By Jacob Wolinsky. Originally published at ValueWalk.

Massiff Capital’s latest commentary on Altius Minerals Corporation (TSE:ALS), a TSX listed royalty and streaming company that they established a position in earlier this year.

Q1 2020 hedge fund letters, conferences and more

Altius has assembled a formidable portfolio of base metal royalties, many of which align with long term structural trends in the global economy. The firm is also the first company (that we are aware of) that is creating a renewable energy royalty business by recycling profits from their legacy coal assets into renewable energy developers.

Massiff thinks very highly of the management team at Altius and are pleased to support them as they continue building their company.

Investment Thesis:

Altius Minerals (TSX: ALS) is a diversified royalty & streaming (R&S) company with a portfolio of 15 royalty contracts1 backed by an investment‐grade balance sheet, reliable and innovative management, and low jurisdictional risk.

Beyond these admirable qualities, we find ALS a compelling investment for several reasons:

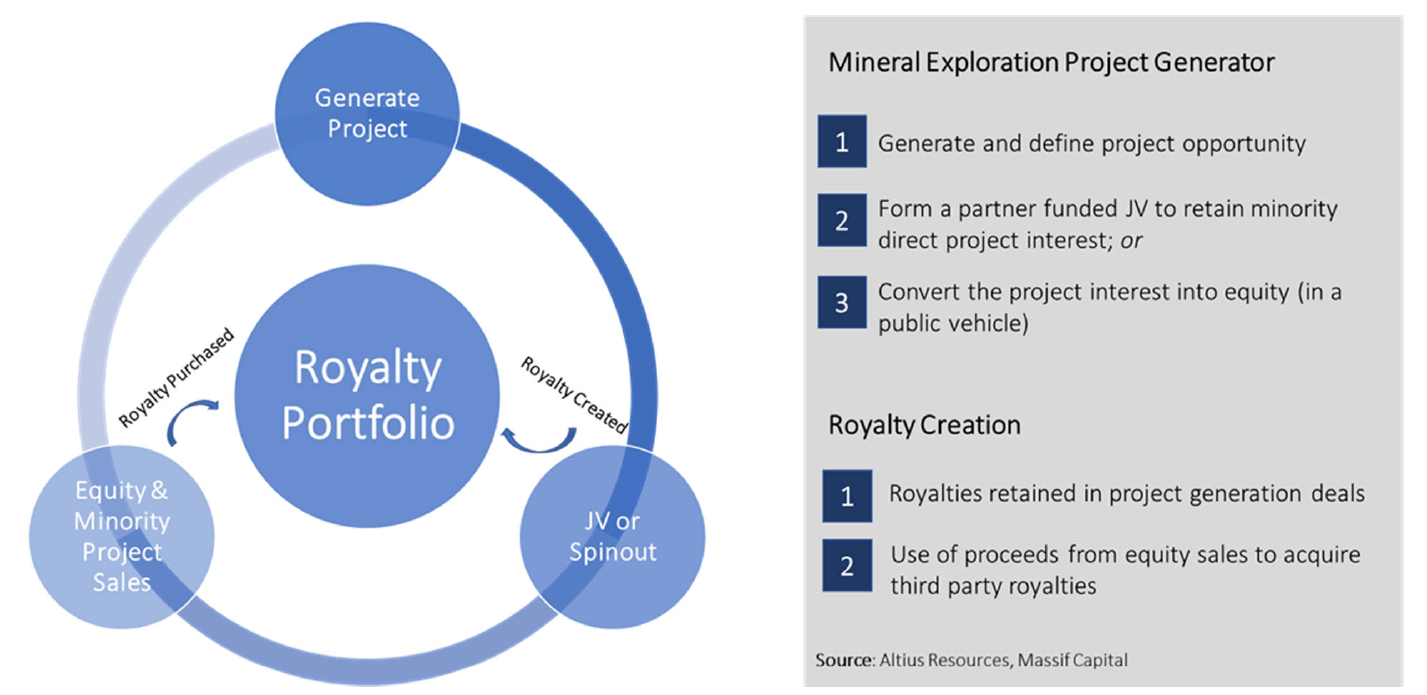

1) Their project generation business feeds the royalty business model. Altius organically assembles geological real estate in periods of market stress that they later sell to junior miners in return for equity stakes and underlying royalties. Counter‐cyclical capital allocation is a critical pillar to their business model, not just a popular catchphrase. Earnings generated from prospect generation are re‐circulated into the exploration business to acquire third party royalties that augment the internally generated royalties held by the business. The firm’s geological flywheel often creates royalties at zero cost for the future benefit of shareholders.

