By Prof. Bradford Cornell, Cornell Capital Group. Originally published at ValueWalk.

I have written about the problem of valuing the S&P 500 in previous columns, but the issue is so important it is worth revisiting one more time. After all, the overall level of the market is the tide which raises and lowers all investment boats, so no matter what your investment strategy, it is a critical issue.

Q1 2020 hedge fund letters, conferences and more

The Intrinsic Value Of The S&P 500 Index

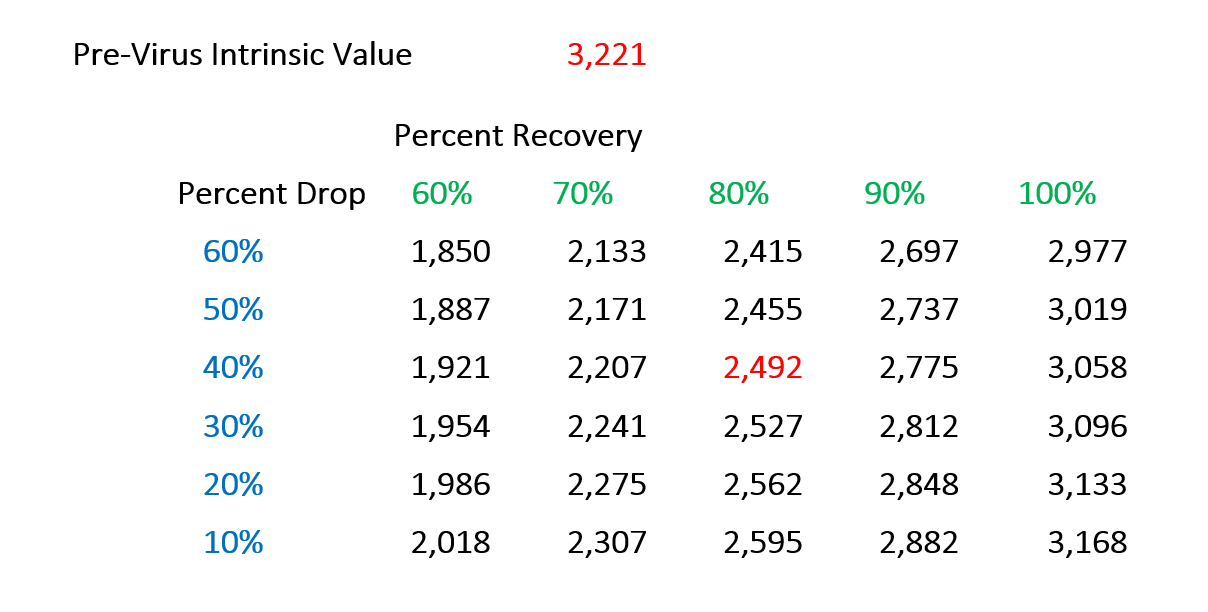

In my previous posts, I made available a valuation tool which can still be downloaded here (download spreadsheet), but many readers found that a bit difficult to use. Therefore, the tables below summarize the key implications of the tool in an easy to read form. The tables start with an estimate of the intrinsic value of the S&P 500 index of 3,221. This is calculated by discounting expected cash payouts on the index to present value as of early February 2020 at a discount rate of 6.70%. The estimated intrinsic value of the index comports well with the actual S&P 500 index of about 3,250 at that time.

Estimating the impact of the virus requires two key inputs. The first is the percentage change in earnings for the companies in the S&P 500 for the year 2020. Prior to the virus crisis, analysts, on average, expected earnings to rise by 5.5% in 2020. Following the outbreak, that growth is clearly off the board. The question is how much will earnings drop in 2020? The tables provide choices of 10% to 60%. By means of comparison, earnings for S&P 500 companies dropped 40% in the recession associated with the 2008 financial crisis. The estimated drop is applied to the actual 2019 earnings for the index of $163.00. For instance, using a 40% drop the estimated earnings for 2020 come to $97.80.

How Earnings Will Recover

The second input is related to how earnings will recover over the five years following the crisis. Using pre-virus analyst projections, earnings per unit of the index were expected to rise from $163.00 in 2019 to $196.31 in 2024. Presumably as the impact of the virus fades, earnings will recover from the depressed levels of 2020. The question is by 2024 what fraction will post-virus earnings be of the originally estimated pre-virus earnings? For instance, if the fraction is assumed to be 80%, then post-virus earnings are set equal to $157.04 (=0.8*$196.31). This makes it possible to calculate the rate at which earnings must grow from the depressed level in 2020, $97.80 in the previous example, to recover to 80% of the pre-virus level by 2024. With the growth rate in hand, earnings for each year from 2020 to 2024 can be calculated. The intrinsic value of the index, incorporating the impact of the virus, is estimated using the same present value calculation as before, but based on these lower earnings. The tables below present the results. The top table shows the levels of the index and the bottom table shows the percentage declines from the February intrinsic value of 3,221.

Each cell in the table is calculated using the percent drop shown in the left most column and the percent recovery shown in the top row. For instance, as a base case I assumed a 40% drop in first year earnings, comparable to the financial crisis, and an 80% recovery to pre-virus forecast earnings in 2024. This combination produces an estimated intrinsic value for the index of 2,492.

The Importance Of The Recovery Assumption

One thing the tables illustrate is the importance of the recovery assumption. While the size of the drop in the first year has an impact, it is small in comparison to the role of the recovery. Valuations increase much more rapidly as you read across a row than down a column. For example, if the recovery rate is raised from 80% to 90% while holding the first-year drop at 40%, the intrinsic value of the index rises from 2,492 to 2,775. Ironically, that increase mirrors what has happened so far this week. The S&P 500 index has risen from a close last Friday of 2,489 to a close this Wednesday of 2,750. In light of the results in the tables, this suggests that the market has become more confident of a nearly complete recovery from the crisis in the years ahead.

In closing, the tables can also be interpreted as conveying a note of caution. The 40%, 90% cell with an intrinsic value of 2,775 represents a drop of only 13.8% from the pre-virus intrinsic value as of 3,221. Given the widespread impact of the virus on the economy, this relatively small drop can be interpreted as optimistic. It suggests that the market now believes that the economy will recover quite quickly and relatively fully from the virus shock. Time will tell if that turns out to be the case.

The post Valuing the S&P 500 one more time appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.