By Michelle Jones. Originally published at ValueWalk.

September 8, 2020 Update: Nikola stock (NKLA) soared by nearly 50% during regular trading hours today after General Motors said it is taking an 11% stake in the hydrogen fuel cell truck maker. GM will also get the right to nominate a board member for Nikola’s board of directors.

In exchange for the 11% stake worth $2 billion and the right to nominate a board member, GM is receiving in-kind services. The partnership between the two automakers will have GM producing Nikola’s Badger pickup truck. Production is slated to begin by the end of 2022. GM will also supply Nikola’s fuel cells for its class 7/8 truck in markets around the world except in Europe.

GM CEO Mary Barra and Nikola founder and Executive Chairman Trevor Milton appeared together on CNBC‘s Squawk Box. Milton said the deal provides his company with more than just a manufacturer. He said the truck maker will also have access to GM’s parts, Ultium battery technology and a multibillion-dollar fuel-cell program.

Barra said the Nikola partnership gives them an opportunity to leverage their Ultium battery platform system and Hydrotec fuel cell technology.

Photos of Badger components released

August 24, 2020 Update: Nikola stock has soared since its debut, partially because investors are looking for the next Tesla. However, the company hasn’t managed as much success as Tesla in its first consumer vehicle, the Badger. Now it is trying to whet the appetite of investors and buyers with some new photos of the components that will be going into the Badger.

The electric and hydrogen fuel cell pickup won’t be officially introduced until Nikola World 2020, which is set for December. However, the company has revealed images of the Badger components, which were published by Wccftech. Right after opening preorders for the vehicle, the company captured about 5,000 reservations, compared to the 146,000 reservations Tesla garnered in the first two days after revealing the Cybertruck.

Nikola stock pulled back today, falling nearly 3% alongside Tesla’s more than 1% decline. Nikola stock’s recent low was around $29 on July 30, and its record high is $93.99. The stock currently trades around $38 a share.

Nikola (NKLA) Badger is most popular EV in 18 states

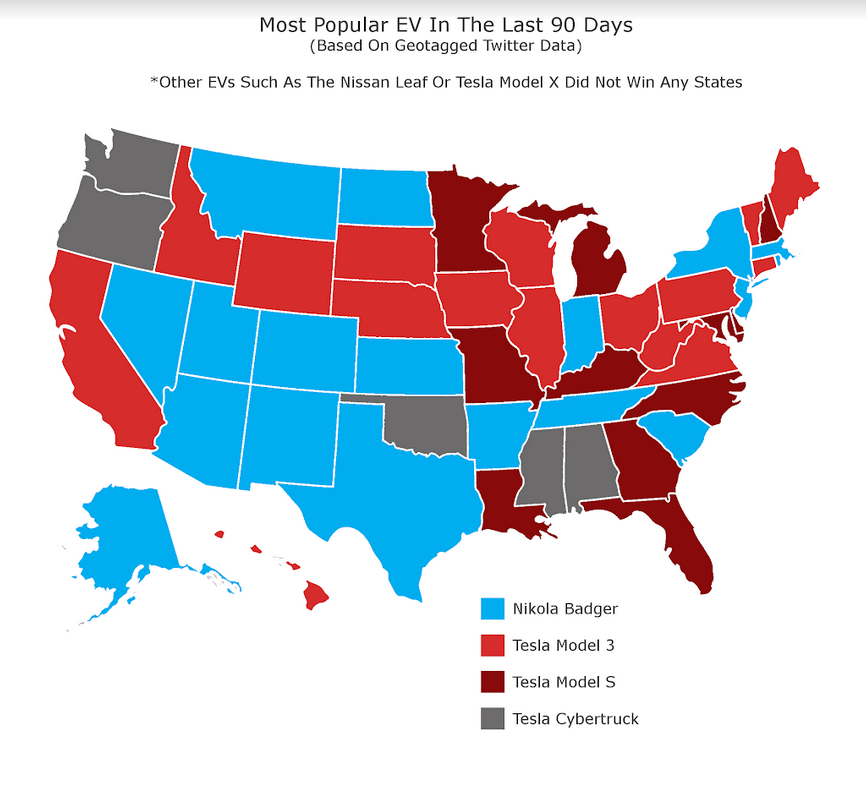

July 1, 2020 Update: The Nikola Badger has been the most talked-about electric vehicle over the last 90 days, according to a new map from partcatalog.com. Based on geotagged Twitter data, tracking tweets and hashtags over the last three months, the Nikola Badger was the most popular electric vehicle in 18 states. The hydrogen electric pickup truck won the most states, although Tesla took the other three spots on the list with three of its vehicles.

The map reveals that the Southwest is particularly interested in the Badger, as it dominated tweets in Texas, Arizona, New Mexico, Nevada, Utah, Colorado, and Kansas. The Badger also received the most electric vehicle mentions in Alaska, Montana, North Dakota, Indiana, New York, Massachusetts, New Jersey, Arkansas, Tennessee and South Carolina.

Interestingly, the Tesla Model Y, Tesla Model X, and Nissan Leaf didn’t win any states as far as Twitter mentions.

Nikola started accepting preorders for the Badger this week. To preorder the truck, you’ll have to put $5,000 down. The Badger still hasn’t even entered production and exists only in renderings. The company only decided to make the truck because founder Trevor Milton doesn’t like the look of the Tesla Cybertruck.

Nikola plans to officially reveal the Badger on Dec. 4 at its Nikola World event. Those who put down a deposit on the vehicle will be able to attend the event and be entered into a drawing for a free pickup truck.

