By Jacob Wolinsky. Originally published at ValueWalk.

State Street CEO Suggests Company’s Leftist Commitments are a Promotional Ploy

Q1 2020 hedge fund letters, conferences and more

Push for ESG Goals Forces Hard-Pressed Companies to Spend Money On Questionable Ideas in a Time of Global Economic Crisis

“Drop the Whole ESG Scam and Get Back to Your Duty to Your Clients,” Advises FEP’s Shepard

State Street’s ESG Commitments Are Subordinated To Serve The Shareholder Interests

Washington, D.C. – State Street CEO Ronald P. O’Hanley affirmed today that the company’s Environmental, Social and Governance (ESG) commitments are subordinated to its longstanding and legally-mandated obligation to serve the interests of its shareholder clients. This assertion raises questions about State Street’s well-publicized recent demands that companies in which State Street owns stock must conform to an enhanced ESG agenda.

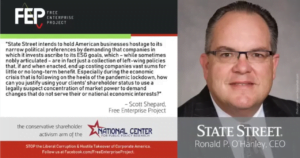

During the company’s virtual annual shareholder meeting, Scott Shepard, Coordinator of the National Center for Public Policy Research’s Free Enterprise Project, asked O’Hanley:

State Street intends to hold American businesses hostage to its narrow political preferences by demanding that companies in which it invests ascribe to its ESG goals. While sometimes nobly articulated, these are in fact just a collection of left-wing policies that, if and when enacted, end up costing companies vast sums for little or no long-term benefit. Especially during the economic crisis that is following on the heels of the pandemic lockdown, how can you justify using your clients’ shareholder status to apply a legally suspect concentration of market power to demand changes that do not serve their or national economic interests?

O’Hanley answered, in part:

[W]hat State Street Global Advisors does in its stewardship activities is look to the boards of these underlying companies to make sure that they are looking at the longterm value creation. Any position or stewardship activity that State Street performs is with that sole goal, of ensuring longterm shareholder value creation. Ultimately it’s not our decision what companies do, and ultimately we will remain invested in those companies, but because we do not have the ability to not be invested in them, we take the stewardship role seriously and we will continue to do so.

Audio of the exchange can be heard here. A written, annotated version of Shepard’s question can be found here.

Scott Shepard’s Response

After the meeting, Shepard responded:

State Street has more than 225 years of experience in American stock markets. For most of that time it has been a fiduciary steward to its clients, the shareholders whose assets it manages. Recently though, it appears to be contemplating a different course.

State Street recently announced an intention to use its clients’ shares to force companies to take costly and politically partisan ESG positions. While these positions are often nobly phrased, they in fact cost companies huge amounts in compliance costs in aid of ill-considered environmental efforts and interventions in employment and corporate governance that are counterproductive to shareholders while failing to create meaningful countervailing benefits for other parties.

An ESG push can have a material effect in two ways. Either it’s a fairly bald attempt to push corporations into left-wing political positions, or it is a concealed effort to reduce the incentives and overview structures that properly align the interests of shareholder owners and corporate-leader management. Neither of these is a good outcome for shareholders, employees, customers or the companies themselves.

O’Hanley suggests that State Street’s interest in ESG is not material, but promotional. In his response to our question, he recommitted State Street to making only decisions that are in the best interests of shareholder clients. But that has always been the legal and moral obligation of all parties involved. If nothing about this ESG push changes these commitments, then the push is just a promotional ploy – an advertising gambit. However, as an advertising gambit it is both very expensive and highly disingenuous.

It’s not likely that O’Hanley and State Street are going to take my business advice, but I will give it anyway: Drop the whole ESG scam and get back to your duty to your clients. Invest for the best interest of shareholders, which is also necessarily in the best interests of employees and clients. Leave the political posturing to the politicians. We get more than enough from them.

Conservative investors can learn how to oppose leftist ESG goals by downloading FEP’s Investor Value Voter Guide. https://nationalcenter.org/IVVG/

The post State Street CEO Suggests Company’s “Leftist Commitments” are a Promotional Ploy appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.