By Michelle Jones. Originally published at ValueWalk.

The pension crisis has been going on for so long that it seems like every headline about it simply adds more bad news to the pile. However, there are a few good things going on at some public pension funds. There are also some very interesting trends, according to a recent study.

The National Conference on Public Employee Retirement Systems (NCPERS) conducted a study of 167 state and local government pension funds. The NCPERS Public Retirement Systems Study analyzed the funds’ “fiscal condition” and the steps they’re taking to bolster their “fiscal and operational integrity.”

Q4 hedge fund letters, conference, scoops etc

Equity returns are higher than other asset classes

Thy found—among other things—that the three asset classes which posted the highest one-year gross returns last year are all equities. However, private equity, hedge funds and other alternatives were in fourth place. It’s interesting that PE, hedge funds and alternatives were all lumped into one group, given what we’ve seen from other studies.

For example, Canaccord Genuity has shown several times that pension funds are increasingly favoring credit and related products over other asset classes, and sometimes PE can overlap with credit. As a result, the NCPERS study makes it a bit difficult to discern exactly where pension funds are getting their returns from.

We have seen in other studies that investors in general have been boosting their allocations to PE funds, often at the expense of hedge funds.

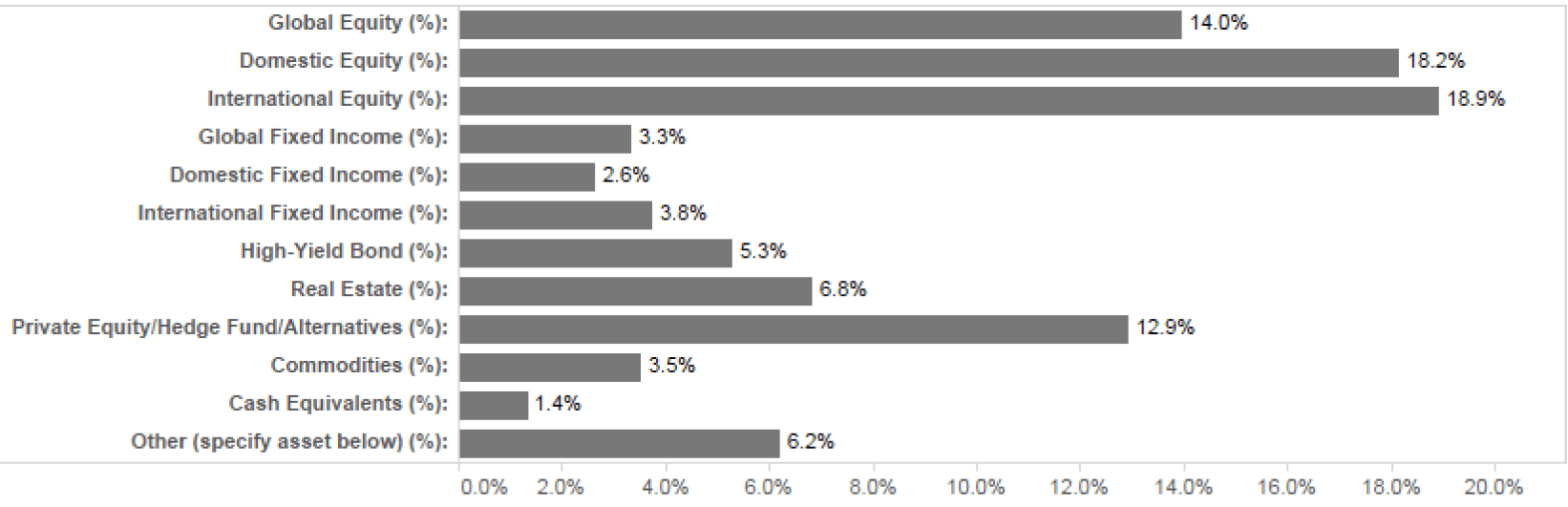

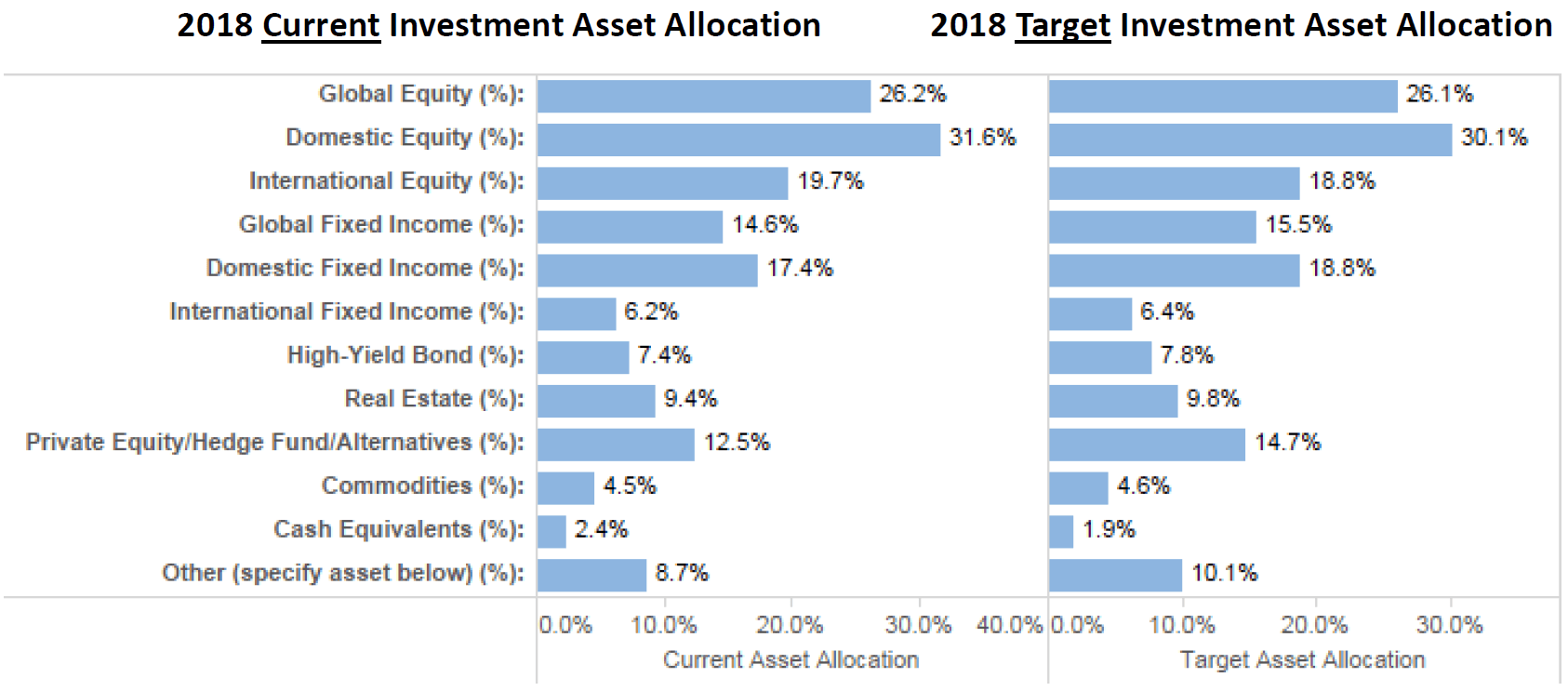

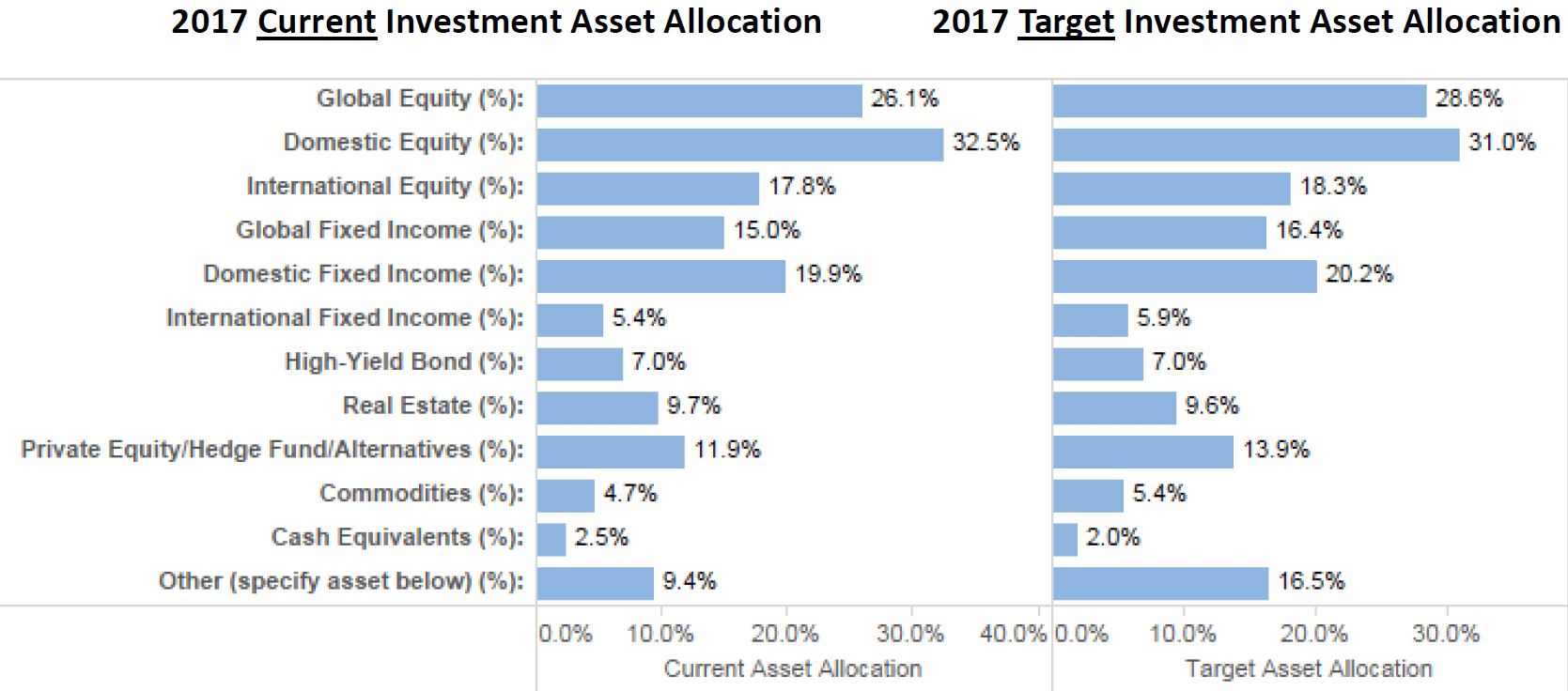

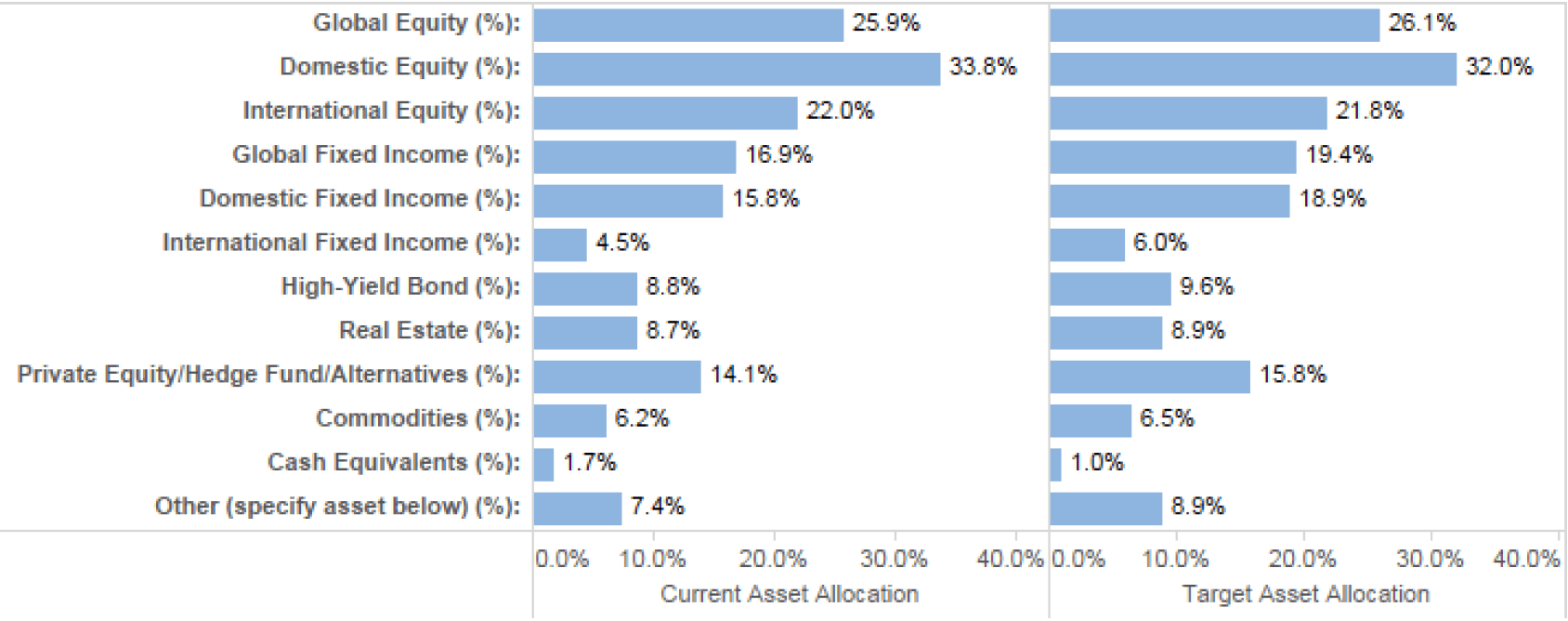

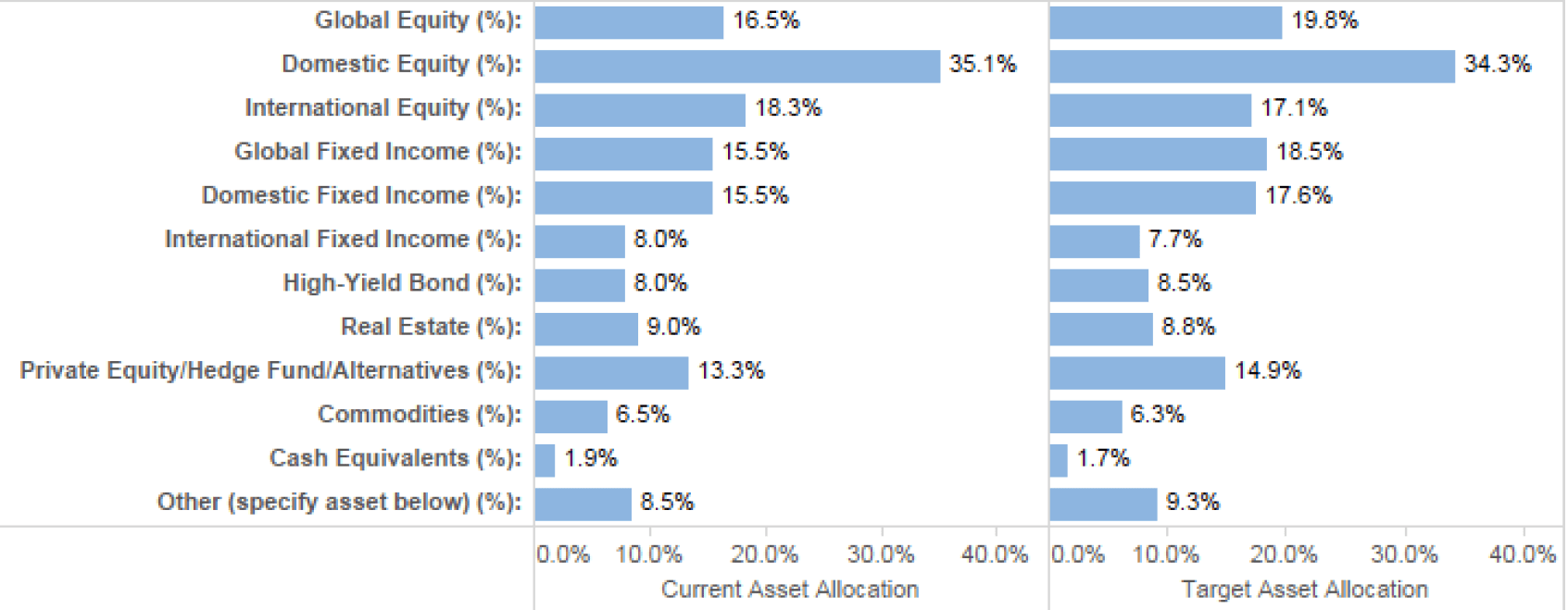

Looking at the allocations of pension funds, the NCPERS study found “a slight decrease” in targeted allocation to equities and fixed income and a “slight increase” in targeted allocation to bonds and PE/ alternatives.

