By Jacob Wolinsky. Originally published at ValueWalk.

Alluvial Fund, LP commentary for the month ended January 31, 2020, discussing their holdings in Galaxy Gaming Inc. (OTCMKTS:GLXZ).

Dear Partners and Colleagues,

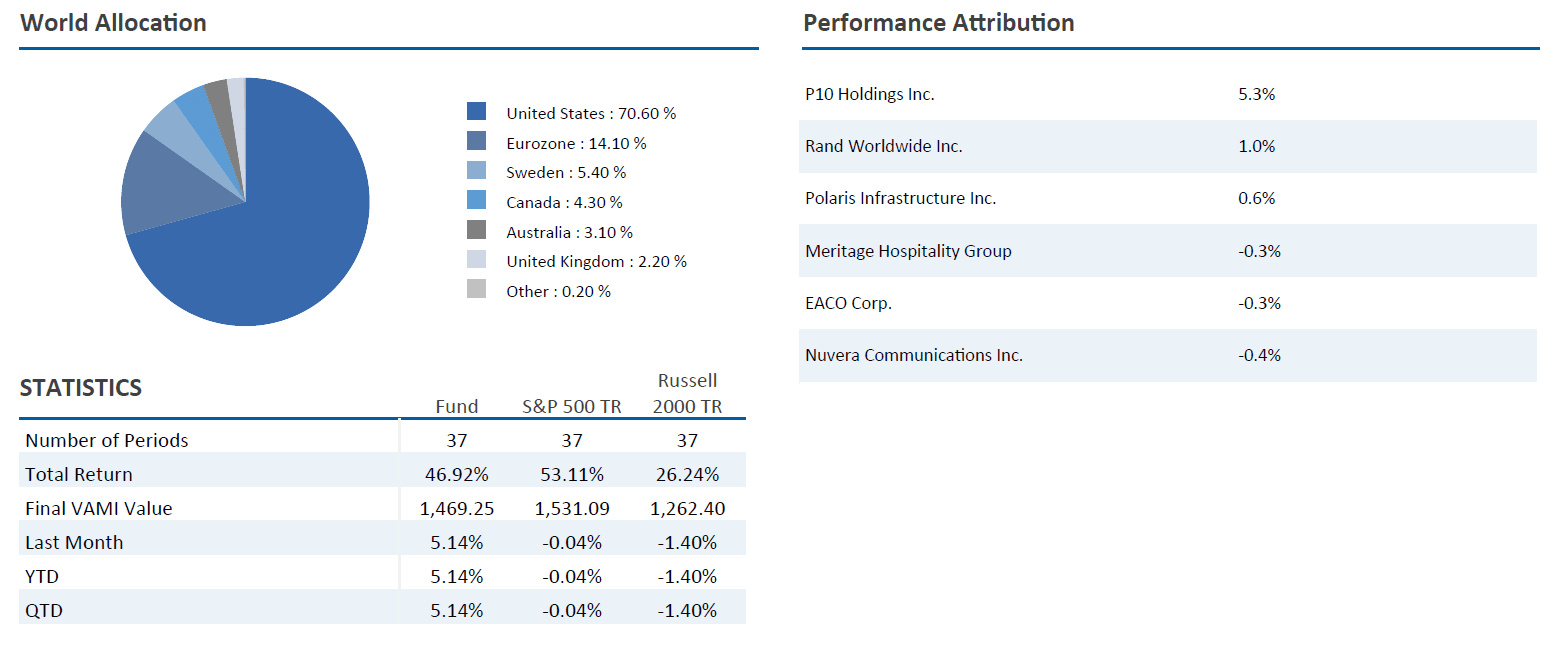

Alluvial Fund, LP returned 5.1% in January, compared to 0.0% for the S&P 500 and -1.4% for the Russell 2000. Since inception, Alluvial Fund, LP has returned 46.9% compared to 53.1% for the S&P 500 and 26.2% for the Russell 2000.

Q4 2019 hedge fund letters, conferences and more

Alluvial Fund, LP is a value investing partnership with a focus on small companies and obscure securities, both domestic and international. The January tearsheet can be seen below:

Galaxy Gaming OTCMKTS:GLXZ thesis

In addition to the monthly tearsheet, we are pleased to present a brief profile describing an interesting holding of Alluvial Fund. These write-ups allow us to provide a quick look at holdings not mentioned in our quarterly letters. Enjoy!

Galaxy Gaming is an independent developer and distributor of proprietary gaming products to land, waterway, and internet-based casinos. Their offerings include enhancements of familiar, public domain games such as blackjack or craps, as well as unique, stand-alone games. Galaxy has products installed in more than 600 casinos worldwide.

Recent earnings for Galaxy Gaming have been strong, driven by solid revenue growth and improving margins. The company also produces lots of free cash flow, to the tune of 26 cents per share over the trailing twelve months and with every expectation that this figure will grow in 2020.

Galaxy Gaming OTCMKTS:GLXZ background

The main cloud looming overhead for Galaxy Gaming involves their founder and former majority shareholder, Robert Saucier. Following growing pressure from Nevada gaming regulators over his past business practices, Mr. Saucier resigned as Chairman and CEO of Galaxy in 2017 before finally surrendering his board seat and his title as EVP of Business Development in late 2018. Galaxy subsequently explored possible strategic alternatives, including the sale of the controlling stake held by Mr. Saucier. Ultimately, Galaxy elected not to pursue a sale. Instead, as permitted by their articles of incorporation, Galaxy redeemed the shares controlled by Mr. Saucier in exchange for a promissory note bearing 2% interest, due in 2029.

Though lawsuits filed followed the redemption transaction are still pending, business as usual has largely resumed for Galaxy of late. Since the transaction, Galaxy Gaming has received approval for thirteen new gaming licenses. The most recent addition to this list is the state of California – the largest table games market in North America. Growth prospects continue to look good for Galaxy Gaming.

Conclusion

If you are interested in learning more about Alluvial Fund, LP, please do not hesitate to contact Alluvial Capital Management, LLC at (412) 368-2321 or info@alluvialcapital.com. We welcome inquiries and would be happy to arrange a call or meeting.

Finally, I will be making the annual trip to Omaha for the Berkshire Hathaway shareholders meeting the first weekend of May. If anyone else plans to be there, please let me know. I would enjoy the chance to catch up in person.

While in Omaha, I will again be participating in an event hosted by Willow Oak Asset Management, LLC, which will be held on Saturday, May 2nd from 5:00 to 8:30pm. Full details will be announced soon, but please use this link to register.

Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC

The post Alluvial Fund January 2020 Update: Galaxy Gaming appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.