By Sven Carlin. Originally published at ValueWalk.

An analysis of Fraport AG Frankfurt Arprt Svcs Wrldwde (FRA:FRA) stock. Many have been attracted by airline stocks recently, but to get exposure to the travel growth mega trend, perhaps it is better to look at airport stocks. Airport stocks are better than airline stocks because some airports offer a moat, something that no airline offers.

Q2 2020 hedge fund letters, conferences and more

Plus, airport stocks are cheap as airport stock prices fell in the same way as airline stocks. Given that you can own an airport for the next 100 years, get the dividend and exposure to growth that is expected to be at 4.5% per year over the next 20 years, it might be interesting to get exposure now when airports stocks are down due to the covid-19 interruption.

Airport Stocks Are A Buy – Not Airline Stocks – Fraport Stock Analysis

Transcript

Good day fellow investors. Many, especially here on YouTube are focused on airline stocks. But if you want to get exposed to the growth, the mega trend, that is travel, global population that the global middle class population is going from the current 3.5 billion to 5.5 billion over the next decade, plus 80% of the current population was never in an aeroplane. So imagine all the potential growth that is there. And this COVID-19 interruption perhaps gives you a great opportunity to become an investor and own an airport. In this video, I’ll discuss a few facts why it’s better to own airports than airlines give you an analysis of Fraport, which is the Frankfurt Airport plus other airports across the world that they have bought and then give you an investment conclusion. What am I doing, what do I think about and what am I going to do with this airport situation now?

Let’s start. So you might wonder how I came to this idea of airports. Well, you know that I have been researching all the Austrian stocks, all the stocks are listed on the Australian Stock Exchange. So as I came to the letter ‘F’, Flughafen Wien, the Vienna airport, and I made an analysis and then I saw Okay, this is a cheap airport looks cheap stock is down. Let me see what else we have there. So I created say, as I do, always, let’s do a sector analysis. Then I looked at why owning airports why not, which we’ll discuss in a second. But I also have a list here that I have to fill now and then see, okay, which airports at what price, what are the risks in general, and this will all be filled and then I’ll make a decision on whether I will buy something or not.

Plus, if we look at stocks, those airport stocks, those have been cheaper in 2010 but then the word was going to end twice. But now the COVID interruption of course they were a little bit expensive. That’s why they didn’t really look at them in that over the past few years. But now this might be really, really interesting. Similar stock charts are for all the other airport stocks that I have seen. So very, very interesting situation to dig into deeper.

Now, what’s the key with airports versus all the other industries in the travel industry? Well, if you have a profitable route, I don’t know from Paris to New York, what will the competition do? They will lease an aeroplane and they will say okay, from today at the lower price, we are also flying that route with airports. If you have a very profitable airport like the Schiphol airport in Amsterdam or I don’t know Heathrow in the centre of London. Yes, there can be this Small airports, one hour from London one hour from Amsterdam or one and a half hour from Paris or something like that. But people will always tend to fly to the closest because you fly to save time. So you don’t want to travel under three hours to an airport. And this means that airports unlike airlines have a moat as you can see on this picture, you have many different brands, many different airlines that compete for the same customer, but only one airport where the customer is flying from or flying to. And that’s the key with airports, especially when you build one you have it you have built it. It’s very very difficult that you will have another one coming next to you if you’re not in Beijing, but that’s a different story. So here we have Amsterdam, I think they have five runways and then they are trying because it’s over capacitated they are trying to find new positions lately. Start Eindhoven not going good since Ryanair even left even if it’s just an hour and something from Amsterdam, the Hague is a small airport, but you see the moat that these guys have here.

Further, as I said airports offer exposure to global mega trends the population will grow 25% over the next 30 years urbanisation more people living in cities more flying. So, increasing living standards, which means more travelling as their consumer behaviour changes to the market dynamics. Therefore, for airline for air traffic growth are very positive, the expected growth trend is 5% per year and 4.2% after that after 2028. So, over the next 20 years the market is expected to grow at 4.6% per year. This means that the market will be 2.5 times bigger in 20 years than it is now. And you always have the same airport there, you may be at the runway, but all these people will come to the same airport, which means a lot more money for the airports that are already there now.

