By Jacob Wolinsky. Originally published at ValueWalk.

Rapid Shift To Online Puts IT & Business Services Onto Frontline – Hampleton Partners M&A Report

Q2 2020 hedge fund letters, conferences and more

The latest IT & Business Services M&A market report from Hampleton Partners, the international technology mergers and acquisitions advisor, reveals how Covid-19 is putting the IT sector on the frontline despite the pandemic’s impact on deal volumes and valuations, with IT departments and suppliers remaining crucial in the shift of entire companies online and in the e-commerce boom.

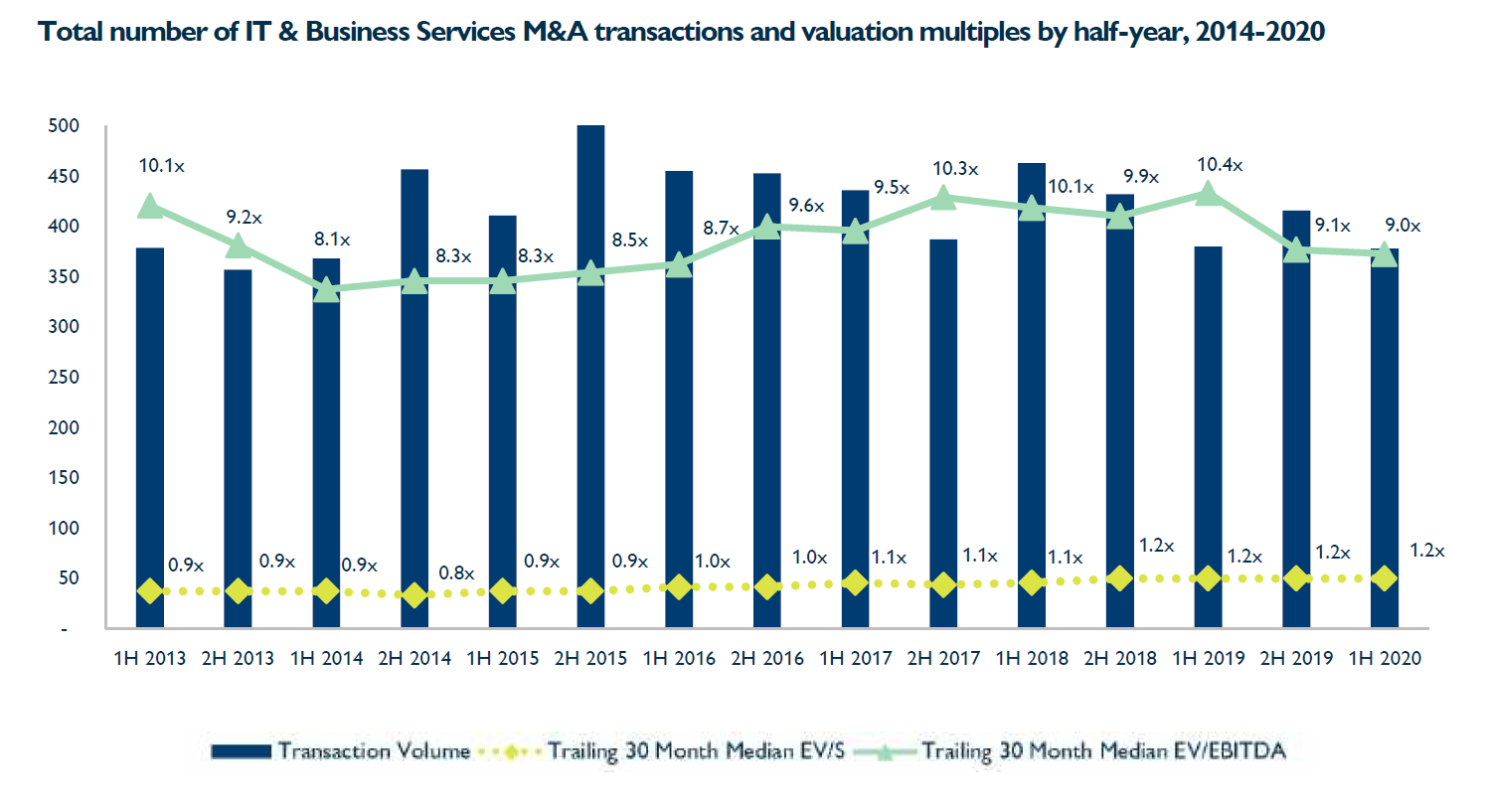

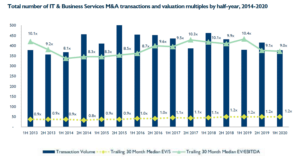

In the first half of 2020, transaction volume dipped to 378 deals, compared to the 416 deals recorded during the second half of 2019.