2) The portfolio of royalties is almost entirely comprised of base metals. By contrast, their listed R&S peers almost exclusively hold royalties in precious metals. Aside from differentiated exposure, base metal mines are often characterized by extremely long lives. This increases the overall optionality of the portfolio and allows the company to grow in a very capital efficient manner.

3) ALS is creating a first of its kind renewable energy royalty business. Tied closely with the firm’s intent to restructure their portfolio to align with global sustainability trends, Altius is recycling its current coal royalties into a newly created renewable subsidiary that is experiencing rapid growth.

The Altius management team is comprised of highly respected capital allocators that are currently buying back their shares at below net asset value (NAV). We believe the aggregate cash flows from the current royalty portfolio are worth roughly C$550 million. Inclusive of the market value of their equity holdings, less net debt and minority interests, the firm is worth about C$12.5 per share, a 65% discount to its current price. 2 Should ALS trade at market multiples comparable to other R&S peers, we think the stock is worth more than C$20 per share.

The Altius Business Model:

Traditional financing can either be unavailable or expensive for junior resource developers. As such, R&S companies can provide an essential financing bridge to junior miners, taking a royalty or streaming interest in the future production of a resource in return for capital.

R&S arrangements are a positive‐sum game for the mine operator, the financing company, and the equity investor. The mine operator can capitalize on proven reserves before an operation becomes productive, the financier enjoys the resource upside while avoiding the direct risks associated with developing/operating a mine, and equity investors can gain exposure to a portfolio of resources through an asset‐light business model.

ALS has three lines of business: a portfolio of royalties, a project generation business, and Altius Renewable Resources (ARR). The royalty contracts have underlying exposure to copper, nickel, zinc, iron ore, potash, and coal. Most mines that feed the royalty business are in either Canada or Brazil.

The Core of Altius – Project Generation:

Project generation is a cornerstone of the Altius business model. In many ways, it was borne of out necessity in late ’97 when ALS went public. CEO Brian Dalton notes that in hindsight, the creation of ALS amid a mining downturn forced them to hone a business model that could endure mining cycles.

Project generation acts as a feeder into the royalty business. ALS will organically assemble prospective geological real estate during periods of bearish sentiment when capital is tight and competition to secure prospective land is limited. When the market turns, ALS sells its portfolio of property to well‐capitalized junior miners in return for equity stakes and/or underlying royalty interests.

The value add of the project generation arm extends beyond the market value of the equity portfolio (which sits today at about $34 million, or ~10% of its current market capitalization). This strategy can create an extremely low, or potentially negative, underlying cost basis for any royalty/stream it may generate. From 2012‐2016, ALS assembled roughly 2 million hectares of land in nine different jurisdictions covering prospective sites for a suite of base metals. Since 2017, ALS has sold 57 global exploration projects under 17 agreements with various partners, converting most of the mineral assets it assembled during the past downturn into new royalties and a portfolio of 20+ junior equity positions.

The Gunnison copper mine in Arizona is set to become the first paying royalty from the project generation business. Inclusive of equity gains for ALS associated with Gunnison, the project has a negative underlying cost base for Altius shareholders.

Once up and running, the project generation strategy can be self‐funding. Over the previous commodity cycle (pre‐2012), Altius generated equity capital gains of greater than $200 million, which the firm used to fund many of their down cycle (2012‐2016) cash flowing royalty acquisitions. This cycle of royalty growth and creation is incredibly capital efficient.

