By Michelle Jones. Originally published at ValueWalk.

The gold price remains above $1,800 an ounce, but where it will go next depends on what type of economic recovery we see. Many are expecting a V-shaped recovery. However, the resurgence in coronavirus cases in the U.S. suggests we could see a U-shaped or W-shaped economic recovery, which would impact gold prices.

Q2 2020 hedge fund letters, conferences and more

Gold outperformed while equities recovered

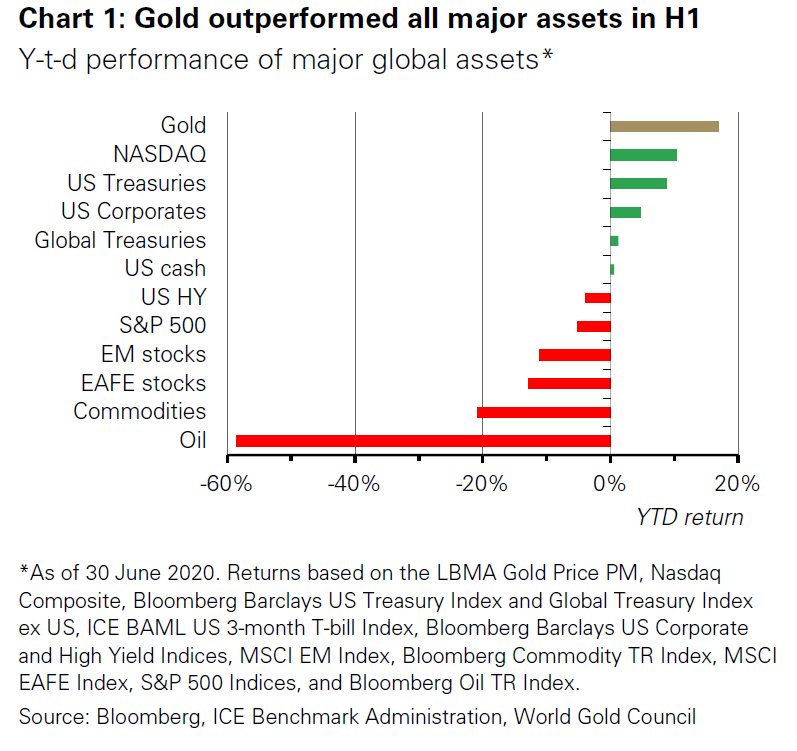

The World Gold Council said in its mid-year outlook on gold prices that the yellow metal outperformed during the first half of the year, rising 16.8% in U.S. dollar terms. In fact, gold outperformed all other major asset classes.

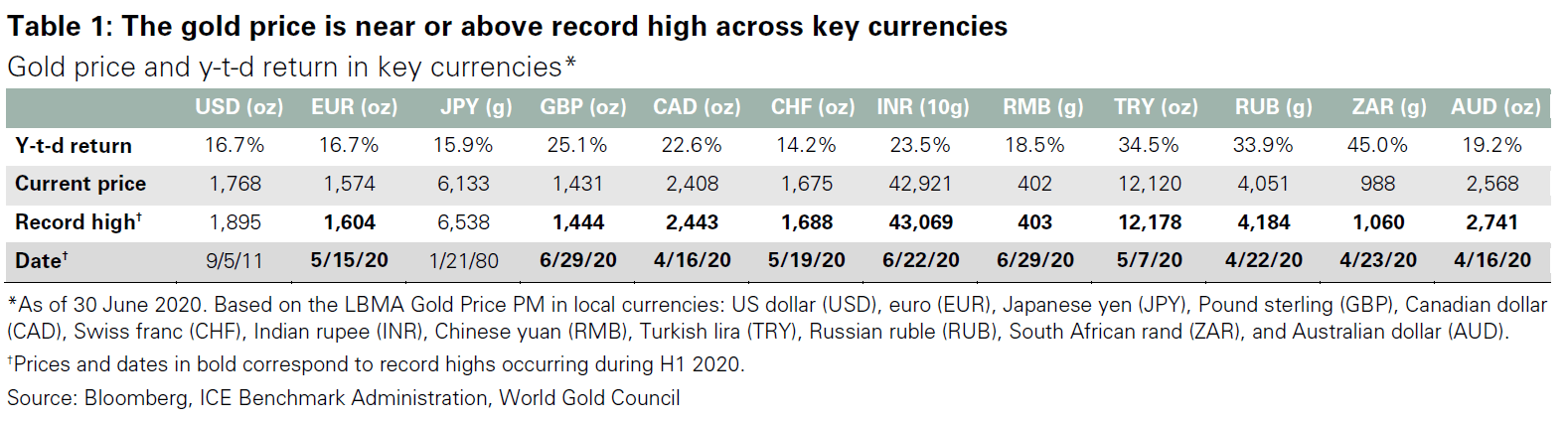

By the end of June, the LBMA Gold Price PM was trading at around $1,770 an ounce, a price that hasn’t been seen since 2012. The yellow metal hit or hovered close to record highs in all other major currencies as well.

By the end of June, the LBMA Gold Price PM was trading at around $1,770 an ounce, a price that hasn’t been seen since 2012. The yellow metal hit or hovered close to record highs in all other major currencies as well.