Along with the number of deals, some valuation multiples came in lower: the trailing 30-month median EBITDA multiple dropped to 9x – the lowest in four years – while the revenue multiple remained stable at 1.2x.

Miro Parizek, founding partner, Hampleton Partners, said:

“So far in 2020, the IT & Business Services sector has seen stable M&A activity. Lockdown measures around the world have accelerated the move to digital, providing ample opportunity for IT players to shine if they can digitise products, processes and services.

“At the same time, valuations have come in somewhat lower and deal-making was more regionally oriented, especially in Q2, as global travel was impacted by travel restrictions.

“Unsurprisingly, outsourcing companies, which offer services ranging from payment processing to software development, continue to enjoy strong growth on the back of improved global connectivity and the ever present need to reduce costs.”

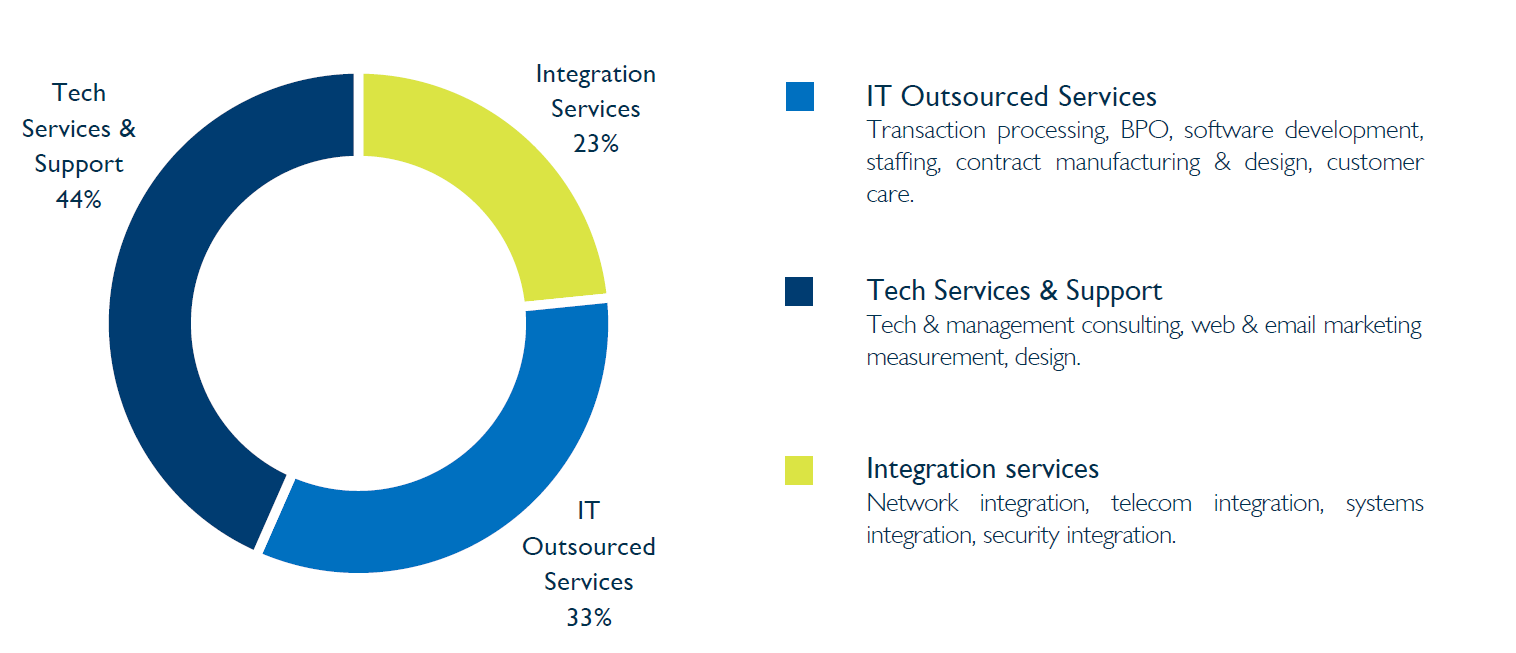

Companies in the IT Outsourced Services segment continued to attract the highest valuations – 9.7x trailing 30-month median EBITDA multiple. The Tech Services & Support segment accounted for 44 per cent of deals, the largest in the IT & Business Services sector.

