By Pierre Raymond. Originally published at ValueWalk.

Welcome to the first update of the new quarter. SEC filings are very few and, so far, only companies with fiscal quarters ended February. The Broad Market Index was up 12.10% last week and 69% of stocks out-performed the index. We are expecting the recent decline in corporate growth to steepen for companies with fiscal quarters ended March due to the March impact of the shutdown.

Q1 2020 hedge fund letters, conferences and more

There is no way to tell what the varied impact of the virus shutdown will be, but it is likely that the unusually high gross profit margin at US companies will fall broadly and possibly steeply. Lower gross profit margin has been very highly correlated with lower share prices.

Since this is an experience that we have never measured before, it is also possible that companies have been effective in passing the costs on to employees and gross profit margins will rise as companies lay off employees and liquidate inventories. It was just last quarter that inventories began to decline relative to sales.

As we look for companies that can sustain and possibly accelerate growth, rising gross profit margins and lower inventories are key metrics.

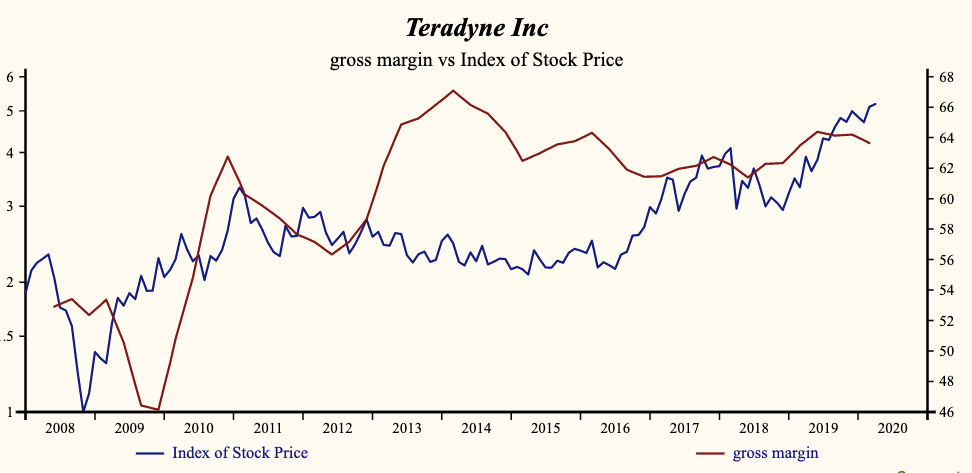

Teradyne Inc (TER) $61.150 – A momentum stock to watch

Teradyne Inc (NASDAQ:TER) will release financial results for the first quarter 2020 on Tuesday, April 21, 2020 and is perfect example of a stock to watch. This company has been an unprofitable company with frequently low cash return on total capital of 7.4% on average over the past 20 years. However, over the long term the shares of Teradyne Inc have advanced by 149% relative to the broad market index.

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 81% correlated with the share price with a five-quarter lead.

Currently, sales growth is 9.2% which is high in the record of the company and higher than last quarter.

The company is recording a high and recently stable gross profit margin. Rising gross profit has been 53% correlated with the share price. Lower inventory to sales has been 47% correlated with the share price. Falling inventories improve the chance of a further increase in the gross margin. Also, the EBITDA Profit margin is rising and has been 46% correlated with the share price.

The current indicated annual dividend produces a yield of 0.7%. Five-year average dividend growth is 9.0%. Current trailing operating cash-flow coverage of the dividend is 9.3 times.

The shares are trading at upper-end of the volatility range in a 16-month rising relative share price trend. The current extended share price implies that there is likely to be a better future opportunity to buy the shares of this evidently accelerating company.

The post Key metrics needed to sustain growth and momentum appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.