By Jacob Wolinsky. Originally published at ValueWalk.

Choice Equities Fund commentary for the fourth quarter ended December 31, 2018, discussing their new potions in Under Armour and Rubicon Project.

Dear Investor:

We are pleased to report strong absolute and relative performance for Choice Equities Fund, LP (CEF or the Fund) for the year, up +15.9% and +12.1% on a gross and net basis, respectively. Our annual performance compares quite well in a tough period for the markets which saw the Russell 2000, the S&P 500 and our primary Blended Benchmark finish in the red at -11.0%, -4.4% and -9.4%. The fourth quarter in particular was a rough one for equities investors, as the Russell 2000 led the way down on -20.2% performance with the S&P 500 following at -13.5%. Our stocks were not immune to the sell-off as the Fund posted a net decline of -12.9%. Despite the down results in Q4 – an infrequent but necessary condition of our investment approach – we are quite pleased with the results for the year, and perhaps even more importantly as I will discuss below, how it positions us as we head into 2019. Our total net compounded return since becoming an independent firm two years ago now stands at $1.36 for every $1.00 invested, versus the $1.06 return derived from our Blended Benchmark.

Q4 hedge fund letters, conference, scoops etc

Executive Summary

As is customary in our year end letters, we will offer some commentary on the market’s performance and examine the drivers of return on an annual basis. We will then provide an update on CEF performance for the quarter before offering a few words on our typical portfolio construction and how we measure success in differing market conditions. We have two new positions to discuss and note their full write-ups are in the appendices which comprise four pages of this nine page letter. Finally, we close with some thoughts on the outlook for the year upcoming and what it means for our portfolio.

Market Commentary

For equities investors of nearly all stripes, 2018 ended as a year to forget. The year began well enough. Enthusiasm was strong as participants cheered the recent passing of the Tax Cuts and Jobs Act. Business confidence and earnings growth, in part driven by the arithmetic effects of the lowered tax rate, was surging. A February wobble followed an unusually strong start to the year, but investors largely looked past the decline given the strong economic backdrop. As summer arrived, issues surfaced and the tailwinds that had largely become priced in, gave way to emerging headwinds and new deterrents to growth. While newspapers had little trouble finding fodder for headlines, the primary issues of tightening monetary policy, an emerging trade war with China and rapidly declining oil prices disrupted the serene picture of synchronized global growth that had previously emerged, and investors soon began to reprice markets for the lower growth trajectory.

Markets began their decline as the calendar turned to Q4 and ultimately entered a “bear” market, given the S&P 500’s decline of greater than 20% off its highs in August. As is often the case in these selloffs, small caps led the way down in terms of order and magnitude of decline. Potentially exacerbating the quarter’s decline was the fact that much of the downdraft occurred in the typically quiet month of December. Absent some of the usual market participants, lower liquidity, year end positioning and tax motivations created a trading environment that produced the biggest decline for the markets in the month of December since 1931, ultimately leaving most equities investors with losses on the year. Looking closer at small cap performance, we see an astounding 89% of these securities finished in the red for the quarter – a higher percentage of declining stocks than even Q4 of 2008 and the fourth worst percentage in the index’s 40-year history. (For a full accounting of the quarter that was for small caps, I found this piece from Royce Funds interesting.)

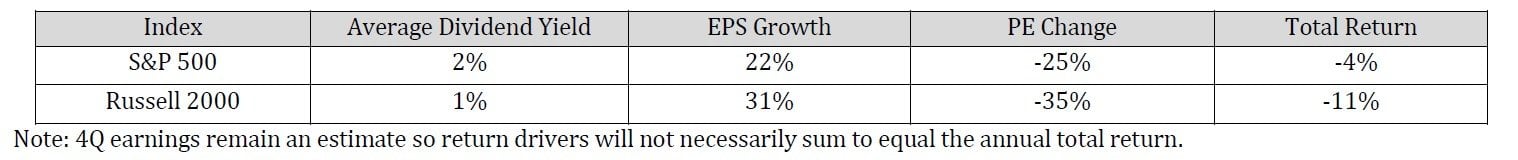

Interestingly, only two of the four periods of similar decline are associated with economic weakness. As we look at the drivers of returns on an annual basis by reviewing our year end template, it seems we will likely add another episode to the list as it was clearly not weak earnings growth that caused the decline. In actuality, it was more likely the reverse, as the Fed used the strong economic growth as grounds to institute four rate hikes rather than the three originally envisioned at the year’s start. The higher rates, themselves suggestive of lower multiples (albeit moderately so) seem to have also spurred on a change in mood which precipitated a big shrink in PE multiples. While perhaps a gross oversimplification, it seems one could characterize 2018’s market performance as the year that: what fiscal policy giveth, monetary policy taketh.

