Courtesy of Declan.

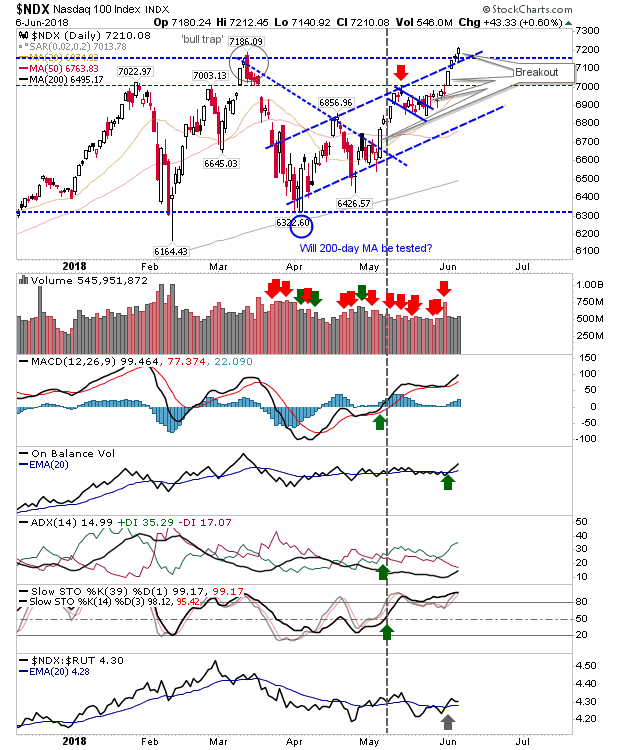

Since my last update markets continued to edge higher. As of Wednesday’s close the Nasdaq 100 was the latest index to break to new all-time highs. Relative performance for the Nasdaq 100 edged a little ahead of the Russell 2000.

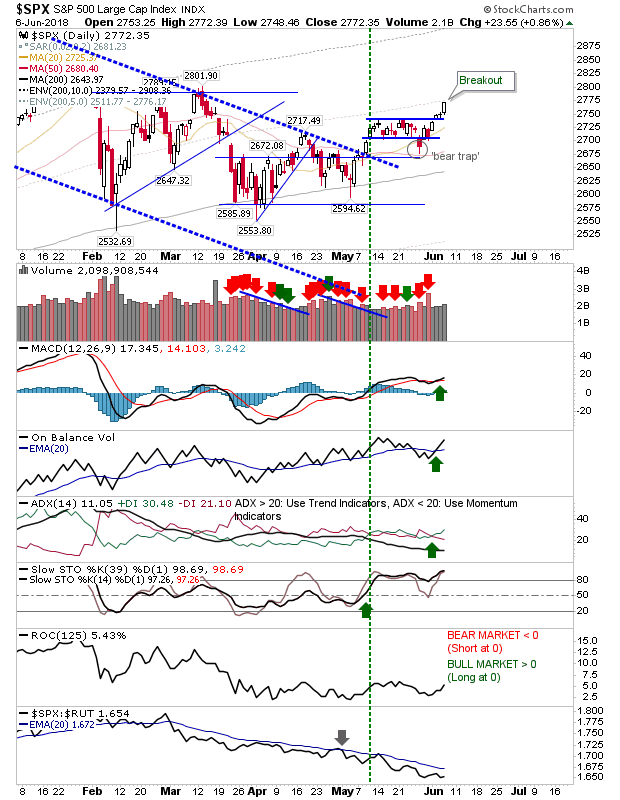

The S&P broke from its handle and has managed to put a bit of distance from the congestion zone. Next resistance is at 2,800 but I would look for a test of all-time highs in line with Tech and Small Cap indices.

