By Pierre Raymond. Originally published at ValueWalk.

The broad stock market index advanced 4% in July. Relative to long-term bonds stocks were flat in July. With long treasury bond yields falling to the lowest level ever and shorter maturities nearing zero yield the value of assets has now vaulted to new highs.

Q2 2020 hedge fund letters, conferences and more

Near Zero Interest Rates Influence

The “wealth effect” where people will spend more if they feel wealthier and has been a central tenant of global central bank policy since George Bush senior. As interest rates drop toward zero, an unintended consequence is a dangerous increase in risk-taking as people reach for investment returns in a near-zero interest rate environment. The result is that asset prices have risen at a more rapid rate since the liquidity scare in February.

Global central banks and governments have literally splurged to limit the economic damage of the virus and the result is a huge increase in wealth for asset owners. Recent strength in the sales and profit margins of the home builders shows that people are willing to make big ticket purchases at premium prices. A greater willingness to take risks in stocks is evident in the shape of the indexes that have become the model portfolio for millions of ETF investors.

Diversify Your Portfolio

A few large stocks account for nearly 30% of the broad market index value which is up from 7% a decade ago. Having an undiversified portfolio brings much higher risk than investors understand. The willingness to act is muted as prices rise. The willingness of governments and central banks to go to any trillion-dollar lengths to sustain rising asset prices has created a monster. The company and individual financial vulnerability have never been higher which calls for less risk-taking. Instead, as rates fall toward zero people are taking even more risk.

Carefully review your portfolio holdings and sell the shares of falling growth companies trading at premium prices. We are still measuring steep and broad declines in company growth as the quarterly SEC filling update evolves. One early filer showing continued growth is Power Integrations Inc (NASDAQ:POWI).

Power Integrations Inc $122.030 BUY this rich company getting better

Power Integrations Inc has been an exceptionally profitable company with inconsistently high cash return on total capital of 20.1% on average over the past 21 years. Over the long term the shares of Power Integrations Inc have advanced by 72% relative to the broad market index.

The shares have been very highly correlated with trends in Financial Condition Factors. The dominant factor in the Financial Condition group is shareholders capital (inverted) which has been 94% correlated with the share price with a five-quarter lead.

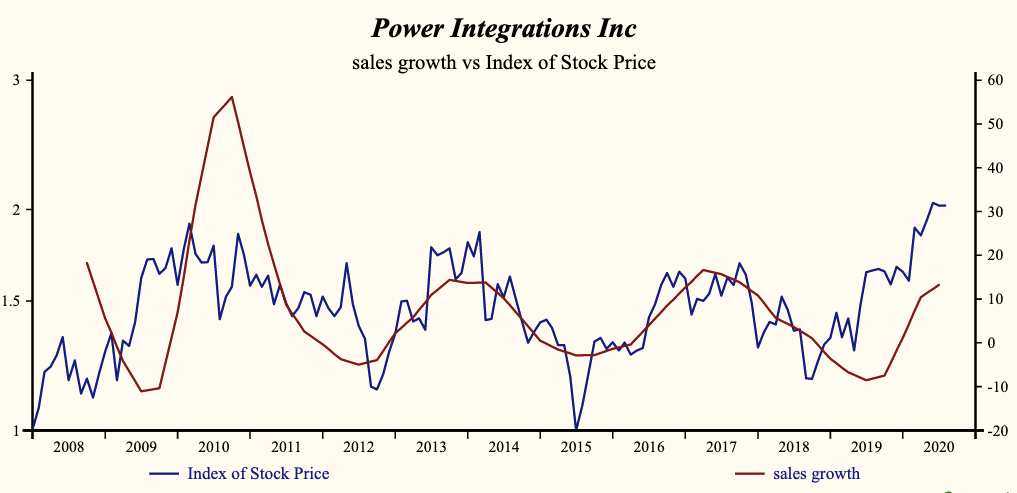

Currently, sales growth is 13.2% which is high in the record of Power Integrations Inc and higher than last quarter. Lower receivables turnover has been 58% correlated with the share price with a five-quarter lead and indicates an increase in the quality of sale growth.

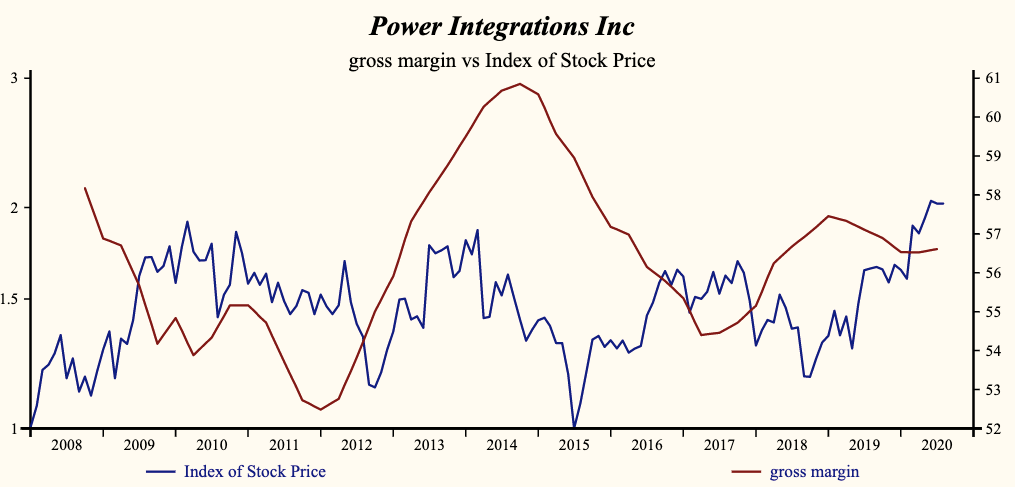

The recent improvement in the gross profit margin is supported by the continued reduction in inventory turnover. The gross profit margin is a strong top-line indicator and has been correlated with the direction of the share price with a three-quarter lead. SG&A expenses are low in the record of the company and falling. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITDA relative to sales.

The current indicated annual dividend produces a yield of 0.7%. Five-year average dividend growth is 8.6%. Current trailing operating cash-flow coverage of the dividend is 10.3 times. The shares are trading at upper-end of the volatility range in a 21-month rising relative share price trend.

Despite the extended share price, the continued improvement in fundamentals provides an opportunity to buy the shares of this evidently accelerating company.

Investors do not wait. Act now!

Buy stocks of companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot) and improving cash position or profitability (Green Crown of the MoneyTree). In other words, the more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

The post Asset Owners: Are you taking too much risk? (Power Integrations) appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.