Courtesy of Declan.

Yesterday’s losses were reversed by a decent recovery which effectively confirmed trading ranges and in the case of the Russell 2000 tagged breakout support.

The small ‘hammer’ in the Russell 2000 is a picture-perfect reaction to the breakout.

In the case of the S&P, today’s intraday range staddled the range of the 2-week handle; the close near its highs suggest a follow through (higher) soon; stops go on a loss of 2,700 with a target of January highs around 2,875.

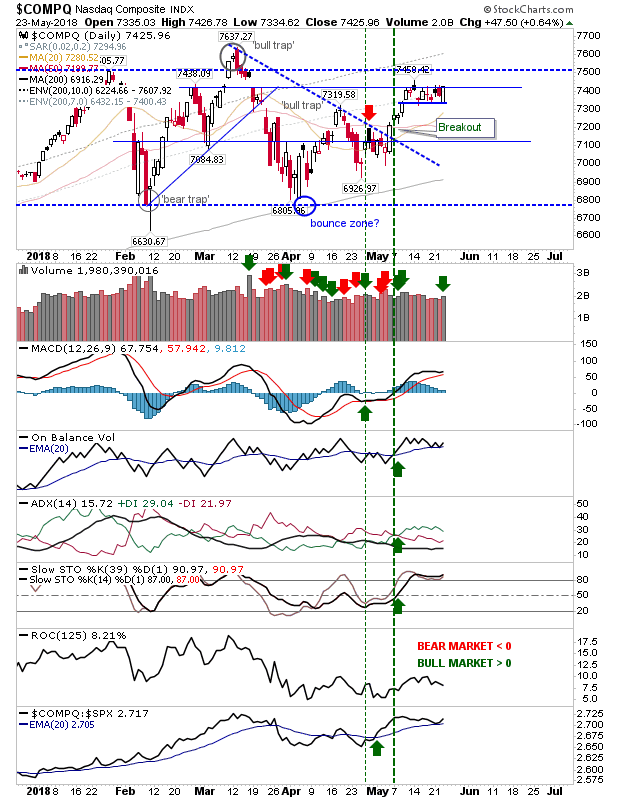

It was a similar setup for the Nasdaq Today’s buying ranked as accumulation as supporting technicals remain net bullish and relative performance remains ahead of Large Caps

The Nasdaq 100 actually managed to go a step further and break from the bullish flag suggesting other indices in similar situations will do likewise.

The Dow Jones Industrial Average filled the gap breakout but didn’t undercut the lows of the ‘pennant’ flag.

For tomorrow, the preferred setup is for longs; long-term buyers can also look to accumulate. Momentum traders can stick with the Russell 2000. Shorts don’t have a lot to work with.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.