By Jacob Wolinsky. Originally published at ValueWalk.

Logica Capital commentary for the month ended June 2020, titled, “Is That All There Is?” discussing the performance of their anti-momentum portfolio (LFB).

Q2 2020 hedge fund letters, conferences and more

Logica Absolute Return – Up/Down Convexity – No Correlation

Logica Tail Risk – Max Downside Convexity – Negative Correlation

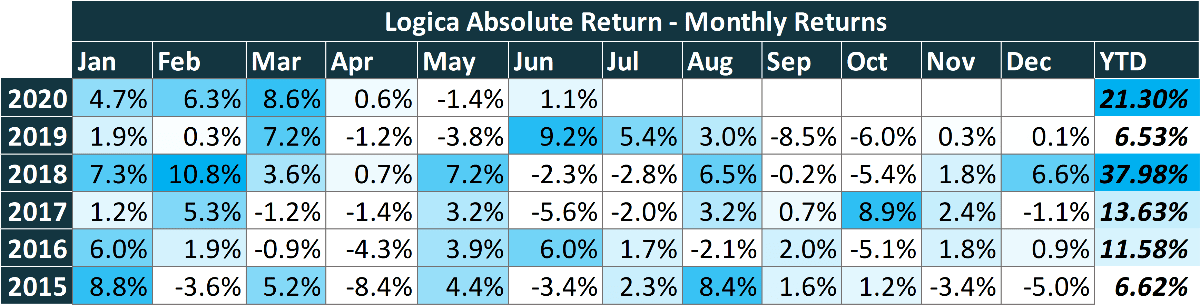

June 2020 Performance

- Logica Absolute Return +1.14%

- Logica Tail Risk +0.37%

- 500 +1.77%

- VIX +2.92 pts

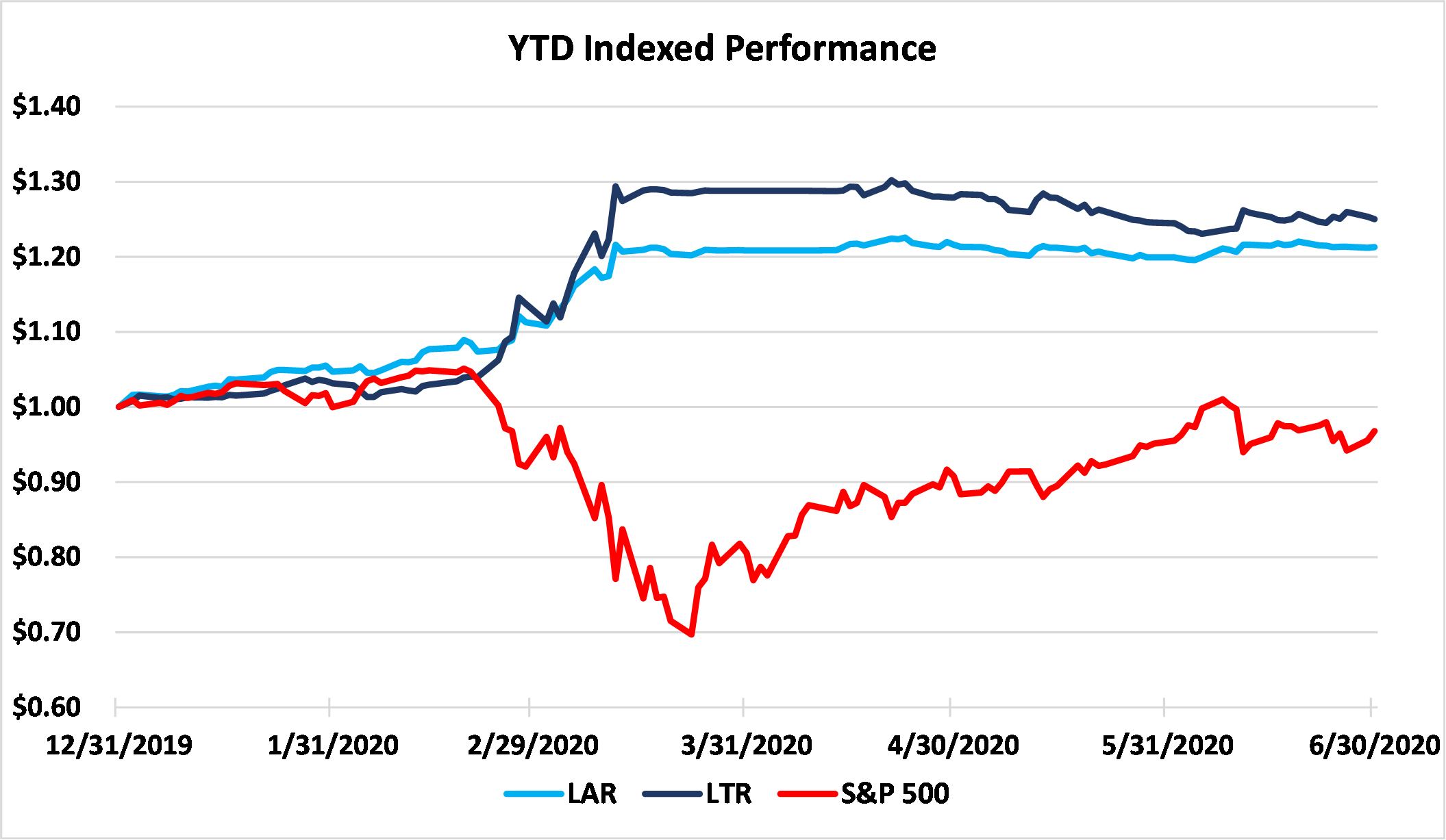

Year To Date Performance

- Logica Absolute Return +21.28%

- Logica Tail Risk +25.02%

- S&P 500 -3.21%

“I stood there shivering in my pajamas and watched the whole world go up in flames. And when it was all over I said to myself, ‘Is that all there is to a fire?’” – Peggy Lee, 1969

Logica’s Anti-Momentum Portfolio (LFB): Is That All There Is?

