By Jacob Wolinsky. Originally published at ValueWalk.

McIntyre Partnerships commentary for the first quarter ended March 31, 2020, discussing how the current crisis will likely impact Chemours (NYSE:CC)’s near-term earnings.

Q1 2020 hedge fund letters, conferences and more

Performance Review – FY 2019

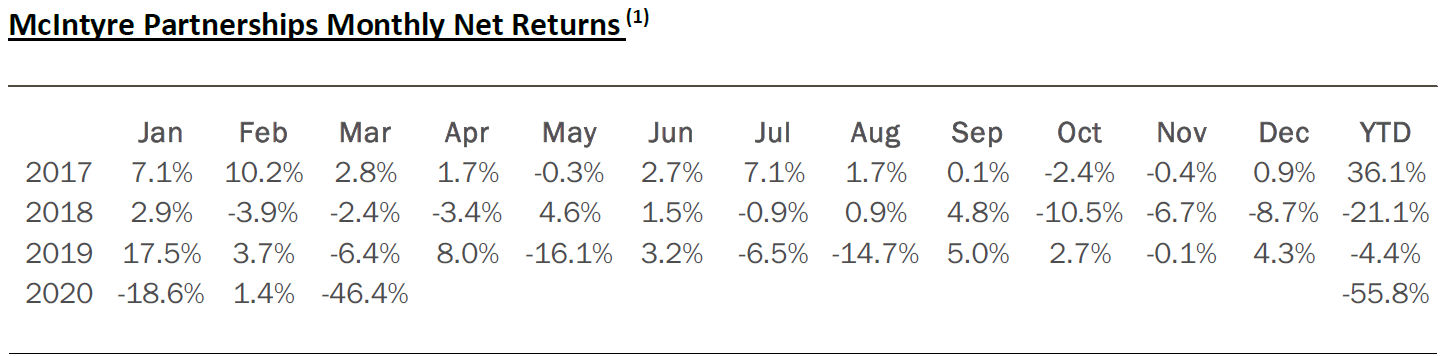

Through Q1 2020, McIntyre Partnerships returned approx. -56% gross and net. This compares to S&P 500, S&P 600, and Russell 2000 returns including dividends of -20%, -33%, and -31% respectively. The fund is heavily concentrated in Chemours Co (NYSE:CC), whose shares fell 51% in the quarter. The fund has recovered modestly in April.

I could say many things about our returns, but the reality is I decided to place the “big bet” in a “scary looking” cyclical and ran into a market crash equivalent to 1929 and 1987, with market indices down 35-45% and hundreds of stock down far worse than that. I cannot imagine a worse possible near-term market backdrop for my decision – the fund is at its highest potential volatility into the highest period of volatility since 2008. The current marks are what they are. A sudden market crash, for whatever reason, is always a possibility, and I have no real strategy to avoid the mark to market drawdowns that inevitably come with them.

Instead of pontificating on the markets, the focus of this letter is on why I believe CC is fundamentally a safe bet, despite the market reaction, and extremely cheap even in a protracted recession.

Portfolio Review – Exposures and Concentration

At quarter end, our exposures are 105% long, 30% short, and 70% net. Our five largest positions were 90% gross exposure. Our CC investment is exceptionally large and has a significant options component which makes our exposures less meaningful versus the market at present.

Our four largest positions are CC, TPHS, GTX, and Permanent Bank. We have no other investments of notable size.

Portfolio Review – Existing Positions

Chemours (CC)

Pre-Covid Update

Prior to the current covid crisis, our CC investment was beginning to work. In mid-February, CC rallied sharply on strong Q4 earnings, and the company guided to 2020 FCF of >$2/share and took back share in the TiO2 market, which is central to my thesis. I felt the guidance was conservative, setting CC up for “beat and raise” earnings. In the two months since then, the TiO2 market has shown signs of a rebound with pricing and volume increasing – a good sign the 18 month destock, which was the largest in industry history, was behind us. Even with the global economy coming to a halt in mid-March, TiO2 volumes have remained reasonably strong with competitors and consultants reporting stable volumes in April. While the current crisis will likely impact near-term earnings, I believe my Chemours thesis has begun to play out and results will continue to improve as the economy recovers post-covid.

