By Pierre Raymond. Originally published at ValueWalk.

It is so important to make the shift to active management now. And a perfect time to talk about the markets. The big rally in non-government bonds is creating a once in a lifetime sell opportunity.

Q1 2020 hedge fund letters, conferences and more

Growth Will Keep Falling

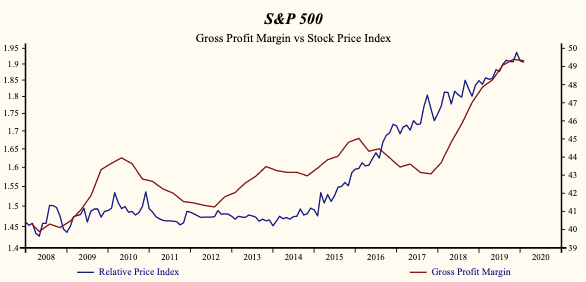

Corporate growth has been falling for a year with sales growth of the Index Average U.S. company down from 14% at the peak in the third quarter of 2018 to 7% in the annual period 2019 just completed. In the third quarter of last year the gross margin dropped from the highest level since 1999 indicating a move to defensive stocks and cash was required.

There is little doubt that the recent growth decline will be steeper in the coming quarters as the impact of the shut-down appears on company financial statements. In the next few weeks, the new reports will help to measure the companies most and least effected by the shut-down, but it will be a while before the shape of a recovery is revealed.

With company cash flow falling in recent quarters and now likely to fall at a more rapid rate, at a time when debt levels are very high and interest costs cannot go lower. The massive cash infusion from the U.S. treasury announced this week reduces the risk premium in the short-term, providing an opportunity to sell all bonds.

Shift To Active? Dividends Will Be Cut

The bigger risks now are widespread dividend cuts for stocks that have historically performed well in a downturn. Traditionally defensive investments like corporate bonds, real estate investment trusts and banks will continue to perform poorly. Verify that all your investments have stable growth records, good financial condition and ample cash-flow coverage of the dividend.

We have already seen the unprecedented jump in unemployment as companies seek to conserve cash as revenue drops. Next will be widespread dividend eliminations and then loan defaults. People dealing with cash concerns will respond the same way. Widespread defaults on mortgage payments will place stresses on the financial system that the financial crisis did not. It is unlikely that a check from the Feds is going to the pay the mortgage, much less the taxes. This will alter the status quo in ways that cannot be known.

Are You Prepared To Make The Shift To Active Management?

Otos clients are well prepared for the future with large cash positions and defensive stock portfolios. How and when to redeploy that cash is the pressing question. We have collected 2019 annual sales data for 275 of the 282 comparable record companies in the S&P 500 Index representing 100% of the capital value. The upcoming quarterly financial statements will be completed by May 8 and will give us some guidance.

That is why it is so important to make the shift to active management now. Empower yourself with data and analytics that has identified every market peak and trough in the past 50 years.

What is Otos?

Otos is a machine-learning artificial intelligence entity that supports all aspects of investment decision-making. Otos has built a 20-year quarterly data record of fundamentals of US companies mined from financial statements in SEC filings. Otos communicates changing fundamentals attributes with the MoneyTree avatar. The visualization supports quick and efficient decisions in asset allocation, sector rotation and ETF/mutual fund selection. Otos supports the design, execution and management your portfolio strategy. Register for free at Otos.io

The post Empower yourself with data & analytics appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.