CEF Commentary

Like the markets, most of our stocks declined in the quarter. Any stocks we owned in size impacted the portfolio accordingly while light hedging activity produced gains of a little more than 1%. No position detracted more than 2.5% for the quarter, though our holdings in YELP, BXC, UA, DEST, and DS each detracted ~2% from gross portfolio performance. Despite their price declines, the businesses are performing as expected on a fundamental basis.

The lone possible exception to this categorization is YELP. It seems the company’s transition to non-term contracts is not going as seamlessly as originally anticipated. Though a few elements of the conversion have proven disruptive, the biggest factor that has slowed near term top-line growth likely stems from a change in the company’s compensation model for its sales force. It seems reps did not adjust to the model with the ease originally expected, and many chose to leave more quickly than the company had anticipated. With fewer reps onboarding paying advertising accounts than targeted, revenue growth slowed. Though the transition has been bumpier than expected, the company’s strong balance sheet and healthy base of user reviews remain. It is also encouraging to see the company recently completed an outstanding stock buyback and has initiated a new one to capitalize on the lower share price. Though the transition has not been a smooth one, the long-term case remains.

DEST – Our position in Destination Maternity presents our latest example of the so-called efficient markets at work and further highlights the vagaries inherent in investing in the small cap space. The company reported 3Q results early in December. Though mostly on track, a few elements revealed during the report were not exactly spot on with expectations, and shares were severely punished. Inventory came in a little higher than anticipated and sales growth in the eCom channel, previously a real bright spot for the company, slowed. Though management reiterated their outlook for FY2019, for FY2018 they lowered their sales guidance by 100 basis points and lowered the high end of EBITDA guidance. All in all, the unanticipated elements and slight shift from expectations was simply not a great look for a team that had just unveiled their big strategic plan just five weeks prior.

But does lowering the top end of EBITDA guidance of $17M by $1M really mean that the company is worth half what it used to be? Mr. Market said yes. Though skeptical of this re-rating, I of course began double checking our work. A week later I had the good pleasure of meeting with the team at the company headquarters in Moorestown, NJ. Upon further examination and as highlighted by management on the call, many of the “issues” from the 3Q report had reasonable and explainable causes. For example, the $7M of excess inventory was from a prior management team and is believed to be monetizable without meaningful discounts. And the eCom growth, while slower than before, came at significantly higher margins and double-digit gross profit dollar growth.

More importantly, the long-term vision – to become a leaner, more efficient company with high returns on capital that dominates a unique specialty retail niche – remains quite achievable. Like most things in the real world, I do not expect the benefits of these efforts to come neatly or in a precisely linear or flawless fashion. But I do expect them to come. With a view that the team is talented and their plan to grow cash flows at 20% or better for the next few years is achievable, we viewed the valuation of less than 4x EBITDA as attractive and unlikely to persist for long. We took the market’s reaction as an overreaction and used it as an opportunity to add to the position.

New Positions – Under Armour (UA) and Rubicon Project (RUBI) are our newest positions. Though they differ by size and industry and seem to have nothing in common on the surface, both fit our investment framework for quality and potential return. Somewhat like Chipotle (CMG), Under Armour is our latest smallish, large cap and another strong brand’s story of progress interrupted. The thesis rests on the case the company can perform better than it has recently and is currently underearning relative to normalized margins. Rubicon Project is the other platform company alluded to last quarter and is probably even more interesting as I believe it offers an opportunity to make multiples on our investment over a multi-year time horizon. Both write-ups are included in the appendix.

A Word On CEF Portfolio Construction – If we are going to outperform the “stock market”, an understanding of the typical behavior of the stocks in the market is useful. As Q4 of 2018 has just demonstrated, the dichotomy of performance between the “market” and the stocks within the market can be quite wide, especially when things go haywire as they seem to every two or three years or so. Consider that while the S&P 500 was down -13.4%, small caps fared worse and underperformed their larger peers by a fairly significant 7%. Perhaps more interestingly, when looking closer at the small cap index itself, we see that while the “market” was down -20.2% for the quarter, a quarter of the stocks within it were down over -33% and the “average” stock, or median decline, from its 52-week high was -37%.

