Courtesy of Benzinga

Uber Technologies Inc (NYSE: UBER) exceeded third-quarter expectations with $3.8 billion in revenue and a loss per share of 68 cents.

For investors, that wasn’t enough. A Tuesday sell-off cut Uber’s stock by more than 7%, but for analysts, the report was generally celebrated.

Rearview Reflection

Uber reported 29.5% adjusted net revenue growth and a take-rate improvement of 170 basis points. Bookings grew 29.4% year-over-year but still fell short of expectations. Meanwhile, the cost of revenue and other operating expense categories came in below forecasts.

While most analysts praised the achievements, not all were satisfied.

“Overall this was a B- quarter by Dara & Co. as the company missed underlying bookings and ridesharing metrics which will be viewed mixed to negatively by the Street,” Wedbush analysts Ygal Arounian and Daniel Ives wrote. “The headline numbers were good enough and increased transparency around the business units will be a step in the right direction, however.”

Looking Down The Road

Management expects Uber Eats investments and seasonal cost hikes to increase quarter-over-quarter losses in earnings before interest, tax, depreciation and amortization (EBITDA).

However, it guided for profitable EBITDA in 2021. DA Davidson analyst Tom White told CNBC “it’s a very aggressive target.” Morgan Stanley embraced it more readily.

“This … speaks to the impact of expected further rides rationalization, more rational investment/markets in Eats (more on this below), further expected opex discipline (continuation from 3Q), scale, and ultimately higher efficiency,” analyst Brian Nowak wrote. The guidance bolstered his bullish thesis.

Management committed to aggressive investments in the next 18 months to become the No. 1 or No. 2 food delivery service.

“Food delivery is rationalizing slower than Rides,” Raymond James analysts Justin Patterson and Aaron Kessler wrote. “We had lowered bookings into earnings, but not nearly enough…. We continue to expect losses to narrow in 2020E and beyond as management approaches each market pragmatically.”

Morgan Stanley was more bullish.

“This will remain a show-me into ’20, but if this is at all similar to the rides industry or what we have seen in certain online food delivery markets like China or Europe, this could prove to be very positive for Uber’s ability to turn Eats into a cash-generative business,” Nowak wrote.

Drag Race Comparison

For the time being, White considers Lyft Inc (NASDAQ: LYFT) a better investment.

“The reason we prefer Lyft is visibility, plain and simple,” White said, noting that Uber may have an appeal over a longer time horizon.

“Over the next 12 to 18 months, Uber is just fighting a lot of battles on a lot of fronts, particularly in Eats, competing with companies that are still private, flush with VC money, and Uber is having to react and respond to some pretty aggressive promotional and competitive activity.”

The Ratings

- DA Davidson maintained a Hold rating and a $46 price target.

- Morgan Stanley maintained an Overweight rating and raised its target from $53 to $55.

- Raymond James maintained an Outperform rating and $54 target.

- Wedbush maintained an Outperform rating and cut its target from $58 to $45.

- Wells Fargo maintained a Market Perform rating and $41 target.

“While we remain positive Uber needs to execute flawlessly over the next 3-4 quarters and regain much-needed Street credibility,” Wedbush wrote. “While a potential avalanche of selling could come beginning Wednesday when the lockup hits, we view this as a fork in the road situation for Uber with our bias positive given the risk/reward in shares.”

Uber’s stock traded around $28.90 per share at time of publication.

Related Links:

Cramer: Uber Lockup Expiration Could Be Much Uglier Than Beyond Meat

Earnings Thoughts Turn To Retail Later This Week, But Uber Starts Parade Today

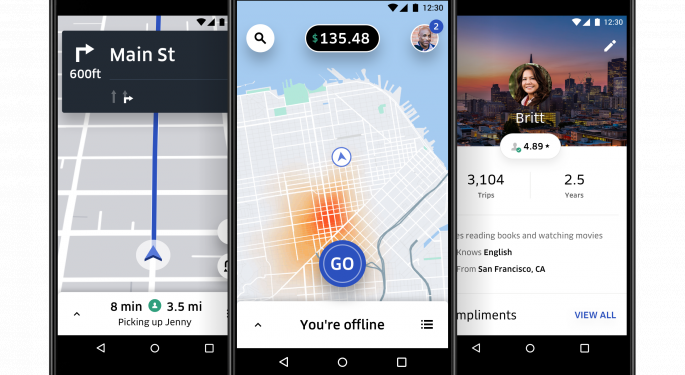

Photo courtesy of Uber.

Latest Ratings for UBER

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Nov 2019 | Maintains | Neutral | ||

| Nov 2019 | Maintains | Overweight | ||

| Nov 2019 | Maintains | Overweight |

View More Analyst Ratings for UBER

View the Latest Analyst Ratings

Posted-In: Analyst Color Earnings Long Ideas News Guidance Price Target Reiteration Top Stories Best of Benzinga