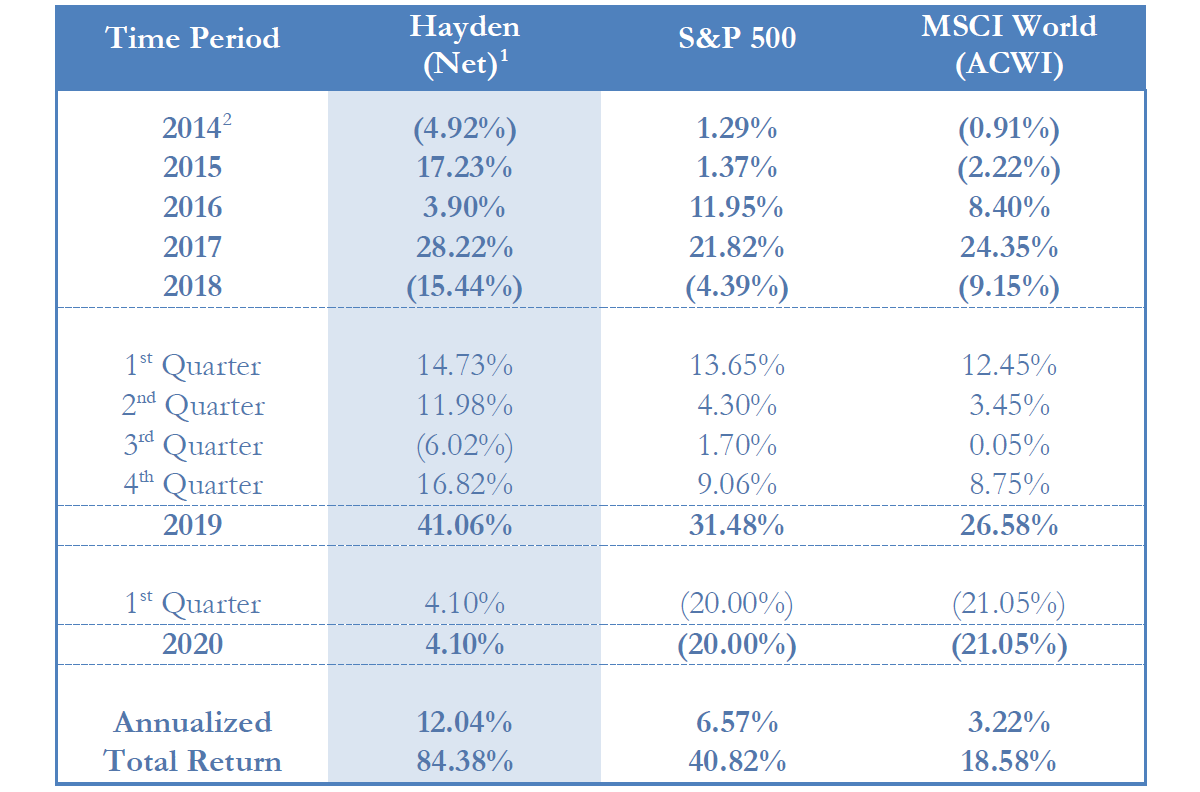

By Jacob Wolinsky. Originally published at ValueWalk.

Hayden Capital commentary for the first quarter ended March 31, 2020, discussing Carvana Co (NYSE:CVNA) partner inventory listing.

Q1 2020 hedge fund letters, conferences and more

Dear Partners and Friends,

By now, you’ve all probably heard plenty of news about the Coronavirus that’s halted much of our world. Just as China was coming out of its own self-quarantine in March, the rest of the world started to enter one as the virus spread its way West. It seems when China sneezes, the rest of the world indeed catches a cold.

The amount of infections and deaths during this event are saddening. I personally know several people in the US who have been infected or have family members infected by this virus. But I’ll leave the political views and what the right course of action should be going forward, for others to debate. Regardless of my personal views, as public investors, we need to invest in the state of the world as it exists (whether we agree with it or not), not as we hope it to be.

We were lucky to have early warning of what the potential impact the Coronavirus could have, given many family members, friends and partners were already in self-isolation in Asia at the time and I could see the impact it was having on the economy. This is the type of information advantage between Asia and the US we specialize in – albeit typically applied to cross-pollenating business models, and not deadly world-wide viruses.

As a result, I suspect we took the virus more seriously than many of our peers sitting in New York. As reports of community spread came out in late February and early March, we started hedging our portfolio more aggressively. In our April 3rd performance update email, I disclosed that these hedges added ~7% to our portfolio.