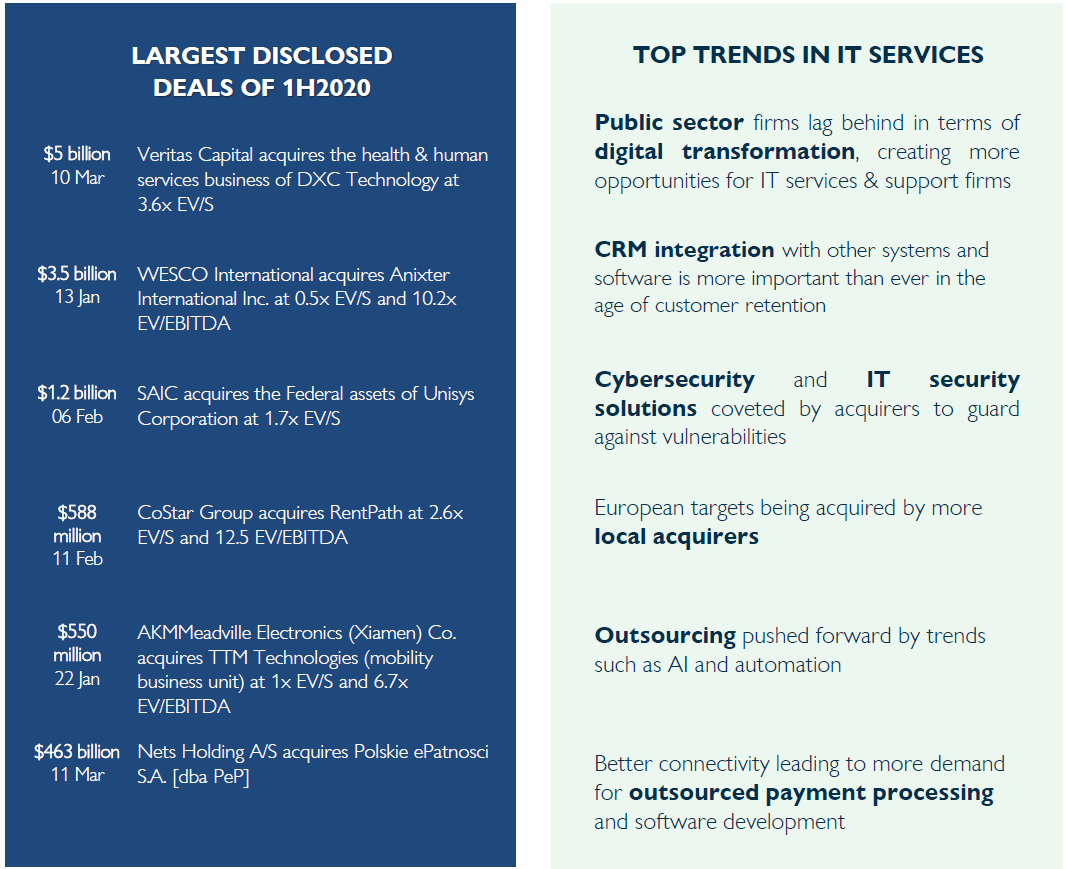

The largest disclosed deals of 1H 2020

The top three largest disclosed IT & Business Services were: Veritas Capital’s acquisition of the health & human services business of DXC Technology for $5bn – at 3.6x EV/S; WESCO International’s acquisition of Anixter International Inc. for $3.5bn at 0.5x EV/S and SAIC’s $1.2bn acquisition of the Federal assets of Unisys Corporation at 1.7x EV/S.

Hampleton’s IT & Business Services M&A report analyses transactions, trends and activity across the Integration, Technology and Support Services segments as well as IT Outsourcing.

M&A Market Report 2H 2020 – IT Services Poised To Thrive Off Widespread Move To Digital

This year, enterprises – be they startups, publiclylisted, or even governmental agencies – have been forced to rapidly digitise their products, processes and services. Lockdown measures around the world have accelerated the move to digital. For instance, working from home has required better IT capabilities, whether in-house or outsourced. In some cases, IT departments have had to move entire companies offsite.

To enable this, IT services firms and departments are working with virtualisation tools and integration with other systems, software and platforms. They are also working with the cloud for efficiency in remote working and corporate agility.

Furthermore, the widespread implementation of capabilities in analytics or digital marketing – especially given the rise of digital commerce to compensate for the crisis in brick-and-mortar retail – has pushed businesses to seek out assistance from IT and marketing services firms. CRM integration with other systems and software, for instance, is more crucial than ever for businesses who rely on customer retention, particularly in this climate.

