By Jacob Wolinsky. Originally published at ValueWalk.

Logica Capital commentary for the month of March 2020, titled, “Is It Different This Time?”

Q1 2020 hedge fund letters, conferences and more

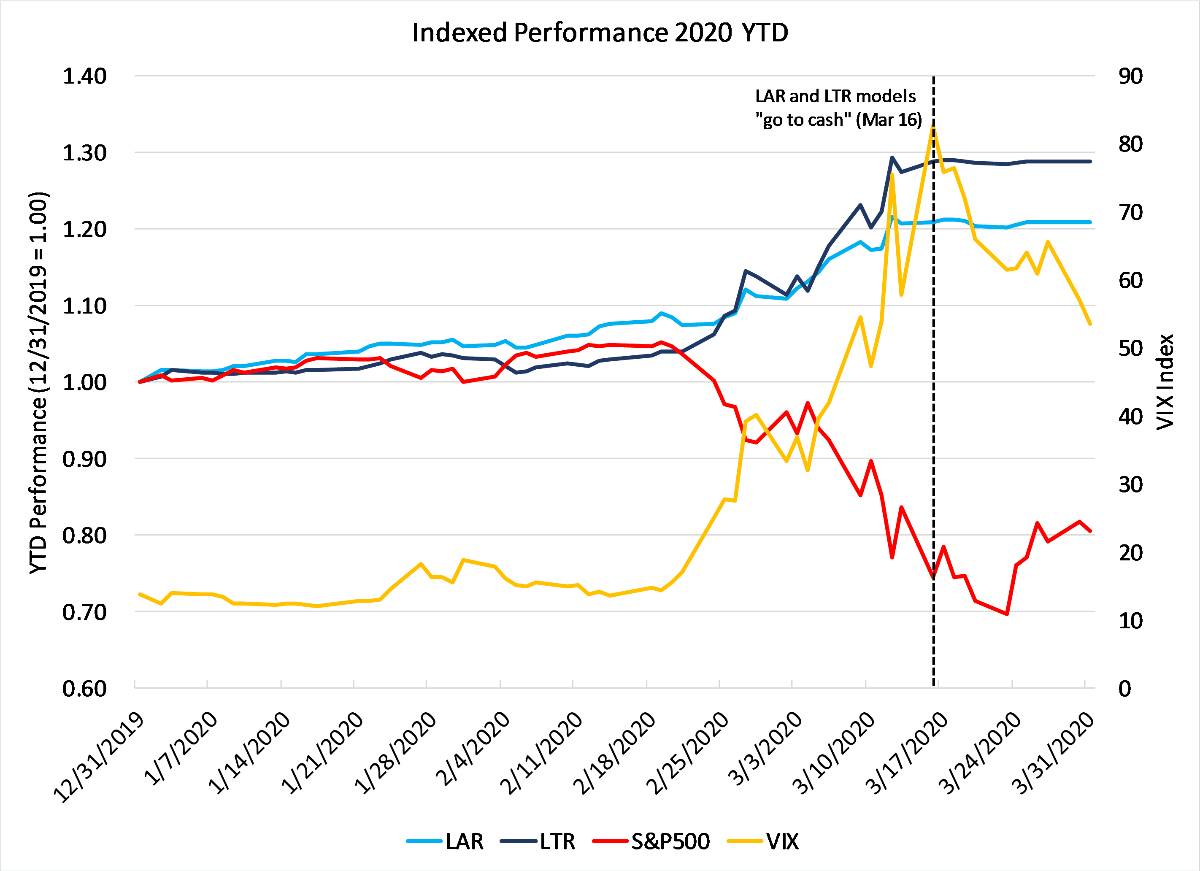

- Logica Absolute Return – Up/Down Convexity – No Correlation

- Logica Tail Risk – Max Downside Convexity – Negative Correlation

March 2020 Performance

- Logica Absolute Return +8.58%

- Logica Tail Risk +13.23%

- S&P 500 -12.49%

Year To Date Performance

- Logica Absolute Return +20.84%

- Logica Tail Risk +28.69%

- S&P 500 -19.45%

“ A great book seeks to explain causality, not correlation. It works to point out the circumstances in which it works, and where it doesn’t. And in so doing, it is broadly applicable.” - Clayton M. Christensen

March Came in Like a Lion

We are of course referring to the hit Netflix series, “Tiger King” which broke records for streaming content and emerged as both the top-rated and most watched series in the United States. It’s almost as if people had nothing better to do than sit around and watch a colossal train wreck of poor judgement, borderline criminality and terrible risk management. Or maybe we are simply projecting the series onto the global policy response to COVID-19. Hopefully you’ve had the opportunity to read our recent thought piece, “Policy in a World of Pandemics, Social Media and Passive Investing”. We are gratified with the response so far and look forward to sharing more thoughts on a regular basis. As March ends, we are also excited with the launch of the Logica Absolute Return Fund in April – our first commingled product. Please reach out to Steven Greenblatt (clientrelations@logicafunds.com) for further information.