Simple Pitch

The simple pitch on why CC is safe even in a harsh recession is that its balance sheet and liquidity are very strong, and its operations have robust competitive advantages that drive profits even in a bad environment.

Long-Term Safety

Over the long-term, CC’s business is a necessary part of the economy. In a world of lockdowns, chemical production has been deemed an essential service and CC’s plants remain open. It is not a random coincidence that the business I chose to concentrate our fund in has been deemed essential. If we are to live in a world where we are not all sitting naked in fields, material science a.k.a. the chemical industry is an essential part of our civilization and cannot simply be turned off like a cruise ship or a restaurant. TiO2 is in the paint on your walls, the plastics in your cell phone, and rubber in your shoes. CC’s refrigerants enable the air conditioning we use to cool our homes and keep our produce fresh. CC’s products are fundamental building blocks of society.

Further, I do not believe CC’s businesses are at risk from any secular shifts. TiO2 and refrigerants have no feasible substitutes, i.e. a secular supply shift, and paint and air conditioning demand are not at risk from any long-term change, i.e. a secular demand shift such as the growth of software, shifting millennial buying patterns, etc. While the macroeconomic ebbs and flows can impact Chemours’ near-term earnings, over the long run, CC’s products are essential, and demand will return.

When considering the fundamental safety of an investment entering a cyclical downturn, there are two critical and linked factors: the company’s financial strength and operating resilience. The company must have ample liquidity to withstand a shock and must generate strong pre-tax earnings even in a protracted, bad recession. On both metrics, I believe CC is strongly situated. Further, CC’s shares are cheap even in a protracted recession.

Financial Strength

In practical terms, companies go bankrupt when they cannot either cover their interest payments or roll over their debt. While other factors, such as breaking a covenant, can technically tip a company into bankruptcy, such occurrences are rare. It is thus imperative for a business to have cash available to pay operating and financial costs in the event of an economic shock.

To evaluate CC’s liquidity, I conduct a stress test and conclude CC has ample liquidity even in unrealistically extreme circumstances. CC has $1.6B in total liquidity, consisting of $1.1B of cash on balance sheet at present and an additional $500MM in revolver availability. This compares to interest expense of $200-$250MM, depending upon cash and revolver balances. There are no maturities due before 2023. The most restrictive covenant is 2.0x senior secured leverage ratio, which CC would not trip unless EBITDA falls 40% and could be renegotiated in such a case.

