Courtesy of Declan.

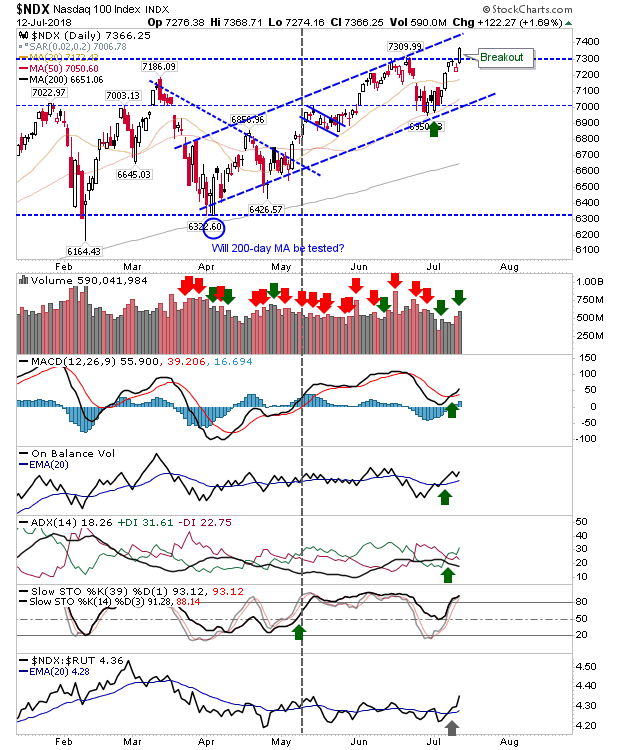

Tech Indices are not waiting on the Semiconductor Index aa both the Nasdaq and Nasdaq 100 closed at new all-time highs. The Nasdaq 100 had the best response with a clear breakout. This move accelerated the relative advance against the Russell 2000 setting things up nicely for a challenge of upper channel resistance.

The Nasdaq also enjoyed an uptick against the S&P as it inched a new high. Volume climbed to register accumulation. Technicals are all net bullish.

The S&P also generated a breakout which was enough to negate the ‘bull trap’. Relative performance continued its recovery after four months of decline. As with Tech indices, the upside target is channel resistance.

The index with work to do is the Russell 2000. It was able to make some ground but not to the same degree as Tech and Large Cap indices. The double top remains in play and with relative performance moving sharply lower, Small Caps could struggle to attract buyers.

For tomorrow, bulls are back in the driving seat after yesterday’s whipsaw short trades in Tech indices. With relative performance moving away from Small Caps to Tech and potentially Large Cap indices new trading opportunities are starting to emerge.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.