By Michelle Jones. Originally published at ValueWalk.

One of the biggest challenges for gold traders recently has been price volatility, but one firm said recently that it is possible to predict movements within the gold market based on four factors. Gold prices fell below $1,700 an ounce briefly today, but due to volatility, they’re back above that key level again.

Q1 2020 hedge fund letters, conferences and more

Gold price target to $3,000 an ounce

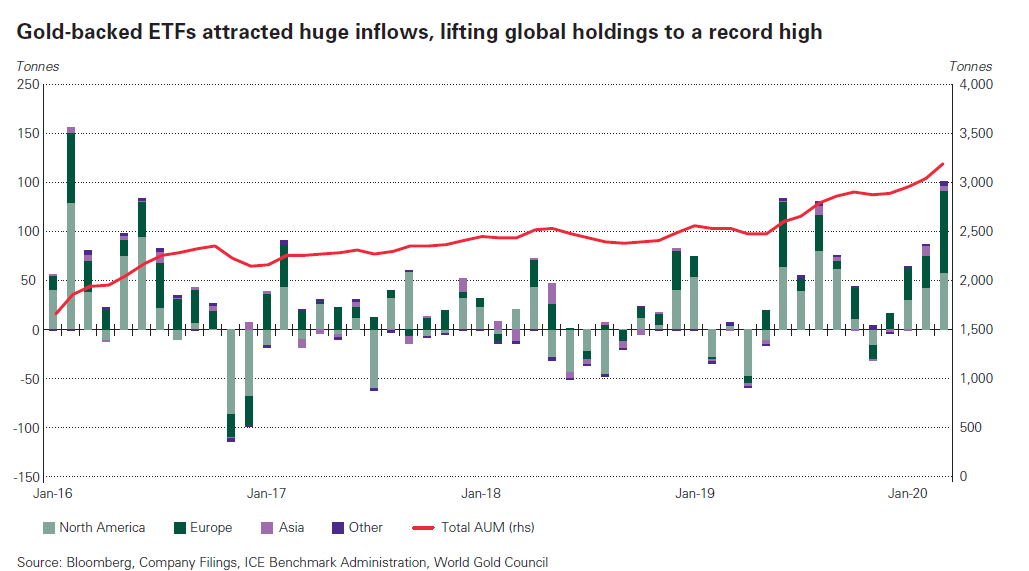

In a note last week, Bank of America analyst Michael Widmer and team said they boosted their 18-month gold price target from $2,000 to $3,000 an ounce. They noted that gold prices have done well over the last 15 months, rallying more than 10% since the Federal Reserve changed its policies in January 2019.

The yellow metal has also done well against other asset classes year to date.

They noted that gold prices haven’t marched steadily upward, as there have been some steep selloffs, especially between March 9 and 19.

However, they also noted that the downward move wasn’t unique to the gold market as other asset classes also saw a spike in volatility during the same time.

Nonetheless, they believe that watching four major factors can help investors gauge gold’s volatility.

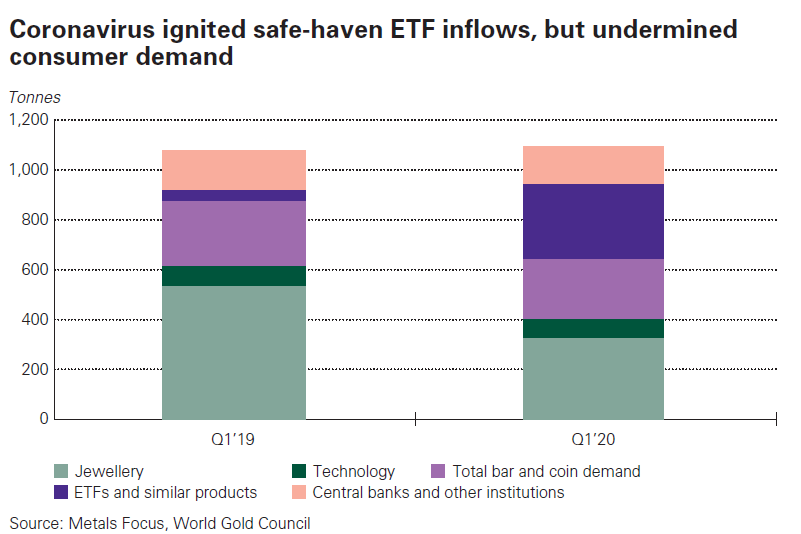

Due to all the stimulus that’s being rolled out around the world, they expect gold prices to remain strong. However, they also note several potential headwinds for the yellow metal, such as the strong U.S. dollar, reduced volatility in the financial market, and reduced jewelry demand in China and India.

They add that despite the supply and demand fundamentals, “financial repression is back on an extraordinary scale.” They expect interest rates in the U.S. and most G-10 economies to be at or below zero “for a long period of time.” They noted that central banks are trying to push inflation back over their targets.

They also describe gold as “the ultimate store of value,” noting that “the Fed can’t print gold.”

Predicting gold volatility

While most analysts agree that gold prices will move mostly upward in the coming months, volatility remains a key issue. Bank of America analysts said gold volatility is a function of real interest rates, the U.S. dollars, commodities and risk.

They describe the March selloff as “somewhat mechanical in nature.” They noted that gold reflects market movements across all major assets. They also argue that swings in real interest rates, the dollar, commodities and risk can explain up to 80% of the weekly volatility in gold prices.

BAML believes that by watching these four variables, it is possible to understand which direction in which gold prices are likely to move in the coming week.

Other lessons about gold volatility

The Bank of America team also pointed out that gold volatility tends to follow volatility in other markets. For example, they said gold volatility increases with market turbulence but lags the spike in other asset classes like equities or oil.

They found that gold volatility roughly tracked volatility in G-10 currencies over the last two months. It especially mirrored safe-haven currencies like the yen. Unlike other commodities, they said gold’s volatility has a term structure that’s more aligned with those of paper assets.

Dislocations with the paper market

The Bank of America team also drew attention to the significant gap between physical gold prices and paper prices. Usually this gap is fairly small because the CME delivery mechanism is running smoothly. However, disruptions in shipments to the U.S. have helped widen this gap.

They explain that it’s rare for futures contracts to be held to expiration, but inventory levels in CME warehouses are far below open interest. About one-third of the world’s refining capacity has been idled due to COVID-19, which has made it difficult to convert bars into shapes suitable for delivery to the CME.

As a result, CME has launched new futures that also accept 400-ounce bars. CME contracts have historically traded in 100koz, while the London Good Delivery Bar is 400koz. Further, refineries in Switzerland have been resuming operations, and insurers are now accepting charter flights for gold shipments in addition to commercial flights. Due to all these factors, the gap between paper and physical gold prices has begun to narrow.

The post 4 factors that can help predict gold price volatility appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.