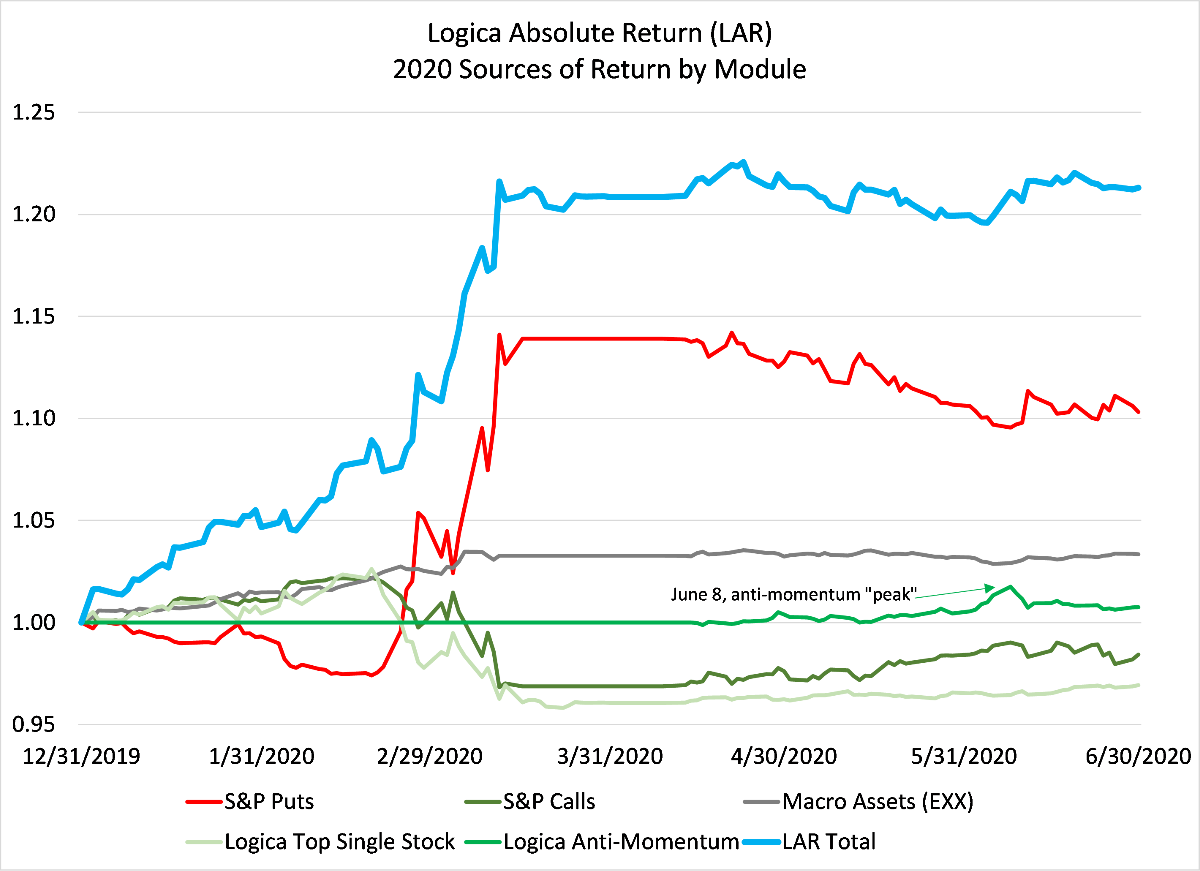

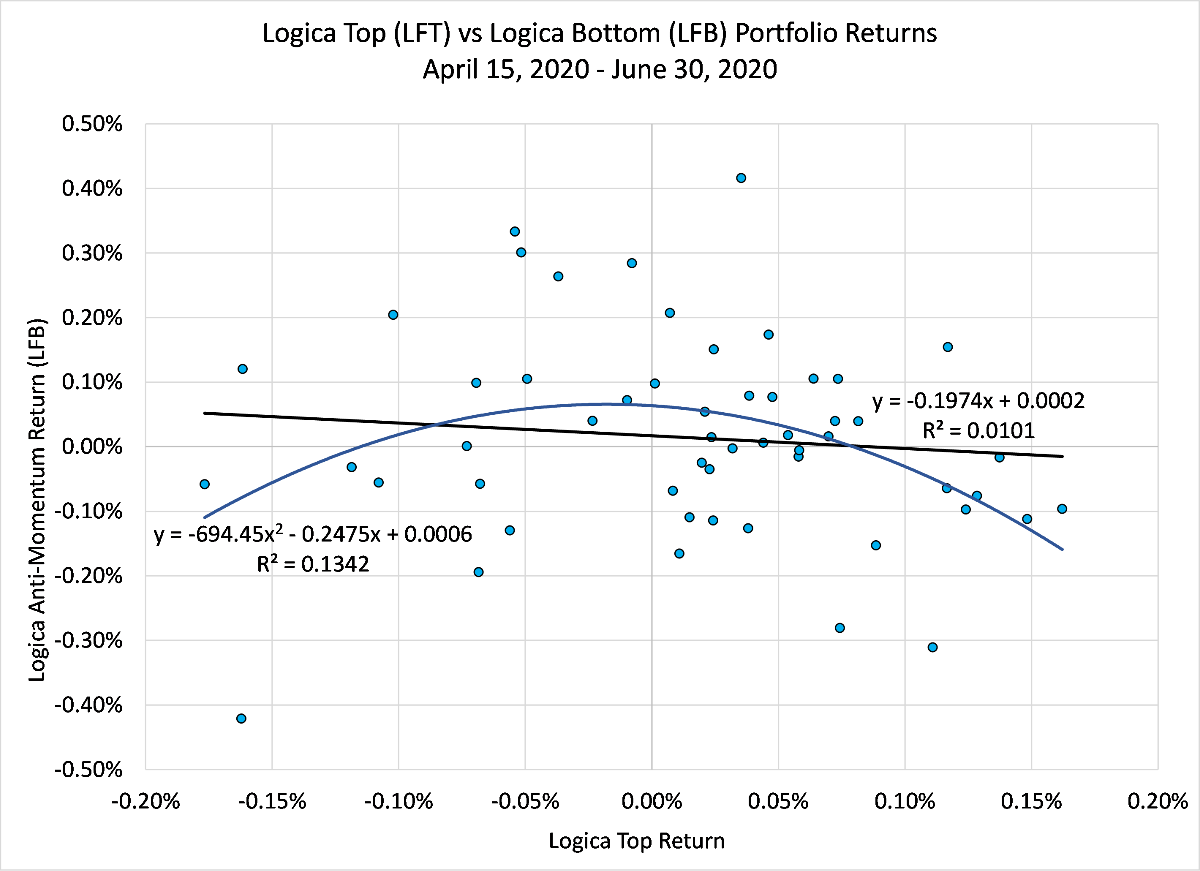

Over the past few months, we have devoted considerable effort to communicating our new module designed to improve performance in the rebound – our “anti-momentum” portfolio (LFB). While continuing to contribute positively for June, since June 8th we have begun to see this portfolio underperform. For what it is worth, this was the day that Hertz (HTZ) peaked at $6.25 from its post-bankruptcy low of $0.40/share. This was also the day when the VIX reversed from its post-CoV-19 lows of 23.5.

This behavior is not a surprise and it is worth emphasizing the temporary nature of these positions. But it also highlights an impact of adding the LFB portfolio – a reduction in portfolio volatility.

As we emphasized in our three part series on Value investing (TYBAV 1-3), “Value” is a short volatility strategy. And LFB exhibits exactly this behavior. Effectively we introduced a small short straddle on top of our traditional topside participation without taking a short position. This is a remarkable feature, as it allows us to introduce short volatility in regimes of very high volatility, without taking the outsized risks associated with an explicit short volatility position. To reiterate, Logica never shorts volatility (and for that matter does not short anything). Having a long position that behaves as a short volatility position is powerful. This gives us tremendous flexibility in addressing high volatility regimes, but it also highlights the need to manage the dynamics associated with our return diversification. With