Wheeeee!

Wheeeee!

There's nothing like a nice sell-off when you're ready for it. Yesterday's dip blasted our Short-Term Portfolio over the 200% line, up $207,272 for the year and up $23,088 (23%) since our 10/18 review as we briefly flipped more bullish for the bounce but then, since the bounce didn't make it over our Strong Bounce Levels, we doubled back down on our SQQQ hedges last week and turned ourselves back to bearish – just in time for this week's catastrophe.

The primary purpose of the Short-Term Portfolio, which started with $100,000 on Jan 2nd of this year, is to protect the Long-Term Portfolio so we're always looking for bearish hedges – no matter how well the market is doing – but we also hedge our hedges with short-term long positions, to help lower the cost of our insurance. For example, we sent out a Top Trade Alert to our Members on Sept 6th with the followin hedging idea (we very rarely add hedges to Top Trades, so it was a big deal):

- Sell 10 MU 2021 $42 puts for $6.40 ($6,400)

- Buy 100 SDS March $34 calls for $2.60 ($26,000)

- Sell 100 SDS March $40 calls for $1.50 ($15,000)

That was net $4,600 on the $60,000 spread and, unfortunately, we used Micron (MU), which turned around and fell 20% since then but, fortunately, we only promised to buy it for net $35.60 and it's now $34.60 so not a panic but those put contracts are now $12 ($12,000) so a bit of a drag but the S&P Ultra-Short (SDS) March $34s are now $7.50 ($75,000) and the $40s are now $4 ($40,000) so net $35,000 on the spread less $12,000 if we buy back the puts is $23,000 which is up $18,400 (400%), which is why the Short-Term Portfolio puts up such crazy gains in a pullback.

Now I do still like MU but, as I said at the time – any stock you REALLY want to buy at the net put price will do. Meanwhile, all SDS has to do is stay over $40 and the premium on the short calls will expire and the net of the spread will rise to $60,000 – so it could still almost triple up from here! We hedge like this all year long and this just happens to be one of those times our insurance policies happen to pay off but THAT IS HOW INSURANCE WORKS – you pay for it regularly so it's there for you in case a disaster strikes – in this case a disaster to your portfolio.

Now that we've had our expected 10% correction though, the big question is whether we have further to fall or if, perhaps, we should cash in our hedges. Well, spoiler alert – we won't be cashing in our hedges because, like SDS, we still have plenty left to gain and the only reason we'd lose them is if our long positions come back and our Long-Term Portfolio started with $500,000 – 5 times more than the STP – so we have a lot to protect!

The indexes were far too scary to trade overnight and, even this morning, I'm less than enthusiastic about the "rally" that's lifting the Dow (/YM) back to 24,800 because that's still 2,200 points (8%) down from 27,000 which means it is only a weak bounce (20% of the 10% drop) and we're not going to be impressed by anything less than getting back over the 25,300 mark, which is still 500 points away.

These are the same bounce lines we predicted we'd need yesterday morning after completing the 10% correction – we just weren't expecting to complete it yesterday and we didn't quite get to 24,300 (the 10% drop from 27,000) but we never quite got to 27,000 either – so fair is fair I suppose…

Actually, I'm not expecting us to bounce back to the strong lines and, as I said last night on Money Talk (where we announced our portfolio adjustments and DID manage to add the MJ trade we discussed yesterday morning), I think we're going to fail our lines and fall another 10%. To that end, we added a Russell Ultra-Short (TZA) hedge to our Money Talk Portfolio in yesterday's review and, in our Live Member Chat Room, we added an additional Nasdaq Ultra-Short (SQQQ) to our Short-Term Portfolio at 10:40 am:

n the STP, we have 80 naked short Nasdaq Ultra-Short (SQQQ) March $14 calls at $1.25, now $2.13 with SQQQ at $13.65. I'm still iffy about covering but let's not take too much risk so let's pick up 80 of the June $12 ($3.30)/17 ($2) bull call spreads at $1.30 ($10,400) as they are well in the money and only lose if the market is going up nicely 8 months from now in which case our longs will be up $250,000 so we won't be worried about losing $10,400, right?

