By Jacob Wolinsky. Originally published at ValueWalk.

Alpine Capital Research commentary for the second quarter ended June 2020, titled, “The Bubble in the Crash.”

Q2 2020 hedge fund letters, conferences and more

Today’s market has required us to navigate a narrow strait between dangerously high equity prices and Great Lockdown capital impairments. We believe valuation risk is near all-time highs with the S&P 500 selling at 33.2x cyclically adjusted as reported earnings. In the meantime, our flagship Equity Quality Return (EQR) strategy is selling at 8.8x our estimate of cyclically adjusted earnings and capable of withstanding a severe recession.1

The Difference Between 2000 And 2020

If corporate profits still matter, we believe these ratios are wildly off the mark. Indeed, the market is presenting us with an historic opportunity, strikingly like the one that prompted ACR’s founding in 2000. Below is a comparison of the two periods with differences underlined.

Then (2000)

1) The decade of the 2000s is likely to produce historically low stock returns—low single-digits or less—as US market values are above 30x cyclically adjusted earnings.2 (It did.)3

2) ACR has identified a small group of value stocks—selling at about 10x earnings—which we believe will produce double-digit returns.4 (They did.)5

3) “Value” is a four-letter word. Value strategies have underperformed in recent years, which has created the current opportunity.

4) 9/11 was about to change the world.

Now (2020)

1) The decade of the 2020s is likely to produce historically low stock returns—low single-digits or less—as US market values are above 30x cyclically adjusted earnings.

2) ACR has identified a small group of value stocks—selling below 10x earnings—that we believe will produce double-digit returns.

3) “Value” is a four-letter word. Value strategies have underperformed in recent years, which has created the current opportunity.

4) COVID-19 is changing the world.

A Bubble In A Crash

The biggest difference between then and now is that today we are in a severe recession, whereas in 2000 we were over a year away from a mild recession. One does not expect to see a bubble in a crash, but our analysis shows that this is exactly what has happened. Strangely, we have the valuation distortions of 2000 with the economic calamity of 2008.