This may seem like bad news for small cap investors. To the contrary, it is actually good news. And it is also a primary reason our portfolio is structured the way it is. As far as stocks go, I view the small cap pond as unequivocally the best one to fish in. There are more stocks. There is more volatility. They offer greater information inefficacies. Put simply, the space just offers a greater likelihood of finding outstanding risk/reward situations that can help us generate attractive investment results. But it is not all good news. When the air goes out of the balloon every so often as it always does, they frequently suffer the worst.

For this reason – in conjunction with the fact that I have all of my investable assets invested in the fund – I do not want a portfolio that is always entirely comprised of small cap stocks. Instead I prefer a portfolio of equities with balance that is equally as capable of outperforming in a down market as it is in an up market. Though nobody can reliably predict when either will come, that does not mean we cannot prepare for both. When one considers the math behind the compounding of capital, it is easy to embrace the notion that the path to capital creation runs first through capital preservation. Accordingly, our approach is one that seeks to balance the risks of the occasional drawdowns that necessarily accompany equities while enabling us to participate in the upside that comes along with the creation of these valuable enterprises. As sure as risk and return are two sides of the same coin, if we are able to mitigate losses during these sell-offs, we have the opportunity to benefit doubly: initially from this minimization of loss of capital, and then subsequently, from the selective purchase of a few securities from a highly attractive pool of newly created bargains.

For these reasons as it pertains to our long-biased, concentrated investing approach, I view any outperformance in a down market as a success. Though our portfolio declined during the quarter, we successfully minimized a meaningful loss of capital. Perhaps more importantly, we did so while simultaneously improving our prospective returns through the buying and selling of existing and new holdings from a highly attractive opportunity set. While giving back gains or experiencing paper losses is never a joyous occasion in the moment, it is an infrequent but necessary condition of our investment approach.

Though I am quite satisfied with our results for the very brief period that was this past quarter, I am even more pleased with our results for the bigger and more important picture that is this past year. To see why, let us compare our results to the indices – our basically free investment alternative. Whereas small cap index investors can now purchase an earnings stream that is still expected to grow at some double-digit rate in the near term, they have to do so from a capital base that has depreciated by a greater amount, effectively negating the opportunities unearthed in the recent market turmoil. On the other hand, in our fortunate circumstance, we are adding a few specific and highly targeted earnings streams, most of which have fallen farther, that are growing faster, that we get to purchase from a capital base that has appreciated. So, while I am delighted with our up performance in a down year, I am even more excited about how this result coupled with our activities in a sloppy trading environment position us for an attractive compounding result next year.

2019 Outlook

The word of the moment seems to be uncertainty. Little clarity has surfaced in our ongoing trade war with China, recent market conditions have been choppy and the dysfunction coming from Washington seems to be even more dysfunctional than usual. Earnings growth has decelerated as the arithmetic effects of the tax cut fade, and many view the path forward as less clear than it was a few months ago. The market’s trailing PE multiples have recently trended to near the lows of the last five years suggesting a plausible argument could be made some of this slower growth has already been discounted. Of course, the trailing numbers tell us nothing of what growth is to come, but our base case suggests continued but slower earnings growth for our domestic economy. Whatever the trajectory of earnings growth, I expect the placid conditions of 2017 will come to be remembered as the anomaly they were, and the more elevated volatility will be here to stay. For the active manager, these periods have often brought great opportunities, even if it was not always clear that was the case at the moment.

Our eclectic portfolio, composed of 10 – 15 businesses with their own idiosyncratic risks and company-specific stories, appears set to perform well in this environment. Though our holdings will assuredly be influenced by the market direction in the short term, in the medium to longer term, our performance will be driven by the business results of these specific companies and the unfolding of the catalysts that lay in front of them. Consider DEST, whose prospects will be determined far more by management’s ability to execute on their plan rather than a moderate move in the broader stock market. And we are currently adding another one that fits this bill. While many would likely lump these into the event driven/special situation bucket, I simply think of them as undervalued opportunities that fit our investment framework. While not all our positions fit this catalyst-driven framework, our portfolio offers a nice balance consisting of many that do and position us well to perform in most any market environment.

As I wrote in a brief Christmas Eve missive to our investors after considering the price to value discrepancy of our portfolio, I believe these winter months will prove to have been a very attractive time to add to our portfolio. While I am pleased with our track record since inception and our trajectory in our first two years as an independent company, I continue to believe that on both an absolute and relative basis, the best is still yet to come.

Conclusion

In closing, while I know our approach will not yield outperformance each and every quarter, I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the majority of our investable assets are invested alongside yours, we would never ask investors to assume risks we ourselves will not.

Thank you for your continued support as we work to grow our capital together. As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time.

