By Jacob Wolinsky. Originally published at ValueWalk.

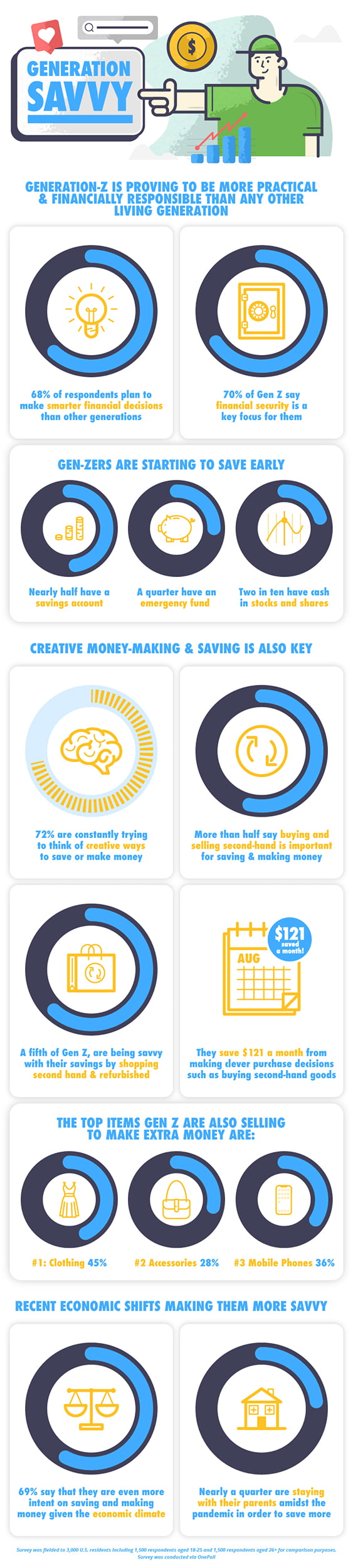

Nearly half of Generation Savvy (Generation Z) already have a savings account, a quarter have an emergency fund and two in 10 have cash in stocks and shares, according to new research.

Q2 2020 hedge fund letters, conferences and more

A survey of 1,500 Americans aged 18–25 examined how Generation Z plans on setting themselves apart from previous generations when it comes to making and saving money.

Generation Savvy Is Saving $387 Per Month

In fact, “Generation Savvy” is saving $387 on average per month from earnings, discounts and from making clever purchase decisions, including buying second hand.

The study by recommerce retailer, Decluttr, revealed 70 percent of respondents said financial security is a key focus for them.

And 72 percent are always trying to think of creative ways to save or make money.

Due to the economic impact of the pandemic, 69 percent said they are even more intent on saving and making money.

Nearly a quarter are staying with their parents during the pandemic to save more, while 26 percent are cutting back on convenience services like UberEats and 25 percent are selling their old tech, clothes, books and toys to make an extra buck.

The study also found 28 percent are using coupons to save more money and a further 12 percent have even started their own online business to help with their cash flow, according to the survey conducted via OnePoll.

“It’s great to see this generation so on top of things when it comes to their finances, at a time when this is becoming ever more important,” said Chief Marketing Officer at Decluttr, Liam Howley.

“The way they are increasingly thinking outside of the box on ways they can make and save money is inspiring and gives us all something to learn from.

“And whether that’s looking at ways to cut costs or actually make an extra dollar, then it doesn’t matter, it’s just so valuable to always have a little more money in your pocket.”

Young Adults Wants To Feel Confident In Their Financial Future

Among the reasons these younger adults are saving, is to feel confident in their financial future (45 percent) and as a buffer in case they were to lose their job or were out of work for a long time (30 percent).

For a fifth of Gen Z, they are also being savvy with their savings by shopping second hand and refurbished.

In fact, they estimate they save $121 a month from making clever purchase decisions such as buying second-hand goods, while money saved from discounts is less at $102 a month.

More than half agreed buying and selling second-hand is important, as it can both save and make you money, while 41 percent recognized its positive impact on the environment.

A further 48 percent said it’s important to shop for pre-owned and refurbished items because it’s less wasteful and 47 percent agreed it’s always good to reorganize and declutter your home.

The research also found that if Gen Zers were looking to make some extra money, 23 percent would sell old laptops, while 28 percent would benefit from selling used cell phones.

As many as 68 percent of respondents plan to make smarter financial decisions than other generations and 42 percent would go as far to say that their millennial seniors can be wasteful with their money.

When compared to the responses of 1,500 Americans of other generations, the average Generation Savvy appeared to be getting prepared for their financial future earlier than their older counterparts.

A Comparison Of Gen Zers And Millennials

Despite their young age, the average Gen Zer has been saving and/or careful with money for three and a half years, whereas the average millennial has only been doing so for just over five years.

Remarkably, more millennials (17 percent) said they are currently not saving or being careful with money, than Gen Zers (14 percent).

Gen Zers were also more likely to save money by purchasing second-hand clothing, mobile phones and gaming equipment, as well as earning money from selling items like clothing and cell phones.

It also emerged 44 percent of Gen Z will get a feeling of pride when saving money or getting a bargain. Three in 10 have felt safe and 37 percent have felt secure when tucking away their dollars and cents.

Yet despite their smarter financial decisions, more than half of Generation Savvy believe it’s harder to save money in this day and age.

Of the 19 percent who believe it to be easier, they attribute it to banking and money-saving apps and the ability to buy and sell things online.

“It’s clear that Gen Z are making their extra dollars through ways many might never have thought of,” Liam Howley added.

“As the most tech-savvy generation, they are also becoming more forward-thinking in their approach to purchasing new tech and have seen that by choosing refurbished, this will not only guarantee the same quality for better value but is also a more sustainable option for this environmentally-conscious group.

“We want to encourage people to follow in Gen Z’s footsteps by also looking at the unused tech and media items they have around the house because trading these items in can help raise a significant sum of money.

“I think we all have something to learn from these savvy savers and can try to be more Gen Z in the future!”

The post Generation Savvy Is Making Clever Financial Savings Decisions appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.