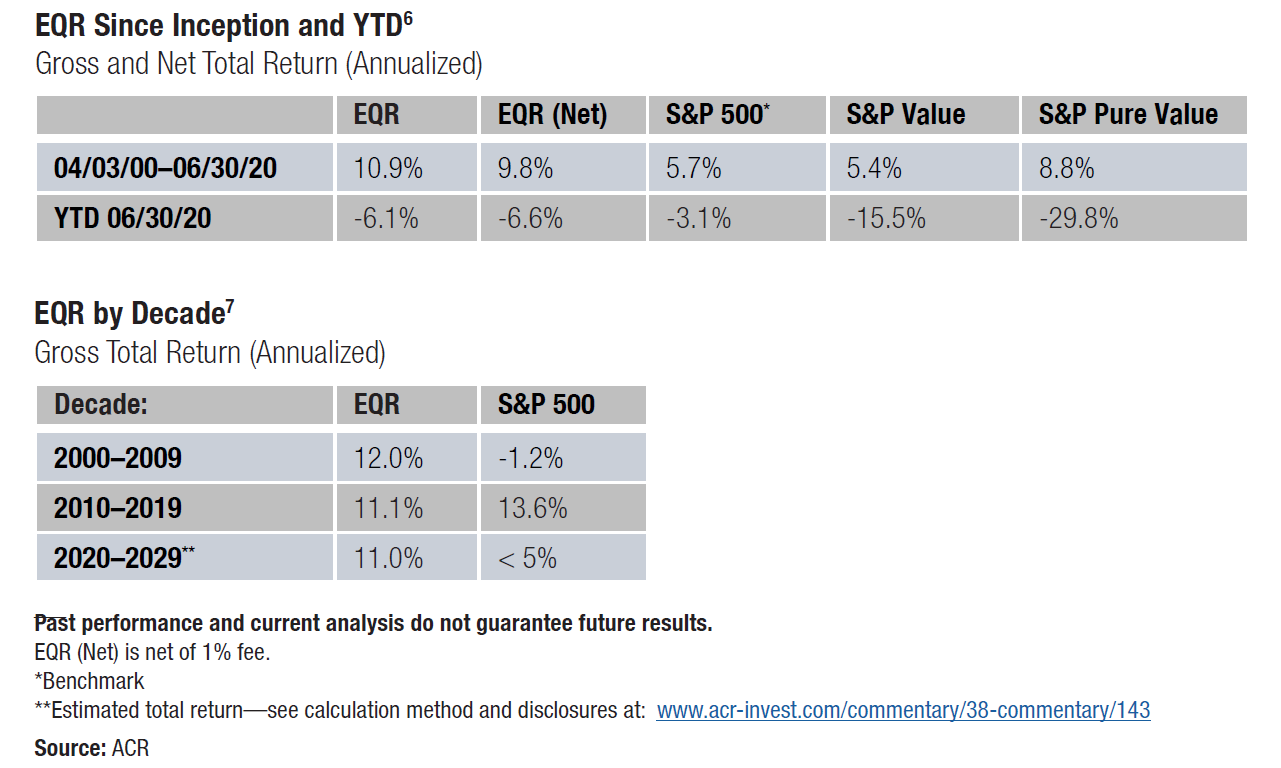

Another difference between then and now is that then ACR was just starting, whereas we now have a 20-year performance track record. Our updated performance data for our flagship EQR strategy as compared to relevant indexes is shown on the next page.

The last difference worth highlighting is that we avoided the underperformance of value during the 1990s with our inception in 2000, but we have had to endure the underperformance of value during the 2010s. We keep close track of such periods because one of our three primary objectives is to beat the broader market in the long term. Here are the numbers:

The EQR composite total return (market appreciation plus dividends) is currently 31% behind the S&P 500 since 2012. Yet our valuation work shows a 224% intrinsic value differential between EQR and the S&P 500 today.8 Therefore, even if the valuation differential is much less than we have estimated, we are not too concerned about making up for lost ground.

The Decade Of The ’20s

Turning to the economy, the decade of the ’20s began with a crisis for the ages. In response, our longest-ever first-quarter commentary covered a great deal of ground. We refer you to this commentary for a full analysis of the economy and markets in relation to the COVID-19 pandemic and the associated Great Lockdown. Our assumptions and conclusions have not changed since then. The equity market, however, has changed quite a bit.

Stock prices went on a tear in the second quarter. As the virus showed signs of containment and the economy started to reopen, market participants reacted with unfettered relief. Stocks rose across the board with little change in underlying valuation disparities. Imbalances that had risen to historic proportions from 2017 to 2019, and which grew even wider during the March declines, have held relatively constant during the rebound. Thus, the greatest bifurcation of values in modern history remains.

While a downward reckoning is a real possibility for the broader market, our research shows a narrow group of value stocks should rise over time. Manufacturing, financials, telecoms, and energy shares have not fully recovered, as the year-to-date return for the S&P Pure Value Index shows. Our cash was used to scoop up stocks in these sectors during the March declines. The upshot is that we are poised to monetize these bargains without the pain of year-to-date value index results.

Like much of pandemic life today, equity markets are downright strange. Who would have thought rampant stock speculation could coexist with runaway coronavirus fears? Yet, witness the proposed secondary stock offering of bankrupt Hertz stock, or the zero-revenue hydrogen truck startup Nikola’s $34 billion market value. If the market is a voting machine in the short term, voters appear to have gone mad. No one, however, should be too surprised. Gambling, fear, and greed are constant fixtures in financial markets. Fortunately, the market is a weighing machine in the long term as real value accumulates in the form of profits. On that score, we look forward to harvesting capital gains and dividends in the coming years as the cash flows produced by our companies generate real spendable dollars.

Nick Tompras

Alpine Capital Research

The post ACR 2Q20 Commentary: The Bubble in the Crash appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.