And this is how it looks like. So 2011 wasn’t such a big year for the Vienna International Airport, but slow, slow growth as the airport was there was being built. You see how the profitability increases much more than the traffic earnings went up six times. So that’s the big thing with airports once you build it, the relatively fixed cost compared to revenue growth leads to higher profits. And then also what was the most difficult the negative situation when you go to an airport when you say goodbye to your loved ones. To go to the parking lot, you want to pay for the 45 minutes you went there, and then you get the heart attack because of the price of how expensive it is to park at airports. If you own airports, you make the money, then further airports are regulated monopoly with the monopoly given you by the state usually so it’s very important to also look at the concessions. This is from frontcourt stock that we’ll discuss in a moment. And they have the Frankfurt Airport, their crown jewel airport, in their portfolio of airports. And the good thing is there is no time there is not a time limit for their concession. So they own 100% of that and they also own the new Ghana airport also no concession limits, which means that you can invest etc.

In Greece, okay. They still have, what 47 years till their concessions to expire. But if you are looking at airports, always look at how long the concession lasts because to avoid any strange surprises. So that’s key when it comes to investing in airports, if you can own 100% of the airport, no time limits, that’s a good deal a better deal than let’s say 2040 expiration or we have 2024 concession expiration, and then they’ll have to all renegotiate or fight for it or who knows what that can get ugly, especially in countries like Turkey without offence, but the reality is reality. And airport stocks have usually been very expensive. So we see now those are 30, 40, 50% down and now the price earnings ratio based on prior year prior covered situation is around 14, but it usually was around 25-30, some, examples, it was even 40. Let’s say in 2017, I think I looked at last time and it was about 40 here for Fraport, Flughafen Wien also before the earnings growth something 30 like this so it was always expensive and the dividend yields were really really small. Now, if the situation normalises the dividend yields start to get interesting for a business that might more than double its revenue over the next decades. Plus price earnings ratios are really, really interesting.

Now, some say okay, airport stocks are risky. Well, let’s look at this is again from Vienna Airport. Yes, the growth in passengers was declined during the financial crisis, was negative during 2012, 911 of course, but still, it constantly grew with some interruption. So of course now everything is still due to call it but even in crisis, it’s not an airport loses too much money. It’s not like an airline has to have a load factor of 94% to be full and if it to be profitable, and if it’s 88, they go bankrupt. If it’s 94 load factor for aircraft, it’s down to 88. Okay, maybe one year the dividend will be cut. But then things recover fast. And especially here you can see the growth that they achieved over the last few years. And this growth really increased profitability and everything. So if this growth continues, maybe not so exponentially, like here, but over the next 10, 20, 30 years, that’s also the reward that investors will be able to expect in the future.

So the first thing you can buy an airport that has a moat, there is a lot of growth, growth trends, growth, more passengers, more money, costs not that much higher, because once you build it, you’ve built it. And that’s it. There It is. It makes money. Aeroplanes came, aeroplanes go. And that’s how you make more and more money. And it’s unlikely somebody else will make a big airport as you have around you to be a real competition. Then also in crisis in normal crisis, we can say that COVID situation is once in a 50 year period that it will happen in normal crisis. It’s not that bad for the airport, those are still cashflow profitable. Even in normal recessions, even in 2009, people will still flying. Which, again, on the great growth trend, higher dividends, higher cash flows, and as dividends grow, so does the stock price. So you’ll get a double whammy there.

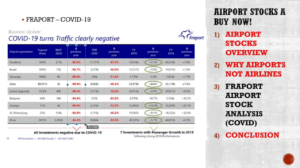

So let’s take a look at Fraport’s stock analysis. This is an interesting airport because it actually didn’t add value to shareholders since it went public in 2001. Because the stock price is similarly still there. So it’s an interesting one to watch and to follow to see whether there might be an explosion again, like it was the case in 2018, you make three times your money plus eventual dividends in the future. And that’s why airport stocks are an interesting buy or an interesting stock to watch now. So as said, the owns mainly 66% of revenue is from Frankfurt, and then other 10 airports from South America, Asia, and also in Europe. So they own manage their airports and they are trying to, of course, increase their profits on COVID-19. The change during the first quarter compared to the previous year was really, really a disaster. Almost 100%, no traffic and a lot of business is related to traffic. So no traffic at an airport, no business. If you look at the number, the revenues related to traffic 90% of that is related to traffic. So if there is no traffic there is no business. And they had the Frankfurt Airport was 2.2 billion euros revenues in 2019. So as the situation looks now it will be if things improve over the end of the year it will be maximally maybe 500 million but really maybe they are on called running costs and they are trying to save on staff costs. So it is 900 million, they can’t avoid it, they will get government deals helps etc, etc. Trying to save 40 million per month, they are trying to save 10 million per month on non staff costs but the cost just to run and keep it like it is are around a billion for sure over the year and they can’t avoid it. 1-1.23 billion and if the situation doesn’t improve in 2020, they will lose a billion euros. That’s a given and that’s the COVID situation risk. Plus they’re continuing with their investments for now because they can borrow at very, very cheap costs so they are expanding the terminal, making new terminal I think in Frankfurt now I know what’s the building that always went on there when I pass there with full speed through a building area. It’s very interesting.