More importantly though, our portfolio of largely internet-based businesses, have proven resilient (and even beneficiaries) during this period. Even without the hedges, our portfolio would have declined just ~-3% – a substantial margin over the comparable indexes.

I am proud of how our portfolio performed this quarter. It was a tough quarter for the indices – the S&P 500 lost -20.00% and the MSCI World declined -21.05%. Meanwhile at Hayden, we made our partners +4.10%.

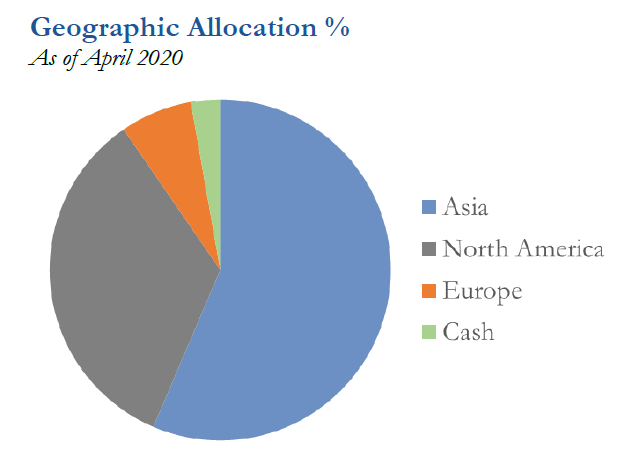

Our geographic exposure remains largely the same as before. The majority of our investments are concentrated in Asia – currently comprising 56% of the portfolio. North America makes up 34%, and Europe and Cash comprise the rest.

As the global economy recovers, I’d wager that our companies will accelerate and benefit even further in the coming years. This event is causing consumers to adapt to a new way of life, and turn to online businesses for needs previously fulfilled by brick & mortar peers. Some of these trends were already in underway. But this event has forced adoption to happen 2 – 3 years faster than I originally anticipated. As I discuss below, we’re already seeing signs that these new online habits will stick around, long after the virus is in the history books.

Finding Opportunity in Disaster

“I always tried to turn every disaster into an opportunity” – John D. Rockefeller