perfect hindsight, we should have increased our allocation to topside participation (i.e. skew our underlying straddle more bullishly) to offset the reduced volatility of our portfolio. This is the certain to be repeated mea culpa for the “too low” risk exposures in the aftermath of the March crash.

“And so I sat there watching the marvelous spectacle

I had the feeling that something was missing

I don’t know what, but when it was over

I said to myself, ‘Is that all there is to a circus?’”

— Peggy Lee, 1969

The Circus

When we wrote our thought piece, “Policy in a World of Pandemics”, we were unquestionably contrarian in our perspective that nothing much had changed and that it was reasonable to expect markets to rebound relatively quickly in a manner that evidenced few linkages to the “real” economy. One of the risks that we highlighted was that this rebound would lead to a reduced sense of urgency from policy makers. The original CARES Act, passed in the Senate on March 25th (two days after the stock market bottom), converted a bill designed to reduce taxes on “Cadillac” health care plans into the most extensive stimulus package in history. Its signature feature, the Paycheck Protection Program (PPP), offered $349 billion in forgivable loans to small businesses to protect employment. This was subsequently expanded to $669B and the requirement that 75% of funds be spent on payroll were reduced to 60% in early June.

“When we passed these bills in March, quite frankly we thought by now, the economy would be in much better shape than it is,” Sen. Ben Cardin, D-MD, said on the Senate floor.