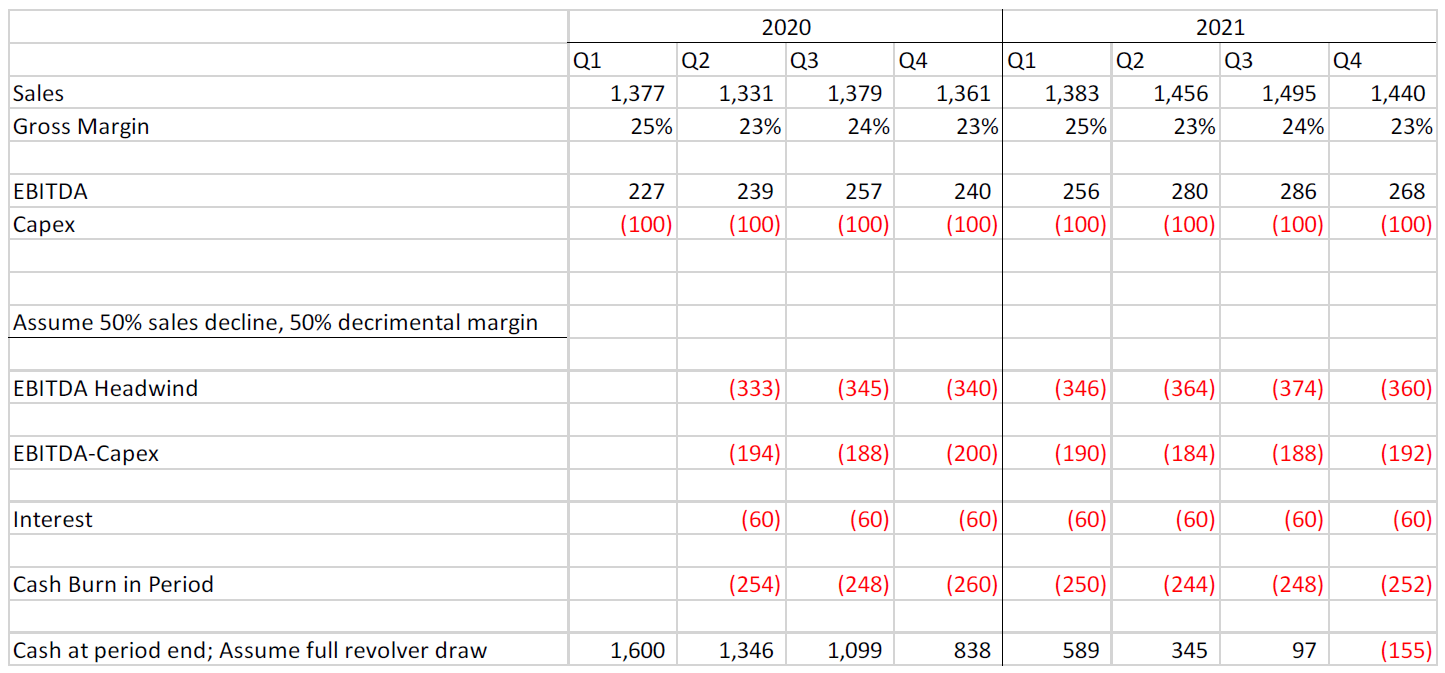

In my stress test, I take Factset’s estimates for consensus sales and EBITDA and assume a 50% drop in sales with a 50% decremental margin, and conclude CC has adequate liquidity to weather such a scenario until Q4 2021.

I want to reiterate how tremendously overly punitive I think this scenario is. This model implies a sustained 20-40% drop in TiO2 and refrigerant volumes, which given their essential nature in my opinion implies a 30-50% drop in global GDP. Further, the operating characteristics of CC’s business, particularly their substantial low-cost position in TiO2 and the specialty chemical margins of Opteon, imply a 50% decremental margin is excessive. I use what I consider a wildly pessimistic view to illustrate that, even in the event I am quite wrong on my operating assumptions, CC has ample liquidity to weather the storm.

Operating Resilience

CC’s two main operating businesses are Tio2 and Fluoroproducts. While both product lines are cyclical, CC’s strong competitive advantages drive operating profits even in recession. In TiO2, CC is the low-cost producer due to their scaled operations and a proprietary production process, which creates a sustainable competitive advantage and predictable profits even when TiO2 peers struggle and burn cash. In Fluoroproducts, CC’s patented Opteon brand is the key profit driver and shares a duopoly market with HON, implying strong margins even if volumes drop. These competitive advantages mean that while peak and mid-cycle earnings are cyclical and difficult to predict, CC’s operating profits in a downturn are far more predictable. Unlike many TiO2 peers such as TROX and KRO, CC can run with modest leverage and be confident in their ability to cover costs even in a sharp, sudden downturn like we are currently experiencing.

