By Jacob Wolinsky. Originally published at ValueWalk.

Tollymore Investment Partners letter to investors for the second quarter ended June 30, 2020.

Q2 2020 hedge fund letters, conferences and more

Dear partners,

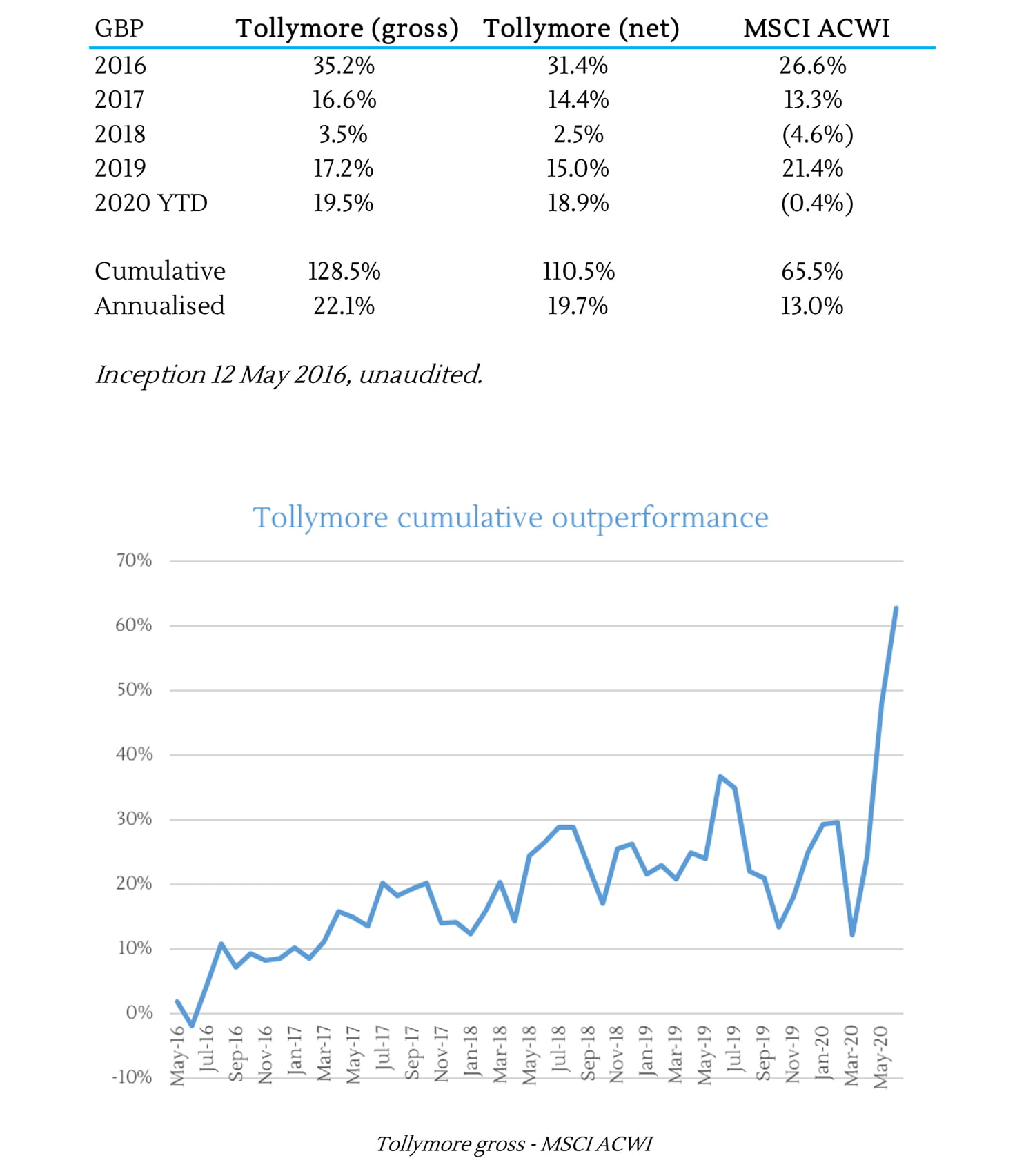

Tollymore Investment Partners generated returns of +19% in the first six months of 2020, net of all fees and expenses.

Investment results since inception are shown below:

Tollymore Investment Partners’s Raison Detre

Tollymore Investment Partners is a partnership which manages capital on behalf of its principals and a small, special cohort of investment partners who have demonstrated the ability to think unconventionally and act countercyclically. In doing so we make decisions in the interests of long-term results. We expect most of these investment results to come from the internal earnings power growth of the companies we hold, augmented by occasional and sensible portfolio management decisions.

We do not expect superior investment results to come from any IQ advantage, but from the implementation of factors that will allow us to acknowledge ignorance or exercise conviction better than our peers. These factors relate to the consistency of investment horizon, temperament, working environment, incentives, and investment partners’ beliefs and actions.