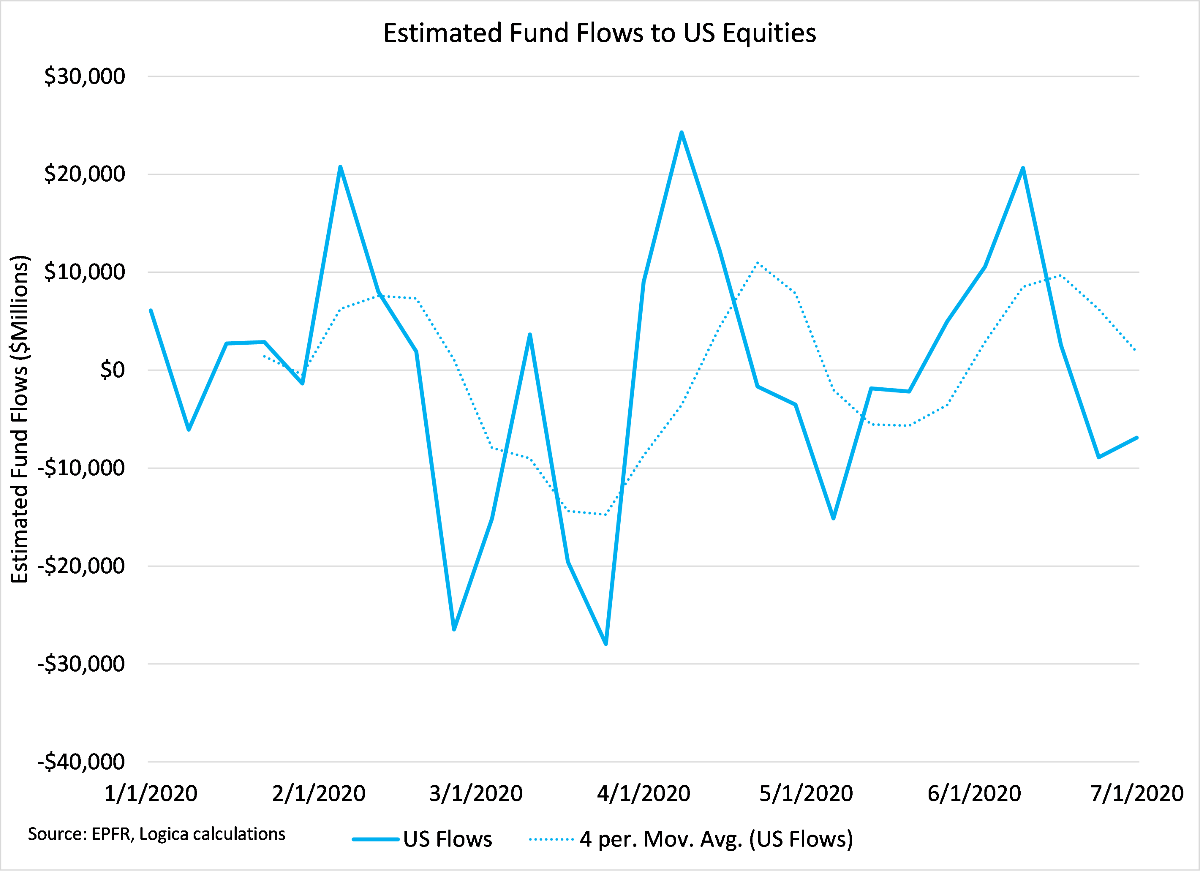

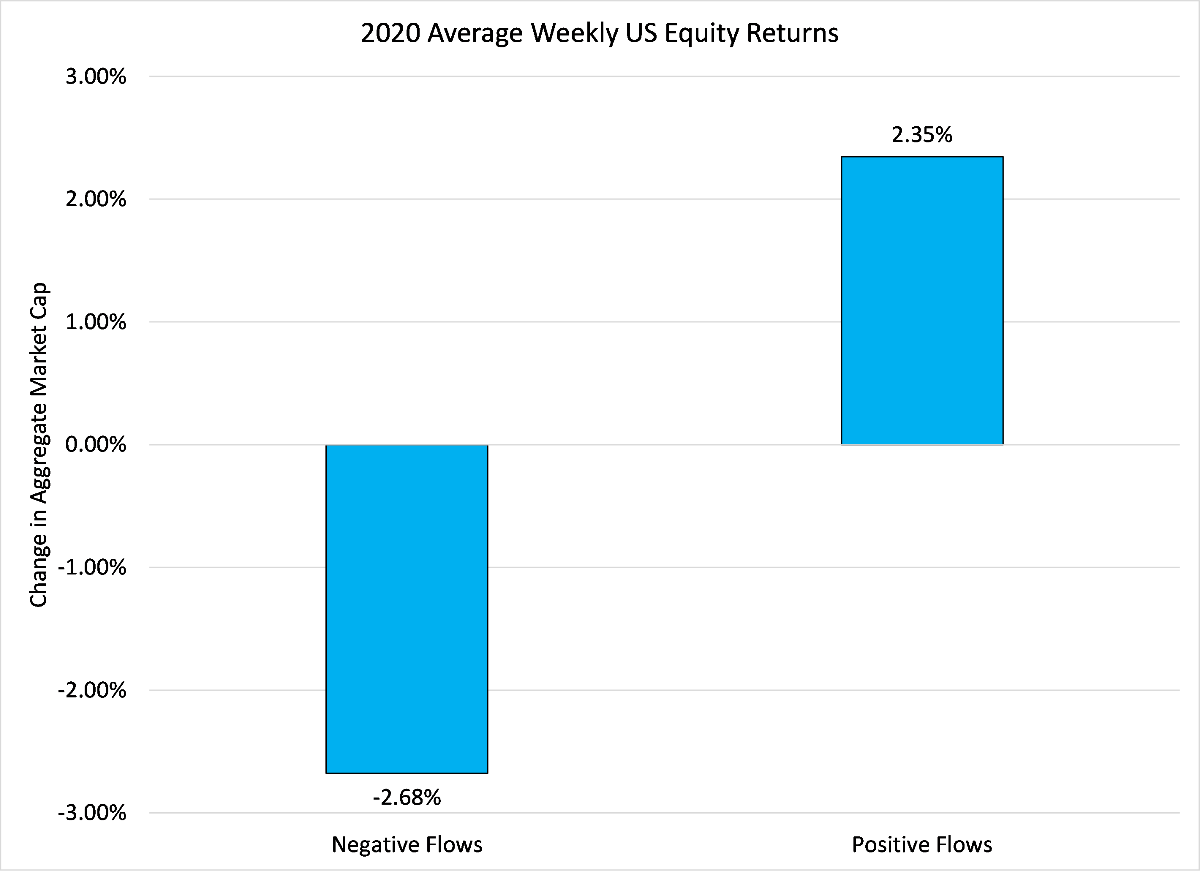

The unintended consequence of this increase in flexibility was a downturn in payrolls that was not captured in the June payroll report which ended June 12th; but it did begin to show in mutual fund inflows, with flows turning negative for the first time since early May. As it did in May, this outflow resulted in torrid market gains pausing.

On a year to date basis, US equity market returns have been very strongly correlated with flows; and as we might expect the risk of policy makers backtracking appears to have been addressed with a simple market consolidation from June 9th to July 2nd. On July 2nd, President Trump signed legislation that extended PPP for an additional six weeks and the odds are that with only modest pressure markets will be able to convince legislators and regulators to keep the stimulus coming.

With reopening under threat from resurgent CoV-19 infections, the extension of PPP and payrolls will be critical. While we are currently celebrating the strong June payrolls, the evidence is becoming increasingly clear that our best-case scenario is looking U-shaped rather than the hoped-for V rebound.