Previously

In the world of green energy, Nikola Corporation (NASDAQ:NKLA) is the new kid on the block, but its stock is already flying high after it went public earlier this month. It seems investors are looking for the next Tesla, and they feel Nikola fits the bill. But will the company really be able to stand up to Tesla? And how much is its stock really worth, excluding the cult status it seems to have already found?

Q1 2020 hedge fund letters, conferences and more

Nikola NKLA versus Tesla TSLA stock

Although Tesla may have picked up a competitor, that hasn’t dampened enthusiasm for its stock. Instead, investors seem to be excited about the competition between Nikola and Tesla in electric pickups. As a result, many dived into Nikola stock, while Tesla stock was driven to new heights over $1,000 a share in recent trading sessions.

Nikola and Tesla share some similarities, but the two companies aren’t exactly the same. NKLA will sell hydrogen-electric trucks, while Tesla sells all-electric cars and SUVs. Tesla is also preparing to launch its own pickup truck, although the Cybertruck doesn’t look much like a pickup at all.

Tesla’s vehicles use batteries that are charged by plugging the vehicle in, but Nikola’s hydrogen-fuel-cell technology will work differently. Hydrogen fuel cells mix hydrogen from a tank with oxygen from the air. They take less time to charge than a battery electric vehicle and have a longer range, but they also tend to be more expensive.

Like Tesla, Nikola plans to build out its own fueling infrastructure. Tesla has been building charging stations for years, but Nikola plans to build hydrogen-fueling stations using solar power supplemented with power from the electric grid. The electricity will be used for hydrogen electrolysis, which essentially just involves shooting electricity through water to separate the hydrogen from the oxygen.

Key differences

At this point, Tesla already has five vehicles in production and two more, the Cybertruck and the Tesla Semi, in the planning stage. Nikola only has some pictures and promises and has yet to make any progress toward getting a single vehicle on the market.

One other way the two companies differ is in the way they went public. Tesla did it the old-fashioned way with an initial public offering. However, Nikola went about it using a reverse merger instead of an IPO. It struck a deal with VectoIQ, a public special purpose acquisition company that was formed for the purpose of merging with one or more other companies.

VectoIQ held its IPO in May 2018, raising $200 million. By going the reverse merger route instead of an IPO, Nikola raised over $700 million in a private stock placement and cash from VectoIQ’s trust account without having to spend money on the expensive and time-consuming IPO process.

One big similarity

One of the issues bears have had with Tesla for years is the fact that the company lost money for a long time before it started making money. Tesla’s expenses far exceeded its revenue, and NKLA is following the same path.

Because NKLA is in the startup phase, its expenses are currently much higher than its revenue. Last year, the company produced $500,000 in revenue from some small solar projects. However, management doesn’t expect solar to be a meaningful contributor to revenue in the future.

In 2019, Nikola saw net losses of $88.7 million. In 2018, it lost $64.3 million, while in 2017, it lost $17.6 million.

Nikola NKLA stock rises on promises

Enthusiastic investors were quick to jump on the Nikola bandwagon, predicting an outcome similar to Tesla’s success. However, for once, Tesla fans and short-sellers are finding themselves on the same side as both are criticizing newcomer Nikola.

Nikola Founder and Chairman Trevor Milton tweeted today that the company will give away one of its Badger pickup trucks in a drawing. The giveaway will be one of the more expensive Executive Series models priced at more than $60,000.

The company plans to open reservations for the Badger on June 29, although the truck isn’t expected to enter production until 2022. Nikola plans to partner with an automaker to manufacture the Badger, and it expects to announce its partner in the coming months. Milton told Reuters that three established automakers are in the running for a joint venture with Nikola on the Badger.

The Badger will be available in a battery-electric version or a hybrid with a hydrogen fuel cell and battery. The all-electric model will have a range of 300 miles, while the hydrogen fuel-cell model will have a range of 600 miles.

Nikola is also working on semi-trucks with hydrogen fuel cells, and Milton said those vehicles will be entering production next year. The company is partnering with Germany’s CNH Industrial for the big rigs. CNH builds Iveco trucks.

What bears think about Nikola NKLA stock

It would seem as if the bulls are largely in control of Nikola stock, but bulls aren’t the ones making their voices heard. Several bears have talked about why Nikola stock won’t work like Tesla has.

In an email, ARK Invest noted that Nikola stock carried the company to a $30 billion market capitalization even though it hasn’t produced a single truck. While the company has said it wants to reduce the cost of trucking, ARK said hydrogen trucks will have a higher cost of ownership than their battery-electric counterparts.

The firm said the cost of hydrogen and inefficiencies in the hydrogen drivetrain are the main difference between the costs of hydrogen fuel and electric trucks. However, it also said one of the biggest obstacles will be the infrastructure for hydrogen refueling, which is more expensive than charging stations for battery electric vehicles. ARK went so far as to say that it “will be surprised if Nikola ever delivers a single fuel cell truck.”

Tesla bull Gary Black tweeted that he believes Nikola “is a bubble that will end badly for the retail investors in it.” He noted in an email to Barron’s that the company will have to get truck makers to build the Badger for them. When the company announces it is partnering with an automaker that builds internal-combustion engine vehicles and has no experience with software or battery technology, he expects Nikola stock to go down.

Andrew Left of Citron Research believes Nikola stock will plunge 40% in a month. He tweeted that investors who buy Nikola stock at current levels even though the company hasn’t sold a single car deserve to lose money. He noted that when Tesla had that valuation, the Model S was already scaled, and the Model X was produced.

The post Nikola stock (NKLA) skyrockets after GM takes a stake appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.