By Jacob Wolinsky. Originally published at ValueWalk.

Logica Absolute Return and Logica Tail Risk Fund commentary for the month ended April 30, 2020.

Q1 2020 hedge fund letters, conferences and more

Logica Absolute Return – Up/Down Convexity – No Correlation

Logica Tail Risk – Max Downside Convexity – Negative Correlation

April 2020 Performance

- Logica Absolute Return +0.63%

- Logica Tail Risk -0.72%

- S&P 500 +12.70%

- VIX -29.39 pts

Year To Date Performance

- Logica Absolute Return +21.61%

- Logica Tail Risk +27.76%

- S&P 500 -9.22%

“See the thing is, you guys look at me and see the backwards hat, the gray socks, the funky outfit and you say, “Now this guy’s a chump”… what you don’t realize is it ain’t easy, it’s hard work making something this pretty look like a chump.” – Billy Hoyle, White Men Can’t Jump (1992)

Apparently VIX Fell Victim to CoV-19

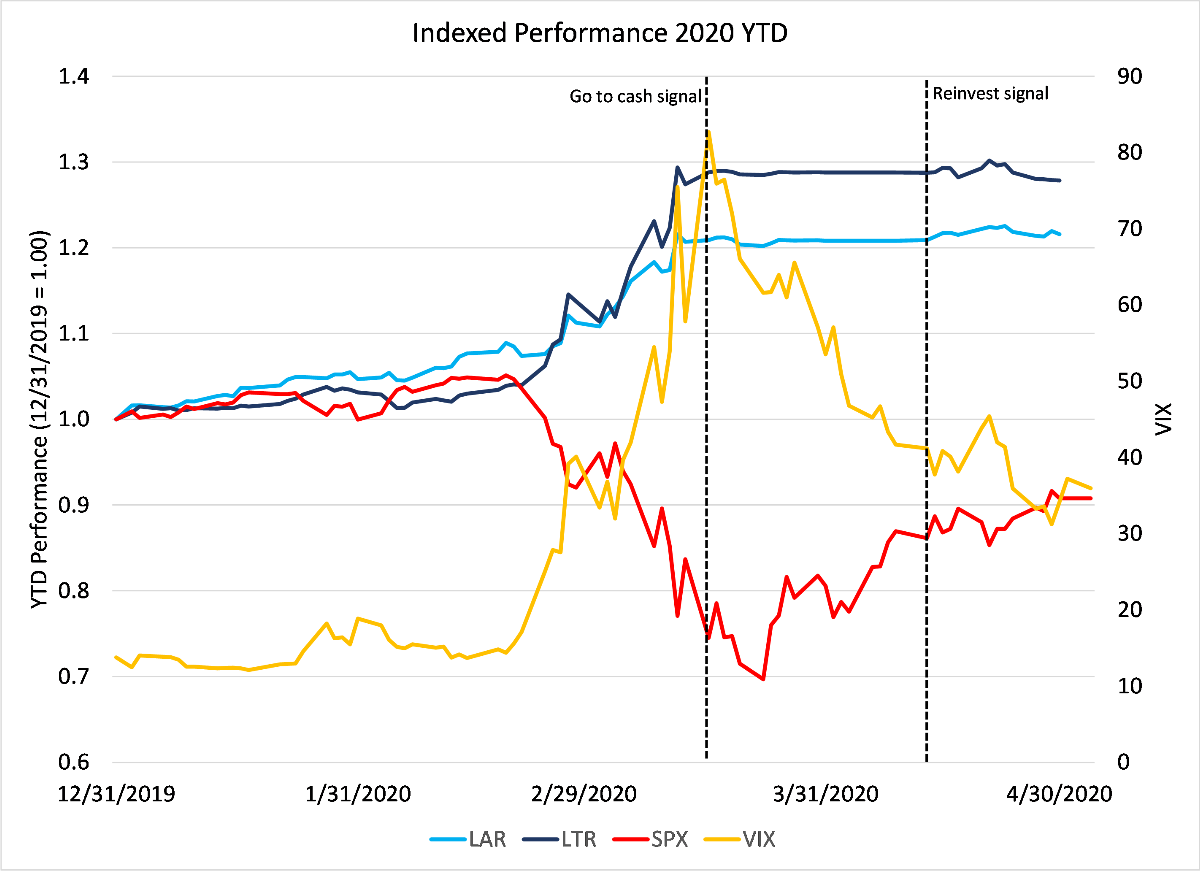

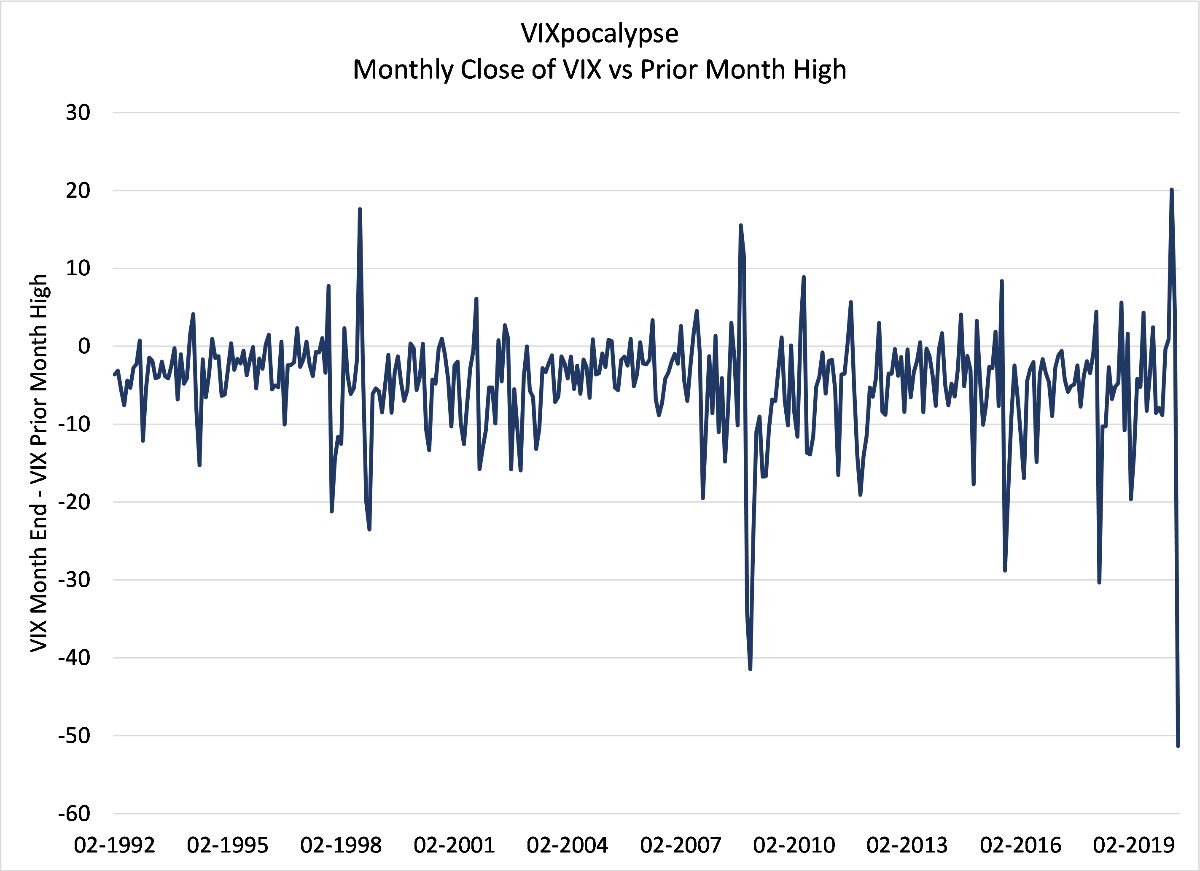

If you’re going to launch a long volatility fund, might we suggest not doing it when volatility is about to fall off a cliff! Fortunately, new investors in the Logica Absolute Return Fund, our first commingled product which launched April 1st, managed to eke out a small gain despite the record decline in the VIX. This positive outcome was a byproduct of both no work and hard work. No work, because the rules of engagement at Logica specify that we don’t buy additional volatility above extended levels of the VIX – we can hold our inventory of volatility instruments and sell them as the VIX rises above these levels, but we don’t add to our positions. As we saw in mid-March, this led to a rare “go to cash” dynamic. The hard work took place on the research side where our Head of Research, David Taylor, PhD, worked feverishly to finish a new investment module that positions our portfolio to better handle the type of strong reversal that typically accompanies these “vol crush” events. This new module, which we refer to internally as “LFB”, is essentially an “anti-momentum” portfolio of calls on the most oversold constituents in the S&P500. This new module accounted for 125% of the gains for the month; encouragingly, we find that the introduction of this module allows us to exit the cash position earlier and with a more robust return framework by diversifying a portion of our historical emphasis on momentum for up-capture. The complementary behavior of momentum alongside “anti-momentum” further ensures participation in recoveries, from either side of where the market finds leadership.

In addition to the unprecedented VIX crush, the S&P500 managed to deliver by far the fastest returns in the past thirty years and while we can’t yet know if this was a bear market rally or a return to the bull market, it is definitely one for the record books coming in second for the fastest 30% rally in history with only 26 days required. Unfortunately, there is no simple conclusion for what the future holds. Of the eight prior “fast rallies”, two were during the middle of the 1930s drawdown and six represented the beginning of new bull markets.