The Royalty Portfolio:

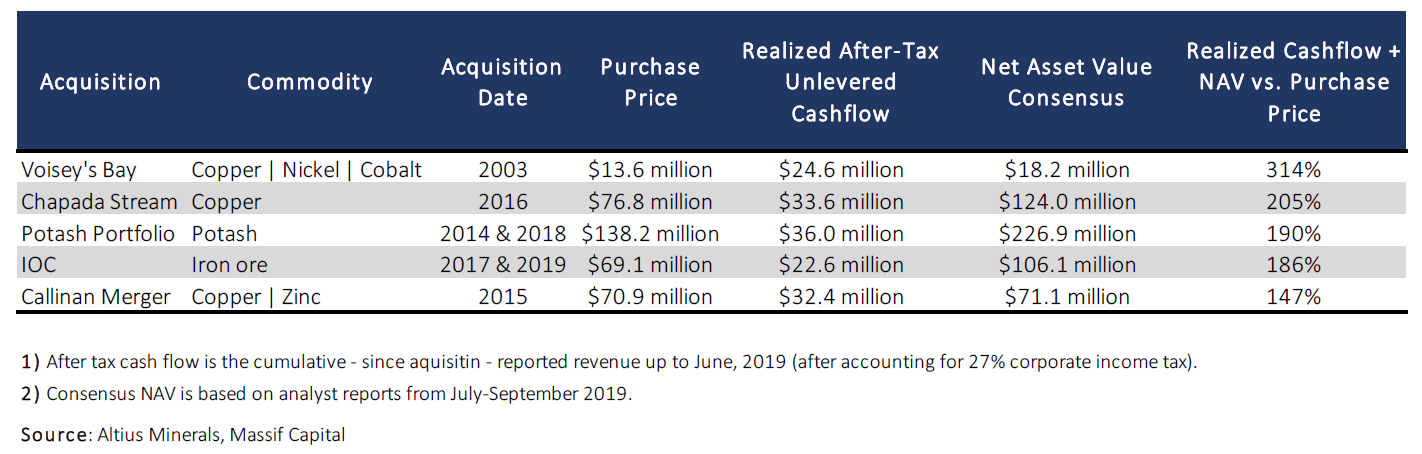

For roughly eight years following the financial crisis, ALS converted its equity gains from the decade before into royalty stakes. In addition to efficient capital recycling, ALS has proven to be successful capital allocators, securing royalties on projects that have ended up being very profitable.

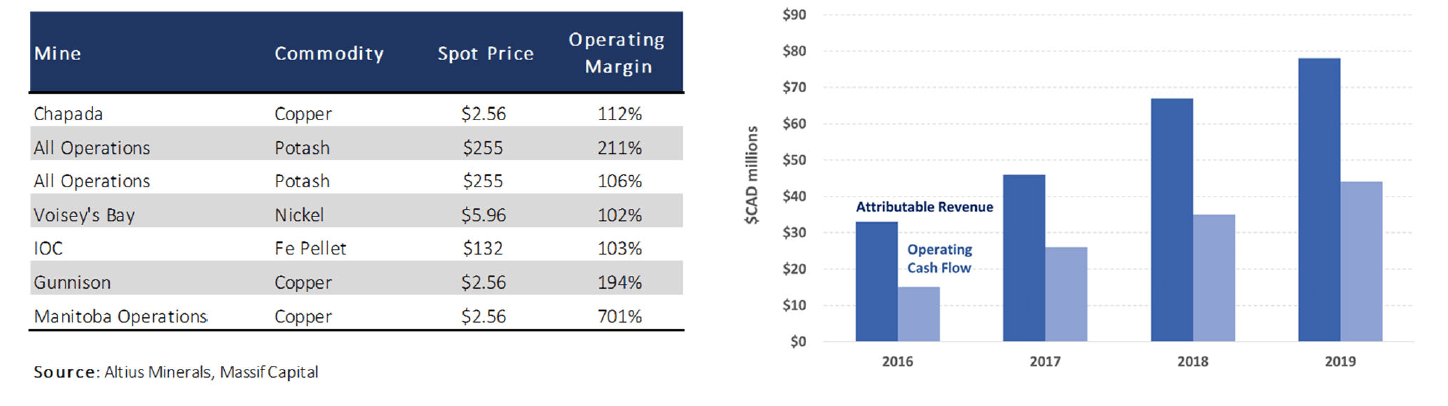

Healthy operating margins, with select commodity prices hovering near all‐time lows, has generated strong cash flow, allowing ALS to reduce leverage and increase their dividend while still providing enough liquidity to buy back shares below NAV and sustain a strong balance sheet. 3

A key differentiator of the Altius’s royalty portfolio is that it is comprised of base metals as opposed to precious metals, a rarity in the public equity R&S space. This may seem like a minor point, but the life of a base metal mine can be an order of magnitude higher than a precious metal mine. A potash mine, for instance, may have a 100+ year life, whereas a gold mine is lucky to have a 15‐year life. With long‐life assets, significant optionality can be secured at the royalty level.

