By Pierre Raymond. Originally published at ValueWalk.

Stocks staged a very strong advance relative to bonds in the month of August. The broad market index was up 7.2% and the long treasury bond index was down 6%. That rally in the face of a steep decline in corporate growth is creating opportunities. Most of the advance was accounted for by a further jump in a small number of popular technology companies.

Q2 2020 hedge fund letters, conferences and more

Overall corporate growth continues to fall with sales growth down on average and more frequently and gross profit margins down on average for the fourth consecutive quarter. Gross profit margins are falling at companies accounting for 63% of the market. That is up from 43% of companies with gross margin pressure at the peak last year.

It now appears that the growth slowdown that began in late 2018 and the sharp deceleration that began with the virus will extend well into 2021. Here again is a good opportunity to sell stocks of falling growth companies trading at premium share prices. Keep your portfolios focused on companies with exceptional growth attributes and good financial condition and add shares of exceptional companies when they become depressed.

Nvidia Corporation $525.910 BUY this rich company getting better

NVIDIA Corporation (NASDAQ:NVDA) has been an exceptionally profitable company with persistently high cash return on total capital of 28.1% on average over the past 21 years. Over the long term the shares of Nvidia Corp have advanced by 1,734% relative to the broad market index.

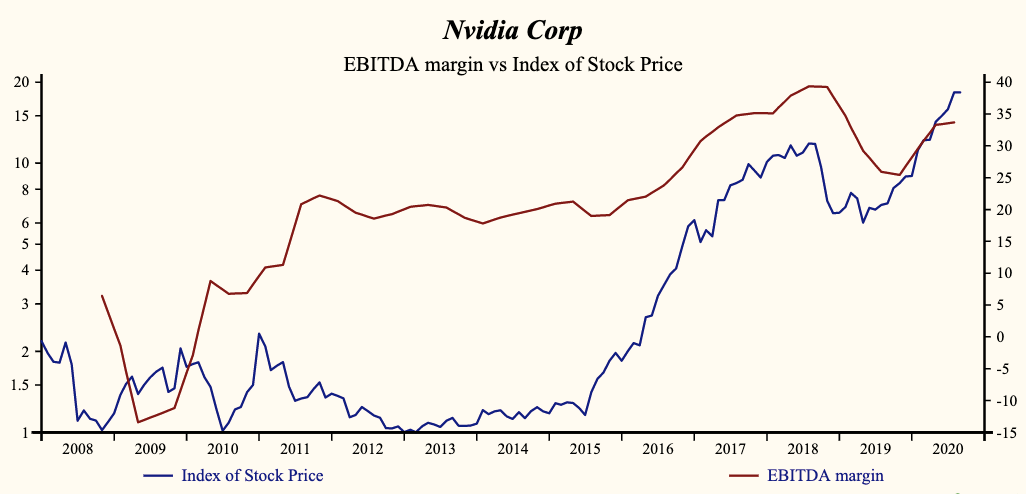

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash from Operations ROI which has been 93% correlated with the share price with a two-quarter lead.

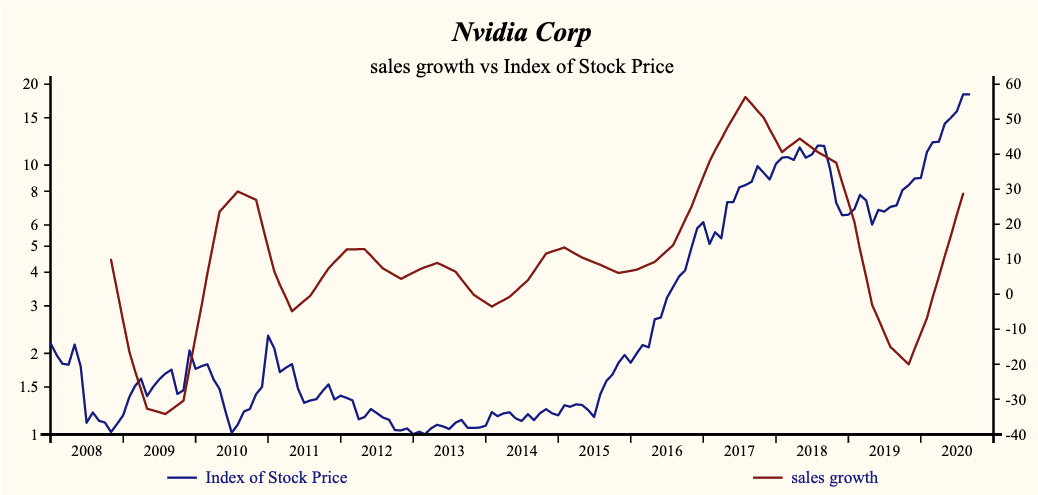

Currently, sales growth is 28.7% which is high in the record of the company and higher than last quarter. Higher sales growth has been 52% correlated with the share price with a five-quarter lead.

The company is recording a rising gross profit margin. SG&A expenses are high in the record of the company and rising. That implies that the company may be capable of accelerating EBITD relative to sales with lower costs, but has yet to achieve a cost reduction. The gross margin is rising at a faster rate than SG&A expenses, producing a rising EBITD margin.