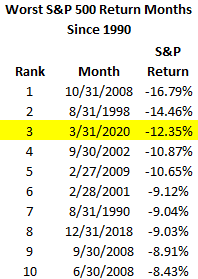

It wouldn’t be unreasonable to extend the chaos of Joe Exotic to the performance of the S&P 500 which managed to deliver one of the worst monthly returns in the past thirty years and by far the fastest bear market drawdown from an all-time high.

In February, we expressed excitement that the (then) extreme market movements, both up and down, in 2020 had given Logica the opportunity to demonstrate the payout characteristics of our strategies. As we had planned, Logica Absolute Return (LAR) exhibited a positive alpha, long straddle payout structure and Logica Tail Risk (LTR) exhibited a positive alpha, long put payout structure. March extremes exhibited another characteristic – delevering to capture gains. We emphasize that Logica products are not designed to “sell the world”; in our view, that is a payout dynamic that (1) rarely works and (2) leads investors to abandon positive skew structures due to persistent negative carry – nobody wins. We believe the options we purchase are undervalued due to a demonstrable flaw in option pricing models that assume the Efficient Market Hypothesis (EMH) and that these characteristics are likely to grow over time due to the growth of passive index strategies. However, when implied volatility reaches extreme levels, the market is basically throwing its hands up in the universal “I don’t know!” signal ¯\_(ツ)_/¯.

“You’re wrong!” is not an answer to “I don’t know!”; we address this by choosing the position with maximum optionality that simultaneously preserves our profits – cash. In our simulations, similar events occurred in the aftermath of 2008. When volatility retreats, we are confident that more opportunities will present themselves. We are especially confident as even lower yields suggest yield enhancement becomes increasingly mandatory. As a research focused firm, the most exciting aspect is that “new” market conditions have been revealed and these have led to a flurry of research activity. We are incredibly excited to share our insights in the coming months as we redeploy our capital back to scale.

Is It Different This Time?

We are experiencing an unprecedented event. There is no published account of any experience in which a society has intentionally shut down its productive capacity to slow (not eliminate which is impossible) the infections and deaths associated with a pandemic. While comparisons are often made to the 1918 Spanish Flu epidemic that killed over 500,000 Americans and nearly 50 million worldwide, the steps taken for COVID-19 dwarf any attempts at mitigation from that period. As researchers demonstrated in 2007, attempts at mitigation in 1918 did not end the pandemic, they merely slowed its progress. For a disease that targeted young workers and soldiers, society made the choice to keep going on the factory floor and the battlefield.

Early implementation of certain interventions, including closure of schools, churches, and theaters, was associated with lower peak death rates, but no single intervention showed an association with improved aggregate outcomes for the 1918 phase of the pandemic. These findings support the hypothesis that rapid implementation of multiple NPIs can significantly reduce influenza transmission, but that viral spread will be renewed upon relaxation of such measures.

– Hatchett et al 2007

In 2020, a very different decision is in play. Globally, the focus has been on preventing an overburdening of healthcare systems and to do so we have shut nearly all “unessential” businesses. These decisions have been made with very little consideration for the rapid innovation that occurs during times of systemic stress. For example, the frequently cited ICU and ventilator shortages have been addressed with the establishment of field facilities (e.g. the Javits Center in NYC) and the extension of ventilator capacity to serve multiple patients (an innovation demonstrated nearly 15 years ago) that roughly quadruples the existing capacity. Retired and inactive medical personnel have willingly volunteered to address expected labor shortages with over 76,000 volunteering in New York alone, a surge of roughly 15% of total capacity including home health aides; if we exclude this subspecialty, it is nearly a 30% increase in capacity.

Medicine has triumphed in modern times, transforming the dangers of childbirth, injury and disease from harrowing to manageable. But when it comes to the inescapable realities of aging and death, what medicine can do often runs counter to what it should. – “Being Mortal”, Atul Gawande

While the tragedy of death cannot be discounted, the choice to save lives regardless of cost must be considered. Within the healthcare establishment, it’s worth considering the appropriateness of intubating elderly patients under emergency quarantine conditions. A 2013 longitudinal study by Johns Hopkins University evaluated the impact of intubation and concluded that 35% of outcomes were analogous to post-traumatic stress disorder (PTSD) with over 60% of these patients suffering for over two years. Risk factors were exacerbated with unfamiliar doctors, extended ICU stays and separation from family. With those over 65 representing nearly 50% of all hospitalizations in hard hit areas like NYC, it does not seem a stretch to suggest that we are establishing conditions for extraordinary mental distress and quite poor long-term outcomes.