As a royalty holder that does not share in the capital costs to expand mine production, a mine expansion will generate additional upside without additional capital outlay. This dynamic is far more pronounced in base metals when compared to precious metals. Base metal mines are still ultimately a depleting asset. Still, the depletion point is often so far out in time that the number of opportunities for production rates to increase is such that investors may be getting perpetual growth royalties.

Today, the Altius royalty business is shifting from an acquisition model to an organic growth platform. The portfolio of royalties is beginning to capitalize on the option value embedded in their assets. The large nickel/copper deposit in Canada, Voisey Bay, is constructing an underground mine that sits within ALS’s extensive royalty land package. The Chapada copper mine in Brazil has been recently taken over by Lundin Mining with a view towards expanding production. In both cases, ALS has rights to the market value of the increased production with zero obligation to help finance the expansions. ALS does not need to be a continuous buyer of assets to drive growth.

Altius Renewable Royalties:

A unique feature of ALS is its subsidiary, Altius Renewable Royalties Corp. (ARR). The venture was conceived as a mechanism to phase out of coal by reinvesting coal royalty revenue into renewable energy via the financing of renewable energy projects. In a little over a year, Altius has funded a $30 million investment with Tri Global Energy, a Texas‐based wind developer and a $35 million investment with Apex Clean Energy, a US‐based wind and solar developer. The pool of capital that has been allocated to Tri Global and Apex has thus far come from existing ALS liquidity and helps the developers bring wind and solar projects to the market. ARR begins to receive royalty payments once the developer sells a project to the final project sponsor and/or operator of the asset, after which they receive a royalty of between 1.5% and 3% of revenue.

The project deal flow has surprised the management team. The original strategy earmarked C$100 million to be invested over ten years. The C$100 million now appears to be a bare minimum, and the timeline greatly accelerated. Early indication from Tri Global suggests that year over year buyers showing up to project sales have doubled.

Rather than being constrained by access to high‐quality projects, ALS now finds itself limited by access to capital. To address this constraint, ALS management is looking to spin off ARR into a separate, publicly listed entity that they believe will not only have a lower cost of capital when separated from the mining business and but also trade at market pricing multiples more in line with renewable energy firms. Depending on market conditions, management expects the spin‐off to occur sometime in 2021. In the near‐term, ALS is looking to raise equity at the subsidiary level to continue to grow the business.

Where we find ourselves today:

2019 was a strong year for ALS. Organic growth from the royalty portfolio drove a 16% increase in revenue with no significant cash acquisition. At year‐end, the value of the junior equity portfolio was $54 million, and the sales, net of investments, generated cash of $17 million. That $17 million was returned to shareholders, evenly split between dividends and share buybacks.

In early April, ALS notified investors that production curtailments4 were in effect at mines that collectively produced just under 2% of the 2019 attributable royalty revenue. Management has informed us they will remain patient during this crisis. Capital prioritization remains geared towards buying back shares and funding renewable energy developers. Scanning current commodity prices and the USD/CAD exchange rate, we expect EBTIDA to be impacted by ~C$4‐5 million relative to 2019 (or between 8‐11% of 2019 earnings).

As of the end of March 2020, ALS has $90 million in term debt, $64 million drawn from their revolver (~64% of their capacity), and $32 million of cash on hand. Both the term and revolving credit facilities do not mature until 2023. We believe that the value of their operating assets is roughly $560 million. Inclusive of the market value of their junior equity portfolio, less net debt and minority interests, we believe the firm is worth just over $500 million, or $12.5 per share.

Relative to their R&S peers, ALS is trading at a material discount. It’s not clear to us why a relative gap has widened so considerably. Perhaps it is their smaller market capitalization; maybe it is the market sentiment around base metals as demand erosion dominates headlines.

The business model is durable and has significant royalty volume growth potential. The portfolio represents long life, high margin assets, producing commodities that are well aligned with long term structural trends in the broader economy. The renewable platform is developing quickly, and metal prices may be facing a perfect storm in the coming years with demand drivers emerging while conditions to bring on required levels of supply remain notably absent. The COVID19 fallout may suggest taking a defensive posture as an investor. Akin to the counter‐cyclical model employed by Altius, we are enthusiastic about deploying capital at these prices.

The post Massiff Capital Long On Altius Minerals appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.