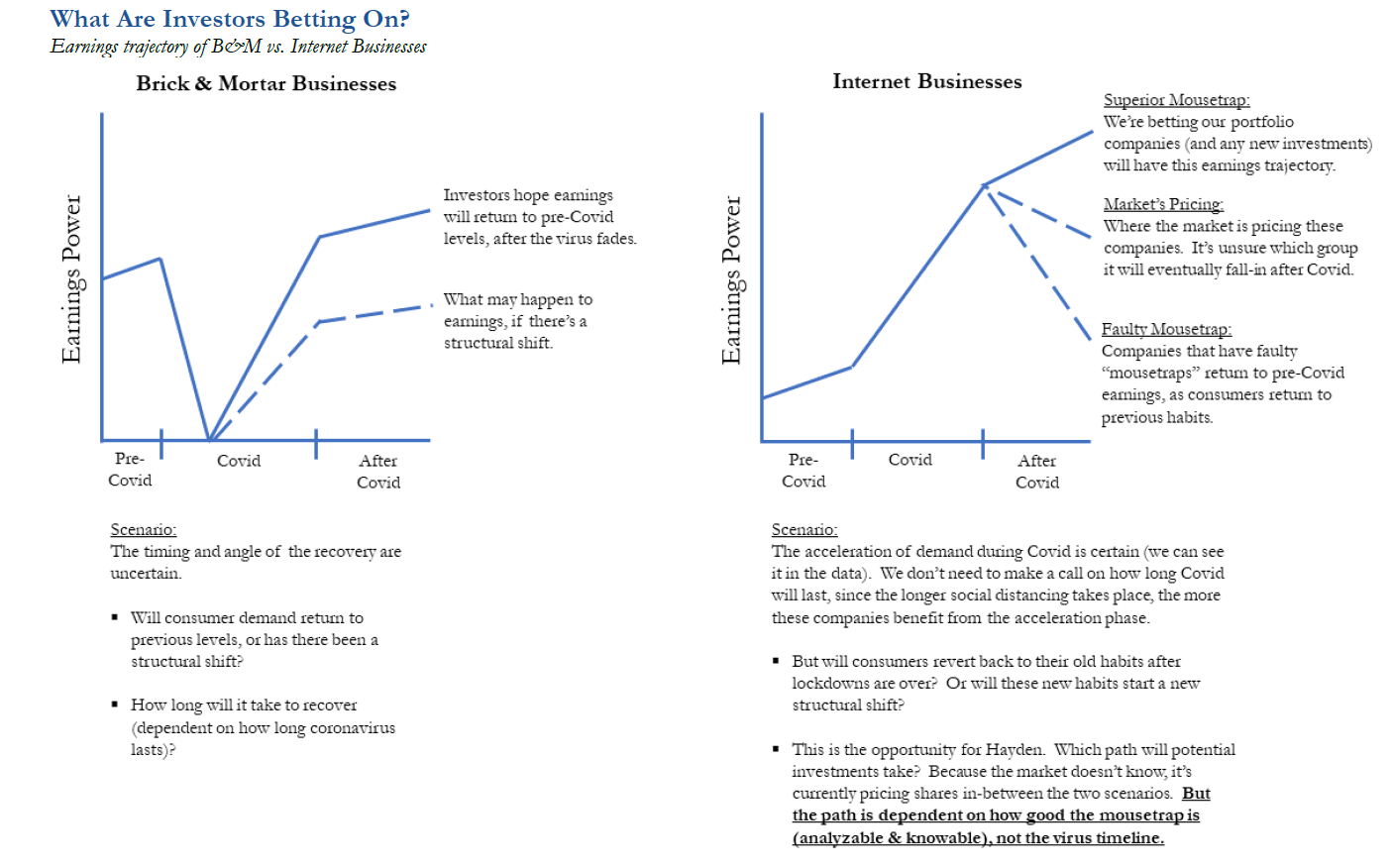

Given the immense draw-downs this quarter, it’s understandable that a lot of our peers are focusing their energies / “shopping lists” in the most beaten-down of sectors (energy, hospitality, physical retail, etc). Some companies in these sectors are down over -50% from the start of the year. So the thinking is that once this virus passes, consumers will resume their old spending habits, these companies will return to their previous earnings, and brave investors will be rewarded.

I’m sure there’s money to be made in this manner, and some investors will profit handsomely. However I personally believe there are easier ways to make attractive returns – with the benefit of an already strong tailwind that’s just been kicked into high gear.

To me, the safer (and potentially higher returning) investments in today’s market, are those companies that will benefit from the lasting change Coronavirus will have on consumer & business habits. These trends were already underway before the virus, but adoption has been accelerated by the wide-spread, suddenly “forced” need to operate in this new manner.

Many of these new habits / business models, are at an early stage of just low-single digit penetration within their industries. At such an early stage, consumer habits are just starting to get formed, so the primary hurdle is getting consumers to just try this new method.

The idea is that if the new business model is truly a superior proposition (i.e. a better mousetrap), the highest ROI is coaxing more mice into the trap and if they like it, to tell all their friends about how great it is (thereby creating a referral loop / social proof, which drives further acceleration of the trend).

This is why you see such large efforts on consumer education among these companies (and the large marketing expenses that come with it). Note, it doesn’t always work though, since some companies have inherently flawed mousetraps to begin with. But this is the opportunity as an investor – to make multiples of your capital, if you can distinguish which businesses have superior mousetraps, and simply need to find a way to attract more mice to be successful (by reaching a large enough scale to be sustainable).

During every crisis, there will always be companies who take the opportunity to emerge stronger and use it to their advantage to grow for years afterwards. In fact, it was during the 2008-09 crisis, that Shopify first proved that its business model is sustainable, and allowed it to accelerate into what it is today. In an interview with How I Built This (LINK), Tobias Lutke (Founder & CEO of Shopify), details how going into the last crisis, he had originally expected subscribers to “fall off a cliff”. But what actually happened was that subscribers and usage started climbing and accelerating.

Shopify Global Traffic

From November 2019 – April 2020 (LINK)

People recently laid-off determined that there was no better time to take a risk and to look for a new source of income / financial independence, and try starting an online store. By providing the tools for these budding entrepreneurs, Shopify went from barely being able to meet payroll, to breaking even for the first time in its history. Even after the economy recovered, these entrepreneurs had found a new career and these online stores continued to thrive, being built on the solutions Shopify provided. In this case, the habits that formed during a period of crisis, proved to be a permanent shift.

It looks like Shopify may be in for a repeat, eleven years later (see exhibit above). Shopify’s CTO tweeted last month that the platform (and thus the +1 million merchants using Shopify), are experiencing daily traffic at the same level as Black Friday!

And even before the financial crisis, there was the “OG” pandemic of SARS in China, seventeen years ago. When the SARS outbreak started in November 2002, Alibaba was just on the cusp of launching its consumer- focused Taobao website. Having sent all employees to work from home, Jack Ma and a core group of developers worked around the clock and launched Taobao from his apartment in May 20033.