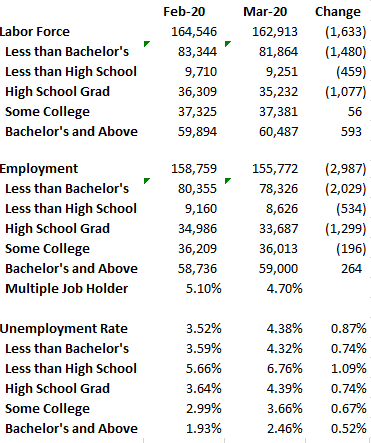

Likewise, we must consider the impact of the shutdowns on those who would be otherwise unaffected by the virus. A timely study from October 2019 identifies the long-term impact of entering the labor force during recessions. Historically, it was believed that these effects were mostly economic and faded over a 10-15 year period, but Schwandt et al 2019 note that “unlucky” labor market entrants experienced persistent adverse outcomes on mortality and behavioral health. This past week we began to get the data on the impact on the economy – it isn’t pretty with unemployment posting dramatically higher among the less skilled workers who bore virtually all the pain. This suggests that the loss of productive workers is simply the beginning of a dramatic “own goal”.

“You can’t learn in school what the world is going to do next year.” – Henry Ford

The current economic consensus seems to be coalescing around a decline in economic activity that has never occurred in the modern era for advanced economies. Goldman Sachs is leading the charge in estimated GDP decline with -9% in Q1 and a staggering -34% in Q2 (both in annualized numbers), before recovering in Q3 and Q4. These numbers would imply a trough in US real GDP in Q2-2020 at $17.2T, a level equivalent to December 2014 and suggesting a decline in GDP/Capita of nearly 11%. In contrast, the Global Financial Crisis saw rGDP/Capita decline by only 5.3% in the US.