Nothing concrete here. Unfortunately, that same uncertainty seems to be playing out with investor flows. While most investor positioning surveys suggest that positioning is relatively low, we are seeing evidence that investor flows are deteriorating with layoffs. In poker terminology, we have a “pair of twos”… not exactly a great hand, but also not an automatic fold.

In February, we expressed excitement that the (then) extreme market movements, both up and down, in 2020 had given Logica the opportunity to demonstrate the payout characteristics of our strategies. As we had planned, Logica Absolute Return (LAR) exhibited a positive alpha, long straddle payout structure and Logica Tail Risk (LTR) exhibited a positive alpha, long put payout structure. March extremes exhibited another characteristic – delevering to capture gains. And finally, April has seen us reenter markets in a volatility retreat. We continue to emphasize that Logica products are not designed to “sell the world”. We believe the options we purchase are undervalued due to a demonstrable flaw in option pricing models that assume the Efficient Market Hypothesis (EMH) and that these characteristics are likely to grow over time due to the growth of passive index strategies. The higher levels of implied volatility compared to earlier in the year have the effect of widening our straddles and pushing our bias slightly more bearish as can be seen comparing the blue and green dots in the below chart. Unfortunately, the volatility crush manifests itself as a headwind, but with a similar volatility crush impossible to replicate, we look forward to a more conducive environment in May.

Sell in May and Go Away?

It is tough to imagine a more challenging experience than the start of 2020, but there are significant reasons to believe we are not yet out of the woods. Nowhere in the Western world does there seem to be a coherent plan for emerging from lockdown. Data is sparse, but the timeliest information we have is from US jobless claims and daily payroll withholdings. Historically, withholdings have done a good job of tracking nominal GDP once adjusted for tax changes (e.g. end of tax holiday in 2013 and tax cut in 2018). The current decline in withholdings suggests nominal GDP is on pace for a decline in the 9.5% range as of April 30th.

Likewise, contributions to 401K plans are facing a dual headwind from declining employment and declining employer match programs. Per the WSJ:

In the wake of the 2008 financial crisis, almost 20% of U.S. companies with at least 1,000 workers surveyed by consulting and risk management firm Willis Towers Watson PLC suspended or reduced their 401(k) matching contributions. Companies that took action then include General Motors Co., for its salaried workers, and United Parcel Service Inc., for its nonunion workforce.

Compared with 2008, “a wider range of employers are taking this route and are making these difficult decisions faster, with a greater assuredness that these steps are immediately necessary, as opposed to waiting and seeing how things develop for their business,” said Joy Napier-Joyce, leader of the employee-benefits practice group at law firm Jackson Lewis P.C. – WSJ 4/1/2020

We wrote last month, “If salaried employment (and hence 401Ks) is supported by stimulus, we believe there is a very good chance that currently vindicated bears will again be running for their caves due to the impact of passive share gain.” While that certainly held true over the last month, the concern is that 401K contributions will lag employment decisions by roughly 1-2 weeks (as severance typically includes continued allocations to 401Ks). On this basis, it is concerning to see the withholdings begin to fall aggressively and our confidence is not high that salaried jobs will be as protected in the next employment report. As we highlighted in our recent piece, Policy in a World of Pandemics, the remarkably high share of passive allocations in 401Ks accounts for most of the growth in the passive sector. While we anticipate a continued trend towards increased passive share, there is a critical risk that the loss of employment and employer match are enough to tip the flows negative for the first time since Q4 2018.

Faced with this degree of uncertainty, we are understandably pleased to sit in our straddle position with perhaps a modest bearish tilt. Having successfully navigated the biggest volatility crush since 1987 (prior to the VIX), we continue to innovate and improve our approach to trading this increasingly passive dominated market. As we discussed last month, we understand that we cannot know the future, but the phenomena that power our approach (the growth of passive and systematic volatility selling) show no signs of abating.

“There are no secrets to success. It is the result of preparation, hard work, and learning from failure.” — Colin Powell

Business Update – Logica Absolute Return Fund Launch

The Logica Absolute Return Fund launched on April 1st, 2020. Next subscription date is June 1st, 2020. Please contact Steven Greenblatt if interested in receiving subscription documents.

Logica Strategy Details

Note: We have comprehensive statistics and metrics available for our strategies, but only include a select few to highlight what we believe is our most valuable contribution to any larger portfolio.

- If you would like to learn more about our strategies, please reach out to Steven Greenblatt.

- If you would like to speak with Wayne or Mike on their views on Hedge Funds/Investing/Trading and trends they see shaping the industry, please contact Steven Greenblatt at greenblatt@logicafunds.com or 424-652-9520.

See the full PDF here.

This article first appeared on ValueWalk Premium.

The post Logica Capital April 2020 Commentary: Apparently VIX Fell Victim to CoV-19 appeared first on .

Sign up for ValueWalk’s free newsletter here.