By Jacob Wolinsky. Originally published at ValueWalk.

Choice Equities Capital Management commentary for the first quarter ended March 31, 2020, discussing small cap value stocks and large cap growth stocks.

Q1 2020 hedge fund letters, conferences and more

Dear Investor:

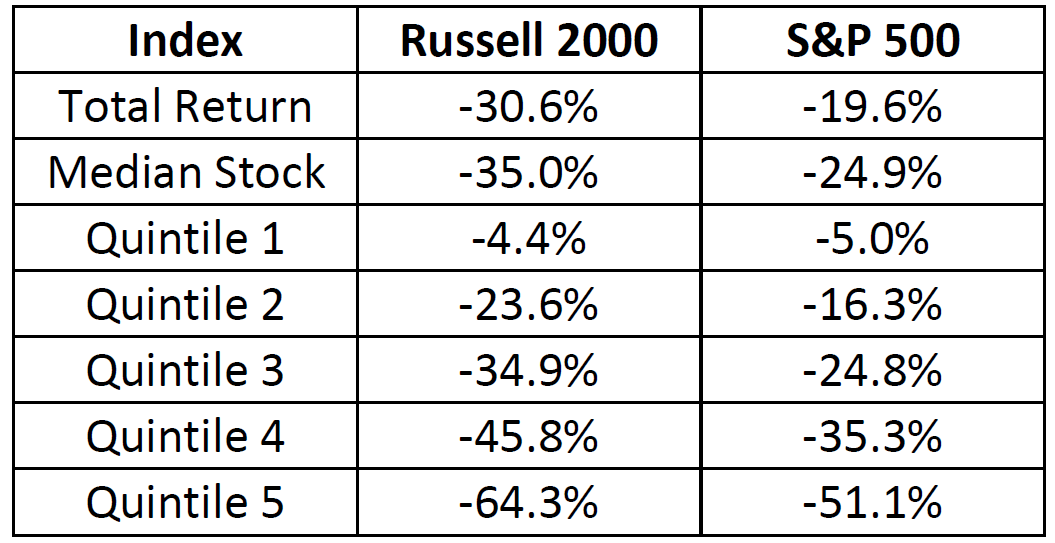

I hope this letter finds you staying safe and making the best of these trying times. Suffice it to say, the events of Q1 have been nothing short of surreal. Life as we once knew it has changed dramatically as we all join the collective effort to fight the COVID 19 pandemic. Social distancing and stay-at-home measures have become the norms of the day and sent a growing global economy into reverse at a previously unthinkable pace. Markets moved in blinding speed to price the reality of a domestic economy on lockdown and produced declines of magnitudes and pace not seen since the 1930s. For the quarter, the S&P finished down -19.6%, while the Russell 2000 finished down -30.6%. Our portfolio was -29.7%.

Executive Summary

In this letter, we discuss the events of the quarter, their impacts on markets and how performance compares to other volatile episodes in history. We then discuss several new portfolio additions and some exits. Finally, we provide a few thoughts on the outlook, using mean reversion and history as guideposts to inform elements of our investment outlook.

Quarterly Commentary

For those interested in market statistics, the quarter’s volatility produced a number of superlative performances. Some of them include: the fastest -30% decline in history at 22 days, an all-time closing high on the VIX and both the best and worst consecutive three-day periods for markets since the 1930s. Small caps led the way down and continued to lag as they have for years now. In March, the Russell 2000 produced its worst month since it began in 1984, making 1Q its second worst quarter ever. More recently, April was the best month since 1987 providing a strong bounce back month, which along with other portfolio moves described further below, have enabled us to recapture more than half our year-to-date losses.

At times of such severe market dislocation, it can be instructive to look under the hood to see how the stocks within the market performed, rather than just the market cap weighted indices which contain them. In that regard and as is often case in severe selloffs, we can see that the median stocks in both the S&P 500 and Russell 2000 trailed the top-heavy indices meaningfully as the table below shows.