In the book “Alibaba: The House That Jack Ma Built”, author Duncan Clark states that the outbreak “came to represent the turning point when the Internet emerged as a truly mass medium in China.” This event coincided with the arrival of broadband connections, and “people began to experience what they could do when they were stuck at home… millions of people, confined to their homes or dormitories for days or weeks on end, looked to the Internet for information or entertainment… Crucially for Alibaba, SARS convinced millions of people, afraid to go outside, to try shopping online instead.”

This event forced a population who hadn’t seen a daily need to try this new thing called ecommerce, to suddenly to adopt this new method of shopping / obtaining daily provisions out of sheer necessity.

King Ma, Working From Home Since 2003

This 2003 picture of Jack Ma & employees during SARS still hangs inside his former apartment

These habits stuck, and you could argue that without SARS, Taobao (and the several hundred-billion-dollar valuation it carries) might not exist today. The event drove a large influx of new users to ecommerce and created the white space Alibaba needed to fight the incumbent eBay EachNet – quickly gaining critical mass / reaching that network tipping point that’s so crucial in a marketplace business.

Alibaba created a superior mousetrap4. They just needed a large group of new ecommerce users – which SARS provided. By 2006, Alibaba had won and become the dominant marketplace in China.

Alibaba’s competitor, JD.com, also had a similar story. In 2003, JD was just a brick & mortar electronics retailer, with 12 offline stores. But as SARS took hold and customers stayed home out of fear of contracting the virus, JD was forced to close almost all of its stores and began doing something it hadn’t tried before – listing its inventory online.

Using QQ groups and online forums, JD saw the potential demand from customers who were likewise stuck at home, and quickly began to realize sales even higher than that of its offline stores. By 2004, JD had closed its remaining store, and converted the entire business to focus on jdlaser.com (the predecessor to JD.com).

The company captured many of the same consumer shifts as Alibaba, and were able to use the event to “jump start” their consumer base. They quickly gained the scale necessary to have negotiating leverage over the brand manufacturers, which allowed them to acquire & resell the goods at prices lower than their competitors. This led to a “flywheel effect”, that eventually grew JD’s electronics business into its $60BN valuation today.

**

So if history is any guide, there will be companies that adapt, and will emerge stronger during this recent crisis too. Once again, it’s the ecommerce industry that’s proving to be a shining example, given the tremendous growth we’re seeing globally in the past few months.

One of the most widely cited examples by the media of this “forced adoption”, is the act of buying groceries online. The trend was already underway in 2019, with ~4.5% US penetration and the industry growing ~30% y/y (LINK). Even so, the majority of Americans had never bought groceries online before, and only 37% tried the service within the last year (LINK).

But starting in March, online grocery orders began to surge overnight. Orders went up 100 – 200% y/y, and most importantly, 42% of those customers had never bought groceries online before (LINK). This is favorable for the industry, since customers proactively seeking out the service means these companies don’t need to spend on acquiring customers. Customers are being “pushed” into the mousetrap by the nation-wide lockdown, as opposed to being “pulled in” by the company’s snazzy advertising. If you believe in the superiority of the mousetrap (although I personally have some doubts) and are an investor in these companies, this is great news.

In fact, just one example of this, is Instacart. After years of losing money and struggling to find a viable business model, they finally achieved a profit in the last few months, benefitting from the increased demand, with sales up +450% vs. December 2019 (LINK).

Nilam Ganenthiran, President at Instacart, confirmed these aspects, stating, “Instacart has seen more growth take place than it was forecasting for the next two to four years,” and that “awareness wasn’t there across the US [pre-Coronavirus], and the bulk of the country didn’t know that a service like ours existed. That has changed… customers know that for the times that they need it, a service like ours exists… There are folks that would never have thought about buying online who are now habituated to it” (LINK).

These are powerful words, and we’ll have to wait to see if that’s true. After coronavirus subsides, will people go back to their old habits, or will the new ones stick?

Additionally, online grocery delivery isn’t the only beneficiary of this global pandemic. Carvana, a pioneer in selling used cars online (and described in more detail below), has faired much better than other used car retailers and is rapidly gaining market share5. Physical car dealerships are closed and many small mom & pop used car dealerships didn’t have an online option at all. If you need a car during this period, Carvana is one of your few options. As a result, recent data is showing that the company is still growing y/y, and even recently returned to January / February order levels (compared to some physical dealers whose sales are cut by half or more, or even completely shut).

In a sign of changing consumer habits, CarGurus did a survey asking how many people would be willing to buy a car online. Before Coronavirus, only 32% of respondents said “yes” they’d be willing to. A few weeks ago, that same survey question had surged to 61% of respondents (LINK).