Best regards,

Mitchell Scott, CFA

Portfolio Manager

Appendix 1: UA and RUBI

UA – Heading into 2015, Under Armour’s success story was nearly unparalleled in sports and brand building history. Built largely from founder Kevin Plank’s blood and sweat on the back of his crafty and savvy marketing moves, the company was the fastest brand to achieve $5B in sales in modern history. Founded in 1996 by the then 24-year-old entrepreneur out of his grandmother’s basement, the company did a whopping $17,000 in sales of the moisture-wicking undershirts the company has now become famous for in that first year of business. 10 years later, the company had $281M in sales and was newly public. Life as a public company was good and the brand came out of the gate hot, posting sales growth in excess of 20% for an astounding 26 quarters straight. (Much of that origin story is told here in a recent interview with David Rubenstein.)

In 2015, emboldened by its success to date, the company unveiled a three-year plan to “Get Big Fast.” The plan was predicated on moving the brand into the big three sports brand hierarchy side by side Nike and Adidas and capturing the benefits that went along with it. They targeted big sales growth spurred on by a big marketing push to support new product launches. The big plans carried big spending and a growing cost structure that matched. Unfortunately for the company, their timing could not have been much worse, as the company went for growth headlong right into what has now become known as the retail apocalypse. Amazon’s impact, previously a nagging competitive issue to retailers, abruptly became acute. Retailers began closing stores. Some like Under Armour’s second largest customer, Sports Authority, who had been struggling gradually, suddenly went bankrupt. Sales growth went from +20% into the red for one quarter. Inventory accumulated in the channel. Gross margins fell ~400 bps and the company deleveraged on their expanded cost structure with EBITDA margins getting cut in half to 7%. Over a tough two-year period, shares got cut into less than a third of their prior value.

As they say in investing circles, the brand hit the wall. Of course, this was not their intended outcome, but the event is not without precedent. Nike hit the wall in 1982. While it was a different era, many parallels exist. Both brands were 21 years old. Nike sales growth slowed from 25% to low single digits. Inventory accumulated in the channel. Gross margins fell by some 500 basis points and the company similarly deleveraged on its cost structure with EBITDA margins falling from 18% to 6%. Over a tough two-year period, shares got cut into less than a third of their prior value. And then they bottomed to create what turned out to be one of the great buying opportunities of a lifetime. Shares were up five-fold over the next five years and never looked back.

Our thesis here is not built on the notion Under Armour is the next Nike. Our thesis is built on the notion the company wants to perform better. And while it seems a given most public companies all want to do better, it is not a given everybody can. That is why a valued brand is critical to thesis. Though the brand remains strong, the company’s momentum, an underappreciated concept in business, has currently waned. Due to the recent underperformance and bloated inventory, some of the company’s marketing efforts were curtailed. With fewer earnings dollars to spend, many new product initiatives were also delayed. Accordingly, for much of the last two years, the company has been focused on cutting costs and has generally been in retrenchment mode.

At their recent analyst day, it was clear the company has a major focus on becoming a leaner and higher returning business. They spoke to more targeted marketing initiatives, faster new product development and improved measurement of return on marketing spend. Now compensated primarily on EBIT dollar growth, the company is incentivized to emerge a leaner, higher returning and more adaptive brand. Will the company’s new products respond to marketing as they have in the past? Only time will tell. But it seems Kevin Plank’s ability to create something from nothing is surely an indication he can again create sustained success from a company that now finds itself among the elite brands in sports. While valuation looks expensive on current multiples, it also seems to imply market participants suggest very little likelihood the company will ever regain its prior operating margin success. While a Nike-like run from here is clearly far from assured, it is perhaps not as farfetched as a first glance might suggest.

Rubicon Project – In small cap land, it is often said it is more important to bet on the right jockey than the right horse. (I found an interview on this subject with MicroCap Club Founder Ian Cassell interesting.) The thinking goes that the smaller the company, fewer bureaucratic layers provide a CEO with more authority and responsibility for strategic direction and successful execution of corporate aims. Greater touches with company leaders and employees provide a strong leader more opportunity to influence company culture and leave an outsized mark on company performance. While I have found this to be generally true in my experience, that does not mean we are not on the lookout for thoroughbreds too. So, what about a situation where we are betting on a jockey who is betting on his chosen horse? I believe we have that here with Rubicon Project.