The current indicated annual dividend produces a yield of 0.2%. Five-year average dividend growth is 13.2%. Current trailing operating cash-flow coverage of the dividend is 10.2 times. More recently, the shares of Nvidia Corp have advanced by 173% since the May, 2019 low. The shares are trading at upper-end of the volatility range in a 15-month rising relative share price trend.

Despite the currently extended share price the continued strength in fundamentals provides an opportunity to BUY stock of a resilient company.

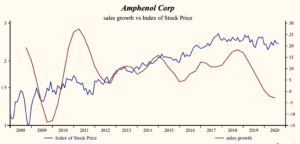

Amphenol Corporation $109.780 SELL this rich company getting worse

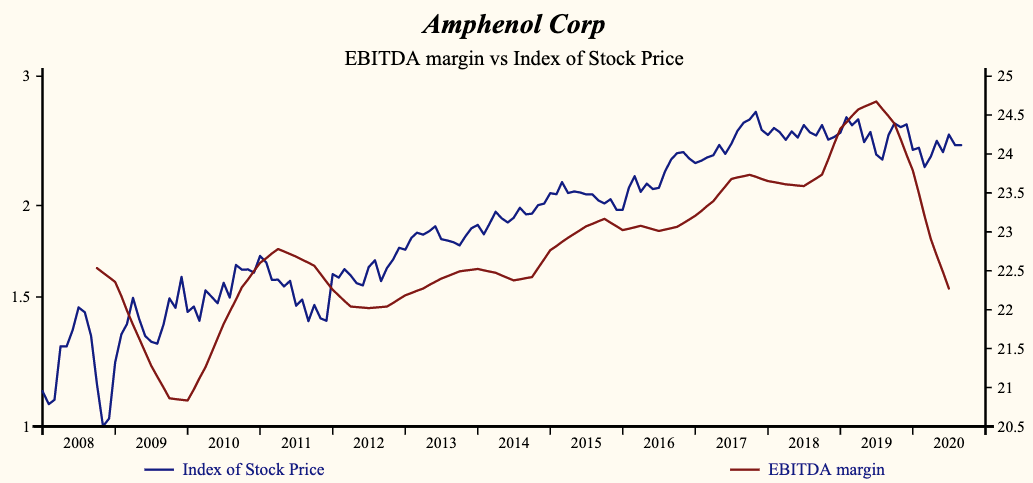

Amphenol Corporation (NYSE:APH) has been an exceptionally profitable company with persistently high cash return on total capital of 21.3% on average over the past 21 years. Over the long term the shares of Amphenol Corp have advanced by 1196% relative to the broad market index.

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 99% correlated with the share price with a five-quarter lead.

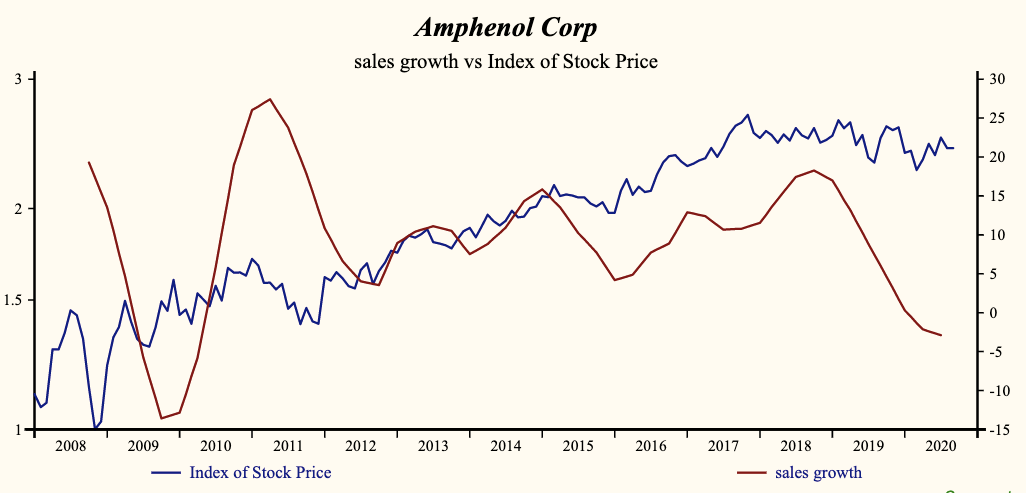

Currently, sales growth is negative (-2.9%) which is the lowest level in over a decade and lower than last quarter. The shares have been very highly correlated with the direction of sales growth.

The company is recording a falling gross profit margin. SG&A expenses are low in the record of the company and rising. That implies that the company has limited scope for further cost containment and rising costs are slowing the EBITD growth rate relative to sales. Lower gross margins and higher SG&A expenses are producing a deceleration in EBITD relative to sales.

The current indicated annual dividend produces a yield of 0.9%. Five-year average dividend growth is 16.1%. Current trailing operating cash-flow coverage of the dividend is 5.1 times. More recently, the shares of Amphenol Corp have declined by 7% since the October, 2019 high. The shares are trading at upper-end of the volatility range in a 10-month falling relative share price trend.

The current extended share price provides a good opportunity to SELL the shares of this evidently decelerating company.

Investors do not wait. Act now!

Buy stocks of companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot) and improving cash position or profitability (Green Crown of the MoneyTree). In other words, the more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

The post Amphenol Loses Momentum while Nvidia Continues to Flourish appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.