As far as style buckets go, small cap value stocks were the biggest laggard for the quarter, finishing down -40%. This group of small cap stocks includes some banks and energy companies which were hit hard due to the nature of the crisis, but also a lot of restaurants and retailers that typify the many businesses of Main Street USA. And like much of the small and medium businesses that constitute Main Street, many of these companies have quickly had to come to grips with the prospects of revenues suddenly approaching zero while facing the unfortunate reality of fixed costs that remain the same.

Against this backdrop, all stocks sold off heavily and our stocks were not immune. Despite entering March with a portfolio positioning that was somewhat more conservative than is frequently typical, the quick pace of the market selloff produced meaningful declines to our portfolio as some of our positions found their way into the fifth quintile. We believe most of the share price declines in this group seem to outweigh any lasting business weakness. For example, companies like PAR Technology Group, who has a durable SAAS business model and a blue chip, primarily quick-serve restaurant customer base and no liquidity concerns, will likely only see short-term business weakness, despite the fact that its competitive position could actually improve. But in other cases, where fixed costs are high and demand is driven by the purchase of large ticket items like homes or furniture as in the case of Bluelinx and At Home or Hooker Furniture, we chose to head to the sidelines for the time being given the changing risk and reward dynamics of those positions and other opportunities that became available. In each of these cases their Q1 earnings reports came in largely in line with our pre-COVID19 expectations, but the unfortunate reality is this was very much old news given the changing new world we find ourselves in.

Our recent purchases have been made with special consideration for the uncertain times of today. All of these businesses can survive and potentially thrive in the times that are ahead. All have entrenched competitive positions, proven management teams, strong balance sheets and durable drivers of demand that will continue to drive purchases in most any economic environment. All offer attractive risk versus reward dynamics. Two of our purchases in March were prior investments CMG and LAWS as their share prices seemed to have changed more than their investment theses.

CMG – Chipotle was thriving heading into this year with same-store sales growth accelerating into the low teens, the bulk of which was driven by an increasing use of digital ordering. These orders tend to be larger and more profitable for the company. The trend of growing delivery and digital ordering has accelerated in this environment and seems likely to persist well into the future, a factor which should be a significant long-term positive for the company.

LAWS – Lawson Products continues to be a well-run micro-cap industrial distribution business with impressive ROIC attributes. The company has a highly variable cost operating model, a clean balance sheet, and is heavily bought by insiders. While the company’s end markets will assuredly see some softness like others, management has proven to be adept as operators in supplying industrial products to their loyal customers who value their vendor-managed inventory offering.

SNDR – Like Lawson and many of the stocks in the small cap value bucket, industrials in general and trucker stocks in particular have a tendency to anticipate economic weakness and often perform well once an economy has slowed. Schneider National is a trucker with a well-diversified business mix. The heavily-family owned company pays a small dividend, has more cash than debt and as an essential business, will assuredly participate in the reopening of our economy when we begin to go to back work.

ECOM – Channel Advisor is another microcap we purchased during the quarter. The company’s SAAS e-commerce platform offers its selling partners a unique and highly efficient means of streamlining marketing, selling and fulfilling activities across hundreds of channels. 2019 was a bit of a transition year for the company, but the company looks to have executed soundly with EBITDA doubling over the level from the year before. Its large customers have seen surges in their online businesses, while other customers will have a clear need to continue to upgrade their online offerings in order to stay competitive in a world that is clearly moving in this direction. At entry, shares were trading at levels with nearly 30% of its market cap in cash and at ~6x 2019 EBITDA.

ULTA – With retail stocks under dramatic pressure, we also initiated a position in Ulta Beauty. ULTA is a well-run company with an outstanding total shareholder return track record that has been steadily taking share in the beauty category for decades. Its 90% off-mall locations, clean balance sheet and growing online offering position it well to continue to take share in the beauty supply space, a category that is known for its resiliency. In late March shares declined to five-year lows at which point we initiated a position.

