Courtesy of Declan.

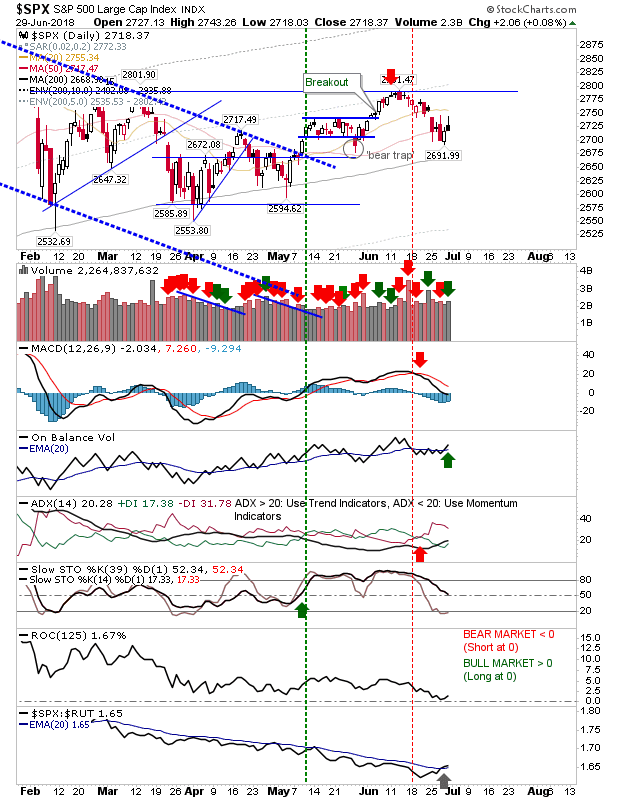

Friday’s action didn’t bring about the bounce I would have liked after Thursday’s picture-perfect defenses of lead moving averages or support.

The S&P closed with a bearish black candlestick on a spike high above the 50-day MA. Volume climbed in accumulation as On-Balance-Volume triggered a ‘buy’ signal. I would see this as a bearish close and would look for downside Monday; potentially playing for a test of the 200-day MA

The Nasdaq also left a bearish black candlestick after it bounced off its 50-day MA. There wasn’t a spike high so it’s not as bearish as the S&P but black candlesticks are nearly always followed by lower closes the next day.

It was the same story for the Nasdaq 100; look for a fresh test of channel support.

The Semiconductor Index is also showing a black candlestick. It occurred below rising support (now resistance) following a second test of the 200-day MA. Monday is a big day for the index. Should the 200-day MA fail to hold as support, then aside from the April swing low, there isn’t a whole lot to hang on too. This will be bad news for the Nasdaq and Nasdaq 100 (and possibly Small and Large Caps too); it’s a key watch index for the coming weeks.

The Russell 2000 finished with a gravestone doji with the 50-day MA its most recent test. Relative performance finished with a switch lower – although this relationship has effectively flat-lined since mid-April. It still has support to work with but wannabe buyers will probably want to see what happens in the Semiconductor Index before jumping in.

For tomorrow, watch the Semiconductor Index, it’s looking like a bellwether for the other indices. Friday’s finish suggests Monday will be a down day.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.