In our sister report, “Enterprise Software M&A 2H2020”, we point to transactions targeting videoconferencing software and desktop virtualisation software for the cloud. Unsurprisingly, on the IT Services side, cloud integration solutions and systems are garnering much attention as the technical condition for cloud software adoption.

More generally, outsourcing companies, which offer services ranging from payment processing to software development, continue to enjoy strong growth on the back of improved .global connectivity and the ever present need to reduce costs.

As a result, the IT Services sector is in a paradoxical position: while the pandemic is causing lower deal volumes and valuations, some areas in IT are evidently poised to benefit from the shift to online and from other changes in our use of technology this year.

M&A Summary

In the first half of 2020, transaction volume dipped to 378 deals, compared to the 416 deals recorded last reporting period. This dip may be due to a drop off in intercontinental deals in Q2 2020 due to pandemicrelated challenges to completing transactions. Along with the number of deals, some valuation multiples came in lower: the trailing 30-month median EBITDA multiple dropped to 9x – the lowest in four years – while the revenue multiple remained stable at 1.2x.

Tech Services & Support is the largest segment of the IT Services sector, accounting for 44 per cent of deals. However, companies in the IT Outsourced Services continue to attract the highest valuations (9.7x trailing 30-month median EBITDA multiple in 1H2020), compared to 7.9x in the Integration Services segment (see subsectors pp. 6-11).

The period saw handful of blockbuster transactions. Yet private equity buyers were more absent from bigticket deals, save for Veritas Capital and its acquisition of the health & human services of DXC Technology. Other large deals were inked by strategic buyers, as illustrated on p3.

The above graph covers the period between January 2013 and July 2020. Throughout this IT & Business Services M&A report, median “trailing 30- month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year.

