By Vikas Shukla. Originally published at ValueWalk.

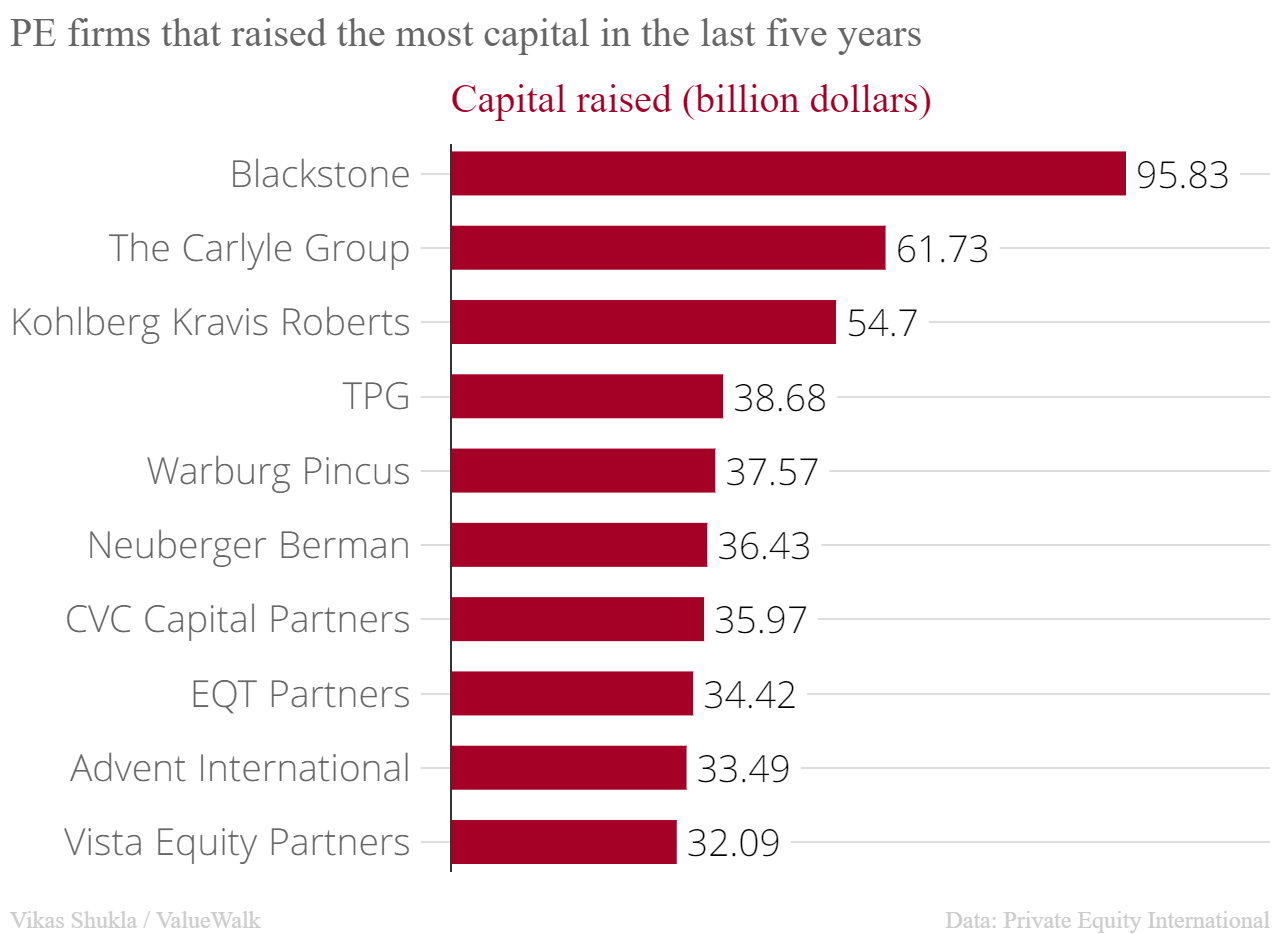

Private equity firms are armed with massive amounts of cash as they navigate the economic and health crisis caused by the COVID-19 pandemic. The world’s top 300 biggest private equity firms have raised a total of $1.988 trillion in the last five years, according to Private Equity International’s 2020 PEI 300 report. Here we take a look at the ten largest of them.