ELY – Callaway Golf was a final addition also late in March. With two turns of leverage, this position carried the most debt of any of the new positions. Still as a brand, the company has a variable cost operating model and a valuable stake in the TopGolf business that could be worth $5 – 6 or more in a more normal operating environment. People have continued to play golf during the pandemic and appear likely to continue to do so when more normal times return. Recently the company raised capital via a convertible preferred note to bolster its balance sheet. The move looks like a sound one for the company, but somewhat limits further upside. We have since taken gains here.

2020 Outlook

In many ways, the outlook now seems to be as uncertain as it has been in many years, if not longer. Trips to the grocery store require masks, and most of America’s storefront businesses are closed. With the rebound in the market, debate seems to have moved to what sort of recovery we might have as we begin to slowly open up our economy. Investors seem resigned to categorize the recovery by a letter shape. Some point to a quick bounce back of a V as possible or likely, while others suggest a long slow recovery like a U. Others suggest a double dip recession like a W is in the offing, or worse, the dreaded L. As is always the case regarding the future, anything is possible, though some trajectories seem to offer a higher likelihood than others.

More recently, I first heard the concept of a K shaped recovery. And I suspect that if forced to pick just one, this seems to be the most apt. The principle assertion is that not all companies will be impacted similarly. There will be winners, and there will be losers. Some will prosper. Some will struggle. Some will not make it. At present, at the risk of oversimplification, the market views large caps as winners, and small caps as relative losers. This seems understandable given the current dynamics. Large cap growth stocks have been in favor for some time now. They offer more defensive means of accessing equity market returns. Many are fabulous companies with durable business models, high returns on capital and cash-heavy balance sheets that are still successfully finding ways to grow their cash flows in this environment. Meanwhile many of the small and medium size business that make up Main Street and populate the small cap indices are quite literally shut.

Earnings Multiple Spread Between Small Cap Value Stocks And Large Cap Growth Stocks

The market moves of this most recent quarter have only extended this long running trend of diverging performance. It is clear these trends have been in place for a while, but for just how long really? Looking back over five years, it is quite surprising to see the Russell 2000 has a negative five-year annualized return of -.2%. This return meaningfully trails its larger cap peers’ +6.7% annualized gain and is such a rare period of prolonged poor performance that it places this observation in the bottom 5% of all monthly periods over the last 40 years, according to Royce Investment Partners. Given the dichotomy, perhaps it is unsurprising to see that, according to O’Shaughnessy Asset Management, the typical earnings multiple spread between small cap value stocks and large cap growth stocks has now reached levels only seen in the top one percent of all observations. So, the headwinds to our long-biased strategy focused on mostly small caps have been blowing for a while. But what, if anything, does this portend for the future?

Well, of course, as always past performance is no predictor of future results. But prior instances in the Royce analysis show the average return from such underperformance was a 22% annualized return over the subsequent three-year period. Even more positively, the O’Shaughnessy study points to even more impressive performance for those small cap stocks in the value bucket.

So, what sort of investment implications might this have? For starters, it reinforces two truisms of investment management. One, mean reversion over time is a powerful and reliable force in markets. Just as trees do not grow to the sky, long established patterns of market returns are unlikely to continue unabated forever. And two, over any medium to long term time horizon, it pays to be optimistic. While many of the small cap stocks that are currently being cast aside as losers may not fare well, many will; and from these depressed prices, many offer multi-bagger potential. As the economy begins to reopen and gradually recover, I suspect these stocks can do quite well from here. So, despite the cloudy economic outlook, whether it be a case of mean reversion or simply securities bouncing back from deeply depressed prices, I am quite optimistic about our prospects for the quarters and years to come.

Conclusion

In closing, while I know our approach will not yield outperformance each and every quarter, I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the overwhelming majority of our investable assets are invested alongside yours, we would never ask investors to assume risks we ourselves will not.

Thank you for your continued support as we work to grow our capital together. As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time.

Best regards,

Mitchell Scott, CFA

Portfolio Manager

This article was first published on ValueWalk Premium.

The post Choice Equities 1Q20 Commentary appeared first on .

Sign up for ValueWalk’s free newsletter here.