We believe in the incomparable importance of flourishing relationships in determining enduring contentment. We try to uncover win-win in investing and life.

Tollymore Partners: Four Unpopular Opinions

1. Holding cash is imprudent

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

2020 has so far been one of the most tumultuous periods in public market history. These episodes are reliable opportunities for clear long-term thinkers to exploit quoted price volatility to improve future investment results. Yet misdirected intellectual energy in the form of market commentary tends to accelerate in periods of market dislocation. The inability to act decisively in these periods, due to capital redemptions, inappropriate capacity constraints, committee-led decision making models, lack of conviction or other source of self-doubt is a barrier to value creation and one of the great shames of our industry.

We have been struck by the broad consternation, and even irritation, at the recovery of equity markets since the nadir in March. A recovery which many market commentators have professed to be disconnected from economic reality. In a scramble to overlay current circumstances over historical precedents2, market strategists and the media have concluded that the market is dangerously ignoring economic fundamentals. It may be interesting to consider the incentives behind such frustration, particularly for those investors who use cash to time markets, and have been walloped by a double whammy of having fully invested portfolios in the first quarter and meaningful cash holdings in the second. These cash flows are part of the reflexive nature of markets; they contribute to the very factors that drive them. Tollymore Investment Partners’s concentrated portfolio and global opportunity set obviate the need to use a cash weighting as a tool to predict stock market movements. A fully invested portfolio is better for profiting from non-fundamental exacerbation of quoted price changes. Increasing cash allocations without demonstrably reliable market insight is not lowering risk. Especially when the trigger for its subsequent redeployment is typically lower uncertainty, the cost of which is higher prices. The uncontested premise that this sell-low buy-high behaviour is consistent with risk mitigation is staggering. We contend that those with fully invested mandates can profit from it.

It is this ‘de-risking’ behaviour that depresses prices and creates opportunities, some of which we described in our March 2020 letter to partners. The economic consequences of the circumstances that led to this selling come after. And it seems sensible to assume that future price movements will be a function of (1) the second derivative; that is, the relative severity of economic conditions relative to expectations, not relative to the past, and (2) the perceived level of uncertainty, which declines as unknown unknowns become known. To expect weak markets to coincide with weak economies vastly oversimplifies a complex system and contradicts financial history. To scoff at the disconnection between the two, to assume that the aggregate sentiment of the market is missing something so obvious that it is being highlighted by every pundit and commentator, is hubristic and naïve. We can do better by being adequately self-aware to respect the complexity of market and economic forecasting and acknowledge the terrible base rate of success in this endeavour.

2. Dispassionately cutting unprofitable investments is consistent with long term ownership

“The best money managers are also the best quitters. They quit early and they quit often. As soon as they see things turning for the worse, they don’t wait around, they bail.” – Scott Fearon

We are comfortable in averaging down when collapsing share prices clearly improve potential future investment results. But one of the challenges of a fully invested investment programme is identifying the most profitable source of funding for this activity. Without cash holdings, we have two funding options: reduce our ownership of successful investments or exit unsuccessful ones. The former may be the theoretically sound choice. Rising stock prices lower prospective stock returns, all else equal. Yet all else is rarely equal, and it is often a mistake to materially pare back investments in companies which have demonstrated strong fundamental business progress. We have become increasingly comfortable with utilising the latter funding source; that is, to distinguish between those losing investments that deserve our patient capital, and those that do not.

In the absence of clear and substantial overvaluation, selling due to valuation implies an ability to predict near term price movements. In addition, selling a familiar business making positive fundamental strides for an unfamiliar one creates reinvestment risk. We are not playing for 20% upside; we will continue to own businesses which we believe will be worth a lot more in five to ten years. We expect Tollymore Investment Partners’s aggregate long-term results to be determined by a small number of outsized winners and a tong tail of (many) below opportunity cost mistakes.

3. ESG ≠ sustainable investing

“For business to survive and prosper, it must create real long-term value in society through principled behaviour.” – Charles Koch

Institutional investment management is broken. Asset gathering business objectives and gold-plated cost structures magnify the imperative to grow AuM. Investment firms led by marketers rather than investment managers create strategies tailored to what will sell rather than what works. Large pools of management fees are required to fund large, expensive, teams designed to convey analytical edge. Pressures to justify high management fees discourage investment professionals from acknowledging ignorance or mistakes and create an action bias that is antithetical to good investment outcomes.

Money management is a very scalable business model. It is possible to raise significant capital without commensurate increases in resources, rapidly increasing the profitability of the investment firm and substantially enriching its owners. Managers’ and investors’ fortunes are typically not aligned. This is a barrier to sound investment decision making. A simple way to weed out the managers that back themselves is to consider the presence and power of incentives. Managers without insider ownership are less incentivised to limit the size of their fund, therefore limiting their achievable investment results. In our view, and in the case of most institutional money managers, the components of stewardship reflect a product to be sold rather than a strong belief in the strategy.

