By Jacob Wolinsky. Originally published at ValueWalk.

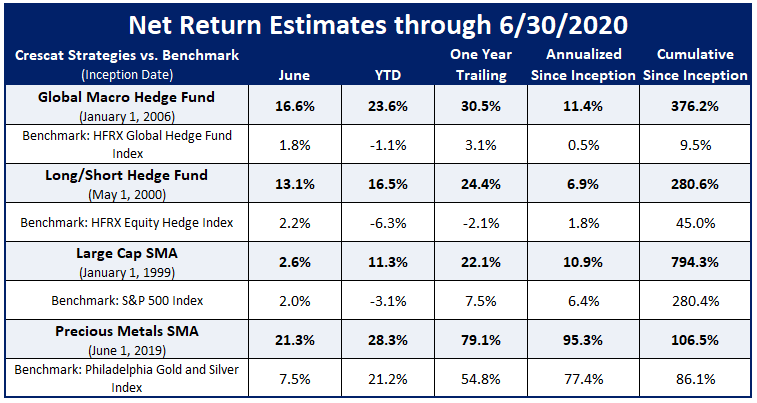

Crescat just finished a strong June beating the S&P 500 Index and our other benchmarks across all four strategies for the month and year to date.

Q1 2020 hedge fund letters, conferences and more

Smaller Cap Gold And Silver Miners Contributed To Crescat’s Monthly Performance

Our global fiat debasement theme was the standout performer for the month. Crescat’s overweight of select smaller cap gold and silver miners, including activist positions, contributed greatly to the Global Macro Fund and the Long/Short Fund which saw estimated net returns of 16.6% and 13.1% respectively in June.

Crescat’s purely precious metals focused separately managed account strategy was our biggest gainer for the month. The SMA composite has strongly outperformed its benchmark Philadelphia Stock Exchange Gold and Silver Index (XAU Index) over the last two months. Since inception, just thirteen months ago, the Precious Metals SMA is up 106.3% net versus 86.0% for the XAU Index.

Precious metals miners just had their best quarterly performance in history after a decade long bear market. We believe it is only early stages of a new secular bull market for the industry.

Central Bank Liquidity Boosting Precious Metals Industry

While central bank liquidity is temporarily boosting the stock market in general, it is boosting the precious metals industry even more. The macro environment is severely impaired due to debt and asset bubbles that the Fed has already created and are doomed to burst. The opportunity to short stocks at record valuations remains, in our view, as attractive as it has ever been.

As the economic downturn unfolds, company fundamentals are deteriorating while excessive corporate and government debt levels continue to suck all liquidity injections provided by the Fed.

At Crescat, we remain positioned for our three high conviction macro themes:

- China’s credit and currency bubble

- The downturn of the global economic cycle

- The once in a lifetime opportunity to buy precious metals

For simplistic reasons, the easy way to envision how to implement these investment ideas is to be long gold in Chinese yuan terms and short global stocks. Overall, this trade has worked phenomenally well, and we strongly believe this is just the beginning of what we consider to be “macro trade of the century”.

As for the “long gold” part of the thesis, we continue to strive to generate value through our comprehensive stock selection process in the precious metals mining industry. Along with the assistance of Quinton Hennigh, PhD, our world class geologic and technical advisor, we are investing across the globe in what we believe to be the most promising new gold and silver deposits in the world. After presenting our activist case for Eloro Resources and Condor Resources last week, we recently shared our involvement with another exciting story in the Golden Triangle: Eskay Mining. Please take a moment to watch the video below where we elaborate on our friendly activist approach in general and with respect to Eskay specifically.

Crescat Gets Activist on Gold #2

Have a Happy Fourth of July!

Sincerely,

Crescat Capital LLC

Kevin C. Smith, CFA

Founder & Chief Investment Officer

Tavi Costa

Partner & Portfolio Manager

The post Crescat Capital: Gold Stocks On Fire appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.