In Southeast Asia, the social distancing measures and lock-downs in some regions have forced small brands to find ways other ways to sell their products. Many of these brands didn’t have an online presence before, and so are using platforms such as Shopee and Lazada for the first time. Or those that were already on the platforms, are now putting their full effort behind these channels. On the consumer side, over 50% of the population had never purchased an item online in their lives – a fact that’s likely to reverse after this year.

In an early indication of this, Lazada’s CEO, Pierre Poignant, indicated in a recent interview that they have “more than double the number of sellers [that they] onboard every day on the platform since the beginning of the crisis” (LINK).

He further said, “we see an immediate direct acceleration of businesses that want to digitize… The brands, a lot of their retail footprint is closed, so they work with us to still continue to engage with the consumer, while one of their main engagement channels, which is retail footprint, is closed… I think, when the crisis is over, and all hope very soon, these habits are here to stay.”

In Latin America, Mercado Libre (the largest ecommerce marketplace in the region) also reported they weathered this period extremely well. After an initial drop in March that bottomed at 3.3% y/y, the number of items sold and GMV grew 76% y/y and 73% y/y respectively, for the month of April (LINK).

In the US, we’re also hearing similar commentary from small brands. One online-focused beauty brand I spoke to, mentioned that their orders are up +20% versus earlier this year, despite already having a strong online and social media presence. Additionally, they’re exploring solutions such as Afterpay, to capitalize on this increased traffic even further, with the higher order sizes and conversion rates that these partnerships provide. With Sephora, Neiman Marcus, Macys, and other fashion retailers closed, brands that relied upon these brick & mortar channels, are racing to increase their online presence as well.

**

So we can see that around the world, these ecommerce businesses are all accelerating their growth rates, not decelerating. The commonality among all these companies, past and present, is that they provide tools / systems, that help other merchants to succeed.

Alibaba helped small stores / factories sell directly to consumers, during a time when physical retail traffic shrunk – just like Shopee and Lazada are doing today. Shopify helped entrepreneurs easily launch a business and begin generating an income quickly, during a time when finding another job was tough. Instacart is helping grocery stores offer an online / delivery service, when they might not have the resources or scale to develop the service themselves. And Afterpay is providing fledgling brands a source of new customers and increasing the value of customers they already have, by driving higher conversion rates and order sizes.

These companies act like utilities for the merchants they serve – providing a critical service that enables their customers to survive hard times like these. Some of these services were already a better “mousetrap” than the incumbent companies there were trying to replace6. This pandemic has simply encouraged more potential customers to overcome that status quo inertia, and finally give these new methods a try.

And the biggest opportunity for investors, is in the earlier-stage businesses. This period will help accelerate their user adoption, and for certain companies, give them the “jump start” needed to achieve their marketplace “tipping point” / a sustainable business model. Logically, this should result in a higher valuation, since the odds of achieving sustainability are much higher, versus just a couple months ago.

So for these types of internet companies whose biggest hurdle is consumer education and getting people to overcome this inertia (assuming that the mousetrap truly is superior), there’s no better time to lay out the traps. It’s time to put out the good cheese, and make sure it’s enticing enough that the mice will stick around long after there’s other options available again.

It’s these types of companies that interest me the most, and seem to have the most opportunity. I don’t know how long the virus will last, so betting on when Coronavirus-sensitive companies will return to “business as normal” seems foolish and mostly a timing bet (a race against time to avoid bankruptcy).

But in these former companies, we’re already seeing hard data on how consumers are behaving and how it’s impacting their financials. These online companies benefit the longer the virus lasts, by giving business / consumer habits a longer time to form.

In fact, a 2009 study found it takes ~66 days to form a new habit – coincidentally the length of the social distancing period in many countries already (LINK). And even if we go back to normal tomorrow, I think it’s safe to bet that some of the habits formed during this period will be carried on & even accelerate into the future.

If there’s anything this period has shown us, it’s that people rely more and more upon the internet to function in their daily lives, even when everything else is in disarray. If that’s not a great business (or arguably even defensive), I don’t know what is.

Portfolio Updates

Interactive Brokers (IBKR):

We sold Interactive Brokers this quarter. I originally made the investment, based upon the thesis of continued impressive account growth (it had been adding new accounts at a high- teens CAGR), and were encouraged by signs that the company was addressing long-held friction points around the platform’s usability. Additionally, these efforts seemed to accelerate the adoption by sophisticated hedge funds, who are larger accounts and use more margin (and thus accrue higher revenues), and new features were launched to entice retail investors as well.