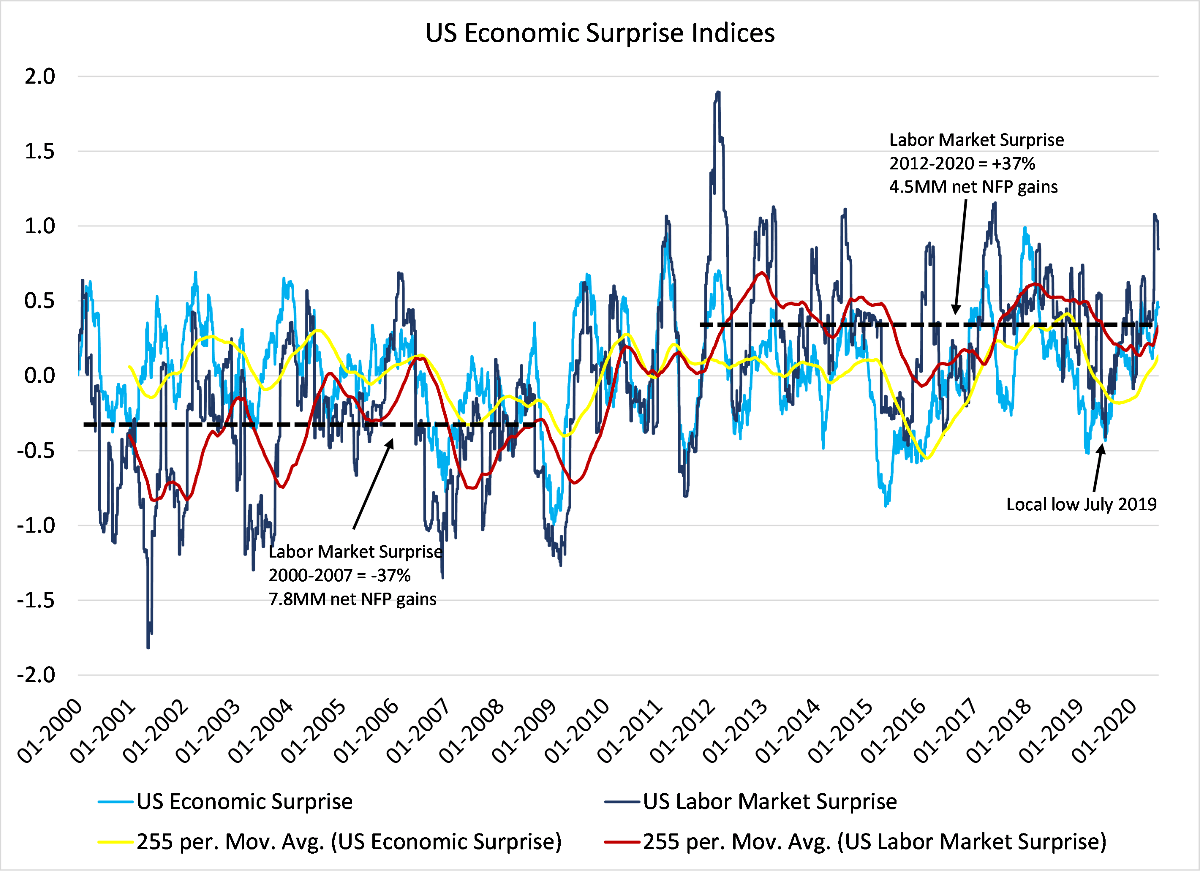

Of course, “surprises” work in interesting ways. While surprises are supposed to be adaptive systems – low expectations lead to beats which leads to raised expectations and misses – a disturbing pattern of persistence in labor market “surprises” has existed for at least the last 20 years. Despite the record level of unemployment, economic “surprises” for the US labor market have been unerringly positive since 2011, and even the most aggressive bear would have a hard time discerning the biggest economic collapse in history from the Bloomberg surprise indices.

The wonderful part of “expectations” narratives is that we now “understand” why markets are higher… they are beating expectations!

“If that’s all there is my friends, then let’s keep dancing.

Let’s break out the booze and have a ball…

If that’s all there is…”

— Peggy Lee, 1969

May I Have This Dance?

With expectations marching higher alongside financial markets and CoV-19 infections, the reversal in anti-momentum likely has some clues for investors concerned about the real world. As Senator Cardin noted, we are far behind the curve in economic reopening and while government stimulus has largely offset much of the cash flow losses, effectively turning much of small business into a Labor Cost+ model for the present moment, reality beckons. A review of real-world outcomes provides a slightly different picture (2).

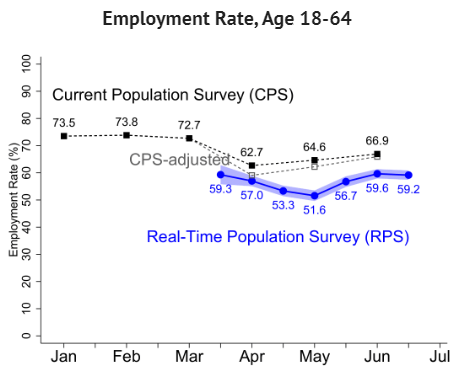

As mentioned above, the strong 4.8MM in June payrolls missed an important inflection that shows up in the Dallas Fed “real-time” population surveys:

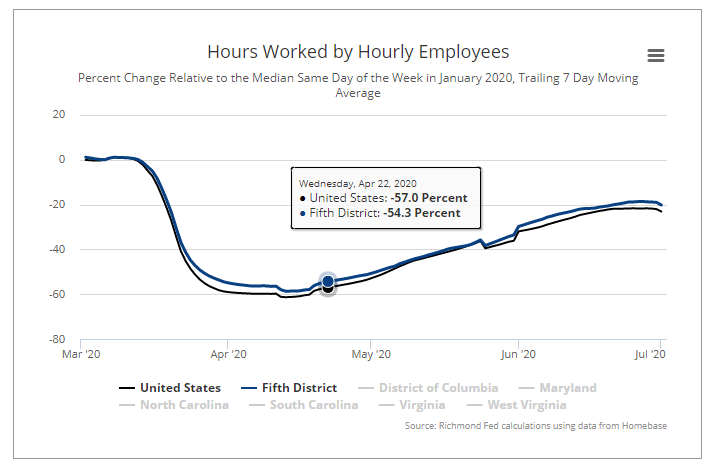

Likewise, the Richmond Fed index of hours worked has begun to rollover:

While PPP has provided support for payrolls (that now appears to be rolling over), rent is a slightly different story. As of May, nearly 50% of commercial rents had not been paid in the past two months. Remember that unpaid rent is unsecured debt.