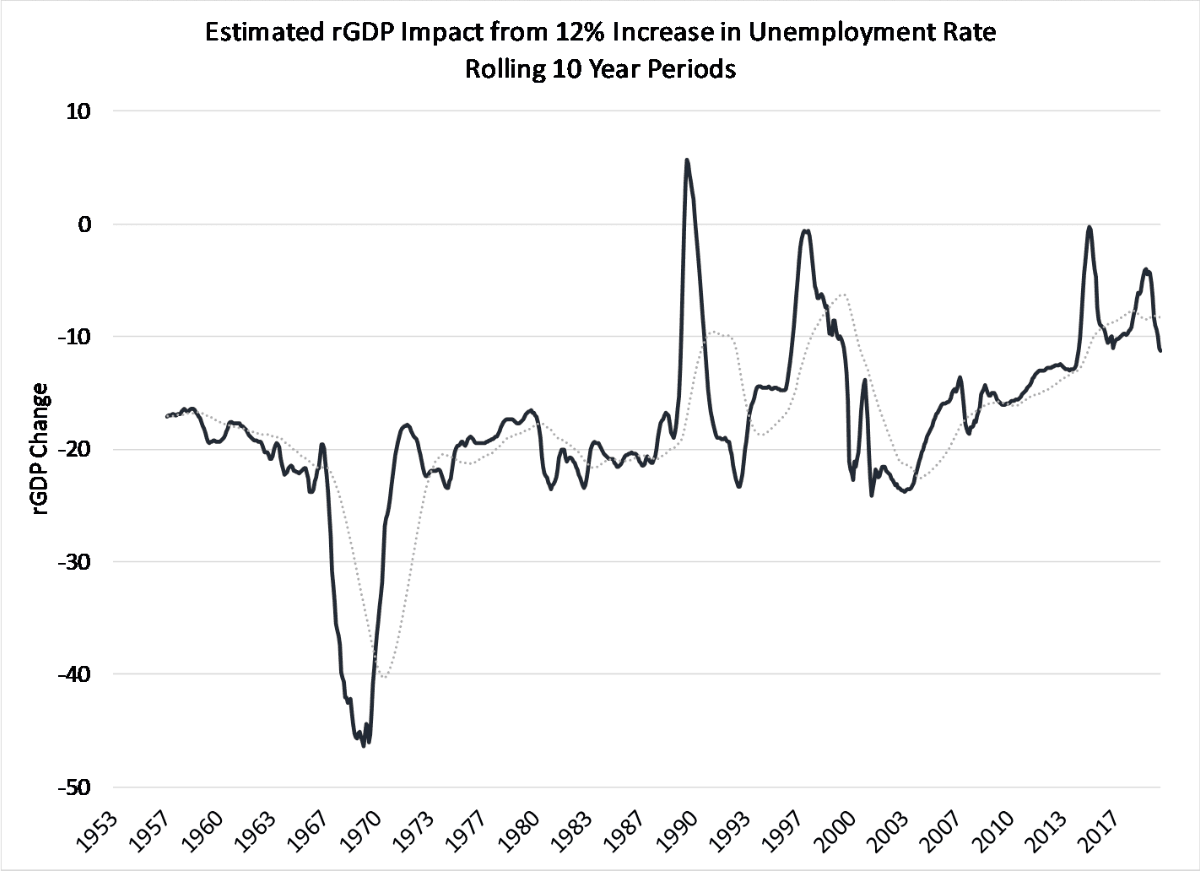

The GS forecast is heavily dependent on a key assumption that GDP can be accurately forecast by a variation of Okun’s Law. As they note, “Normally, the coefficient for Okun’s law is thought to be about 2, meaning that a 1pp rise in the unemployment corresponds to a 2% hit to real GDP. During this crisis, however, a more appropriate Okun’s law coefficient is likely to be closer to 1… Our current estimate of a roughly 12pp increase in the unemployment rate implies a roughly 12% peak decline in the level of GDP”

Replicating this analysis is quite straightforward and of course we get a similar answer to GS given the assumption of a 12% increase in unemployment rate (to 15.5% by Q2). However, there is interesting information generated by providing the historical relationship as seen below. Since 2002, the historical relationship has clearly broken down. Expecting an Okun coefficient of 1.0 (11% GDP decline) seems quite arbitrary with the range of GDP outcomes from positive 5% to -45% based on historical analysis. In other words, we simply don’t know. Pretending otherwise would be foolish.

What we do know, however, is that the stimulus programs to this point have focused on one very clear objective – providing incredible support for the large corporates in the United States. As the early information on unemployment in the United States makes very clear, the job losses have been concentrated in the ranks of the unskilled and the multiple job holders. Perhaps they will spread aggressively to the white-collar salaried ranks currently working from home, but there is reason to be skeptical. The large corporate sector has availed themselves of lines of credit and many of them have used their large purchasing power to unilaterally “negotiate” extraordinary terms, e.g. Cheesecake Factory announcing suspension of rental payments. With trillions in stimulus at play, it seems difficult to imagine a scenario in which large corporates do not emerge with less competition and more pricing power. That this occurs against a backdrop of growing political unification in favor of massively increased government deficits and support for diversifying supply chains away from China seems likely to drive even further consolidation. It is tempting to refer to one of the greatest movies of the 20th century, “Demolition Man”:

“Your tone is quasi-facetious, but you do not realize that Taco Bell was the only restaurant to survive the franchise wars…”