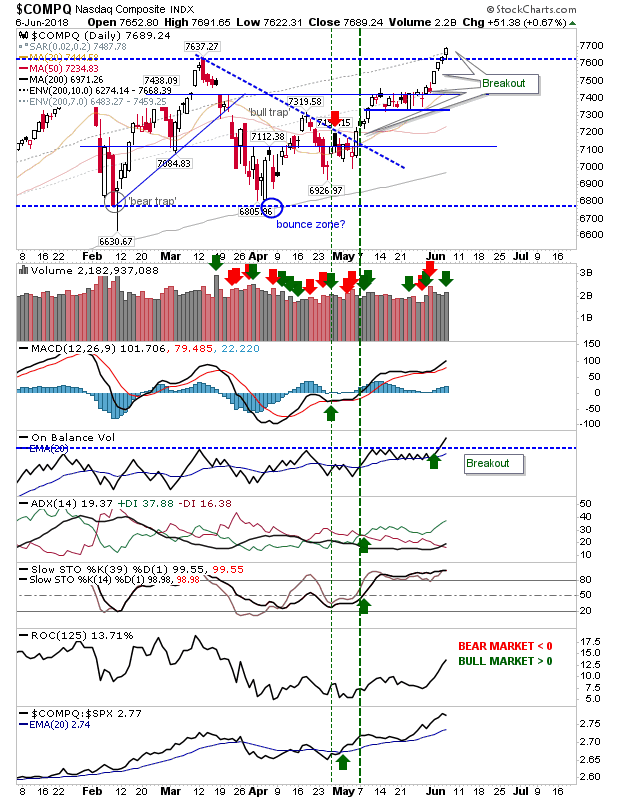

The Nasdaq negated the March ‘bull trap’ with a new all-time highs (supported by a breakout in On-Balance-Volume).

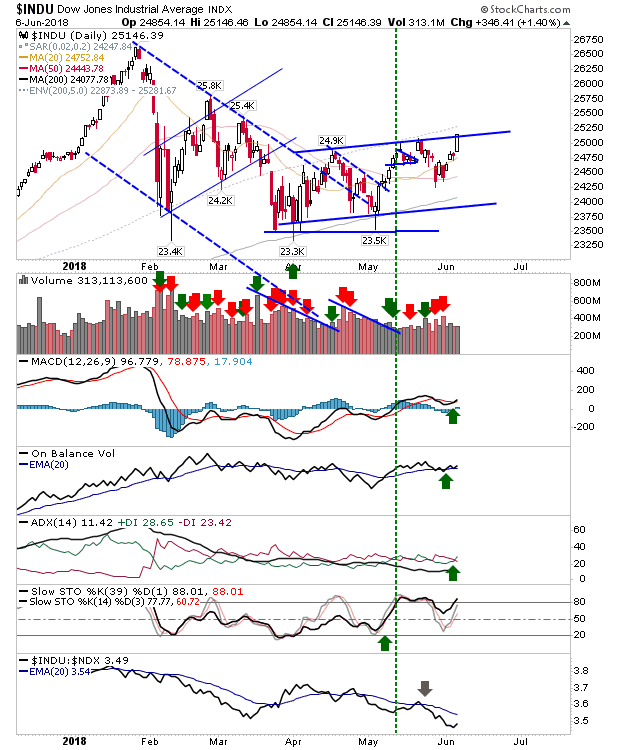

The Dow Jones Index made it up to channel resistance. Other indices do not immediately suggest a reversal is on the cards but this index does offer shorts something to work with (if not a very convincing call).

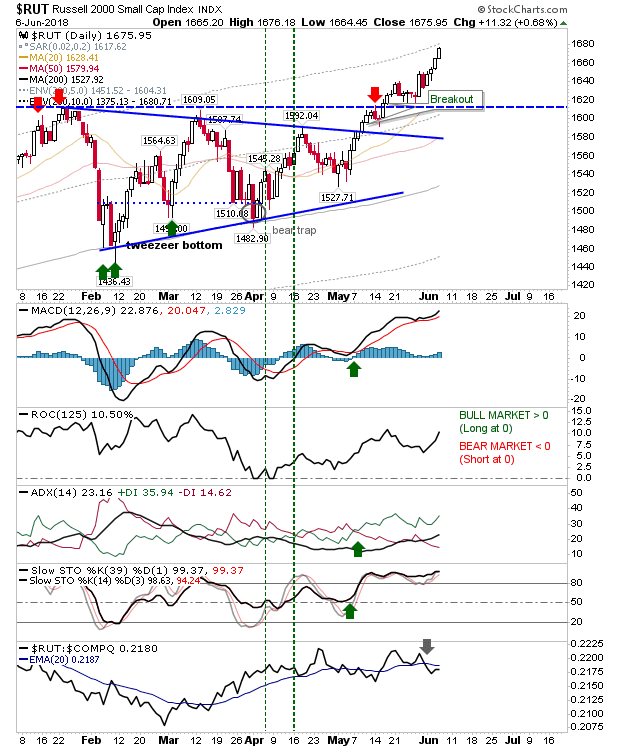

The Russell 2000 continued its run of good form. Those who traded the breakout have yet to be given an exit signal but near-term traders could look to take some profits.

For tomorrow, bulls can look for a continuation in the run in good form; even if sellers reappear it will take a significant reversal to break the uptrend. Taking partial profits will help keep you in the green if your holding period is a couple of weeks or less. Long-term investors have little reason to sell at this stage. Aggressive shorts could try the Dow Jones Industrial Average but cover on a break of channel resistance.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.