There are ways to enrich the owners of an asset management business that are consistent with compounding investors’ capital. Incentive principles should allow for the enrichment of GPs together with, and not at the expense of, LPs. The manager’s compensation should be driven by the compounding of his own capital in lieu of fees on additional capital. Sharing of investment returns in excess of appropriate hurdles lowers pressure to grow beyond the strategy’s investment capacity. The creation and promotion of investment strategies that will sell result in niche investment universes predicated on analytical edge, primary research methods, or proprietary idea generation funnels, all of which look ‘differentiated’ in a pitchbook. The latest incarnation of this pitchbook mentality comes in the form of ESG investing mandates.

Investors last year ploughed a record $21bn into ‘socially-responsible’ investment funds in the US, almost quadrupling the rate of inflows in 2018. The surge in popularity of companies with the best social, environmental, and governance scores in recent times has resulted in a crop of ESG funds, eager to attract some of the cyclical capital flows to this bucket.

Attempts to quantify art through an obsession with measurement create bubbles, disincentivise first principles thinking, and make capital allocation and manager selection processes less efficient by making them more data driven. But data can be falsely empowering, unaccompanied by thoughtful qualitative review of a manager’s capacity and incentives to do a good job.

The shoehorning of ESG frameworks into existing asset management programmes and the surge in new ESG funds extend the already warped incentives in the investment management industry. Stocks with strong ESG scores are bid up as these capital flows are put to work. Are investment managers, guided by the desire to grow assets and the employment of a quantitative ESG scoring framework, and absent the facility to think independently about the sustainability and reasonable governance of companies, and the investment merits of their equity, being socially responsible by directing endowments’, charities’ and pension funds’ capital to this more richly valued subset of the global investment universe?

ESG’s commonly accepted synonymity with ‘sustainable investing’ is especially perplexing. Who wants to own unsustainable businesses? What is investing if not the purchase of part-ownership of sustainable, flourishing enterprises? What long term business owner, managing capital for investors with long term, sometimes perpetual, investment horizons, would like the company she owns to be run by dishonest, self-serving managers misaligned with company owners, to treat employees poorly, create negative externalities, and exploit its customers? The studious long-term investor must consider the company’s relationship with all its stakeholders. At a minimum, understanding the strength of these relationships is central to mitigating risk of permanent capital erosion. Ideally, these relationships confer a lasting unfair business advantage, difficult to replicate by peers merely paying lip service to regulators and investors requiring the completion of ESG checklists. The items on these checklists must be measurable. This encourages the quantification of factors which are qualitative. How can one quantify, or score, whether, and the extent to which, social media companies exploit their users to the detriment of their health? Can these checklists consider and measure the enormous and compounding positive externalities created by modern platform businesses? An appreciation of the relationship between a company and its stakeholders is a qualitative, subtle, and effortful endeavour. The interrogation of business ethics and the capacity for company managers to make the right long-term decisions are at the heart of serious investment programmes. The employment of an outside analytics firm to bestow credibility on an ESG framework should be no part of this.

Any investor with an interest in owning sustainable businesses must recognise that company boards have broader responsibilities to consider environmental and social issues. They will also understand that these duties do not dilute their fiduciary obligations to equity holders. Rather, they are a necessary part of satisfying them. Decisions to create large positive externalities and forge win-win outcomes – non-zero-sumness – take time and often come at the expense of traditional short-term measures of shareholder return. But these are the decisions that determine corporate vitality and staying power.

The broad disregard for long term win-win outcomes is a function of short holding periods. Company ownership changes hands on average every few months, vs. eight years in the 1960s. This is a by-product of investment constraints deeply embedded in the institutional money management industry, such as short-term capital, manager/investor misalignment, career risk and asset-growth agendas. These constraints cannot be addressed with an ESG checklist.

Just as truly special corporations seek to thrive under the principle of win-win, so must investment management firms create more value that they consume. Incentive structures should make it sensible to forgo additional management fees in lieu of excess returns on insider capital. Frameworks for economic profit-sharing should reward acceptable performance and coordinate manager and investor enrichment. These include the employment of hurdles to make weak performance cheap and strong performance expensive. Investors should receive most of any outperformance generated, not just most of the absolute return. Fee structures should therefore allow fund managers to talk about integrity with some legitimacy. Too many managers charge egregious fees with the sole purpose of enriching themselves at the expense of clients.