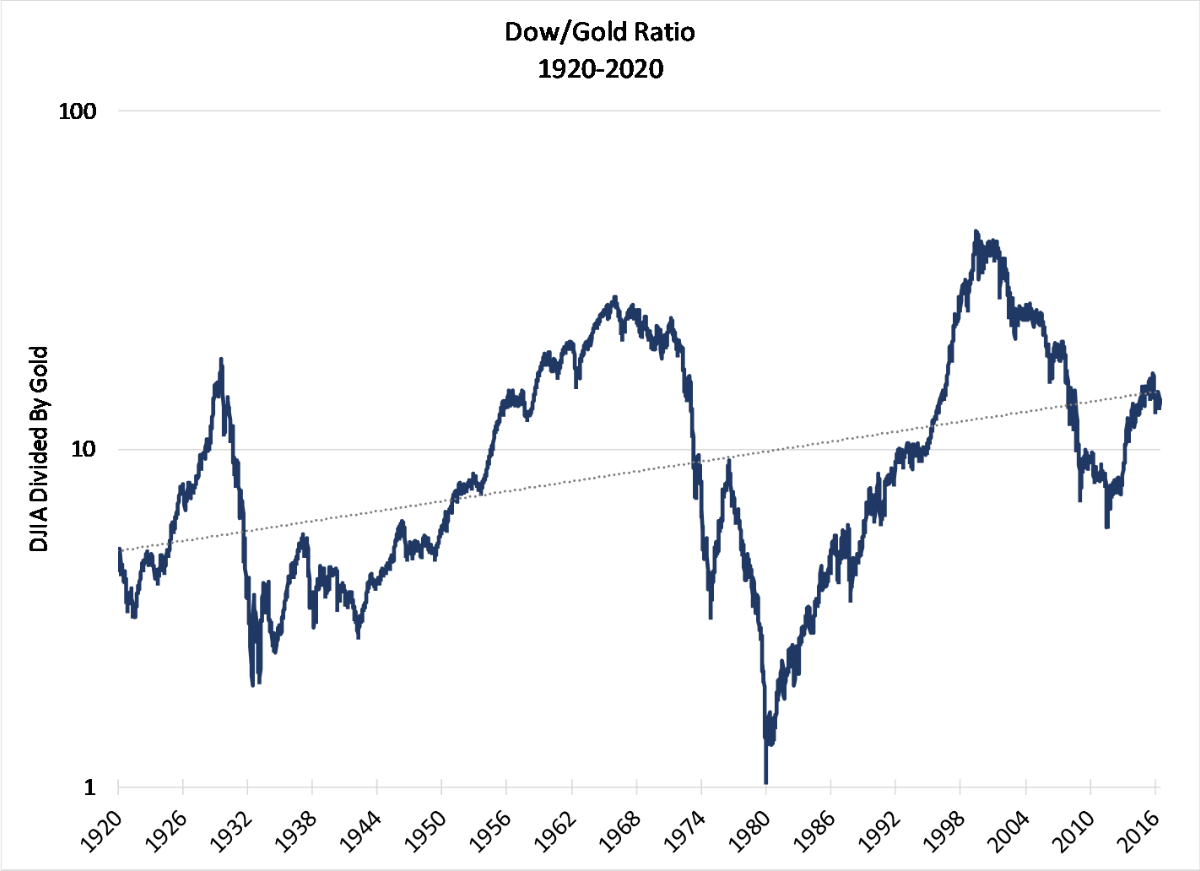

Demolition Man not only forecast casual dining consolidation, but also predicted a future toilet paper shortage. At Logica, we have no such forecasting skill. We do not know how this will ultimately play out. Given this uncertainty, it seems odd that most of the focus is to the downside. One simple observation is that the longest historical equity index dataset, the Dow/Gold ratio, has again moved below trend. Excluding dividend yield, the DJIA is only up 0.9% per year for the last 100 years. Since the trough of the GFC, price gains are only 5.7%/year despite huge buybacks. Is it possible that the large US corporate sector is “cheap” as it was in 1987? In all seriousness, only the future can answer this question.

Regardless, Logica remains committed to expressing our humility in our trading strategy. As volatility begins its inexorable retreat, we are again looking to deploy capital and convert our option rich cash balance back into risk positions that demonstrate appetizing reward. In both Logica Tail Risk and Logica Absolute Return we understand that we cannot know the future, but that there are phenomena that do not appear to have run their course – namely the passive sector continues to take share from the active manager segment and historically low interest rate policy from Central Banks result in demand for volatility dampening yield enhancement strategies. One piece of evidence that continues to support this thesis is the continued outperformance of momentum strategies deep into this crisis. If salaried employment (and hence 401Ks) is supported by stimulus, we believe there is a very good chance that currently vindicated bears will again be running for their caves due to the impact of passive share gain. But of course, if we’re wrong our downside is always rigorously protected.

“Everything serious in the world is well approached by humor. It’s a powerful and often quite subversive tool. I suppose there is an argument that could be made against me for being frivolous, but I do think a laugh is a very generous thing to give.” – Beeban Kidron, House of Lords

Business Update – Logica Absolute Return Fund Launch

The Logica Absolute Return Fund launched on April 1st, 2020. Next subscription date is May 1st, 2020. Please contact Steven Greenblatt if interested in receiving subscription documents

