Courtesy of Declan

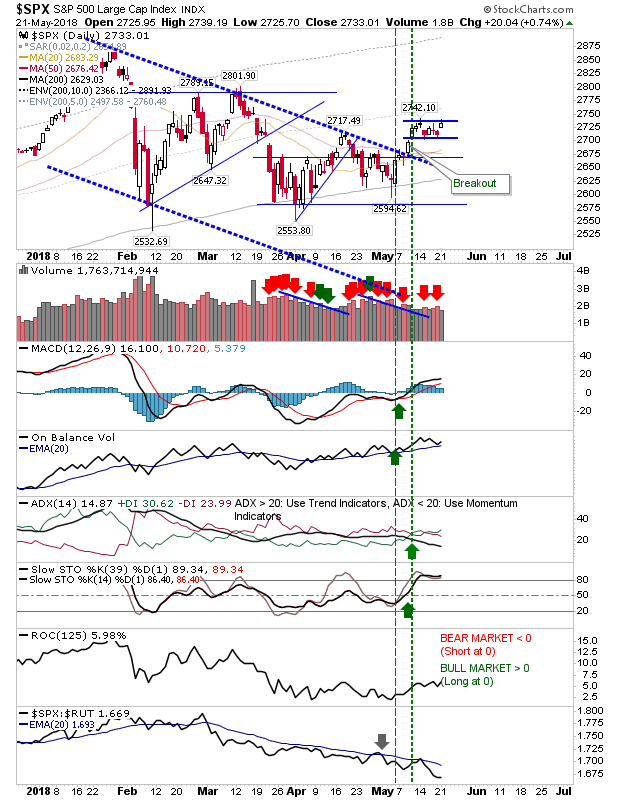

The past few days have seen markets shape narrow mini-trading ranges, each following breakouts from larger consolidations. Large Caps show this best.

The S&P cleared a dual 4-month and 6-week consolidation before shaping the past 8-day 'flag'. Look for a break of 2,740 and a push to challenge the next swing high at 2,800 – although a test of this should be enough to go on and challenge all-time highs.

The Dow Jones Index could be considered to have broken from its mini-consolidation. Volume was not hugely impressive but technicals are all bullish and relative performance is on a new 'buy' trigger.

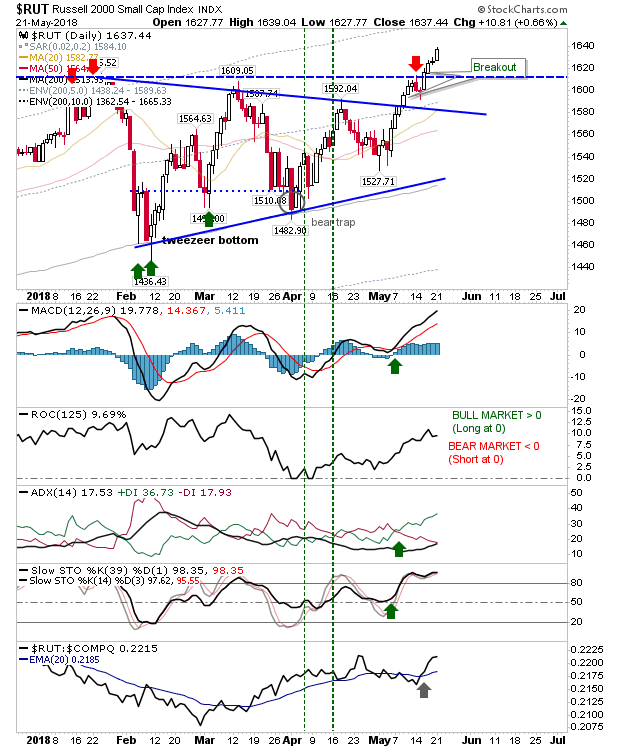

Small Caps had the best of the day's action but given they are leading with no overhead resistance the chance for buying 'value' is less than for other indices. However, momentum traders can look to this index for opportunities. Relative performance is not surprisingly, excellent.

The Nasdaq has shaped its own consolidation just below 7,435. While relative performance has started to lag it hasn't yet turned negative and all other technicals are bullish.

The Nasdaq 100 has also shaped a 'bullish flag' is it works a challenge of the prior all-time high. It has seen a bearish turn in relative performance although I still see this as a bullish setup.

Overall, some nice bullish action which could follow with a trade-worthy bullish run. The Russell 2000 has the least path of resistance but it's hard to set risk. The risk-reward from consolidations in Large Caps and Tech is easier to determine with upside targets of all-time highs (since broken in the Russell 2000).