Overall, it adds about $30,000 of insurance (the upside potential) as well as letting the short SQQQs ride for $17,000 we gain if they expire worthless.

So it's another hedge, this one from last Thursday and that's what we do – we layer our hedges as the market falls to provide a constant stream of insurance payouts on the way down. SQQQ tested $16 already yesterday and already the June $12 calls are $5 and the June $17 calls are $3.30 so net $1.70 is only an 0.40 ($3,200) gain so far but the potential payout is for $40,000 – so it's still good for a new hedge if you need it.

Remember: I can only tell you what the market is likely to do and how to make money trading it – that is the extent of my powers…

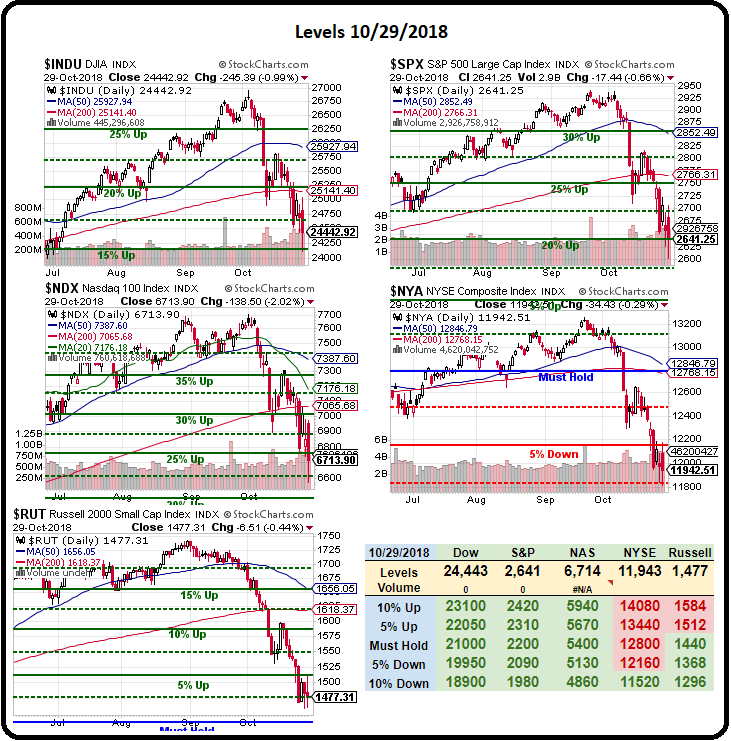

Now we need to watch all the 10% lines to see if they fail and those and we're not goingt to get bullish again until we are back over our strong bounce lines – which would be 6% off the top, recapturing 40% of the drop. Failing those 10% lines is a strong sign that we are on our way to a 20% correction – another 10% lower than we are now. Those 10% lines to watch are:

- Dow 24,300 with a weak bounce at 24,800 and a strong bounce at 25,300

- S&P 2,640 with a weak bounce at 2,710 and a strong bounce at 2,780

- Nasdaq 6,870 with a weak bounce at 7,080 and a strong bounce at 7,230

- Russell 1,485 with a weak bounce at 1,530 and a strong bounce at 1,575

- NYSE 11,880 with a weak bounce at 12,150 and a strong bounce at 12,400

All that red is NOT GOOD and, as you can see, we're right on the cusp on the Russell and S&P so, if they go red – it will be time to layer in another hedge! Forget the levels – last Wednesday I put up this list of 30 Risks to the Markets in 2018 and these are the same FUNDAMENTAL issues that kept me banging the caution table all summer long and, until some of these things get resolved – there's no reason for this market not to keep going lower.

All that red is NOT GOOD and, as you can see, we're right on the cusp on the Russell and S&P so, if they go red – it will be time to layer in another hedge! Forget the levels – last Wednesday I put up this list of 30 Risks to the Markets in 2018 and these are the same FUNDAMENTAL issues that kept me banging the caution table all summer long and, until some of these things get resolved – there's no reason for this market not to keep going lower.