The thesis was largely correct, as the number of accounts had doubled at Interactive Brokers during our ownership period, from ~360K accounts to ~720K (a 100% increase). However, in the last year, Interactive has faced several industry-wide headwinds that hindered some of these positive developments.

Interactive Brokers makes ~60% of its gross profits from “net interest income”. This is the spread between what Interactive makes on client cash balances, margin loans, borrowed securities, and the rate they pay their customers on these assets.

As this segment is dependent upon global benchmark interest rates (the benchmark depends upon the currency denomination of the assets), it has come under pressure from global interest rates that have only gone down over the last few years. For example, net interest margins have declined 15% from a peak of ~1.7% a year ago, to most recently ~1.45%. This means even as accounts have grown, Interactive will make a less money per account, going forward.

Industry-wide commissions have also been under pressure, as many retail-focused competitors started offering $0 trading commissions last fall. Interactive was one of the original low-price leaders, and was also one of the first to initiate the $0 commission price war via its new IBKR Lite platform, once it was clear the industry would inevitably move in this direction.

On the margins, this move was more defensive than offensive. Given that Interactive Broker’s competitive advantage has historically been in its low-pricing (back when the value proposition was ~$1 – 2 per trade, vs. competitors at $5 – 7), this industry shift will have some negative impact (although not as much, as if

Interactive didn’t take any action). So far this price war hasn’t had a big impact on existing customers, since only 2.6% of Interactive customers have converted to a Lite account7.

Now that all the major players have a free option, I suspect the incremental new retail accounts who may have chosen Interactive before, will gravitate towards the likes of Fidelity and Charles Schwab, who offer better customer support and a friendlier user interface8. Individual customers make up 52% of Interactive’s accounts and 36% of client equity. These clients likely don’t require all the sophisticated features and worldwide trading that Interactive provides, so the primary attraction for this customer segment has been eroded.

I still think Interactive Brokers will do just fine going forward, and our sale is by no means a signal that I’ve lost confidence in the product9. Rather, I just think the market has gotten incrementally more competitive for the individual customers segment, who might not find as much value in the plethora of features Interactive offers, or needs to trade futures on obscure commodities. Additionally, it’s hard to make a call on the direction of interest rates, which Interactive depends so heavily on for the bulk of its earnings.

Interactive Brokers will likely continue to grow more valuable over the years. However the rate of this value creation will likely be lower than our other opportunities, so I took the occasion to deploy the proceeds elsewhere.

We sold the shares at an average price of ~$51. We had originally purchased the shares in mid-2016, at an initial price of ~$35, which implies an IRR of ~10% on our investment in a little under 4 years.

Carvana (CVNA):

This quarter, CVNA began trialing an interesting new program involving “Partner Inventory” (note, the company hasn’t publicly commented on this initiative before – we discovered the program only after some sleuthing). The basic idea is that instead of purchasing vehicle inventory outright (and tying up capital in the process), Carvana will list vehicles owned by other dealers on their behalf (similar to a consignment / marketplace model)10.

The vehicles are listed on CVNA’s website, but with pictures taken by the dealer themselves. In 2018, Carvana acquired Car360 for $22 million (LINK) – a technology that allows users to take a high-resolution 360-degree representation of a car, with just a smartphone (LINK; Carvana had historically used expensive DSLR rigs and custom photo-booths to provide this experience. CVNA’s dealer partners are likely using Car360’s technology for this initiative).

So why is CVNA opening up its platform and technology to its competitors? Well for Carvana, it allows them to conserve their capital to increase their competitive advantage in the differentiated aspects of the business, such as logistics, marketing and brand-building, etc.

Used car inventory is one of the most commoditized aspects of CVNA’s business. While Carvana may have a far wider selection of vehicles, on an individual car basis, Carvana’s 2017 Black Honda Accord isn’t going to be significantly different than a local dealer’s. What prompts a customer to choose Carvana over a local dealer, is rather the site’s ease of use and payment, transparency, the fact that they’ll deliver the car to your home, and the trust Carvana’s brand has built where consumers are confident they’ll get the car in the condition they were promised and there won’t be any negative surprises down the line.

This initiative also helps CVNA to scale their inventory diversity without capital. It’s important, since the company’s customer feedback suggests that the #1 reason potential customers don’t buy a car from Carvana, is that they “did not find the car [they] were looking for.” (LINK). So expanding the inventory selection / diversity is a major variable in driving CVNA’s growth further – and a basis for both this program and CVNA starting to aggressively encourage trade-ins / sourcing cars directly from customers a year ago.