PE firms pool capital from accredited investors who have a relatively high risk tolerance. They invest the money in privately-held businesses, hot startups, leveraged buyouts, and other opportunities. Private equity firms often take a long-term view to maximize the value of their investments. Investors putting their money in a PE fund stay invested for a specific period of time, ranging from 3-12 years.

Biggest private equity firms

The Private Equity International’s latest PEI 300 ranking is based on the amount of capital PE firms have raised from investors between January 2015 and April 2020. According to the report, the ten biggest private equity firms have collectively raised $461 billion in the last five years.

10- Vista Equity Partners, $32.09 billion

Founded by Robert Smith and Brian Sheth in 2000, Austin-based Vista Equity has $57 billion in total assets under management. It invests primarily in technology startups, and sometimes also makes passive equity investments. Vista Equity Partners has raised $32.09 billion from investors in the last five years. Earlier this year, it invested $1.5 billion in India’s Jio Platforms.

9- Advent International, $33.49 billion

Boston-based Advent International engages in buyouts, growth investing, and strategic restructuring. Since its inception in 1984, Advent has completed about 350 transactions across North America, Europe, Asia, and Latin America. According to PEI 300, it has $56.80 billion in assets under management.

8- EQT Partners, $34.42 billion

EQT is one of the only two non-US private equity firms on this list. The Swedish PE firm was founded in 1994 by the powerful Wallenberg family, AEA Investors, and SEB. It has invested in more than 200 companies across North America, China, and Nordic countries. EQT Partners has raised $34.42 billion in the last five years.

7- CVC Capital Partners, $35.97 billion

Luxembourg-based CVC Capital is the biggest non-US private equity firm in the world. It has raised $35.97 billion in the last five years. CVC was founded in 1981 as the European subsidiary of Citicorp Venture Capital (CVC). It spun out of Citicorp in 1993 to become an independent PE firm.

6- Neuberger Berman, $36.43 billion

New York-based Neuberger Berman has raised $36.43 billion in the last five years, according to the PEI 300 report. It raises capital mainly from sovereign wealth funds, pension funds, charity organizations, and high net-worth individuals. The firm is fully owned by its employees. Lehman Brothers acquired Neuberger Berman in 2003, but the PE firm survived the collapse of its parent company in 2008.

5- Warburg Pincus, $37.57 billion

Founded in 1966, Warburg Pincus focuses on growth investing. It has invested in approximately 900 companies around the world. Warburg Pincus invests across technology, media, healthcare, financial services, retail, and industrial manufacturing sectors. It has attracted $37.57 billion capital from investors between January 2015 and April 2020.

4- TPG Capital, $38.68 billion

San Francisco-based TPG Capital focuses on growth investing and leveraged buyouts. It invests in a wide range of sectors including telecom, media, healthcare, technology, and retail. Earlier this month, TPG Capital invested $600 million in India’s Jio Platforms. TPG raises capital from sovereign wealth funds, endowments, pension funds, and insurance companies.

3- Kohlberg Kravis Roberts (KKR), $54.7 billion

KKR is the world’s third biggest private equity firm. It has raised a staggering $54.7 billion from investors in the last five years. It was founded by former Bear Sterns employees Jerome Kohlberg, Jr., Henry Kravis and George R. Roberts in 1976. It has offices in 16 countries. KKR is notorious for aggressive leveraged buyouts, including that of TXU Energy in 2007 and RJR Nabisco in 1976.

2- The Carlyle Group, $61.73 billion

Washington, DC-based Carlyle was founded in 1987 as an investment banking boutique. Today it has become one of the world’s largest private equity firms. Carlyle focuses on leveraged buyouts, growth investing, and real assets. It attracted bad press in 2001 when it invited Osama Bin Laden’s family member Shafiq Bin Laden as the ‘guest of honor’ at its investing conference.

1- The Blackstone Group, $95.83 billion

The Blackstone Group has retained the top spot from last year. Its five-year fundraising stood at $95.83 billion, much higher than the Carlyle Group’s $61.73 billion. New York-based Blackstone is one of the largest leveraged buyout investors. It has invested in popular brands such as Hilton, Leica Camera, SeaWorld, and Freescale Semiconductor. It was founded by Peter Peterson and Stephen Schwarzman in 1985.

The post Top 10 biggest private equity firms in the world appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.