Logica Strategy Details

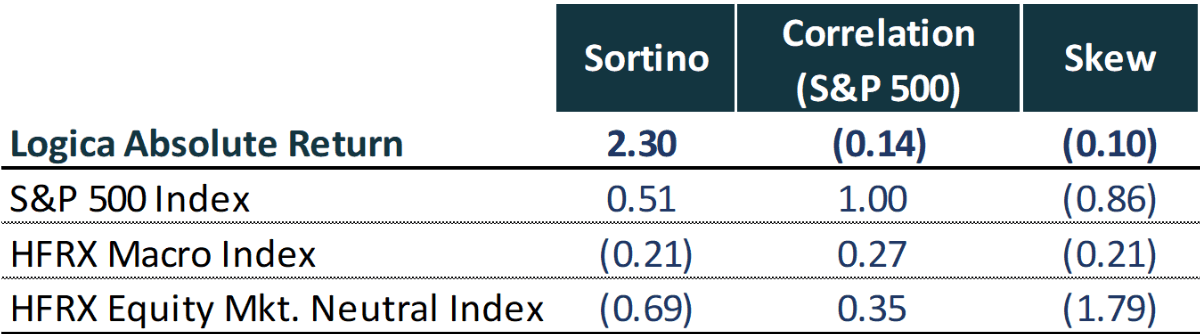

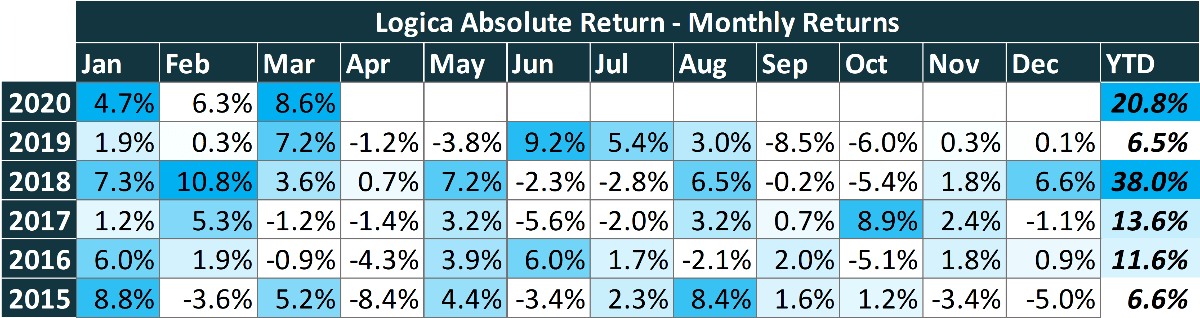

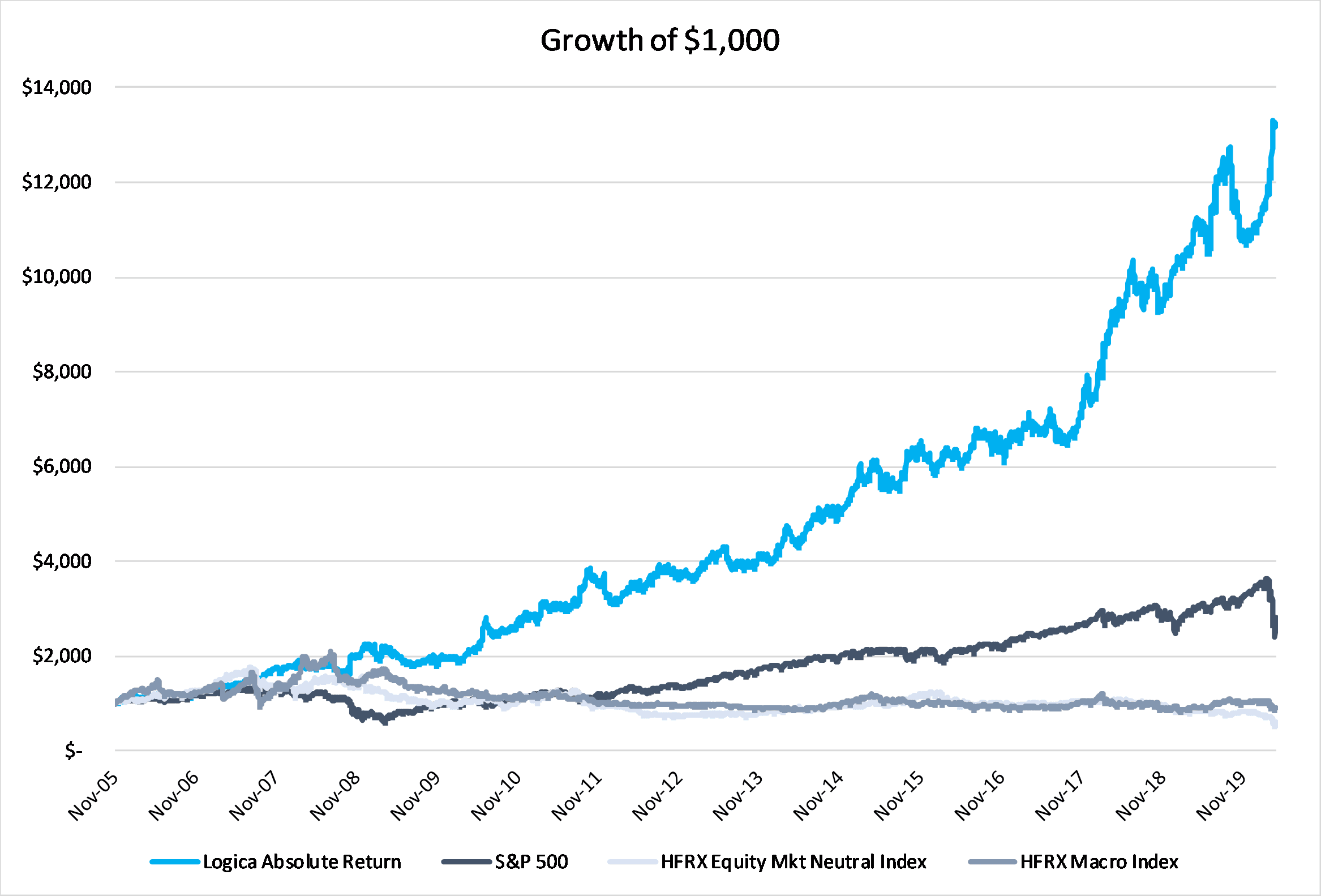

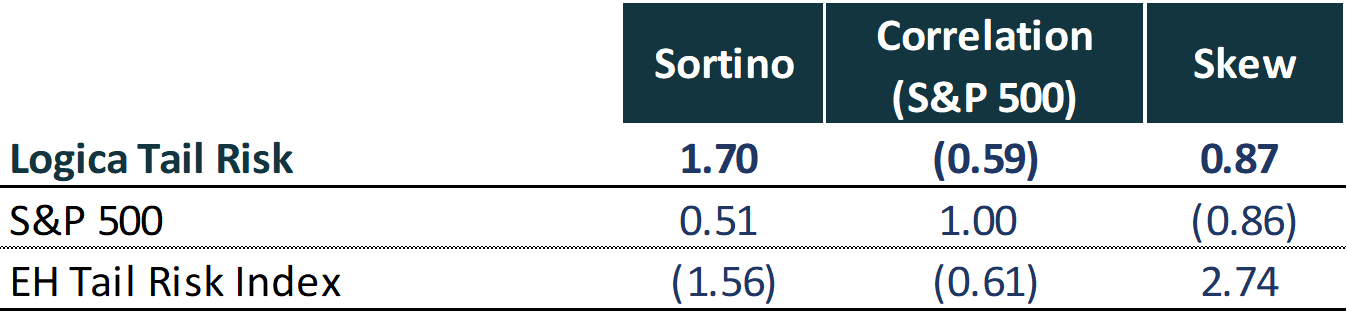

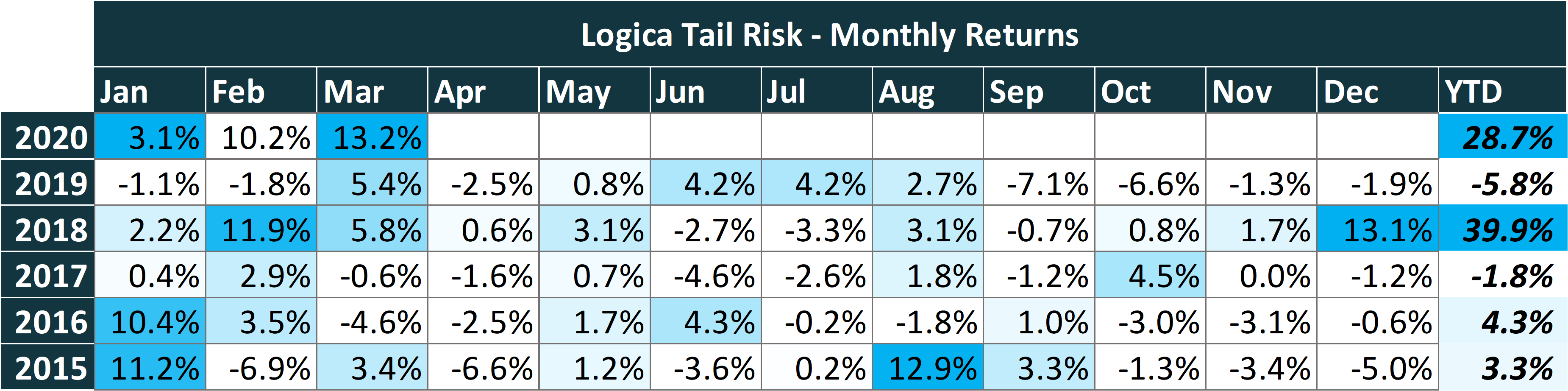

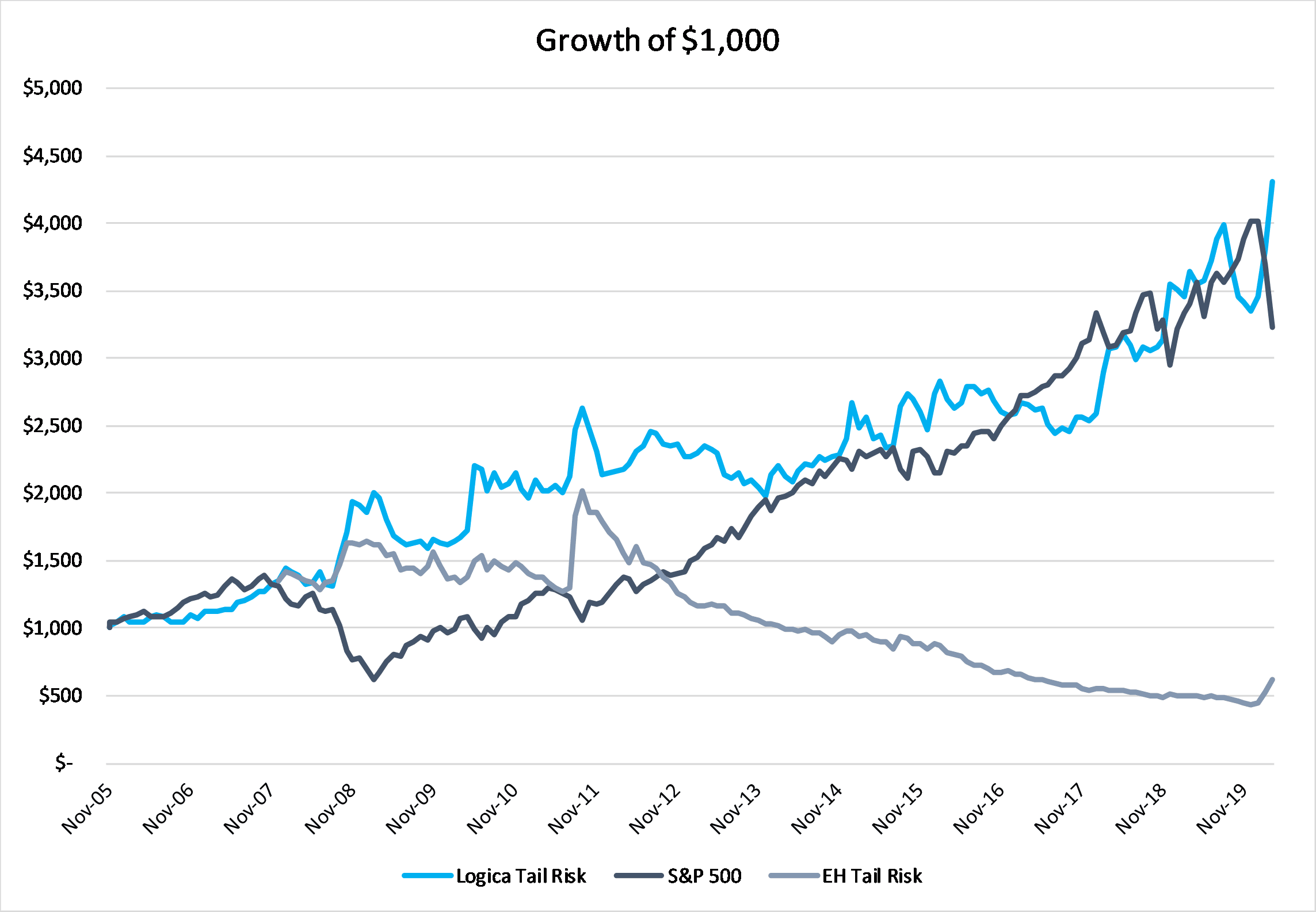

Note: We have comprehensive statistics and metrics available for our strategies, but only include a select few to highlight what we believe is our most valuable contribution to any larger portfolio.

- If you would like to learn more about our strategies, please reach out to Steven Greenblatt.

- If you would like to speak with Wayne or Mike on their views on Hedge Funds/Investing/Trading and trends they