Tollymore enjoys trusted relationships with long term investment partners. Partners who can think like business owners rather than stock market traders and understand that a common stock represents a fractional interest in real assets. Great investment partners are a competitive advantage: an evolving, mutually appreciative, and increasingly resilient relationship is an enabler of greater and more sustainable value creation. Our goal is to accumulate wealth by investing in high quality businesses for the long term; it is not to predict share price movements.

With business ownership in the public markets so fleeting, and given the strong economic incentive to raise capital, it is unsurprising that the objective of investing in viable, durable, companies is not evergreen nor widely practised. This is a sombre impeachment of the asset management industry. But it creates opportunity for those investors who recognise that treating stakeholders well is good for business owners. We look for symbiotic value chains; there need not be a trade-off between compounding owners’ capital and the principled consideration of all other lives our companies affect. Managers of the companies we own must look beyond the direct or immediate consequences of their actions to create lasting value. And a long-term outlook is essential, because shorter term sacrifices – ‘the capacity to suffer’ – are often required to create value of any permanence.

4. Successful investing requires intuition

“One’s investment approach [should] be intuitive and adaptive rather than fixed and mechanistic.” – Howard Marks

The emulation of successful investors is dangerous and reductive. Blindly copying the factors that may have driven others’ success is less likely to lead to good outcomes than the introspective examination of one’s own temperament and qualities, and a careful matching of those qualities with our environment.

We believe a behavioural advantage is possible by coordinating the disposition of the firm’s principals, the mentality of its investment partners, physical working environment, methods of internal communication, the time horizon of the strategy, and the implementation of the programme. We spend time thinking about the complementary nature of these aspects of the ecosystem. We spend less time thinking about the individual merits of concentrated vs. diversified portfolios, noisy vs. quiet offices, or short vs. long term decision making. There are lots of ways to invest, but the best results come from thinking about the interdependence of every aspect of an investment organisation.

Investing is an art. Yet money managers attempt to quantify and measure progress and decision making due to an incentive to raise large amounts of institutional capital through the suggestion of repeatability. History’s greatest investors have used intuition to guide their decision making, particularly with respect to idea generation and portfolio management. The highest achievers in another complex, reflexive game – chess grand masters – rely heavily on intuition.

It seems popular nowadays to espouse the benefits of quelling emotion to make more rational choices, thanks to the fantastic work of Daniel Kahneman and Amos Tversky, and studies such as “Lessons from the Brain-Damaged Investor”3. While Tollymore Investment Partners is an effort to exploit the behavioural shortcomings and constraints of peers, we are not sure it is possible or even desirable to simply banish emotion. A life without empathy, sorrow, passion, excitement, or joy sounds horribly unfulfilling4. Even the desire to avoid negative emotions such as shame or regret make it more difficult to acknowledge and learn from mistakes and can lead to suboptimal investment decisions5. Finally, attempts to suppress emotion are highly energy-depleting. This energy is required to form the insights and make the judgements necessary for sound investing practice.

Emotional management is clearly sensible in investing. Market cycles can boil down to fluctuations between participants’ states of happiness and sadness. So, an ability to regulate these emotions is plainly helpful. But there are other aspects to emotional intelligence such as empathy and self-awareness that do not seem to receive the same attention. Avoiding the discomfort associated with an honest evaluation of oneself is a barrier to self-awareness. In this way a military focus on eliminating negative emotions can be counterproductive in making good decisions.

The art of using and perceiving emotion is something we can become better at over time. Trying to improve in these areas in the pursuit of a good life will also make us better investors. By dismissing the opportunity to develop in these areas, we run the risk of abandoning intuition in favour of purely quantitative information processing. This is likely to lower a tolerance for uncertainty which may be one of the only advantages we have as public equity managers. This seems especially relevant today when most ‘investment’ decisions are being made by computers.

We spend most of our time on rational reasoning through independent study of companies and examination of their investment virtues. But fundamental business analysis is table stakes; and it is more commoditised than money managers realise or admit. A disciplined investment process is required to prevent otherwise helpful emotions from becoming unregulated. So too are the people that will help us to stay humble in periods of success and support us in periods of self-doubt.

Back to intuition. We think it is a mistake to dismiss gut feelings. They are not random but the product of pattern recognition. They can lead to poor decision making when not subject to analytical scrutiny. But when operating in a culture that promotes introspection, mental flexibility, and humility, and accompanied by relevant experience, these feelings can improve judgement. The low utilisation of intuition in investment management is not due to the dismissal of its efficacy, but rather the difficulty in underwriting its deployment; that is – it is tough to market a credible investment strategy that relies on ‘feelings’. With qualitative judgement in short supply, we see great opportunity for those willing to embrace intuition to guide idea generation and portfolio management. Neither rational analysis nor intuition are sufficient, but both are important components of sensible investing.

Yours sincerely,

Mark

This article first appeared on ValueWalk Premium.

The post Tollymore Investment Partners 2Q20 Letter: Up 20% YTD appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.