Lima also big investments in Greece they have made some investments and also in Brazil so they are continuing hoping that this will be just an interruption and not the full crisis that will last for decades and the world is going to end as many breach. This is their debt profile. The average debt condition their interest rate is 2.3%. Which is really really ridiculous but they have a lot of debt, they have 5.6 billion Euros in debt with good maturities dispersed across the year so they should be able to refinance debt, especially if this is an interruption. Their problem could be if interest rates go up and there is no inflation but that’s unlikely given the monetary environment we are in so Fraport is one of the most indebted airports but if things improve, this debt is leveraged so the stock will explode higher, much, much more. Their strategy is very simple middle class growth, migration, globalisation tourism, and they hope to increase and grow 4.6% or 4% per year as it was the average that we projected already or like Airbus, Boeing and Brier and everybody else in the aeroplane industry expect.

Let’s look at fundamentals. Now revenue. slow growth there, net income also grew slowly over the years, they have been increasing their dividends which is also okay. book value went up, okay, they’re creating value. But this is the key, look at the operating cash flows. So, operating cash flows are almost at a billion euros and they are investing a lot. They have been investing a lot new terminal in Frankfurt, so they have high capital expenditures, and that leads to negative cash flows over the last few years. But let’s say that they make 1 billion in operating cash flows per year, deduct let’s say, a normal amount of capital expenditures of let’s say 400 million, and then deduct 100 million for the interest that they have to pay. They would have positive free cash flows in a normal good year when the investment cycle is over, off about 500 million. Divide that by the number of shares of 93 million, and that’s 6 euros per share, if they start paying 6 euros per share in dividends, which is possible over the next 5-10 years, I can guarantee you that this will not be at 37, this will be at least at 120 or even more. So that’s the investment thesis, the upside when it comes to investing in airports now, especially if the airports grow, so market cap is 3.46 billion. If they start paying 500 million in dividends, you know how the story goes when there is a growth stock increasing its dividend so as we said, if we assume 400 million euros of maintain and free cash flow 600 million euros deduct the interest that they have to pay down 500 million euros. It’s possible that They pay a dividend do the 14% on cost, even in deals, airports are always expensive will go to 4%. That’s three times your money on the stock. And this can happen over the next five to 10 years. And that’s why property is an interesting investment like all the other airports in the current environment, there are also risks this company is expanding as we have seen all across the globe, which means if the growth the 5% growth that is estimated doesn’t come, then they have overextended and then that will be a weight on the profits, not an uplift. So it’s all about the trends there in the growth.

Then there is always competition. I started with Vienna, looked at Fraport, Frankfurt and I look at Zurich and these hubs are all aiming to get that international traffic that later goes now you fly into Vienna or Zurich, then you fly from there, for example, to Venice or Florence or whatever. Want to go on your global trip. So that’s also the competition there is intensifying. But it all depends on how fast the market grows, if it’s 3% they might be over investing. Now, if it’s 7% 6%, they will make a lot of money. And then there is also debt issues. That’s also always a two edged sword COVID-19 how long it will last. And the main risk is slower than expected growth in the future. So always keep in mind those risks, and how those will affect your positions if you own.

What am I going to do, I really like airports, especially at this level. So I’m going to go through the all whole list my initial reports will be published on my blog, maybe I’ll make a few videos again, but you can check them there. You can also subscribe there on my newsletter to get all the initial researchers in your email and then see what something fits or not. And then also for my stock market research platform, which you can check in the links below. You can see whether what am I going to buy how I’m going to position myself I might buy nothing now and then by an airport in four years, if this is a sector that I will really dedicate myself to learning and understanding that’s what I do. That’s what we do on this channel. So please subscribe click that notification bell. Thanks for watching, look forward to comments, and I’ll see you in the next video.

The post Fraport Stock Analysis: Airport Stocks Are A Buy appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.