TiO2

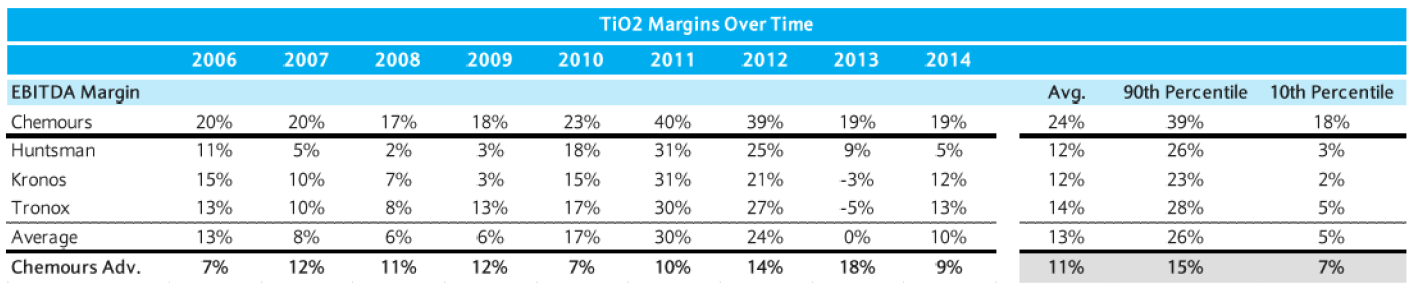

Despite its cyclicality, I consider CC’s TiO2 business to be one of the most robust competitively advantaged businesses I have ever analyzed. TiO2 is a commodity. While there is a sharp quality difference between high-tech Western TiO2 manufacturers and low-tech Chinese manufacturers, Western companies’ TiO2 is effectively interchangeable and Western producers’ margins are broadly similar – except for Chemours. CC operates its plants at a massive scale versus peers and has a proprietary process allowing the company to use a variety of feedstocks not available to competitors, which drives a large cost per ton advantage versus competitors. Here is a chart of CC’s historical margins versus TiO2 peers:

CC has earned on average almost twice the EBITDA margin of competitors despite making functionally similar products. The benefits of this advantage are particularly acute in downturns. In 2008 and 2009, CC’s competitions saw margins and profits sharply contract. As capex typically runs 3% of sales in TiO2 production, most were struggling to breakeven and some filed for bankruptcy. However, CC generated a high-teens EBITDA margin even as competitors were burning cash.

In per unit math, CC’s low-cost position equates to a roughly $300/ton advantage versus peers, or $400/ton EBITDA including $100/ton in D&A/maintenance capex. CC has roughly 1.3MM tons of nameplate capacity which it can operate at a 90% utilization rate. This implies CC can earn $500MM in annual EBITDA in an environment in which literally every other Western TiO2 producer is forced into bankruptcy. In practical terms, given TiO2’s essential nature, TiO2 producers typically trough at cash burn for a quarter or two before capacity closes and some degree of profits returns, thus I consider $500-$600MM in TiO2 EBITDA to be a true trough condition.

CC’s ability to generate significant profits even in conditions where competitors are burning cash is at the core of why I believe CC is a safe investment. I consider this cash flow stream to be one of safest available in the market. While one-time issues, such as CC’s move to fixed volume contracts, a pandemic causing a sudden volume drop, a plant outage, etc. can impact Chemours’ near-term TiO2 profits, the sustainable competitive advantage implies this EBITDA stream of at least $500-$600MM will return.

Opteon

Opteon is CC’s patented next generation refrigerant, which results in a 99% reduction in global warming potential versus legacy products and shares a duopoly market with HON’s Solstice product. Opteon is accounted for in CC’s Fluoroproducts segment, which is the company’s other significant EBITDA driver. Prior to covid, Street estimates were for $600-700MM in 2020 Fluoroproducts EBITDA, which I believe was a reasonable range. Covid has thrown that estimate into doubt, and the question is by how much. I estimate Opteon drives at least 50% of segment profits or $350MM of EBITDA. While the majority of Opteon sales are cyclical with global car sales, ex-covid, Opteon was experiencing double digit sales growth and the duopoly market implies limited pricing pressures. In a sharp 20% decline in global auto sales, I estimate Opteon EBITDA would fall at most 20%, yielding $280MM. The rest of the Fluoroproducts segment are legacy refrigerants and fluoropolymers, which are modestly cyclical. For conservatism, I assume a 50% drop in the rest of Fluoroproducts EBITDA, yielding a whole segment trough EBITDA of $450MM.