In the used car industry, typically half of gross profits (and an even larger portion of net profits) are derived from ancillary services, such as selling the finance receivables, selling extended protection plans, GAP coverage, etc. These are high margin products (compared to single digit margins from selling the vehicle itself), and in Carvana’s case comprised ~52% of total gross profits per unit last quarter. Under the Partner Inventory program, CVNA retains these profits and equally important, retains the customer relationship.

If you look at the example snapshot below, you’ll notice that customers don’t see the dealer partner’s name anywhere. Instead, the process is just as if you were buying directly from CVNA’s own inventory pool, and the order / delivery experience is exact same. Unless customers are reading the fine print, they wouldn’t notice a difference.

Carvana “Partner Inventory” Listing

From Carvana.com

For dealers, this program allows them to leverage Carvana’s site traffic and customers to turnover their vehicles quicker. Carvana.com generates 100’s of times the traffic than an independent used car lot would generate on its own11. The dealer is giving up half of their potential profits, but in return, the dealer still makes more money in the end if they can reduce the amount of time it takes to sell a car by more than half 12. And in today’s Coronavirus environment, traditional dealers are more desperate than ever to have an easy mechanism to sell their inventory online. It is a win-win for both parties.

If you think about how Amazon built Prime, it was a very similar roadmap. When ecommerce was nascent and consumers weren’t used to / didn’t trust ordering goods online in the 2005, Amazon had to prove that it was an easy and trustworthy experience13.

The only way to do that, was to control the experience from end-to-end, and develop trust for the Amazon Prime brand. This meant investing heavily in inventory, expanding the number of shopping categories, offering 2-day delivery when competitors took a week, etc. Amazon’s profits suffered as a result – but the goodwill it built with customers allowed them to leverage their brand & infrastructure, and eventually monetize it when they expanded to partnering with 3rd Party merchants.

Note, even though other car marketplaces already exist, the model CVNA is pursuing is very different from peers. Unlike other marketplaces, CVNA is providing a standardized level of service and quality guarantee, similar to what Amazon’s Prime program and Fulfilled by Amazon, did for marketplace sellers. Other platforms like Cargurus, are simply a lead generation tool for dealers and don’t control the offline user experience (which is exactly the part of the buying process used car purchasers dislike).

For example, Ebay already existed (and had a much larger network) when Amazon launched marketplace in 2000, and Fulfilled by Amazon in 2006. But what propelled Amazon Marketplace to over-take Ebay, was their ability to provide a consistent customer experience (quick shipping, simplified shopping experience), regardless of which seller’s inventory it was coming from.

While on Ebay, a customer had to research each individual seller’s ratings and make a judgement as to whether the seller was reliable. Depending on which seller a customer bought from, the Ebay experience could vary drastically (the consumer trust rested with the individual store, not with Ebay’s platform).

However on Amazon Marketplace, the customer just had to trust Amazon, since the places in the supply chain that caused variability (shipping times, customer service response times, hassle-free returns) were all standardized and controlled by Amazon itself. Since the goods themselves were commodities, and multiple sellers of the same item would compete to offer the lowest price / the position in the “buy box”, most of the value and customer trust accrued to Amazon.

CVNA seems to be following a similar playbook. Similar to how Amazon educated the consumer and changed online shopping habits with its own 1P business and Amazon Prime, Carvana is doing the same with its marketing and hassle-free experience. Once they proved the market with their own inventory and built the trust, traffic, and infrastructure, Amazon eventually opened up the platform to 3rd Party sellers and provided them with the tools to succeed.

Fulfilled by Amazon held 3P seller’s inventory in its own warehouses, and provided a seamless delivery experience, while allowing sellers to focus on providing high-quality items procured at low prices. Carvana is at this stage now, opening up its reconditioning centers and logistics network, to provide a consistent experience to its customers. Arguably, these standardized aspects are even more important for CVNA, since the items are so much more valuable – it takes more trust in the platform to buy a $20,000 car online than a $10 laundry detergent. So far, Carvana is doing a great job laying the ground work to become the infrastructure provider, preparing for the day when shopping for a car online becomes mainstream.

As it relates to our investment, infrastructure providers also tend to command higher multiples as well, since they sit in a more valuable part of the industry ecosystem. Revenues become more predictable, as the company moves from just a retailer, to a “tax collector” (I described why these “tax collector” businesses are so attractive in our Q1 2019 letter (LINK)).

**

This quarter, CVNA also did a $600M equity raise and expanded their loan purchase program with Ally to $2BN. This is on top of the $450M of liquidity Carvana had going into the quarter, mostly in the form of cash and revolvers.

