By ActivistInsight. Originally published at ValueWalk.

Both Moss Bros and L Brands’ Victoria’s Secret brand lost their buyers this week, sending both stocks spiralling downwards. Brigadier Acquisition Company, the bid vehicle of Crew Clothing owner Menoshi Shina, applied to the Takeover Panel to withdraw its 22.6 billion pound takeover bid for Moss Bros but was barred from doing so. The 169-year-old clothing company said the U.K. takeover code barred an offeror from pulling out from an acquisition unless circumstances giving it the right to do so “are of material significance … in the context of the offer.”

Q1 2020 hedge fund letters, conferences and more

Moss Bros Issues A Profit Warning

The deal came less than two weeks before the U.K. government ordered the closure of non-essential shops, which forced Moss Bros to shut all its stores. In late March, Moss Bros issued a profit warning, saying it expects the coronavirus pandemic to lead to “a significant reduction in revenue and profitability” for the year ending January 30, 2021.

Victoria’s Secret also closed a large number of its 1,600 stores and started to lay off staff to cope with the COVID-19 pandemic, causing private equity firm Sycamore Partners to attempt to walk away from a deal to buy a majority stake in the brand. The firm argued that L Brands had breached its agreement by closing stores without its prior approval.

Victoria’s Secret executives said their actions were “consistent with the steps that retailers across the country have taken in response to the pandemic.” But Sycamore said that argument is irrelevant because the other retailers do not have a detailed set of obligations associated with an M&A transaction.

What We’ll Be Watching For This Week

- How will Spar Group shareholders vote regarding former CEO Robert Brown’s resolution to appoint his brother, James Brown Sr., to the board at the meeting on Thursday?

- How will USA Technologies shareholders vote regarding Hudson Executive Capital’s eight-person slate at the meeting on Thursday?

- Will Tegna shareholders back Standard General’s four-person slate or stick to the status quo at the meeting on Thursday?

Activist Shorts Update

With 55 short campaigns started between January 01, 2020 and April 23, 2020, the highest in the same period since 2017, activist short sellers have had a strong start to the year. Six of those campaigns were launched last week alone, two of which were courtesy of Hindenburg Research.

Hindenburg released a negative report claiming silver mining firm New Pacific Metals has a 90% downside after the short seller uncovered legal disputes concerning the firm’s Bolivian operations. Silvercorp, which owns a 29% stake in New Pacific, could fall as much as 45%, the short seller said. Hindenburg claimed that New Pacific’s Bolivian operations have been left in a “legal limbo” since having its mining concessions stripped in 2015 before a new Bolivian government came to power in 2019. According to the short seller, New Pacific has no claim to its properties in Bolivia.

Meanwhile, Quintessential Capital Management accused music streaming platform Akazoo of vastly inflating the number of its customers, and ShadowFall Capital & Research argued that COVID-19 threatens an already vulnerable dividend at financial services company St James’s Place.

In the healthcare sector, Wolfpack Research claimed that Inspire Medical Systems have reaped the rewards of a treatment that is “too invasive and restrictive to ever gain traction.” Kerrisdale Capital Management said that Mirati Therapeutics is only worth a “small fraction” of its current $4.6 billion valuation because both its drugs are unlikely to reach the oncology market, let alone prosper.

Chart Of The Week

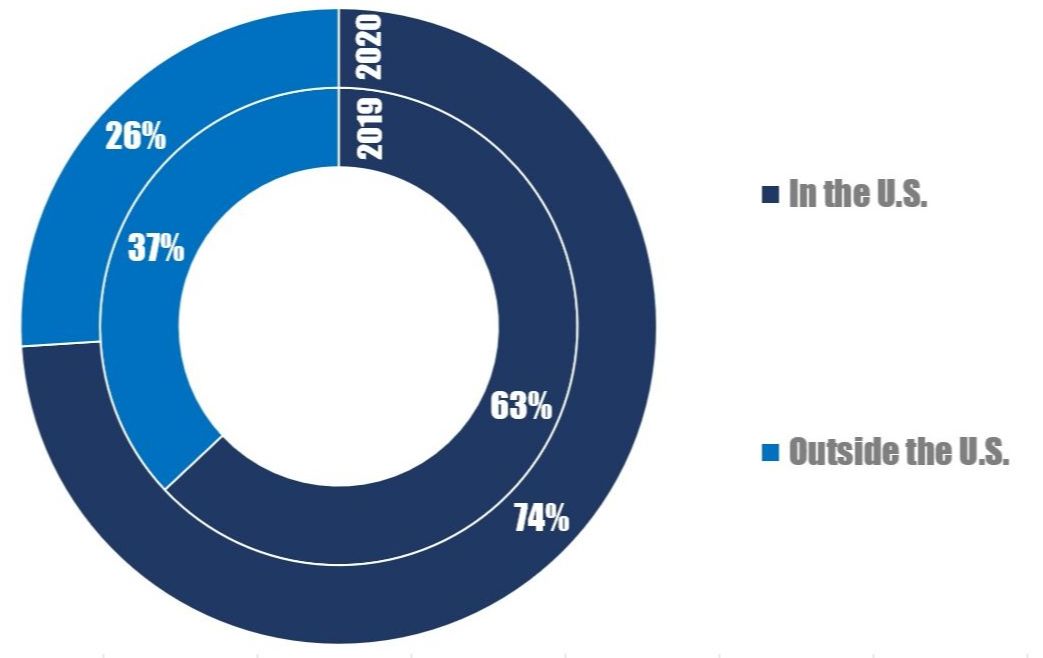

92 of the 352 companies publicly subjected to activist demands between January 01, 2020 and April 24, 2020, are headquartered outside the U.S., compared to 164 of 442 in the same period last year.

Note: rounding may lead to summation errors.

The post Moss Bros And Victoria’s Secret Lost Their Buyers appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.