Whole Company Math

On conservative trough conditions, I estimate TiO2 EBITDA of $500MM, Fluoroproducts of $450MM, and “rest of company” including corporate expense of -$50MM, yielding $900MM of whole co. EBITDA. This compares to 2020 capex guidance of $400MM, which could be reduced to $300MM or less if needed, and $200MM of interest expense, which yields ample coverage. Further, assuming a 20% tax rate, CC would earn FCF of $240MM or $1.50/share in a harsh trough environment, a 15% yield at current prices. I believe CC is a fundamentally conservative bet.

Covid and Economic Thoughts

“In some parts of the country [the pandemic] has caused a decrease in production of approximately 50 percent and almost everywhere it has occasioned more or less falling off. The loss of trade which the retail merchants throughout the country have met with has been very large. The impairment of efficiency has also been noticeable. There never has been in this country, so the experts say, so complete domination by an epidemic as has been the case with this one.” – The Wall Street Journal, October 24, 1918

Some quick covid observations:

- Covid is likely 2-3x as contagious as the flu

- Every year 20-35% of the world’s population gets the flu, despite the existence of a partially effective vaccine

- The record for fastest development of a vaccine is five years

- While difficult to estimate due to imperfect testing data, most epidemiologists put the disease’s current fatality rate at 2-5x that of seasonal flu if the healthcare system functions

- In virtually every epidemic, a virus’s virulence diminishes over time

- Nursing home residents accounts for around 50% of deaths in various European countries and US states

- For those under 65, and those over 65 without multiple comorbidities, the risk of fatality from infection is similar to driving to work every day

From a personal perspective, every death from this disease is a tragedy and my thoughts are with those who have lost someone. However, from an economic perspective, these deaths in and of themselves are not causing the economic contraction. What is causing the economic damage is our response to this disease, both from government regulations and individuals’ self-imposed social distancing. For investors, what matters is how long the current social distancing can continue and what its impact is to the economy.

I do not believe the social or political capital exists to extend the lockdowns on non-essential services much beyond the present timeline presented by North American and European governments. The extremeness of certain countries’ and the United States’ social distancing rules are simply unsustainable for any length of time. For example, Quest Diagnostics, one of the nation’s largest medical testing companies who has conducted almost half of the commercial covid testing in the USA, saw a greater than 40% drop in overall test volumes in late March and has furloughed a significant part of their workforce. That implies literally millions of delayed or canceled cancer screenings, heart disease checks, etc. From a purely public health perspective, it’s highly unlikely months more of this extreme social distancing would even save lives in aggregate. Fortunately, the tide seems to be turning and many states and countries are beginning to slowly reopen. There are now numerous examples of other countries, such as Sweden and China, who are managing the crisis in a more measured manner without breaking their healthcare systems.

The question then turns to the economic impact. I never really have a strong view on the economy, but something like a very bad Q2 contraction followed by a sharp rebound in H2 seems reasonable. This tracks other pandemics, such as Hong Kong following the SARS outbreak in 2003 and the US after the Spanish Flu outbreak in 1918. Most importantly, there is significant political will to use fiscal and monetary stimulus to right the ship. Here is a quote from Federal Reserve Chairman Jerome Powell on April 9, 2020:

“People are undertaking these sacrifices for the common good. We need to make them whole. We should be doing that, as a society. They didn’t cause this. Their business isn’t closed because of anything they did wrong. They didn’t lose their job because of anything they did wrong.”

Restarting the economy in the US and globally will be rocky at first, but I believe the significant political will to fix the situation and the logical benefit from simply reopening businesses will likely make the economic pain short lived. Further, politicians and central bankers are signaling they are prepared to deliver increased aid if the recovery needs further help.

For those interested, here are links to studies of prior pandemics:

Hong Kong 2003 – https://hub.hku.hk/bitstream/10722/88855/1/content.pdf

United States 1918 – https://www.chicagofed.org/publications/working-papers/2020/2020-11

As always, please feel free to contact me with any questions.

Sincerely,

Chris McIntyre

chris@mcintyrepartnerships.com

The post McIntyre Partnerships 1Q20 Commentary: Long Chemours [Analysis] appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.