Nearly half of commercial retail rents were not paid in May. Companies as big as Starbucks say the financial devastation from the shutdown has left them unable to pay their full property bills on time. Some companies warn they will not be able to pay rent for months. – Heather Long, June 4, 2020, Washington Post

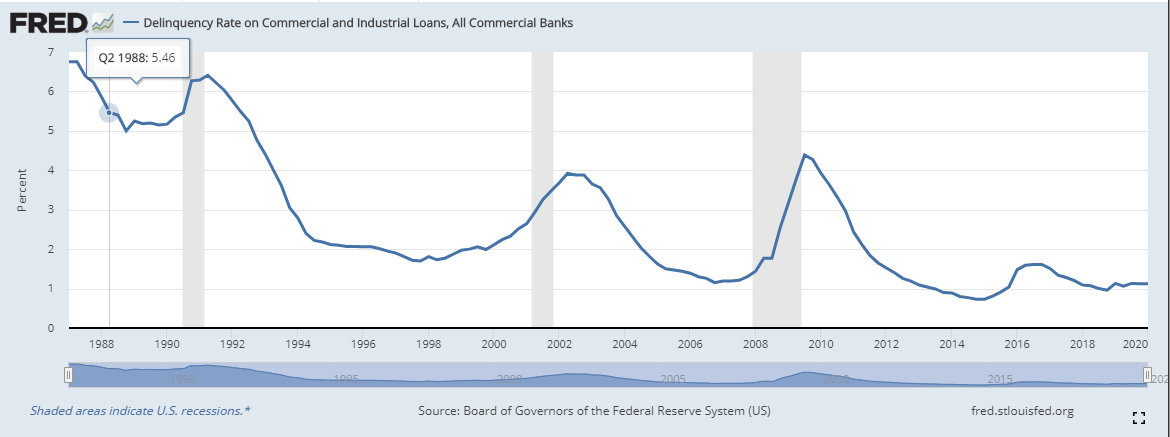

And while this has not yet shown up in delinquency data, the CMBS market is sniffing blood, with the retail intensive Series 6 having begun its recent decline on the same day that our anti-momentum strategy hit its local peak.

The difference between equity markets and credit markets is the cash dynamic. Like rent, there comes a time where management teams may be forced to make the choice, “Do we retain our cash or give it to our debt holders?” The second quarter earnings are likely to introduce a lot of commentary that suggests all is not as rosy as the financial markets are suggesting.

“As long as the music is playing, you’ve got to get up and dance.”

Chuck Prince 2007

Last Dance…

As if 2020 had not already been eventful enough, there is an interesting event on the horizon that is not the U.S. presidential election. It is Vanguard Target Date Rebalance time! What? No one told you?

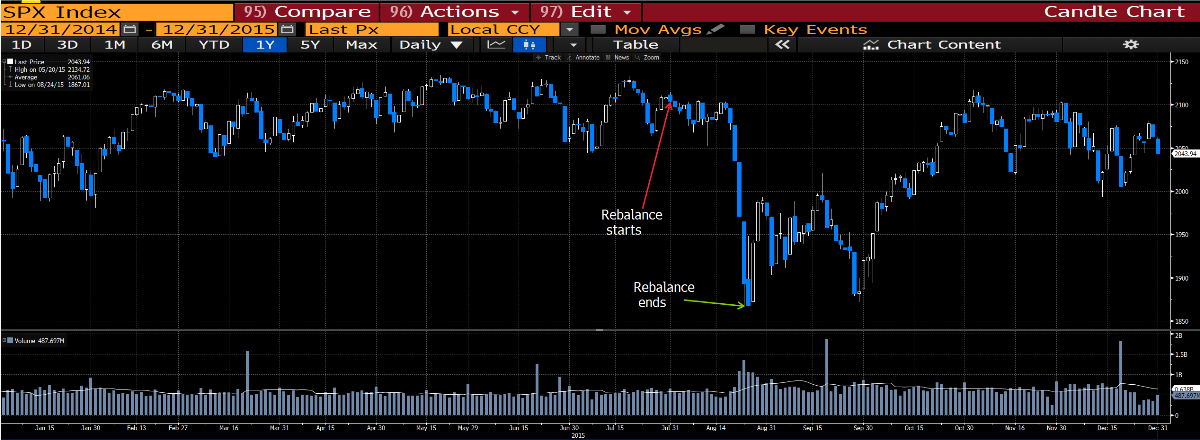

This is somewhat unsurprising because it has not happened very often. In fact, only three times before has a large systematic rebalance of Target Date Funds occurred. The last time was summer 2015. This was fairly uneventful.

For those interested in self-directed study, I’d encourage you to read up Vanguard’s plan (Narrator: They do not have a plan). Target Date Fund assets are roughly 100% larger today than 2015. We consider ourselves fortunate under the Chinese blessing, “May you live in interesting times.”

The good news is that we are positioned for either scenario. If the Target Date rebalance ignites a 2015-style implosion (the long discussed “second leg down”), then we are ready; but if the effect is not as expected, and more “surprises” unfold in greater upside and/or economic dislocation, then we are ready as well.

Business Update – Logica Absolute Return Fund Launch

If you are interested in discussing Target Date Fund rebalancing, please reach out to Steven Greenblatt to schedule time with Michael Green. Our next subscription date is August 1st, 2020. Please contact Steven Greenblatt if interested in receiving subscription documents.

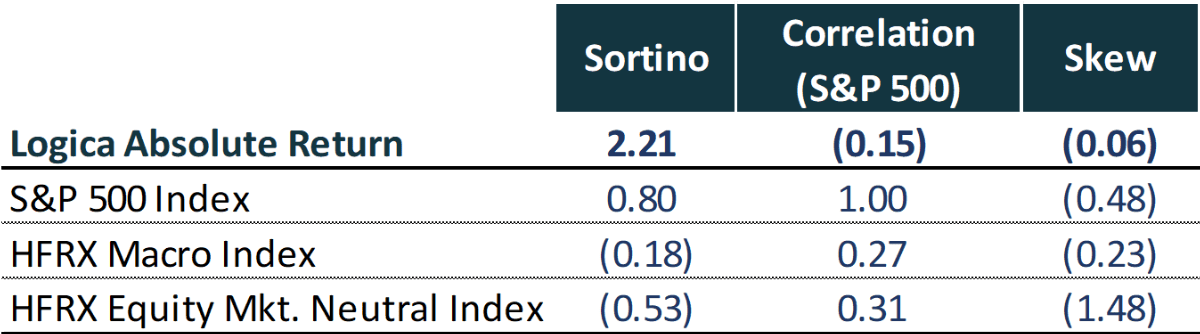

Logica Strategy Details

Note: We have comprehensive statistics and metrics available for our strategies, but only include a select few to highlight what we believe is our most valuable contribution to any larger portfolio.