Although global equity markets rallied sharply from their lows during the first quarter, uncertainty around the coronavirus pandemic remains high. Between the uncertainty and the ultra-low interest rate environment, investors fled to quality assets.

Although global equity markets rallied sharply from their lows during the first quarter, uncertainty around the coronavirus pandemic remains high. Between the uncertainty and the ultra-low interest rate environment, investors fled to quality assets.

Investors looked to reduce risk in their portfolios, so gold prices and money market and high-quality bond funds all benefited. Gold has also been recognized as a hedge against selloffs in other assets, which drove record inflows to gold-backed exchange-traded funds.

Gold price to depend on economic recovery

A key question on investors’ and economists’ minds right now is what type of economic recovery we will see. There’s no denying that the COVID-19 pandemic is weighing heavily on the global economy. The International Monetary Fund expects global growth to contract 4.9% this year as unemployment remains high while wealth is destroyed.

More and more market watchers are starting to believe the V-shaped economic recovery many were hoping for will likely be a U-shaped recovery, which would be slower. A slower economic recovery will impact gold prices. Some are expecting the V-shaped recovery to change into a W-shaped recovery, which involves setbacks due to resurgences of the virus after progress on recovery is made.

The changing view of what type of economic recovery to expect is heightening uncertainty, which is good for gold prices. The high level of uncertainty could also have a long-lasting impact on the performance of investment portfolios.

Due to the high level of uncertainty around the economic recovery, the World Gold Council believes the yellow metal could be a valuable asset. Not only can gold enable investors to diversify risks, but it may also improve their risk-adjusted returns.

How asset prices are responding to the pandemic

The world’s central banks have been rolling out unprecedented amounts of stimulus to deal with the pandemic. They’ve cut interest rates aggressively and expanded their asset purchasing programs to stimulate and stabilize their economies, which the World Gold Council said is having unintended consequences on asset performance.

For example, equity market valuations have been soaring, and the increases are not being driven by fundamentals, which increases the chances of selloffs. Corporate bond prices are also on the rise, which moves investors further down the credit-quality curve. Additionally, there is limited if any upside to short-term and high-quality bonds, which means they are less effective as hedges.

Inflation concerns are also on the rise due to broad-based fiscal stimulus and skyrocketing government debt. Another possibility is significant declines in the value of fiat currencies. However, some see deflation as the greater near-term risk.

As risk increases due to these factors, resulting in the possibility of lower-than-expected returns, gold may end up playing a bigger and bigger role in investor portfolios.

Equities versus gold price during the economic recovery

For now, stocks are getting extremely expensive, so the World Gold Council warns about sharp pullbacks. Equities were climbing with almost no interruptions for more than 10 years until the COVID-19 pandemic.

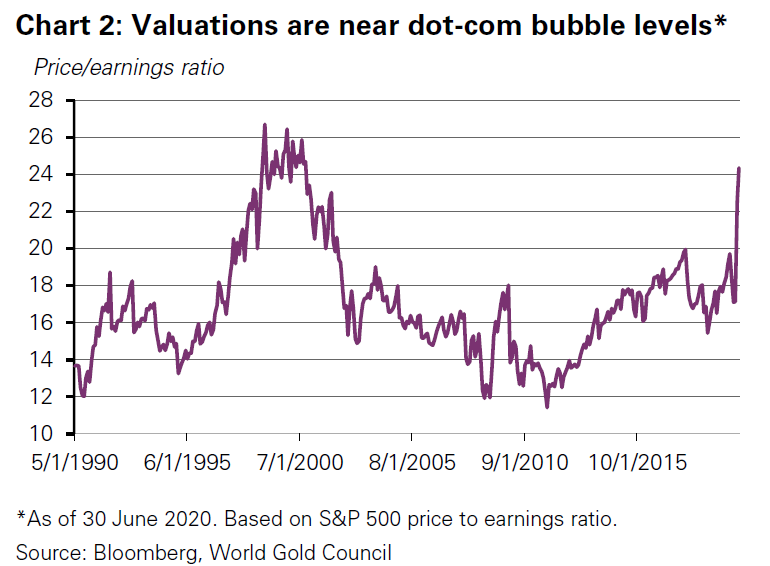

Major stock indices plunged more than 30% during the first quarter, although stocks have sharply recovered since then, especially tech stocks. However, the organization warns that stock prices are not fully supported by company financials or the economy. Price-to-earnings ratios have climbed to levels not seen since the dotcom bubble.

Gold can serve as an effective hedge against the risk of a sharp pullback in stocks. The World Gold Council said bonds may offer only limited protection in the low-interest-rate environment, which has pushed investors to boost their risk levels by buying longer-term bonds, lower-quality bonds, or riskier assets like stocks or alternative assets.

The organization does not expect investors to achieve the same bond returns they have enjoyed in the last few decades. They estimate the average compounded annual return of bonds at less than 1% over the next 10 years. That could end up being especially difficult for pension funds, which typically aim to delivery returns of 7% to 9%.

Lower interest rates limit bonds’ effectiveness at reducing risk while pressuring the ability to match liabilities. The organization argues that gold could be a viable substitute for some of investors’ bond exposure.

The post How the economic recovery shape impacts gold price appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.