Highest returns favored equity allocations

The study also found that the pension funds with the highest one-year investment returns were those that favored equities, global fixed income, PE and alternatives, and commodities. On the other hand, these funds had lower allocations to domestic and international fixed income.

Given the strong run stocks had last year, it isn’t a big surprise that equity-focused funds did better than others, although December through a major wrench into the works for some strategies. Due to that, we should emphasize that some of the funds included in the NCPERS study ended their fiscal years in December, while others ended them earlier in the year.

NCPERS found a similar story with 10-year returns. Once again, pensions with higher equity allocations enjoyed higher returns.

Pension funding levels tick higher

NCPERS also found that pensions’ funding levels shifted slightly higher. According to the study, the average funded level in 2018 was 72.6%, up from 71.4% in 2017.

This is certainly good news, but it demonstrates how the worst of the worst pensions in terms of unfunded liabilities are the ones that tend to grab the headlines. Of course, a roughly 70% funding level isn’t great, but it sounds quite good compared to the many headlines which have warned about pensions teetering on the edge of insolvency.

Public pensions are trying to take steps to boost their funding liabilities, and the NCPERS study asked what steps they are taking. The organization received several interesting answers—and a few concerning ones.

Some concerning answers from pension funds

For example, one fund said it has “implemented a little more risk with our investment strategy.” This is a concerning trend we’ve been hearing about elsewhere. A Canaccord Genuity analyst argued recently that this increased appetite for risk among pensions is what has been driving the extreme boom and bust cycles of the last few years. He also suggested that this problem is going to get worse and worse until the next financial crisis—or perhaps until lawmakers take steps to rein in pension funds.

Here’s another concerning quote. One fund said in order to increase its funding levels, “We ensure that we collect employer and member contributions.” The study did not say which pension fund said this, but it is rather concerning because it sounds like the fund isn’t doing anything to raise funding levels. Of course, if the fund is one of the few that’s mostly funded, then it wouldn’t be bad, but the average fund is only about 70% funded, according to this same study.

Another fund admitted that the only thing it has done is shorten the amortization period from 30 to 20 years, and several other funds also made similar comments about shortening their amortization periods. Unfortunately, we’ve heard this “strategy” often enough to know that it’s less of a strategy and more of a new way to kick the can down the road and make the unfunded liabilities someone else’s problem.

This comment makes it sound like the fund in question is doing nothing: “Employers are allowed (and encouraged) to pay additional contributions toward their unfunded liability.”

A few funds are making big waves

On the other hand, several public pensions listed several steps they’ve taken to try to boost their funding status. For example, one fund said they have “increased member and employer contributions until plan reaches 100% funding; raised benefit eligibility age and service requirements; raised FAS period and vesting requirements.”

Another fund said it has “increased employer contributions over 4 years (2017-2020); 2012 New Tier of New Members with: Lower Benefit Multipliers, Higher vesting and age requirements, Higher member contributions, Lower post-retirement benefits, Lower average final compensation, [and] Restricted eligible compensation to base pay.”

This fund is trying to put the age-old investment advice of diversification to work: “Broaden the number and type of investment holding trying to spread the risk and enhance the ability to earn over a wider variety of investments. In addition the board has requested and been granted a four-year implementation of contribution increases at the rate of .25 per year beginning with 2018 and ending in 2021 whereby the contribution rate will be 9% employee/employer match.”

The good news is that it seems like more public pensions are at least attempting to dig themselves out of the deep hole they’ve gotten themselves into. We can be that the funds which end up being successful will become case studies for those that don’t.

This article first appeared on ValueWalk Premium

The post Public Pensions Share What They’re Doing To Boost Funding Levels appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.