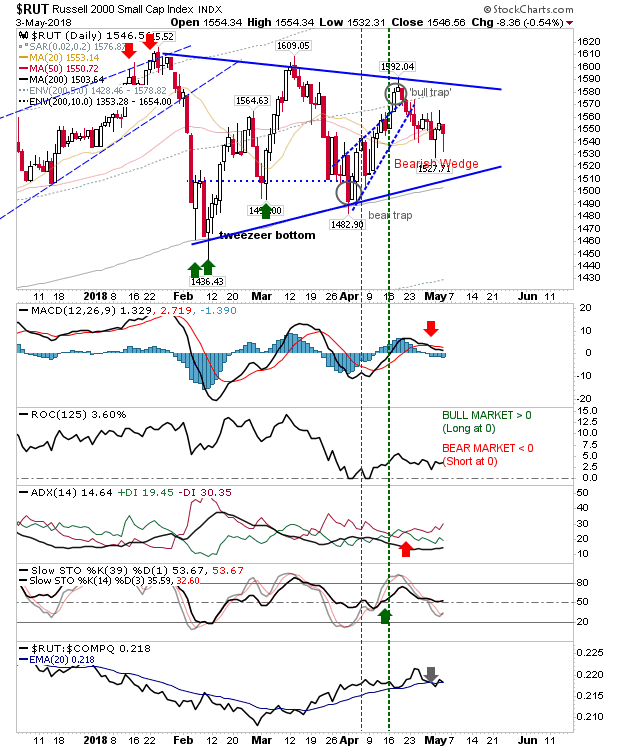

The Russell 2000 created a bullish ‘hammer’ – the second in three days – both occurring at converged 20-day and 50-day MAs. While this is trading inside the triangle it does look like a move higher favored. Technicals are mixed, so no help here.

The Dow Jones is another index offering longs a chance to play. Today’s ‘hammer’ pushed into the 200-day MA and tagged the lower end of support. Technicals are all net bearish including a fresh acceleration lower but this looks good for a bounce, especially given Thursday’s action held above resistance (now support) of the downward channel.

The Semiconductor Index continues to cluster around the 200-day MA. While action is bullish it does need to move higher if this test is not to morph into a measured move lower – down into 1,140.

For tomorrow, look for long opportunities in the S&P, Dow Jones Index, Semiconductor Index and Russell 2000. Shorts would want to look at the Semiconductor Index if it can’t hold its 200-day MA but at the moment, bulls are favored.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.