The Rubicon Project is an independent ad exchange platform that focuses on automating the process of buying and selling digital ads. As a supply side exchange, the company’s principal focus is on matching the ad inventory of its content publishing customers with brands and advertisers who are looking for digital real estate for their ads. Given the thousands of miniature auctions that take place to match a buyer and seller to create an impression (i.e. a successfully matched ad), the company relies on algorithms to match the best bids with the appropriate content all in a way that places ads quickly, so the content is displayed without delay. Today ~$1B of ad spend goes through the company’s platform which processes trillions of impressions per month. For its role in sourcing and matching advertising demand, the company keeps a small percentage of the ad value flowing through its platform as a fee, known as its take rate.

The global programmatic ad market is large, estimated at ~$34B today. While Facebook, Google and Amazon are the largest players (who importantly also already have their own ad inventory), the rest of the industry is quite fragmented and growing strongly. Mobile is the big driver of growth today, but other uses like programmatic audio for companies like Spotify and connected tv applications suggest the industry is likely to continue to grow at a mid-teens rate in the coming years. As one of the largest remaining standalone independent ad exchange platforms, Rubicon is currently very well positioned to capture much of this industry growth. But it was not always this way.

In early 2017 when company founder and CEO Frank Addante began looking to move to the boardroom and install a new CEO, the company was facing a number of challenges. Rubicon was late to respond to the industry’s move to header-bidding, an open auction format that was a change from the more insulated waterfall ad matching structure that had allowed the company to thrive on its close-knit publishing relationships. With ads effectively bypassing the Rubicon platform, the company’s place in the value chain soon came under question. It was losing share, ads going through the platform were declining and take rates were shrinking. In May 2017, well-regarded ad tech industry veteran Michael Barrett joined the company as CEO in the midst of this shift in the industry. With strong credentials, including two nine figure exits and a stint as Yahoo’s Chief Revenue Officer, we view his industry experience and contacts and understanding of the competitive landscape as a major plus.

So, we found one of Barrett’s first moves after joining the company to be quite surprising. A few months into his tenure, he effectively cut the company in half by deciding to take their demand side take rates down to 0%. No longer was Rubicon a two-sided exchange charging fees to both parties in the transaction; instead it became a one-sided exchange focused primarily on sourcing the best demand possible for its content-providing customers. By eliminating the buyside fee, the company’s role in the bid matching process is now more clearly understood as solely that of an aggregator of purchasing demand for its publishing customers. In an industry that has had its fair share of shady players who have used the opaque nature of the marketplace as a conduit to overcharge, gouge and even in some cases, defraud its customers, the company has eliminated any appearances of self-dealing that the two-sided platforms sometimes face. The eliminated buyer fees have also reduced the total cost of transacting on the Rubicon platform, which has enabled it to attract a greater access to inventory. By moving to a transparent, efficient and low-cost model, the company has positioned its platform to thrive as a one-sided marketplace focused on high volume and low cost per transaction.

These strategic moves appear aptly timed as another trend in the industry, Supply Path Optimization (SPO), has spurred many advertisers to shrink the number of platforms they are using to locate ad inventory. Buying groups such as advertising agencies and demand side platforms are concluding more meaningful relationships with fewer exchanges are preferable to the inverse and lead to a higher quality experience of placing ads and an improved ability to measure ROI. These trends and the competitive dynamics typically associated with scaled exchanges with powerful network effects suggest that ad platforms which currently number in the hundreds will likely consolidate down to five or ten in the coming years. It is likely some may exit due to the synergistic nature of an acquisition by a player with its own existing inventory as we recently saw with AT&T’s purchase of AppNexus. The transaction is speculated to have occurred at ~8x multiple of sales, a level which speaks to the synergistic nature of opening up a content provider’s inventory to a broader pool of buyers, as well as the conflicts of interest potentially involved when an exchange platform is not truly independent.

Rubicon’s move to cut its demand side buyer fees – one of the ultimate in the category of short term pain for long term gain – has positioned the company quite well to emerge as one of the few consolidating exchanges of scale. But few investors seem to have noticed as consolidated financials continue to paint the portrait of a business in transition. As the company is still lapping tough comparisons from the prior year due to the change in business model, 3Q 2018 consolidated financials show the company posted an 18% decline in sales. But for people looking a little closer, signs of a healthy and growing business are there. The take rate has been increasing modestly while ad spend going through the platform is growing 24%. Secular growth drivers like streaming video which are associated with higher spend per ad are now coming into view with sales in this vertical growing at a 70% rate. With the company enjoying high incremental margins and expecting sales growth in the ~20% range, it likely will not take long for the financials to present a different picture. With half of its market cap in cash, shares at less than 1x EV/sales look attractive and offer a realistic path to earning multiples on our investment over the coming years.

This article first appeared on ValueWalk Premium

The post CEF 4Q18 Commentary: New Positions Under Armour & Rubicon Project appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.