Needless to say, this additional capital gives Carvana plenty of runway – even if they don’t earn a single dollar of revenue for the next several quarters. However, this scenario was a highly unlikely possibility, since data we’ve seen indicates that even during the depths of March, Carvana’s sales weren’t affected nearly as much as their competitors. And in recent weeks, their orders have already returned to January / February levels.

Undoubtedly, this was aided by government “stay at home” mandates, which forced many competitor’s brick & mortar lots to close. If you needed a car during this period, Carvana’s “contactless delivery” was one of the only options available and ready to deliver (LINK).

The equity raise in late March took solvency risk off the table (although as stated before, it wasn’t a big risk to begin with, and there were several cost items that Carvana could have cut back on to conserve capital). The market reacted positively though, since it narrowed the range of outcomes and skewed the equity’s expected value upwards14. It doesn’t surprise me that shares have recovered from ~$22 at the lowest point to ~$90 today.

We had sold some of our CVNA shares in late February, after the stock rose +30% in the span of three days. We bought back some of it in the weeks after, but got much more aggressive as the stock fell during this last drawdown. By now we’ve bought back all the shares we sold and more, with most of the purchases in the $30’s and $40’s.

Conclusion

On April 3rd, I sent a performance update for the quarter and a call for capital from our current and prospective partners. For those that participated, thank you for entrusting us with your capital. It’s only been a month, but returns on these contributions are already starting to pay off.

Due to the aforementioned positive datapoints we’re seeing in global ecommerce and technology companies in general, I suspect this is just the beginning of a structural trend. Even though our investments have performed well since that capital call a few weeks ago, I firmly believe the real money is going to be made in the next several years, as consumers take their new habits and the increased online reliance developed during this period, into well after this virus subsides.

There’s going to be multi-bagger returns for the winners, far beyond the mid-teens percentage rebound we’ve seen in the indices these last few weeks. Just as Alibaba and Shopify benefited from the prior two crises to come out stronger and produce eye-popping returns for their investors, we’ll be focusing our efforts on the future crop of beneficiaries from this cycle. The winners will be ones that use this crisis to propel their businesses models over the “tipping point” and become the dominant players in their niche.

If you’d like join us in this opportunity, and the pursuit of these future dominant platforms, please let me know. The opportunity set in front of us is one of the best since I launched Hayden – and if you can’t tell, I’m very excited for the next few years ahead. We’re always looking for supportive partners, who wish to join us on this volatile, but hopefully very profitable journey.

**

Over the past few years, we’ve take on many interns ranging from undergrads, to MBAs, to those with several years of experience15. While I’d love to hire each one of them, unfortunately we just don’t have the room.

They’ve all been personally trained by me, in the classic “Hayden style” of deep research and good old- fashioned perseverance to get the information we need (whether it’s cold-emailing contacts on Linkedin, working our networks to build rapport with a company’s stakeholders, or even stalking CEOs to cafes).

Each of them possesses the modeling skills to out-model a 2nd year investment banking analyst on 8-hours of sleep (a rarity), and are handed a copy of the book “The Sleuth Investor” within their first few days on the job (one of the finest books written on the primary research / due diligence process).

All this is to say, our interns are well-trained. And if you appreciate our style of investing and are looking to expand your team, please feel free to reach out. Similar to Hayden’s portfolio, our former interns tend to be open to jobs globally, whether it’s in the US, London, Singapore, Hong Kong, Beijing, Shanghai, etc. Just send me an email, and I’d be happy to connect you with our former interns who I think would be a good fit (plus, you get to save on the headhunter fee).

**

When I wrote our letter three months ago, I had hoped that the virus outbreak would be contained to Asia. But as February progressed, it became clear that I’d have to rethink these plans. So much for our travel plans this quarter…

Our trips to Asia and Europe are tentatively postponed until this Fall, and the only traveling I’ve done is driving to our house in Ohio in mid-March, where I’ve been working from for the past two months. I hope we’ll be able to make these trips later this year, and that Berkshire’s annual meeting will resume next year.

The good news is that with most restaurants in Ohio still closed and with the benefit of a larger kitchen, we’ve been cooking a lot more. I’ve definitely expanded my culinary repertoire, and the next time you see me, I might be a bit heavier.

I hope to return to NYC and be back in the office this summer. In the meantime, give me a call at any time if there’s anything I can assist with. Hopefully the next time we meet, it will be over coffee with a social- distance approved elbow-bump.

Sincerely,

Fred Liu, CFA Managing Partner

See the full PDF here.

This article first appeared on ValueWalk Premium.

The post Hayden Capital 1Q20 Commentary: Long Carvana appeared first on .

Sign up for ValueWalk’s free newsletter here.