see shaping the industry, please contact Steven Greenblatt at greenblatt@logicafunds.com or 424-652-9520.

Logica Absolute Return

- 2015-2019 stats & grid, reconstitution of live sub-strategies

- 2005 to present growth of $1000 chart, simulation

- Jan 2020 live with partner capital

Logica Tail Risk

- 2015-2019 stats & grid, reconstitution of live sub-strategies

- 2005 to present growth of $1000 chart, simulation

- Jan 2020 live with partner capital

References

- “Public health interventions and epidemic intensity during the 1918 influenza pandemic”

Richard J. Hatchett, Carter E. Mecher, Marc Lipsitch - Proceedings of the National Academy of Sciences May 2007, 104 (18) 7582-7587; DOI: 10.1073/pnas.0610941104

- “A Single Ventilator for Multiple Simulated Patients to Meet Disaster Surge” Neyman et al 2006

- Bienvenu, O., Gellar, J., Althouse, B., Colantuoni, E., Sricharoenchai, T., Mendez-Tellez, P., . . . Needham, D. (2013). Post-traumatic stress disorder symptoms after acute lung injury: A 2-year prospective longitudinal study. Psychological Medicine, 43(12), 2657-2671. doi:10.1017/S0033291713000214

- “Socioeconomic Decline and Death: Midlife Impacts of Graduating in a Recession” Schwandt et al, 2019

The post Logica Capital March 2020 Commentary: Is It Different This Time? appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.