- If you would like to learn more about our strategies, please reach out to Steven Greenblatt.

- If you would like to speak with Wayne or Mike on their views on Hedge Funds/Investing/Trading and trends they see shaping the industry, please contact Steven Greenblatt at greenblatt@logicafunds.com or 424-652-9520.

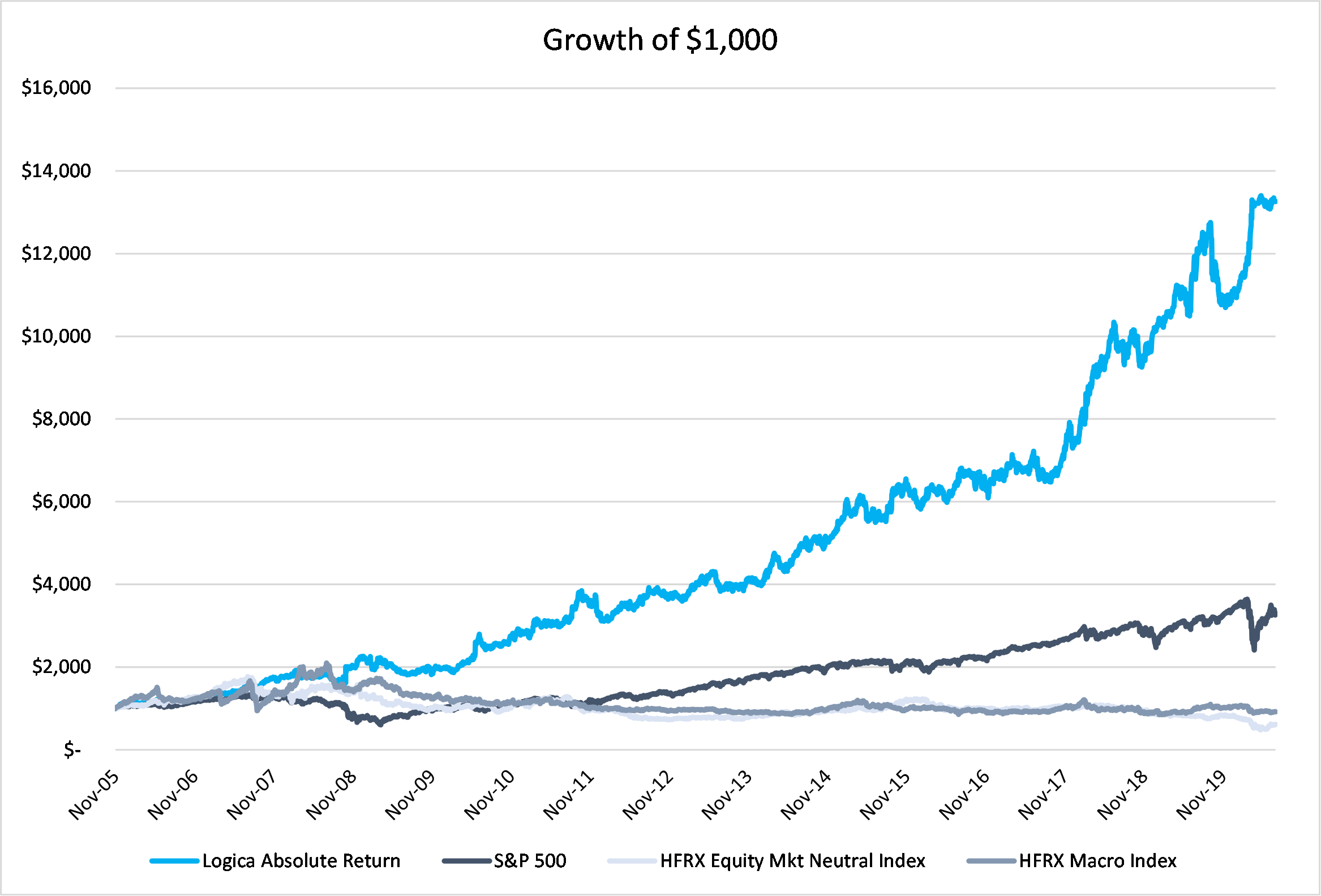

Logica Absolute Return

2015-2019 stats & grid, reconstitution of live sub-strategies

2005 to present growth of $1000 chart, simulation

Jan 2020 live with partner capital

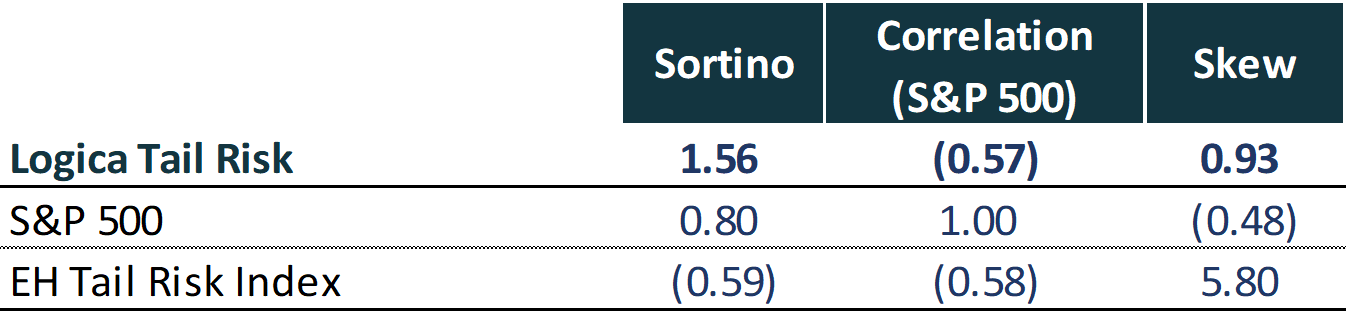

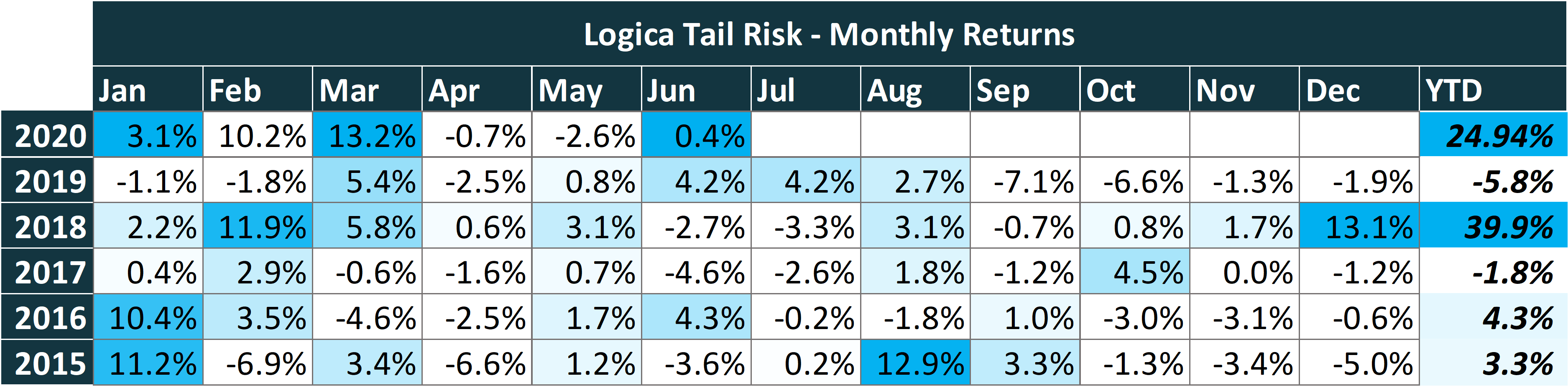

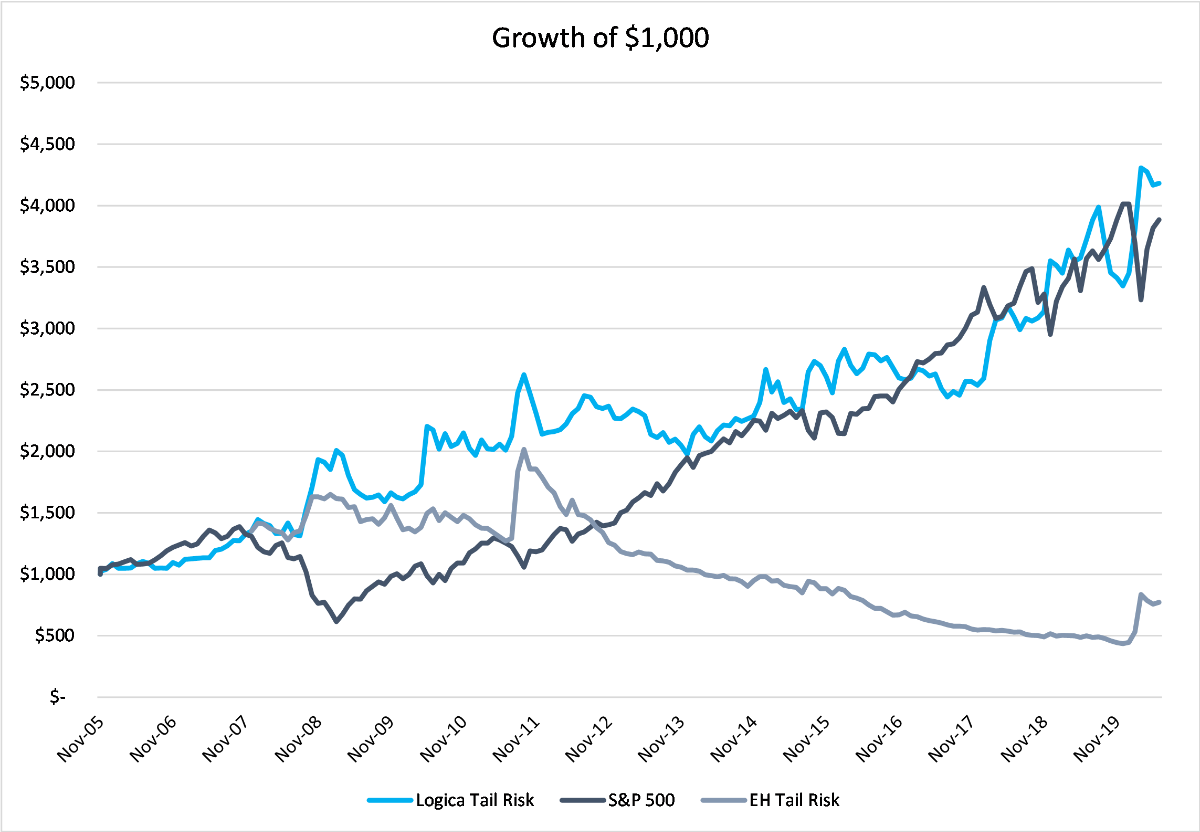

Logica Tail Risk

2015-2019 stats & grid, reconstitution of live sub-strategies

2005 to present growth of $1000 chart, simulation

Jan 2020 live with partner capital

Endnotes

- https://www.bankingdive.com/news/senate-paycheck-protection-program-payroll-rule-spending-period/579190/

- Inspiration for much of this section is drawn from recent work of Dr. Chris Dark (www.chrisdark.com)

- https://www.washingtonpost.com/business/2020/06/03/next-big-problem-businesses-cant-or-wont-pay-their-rent-its-setting-off-dangerous-chain-reaction/

The post Logica Capital June 2020 Commentary: The Circus appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.