This morning China made two desperate moves to stop their own market bleeding – they lowered the Yuan to 6.9574 to the Dollar – their weakest level since May of 2008, when their market was in the middle of a 50% correction and they also relaxed the rules – now ENCOURAGING companies to buy back their own stock (because no one else seems to want it). In addition to that, Chinese Regulators are proposing a 50% reduction in the Auto Tax and the State Government is buying stakes in 47 private companies to prevent them from failing but I'm not sure they can save them all if these measures don't spur investor confidence.

This is DIRE stuff folks. Perhaps not 2008 dire, yet, but DIRE nontheless so please stop worrying about missing out on bottoms and make sure your portfolio is protected – in case this isn't the bottom. I know you've been very anxious to buy and I've been pulling the reigns back all summer but it turns out I was right all summer so PLEASE – give me the benefit of the doubt now and continue to be very careful out there – thanks!

- June 27th: Will We Hold It Wednesday – 24,000, 2,700, 7,000 and 1,650 Edition

- July 6th: Trade War Friday – “You Maniacs, You Blew It Up!”

- July 12th: Thrilling Thursday – Senate Overrides Trump Tariffs – Everything is Awesome Again

- July 18th: Weakening Wednesday – Powell’s Testimony Doesn’t Really Help

- July 20th: TGIF – Trump, Tariffs and the Game of Monopoly – Why You Should Care:

- July 25th: Which Way Wednesday – Trump and Earnings Drive the Market, both are Unpredictable

- Aug 1st: Which Way Wednesday – Strong Bounces, Weak Follow-Throughs

- Aug 7th: Toppy Tuesday – Markets Continue to “Ignore and Soar”

- Aug 8th: Wednesday’s Whopper – Musk Claims Some Idiot Offered Him $420/share for Tesla!

- Aug 9th: Thursday Thoughts – The Trade War We Choose to Ignore

- Aug 20th: Monday Market Movement – The Climb Continues – For Now

- Aug 21st: 2,860 Tuesday – Donald Dumps on the Dollar, Demands Fed Help Boost Markets

- Aug 24th: Trade War Friday – US China Talks Collapse With No Resolution

- Aug 28th: Toppy Tuesday – S&P 2,900 so it’s 3,000 or Bust!

- Aug 29th: Will We Hold It Wednesday – Record Highs Edition

- Sept 4th: Tuesday Trade War Worries and Toppy Trading Patterns Persist

- Sept 6th: Floundering Thursday – Indexes Struggle to Get Back on Track

- Sept 11th: Tumblin’ Tuesday (again) – China Retaliates on Trade (again)

- Sept 14th: Fake Money Friday – Weak Dollar Makes Markets Look Like They Are Recovering

- Sept 17th: Monday Market Madness – Denial is Not Just a River in Egypt

- Sept 18th: Tariffic Tuesday – Markets Ignore Another $200Bn Drag on Global Trade

- Sept 19th: Will We Hold It Wednesday – S&P 2,915 Again

- Sept 20th: Thursday Failure – Shanghai Stocks Down 20% for the Year and Social Security Closer to Failure

- Sept 24th: Monday Market Movement – OPEC Blasts Oil Higher, China Walks from Trade Talks

- Sept 27th: GDPhursday – 4.2% Now, Below 3% From Now On

- Oct 3rd: Which Way Wednesday – S&P 2,940 or Bust (again)!

- Oct 11th: $5,000 Thursday – Cashing in Our Shorts and Looking for the Bounce Lines

- Oct 16th: Tempting Tuesday – Nothing has Changed but Markets Move Higher

- Oct 17th: Will We Hold it Wednesday – Markets Forced Over Strong Bounce Lines, Now What?

- Oct 23rd: Tumblin’ Tuesday (Again) – Markets Turn Ugly, Dow 25,000 Fails

More to come…