Highlights

Geographical Breakdown

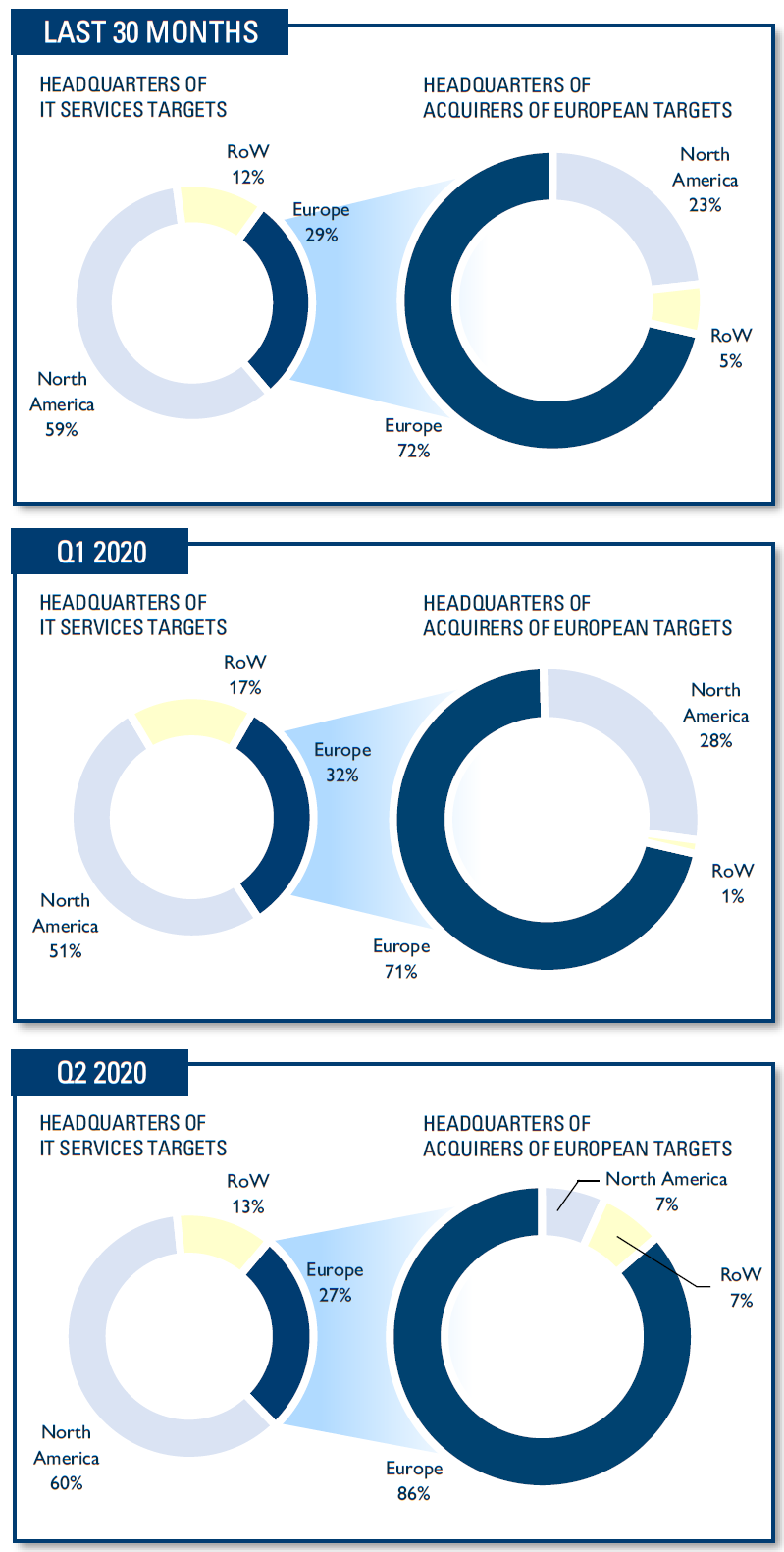

Over the past 30 months, 72 per cent of European targets were bought by acquirers that were also European. This figure is broadly similar for Q1 2020, before the coronavirus outbreak.

However, this number has jumped to 86 per cent if we look only at deals closed in Q2 2020, pointing to more regional dealmaking for 2020. This is likely to be due to travel restrictions and local lockdown measures strongly impacting the prospects for intercontinental M&A.

Meanwhile, across global M&A activity, North American targets have maintained their majority share of deals, accounting for 51 per cent of all deals in Q1 2020 and 60 per cent in Q2 2020.

Top Acquirers – Past 30 Months

Many acquirers lay low in first half of 2020

Prolific acquirer Accenture continued its acquisition spree, adding on various digital capabilities and making 58 acquisitions in the past 30 months. The tech consulting company made a whopping 15 acquisitions in 1H2020, following 24 deals in 2019 and 16 deals in 2018.

Most recently, the firm made purchases in AI-enabled data consulting, PLM systems design and BPO/management consulting. A few weeks prior, Accenture finalised its acquisition of Gekko, a Francebased Amazon Web Services (AWS) cloud services company, for an undisclosed amount. The deal seeks to improve Accenture’s cloud and AI position and complement the cloud transformation experience and strategic priorities of the Accenture AWS Business Group (AABG) in France, Belgium, Luxembourg, and the Netherlands.

Few other buyers made acquisitions in the first half of 2020. Cognizant, for instance targeted an ERP systems integrator; a digital marketing systems integrator; and a Salesforce partner IT Services consultancy between March and June 2020. Other companies below remain top of the scoreboard by virtue of acquisitions made between 2018 and 2019.

Integration Services

Sub-sector overview

M&A metrics in the Integration Services segment are declining, as are some valuation multiples. Total transaction volume was the lowest since 2014, with 85 transactions recorded in 1H2020 – compared to 109 transactions closed in 2H2019. The trailing 30-month median EBITDA multiple has been declining since the second half of 2017 and dipped to 7.9x this reporting period. The revenue multiple remained stable at 1.1x.

CRM integration: crucial in the age of customer retention

One notable deal in this segment is the purchase of Simplus, a provider of Salesforce-based systems integration, software development, IT consulting and managed hosting, by Indian IT consulting giant Infosys for $200 million.

Simplus, an American firm, is one of the fastest growing Salesforce Platinum Partners and integration consultants in the USA and Australia. Based in Salt Lake City, Utah, the company was launched in 2014 and, before the acquisition, had raised almost $50 million.

According to TechCrunch, this acquisition follows Infosys’s purchase of Fluida, another Salesforce consulting shop, in 2018. The moves suggest that Infosys wants to build deeper expertise around Salesforce and make that a key piece of its consulting operations moving forward.

Security integration: a priority for Accenture

In April 2020, Accenture acquired Revolutionary Security, an American provider of security integration and consulting services, for an undisclosed amount.

According to CRN, the Revolutionary Security acquisition will be vital in Accenture’s push to triple the size of its critical infrastructure and operational technology (OT) security business over a three-year period. Revolutionary Security’s expertise in protecting communications and life sciences customers will complement Accenture’s current security capabilities around utilities, oil & gas, and minerals and mining.

Revolutionary Security was founded in 2016, employs 90 people, and serves a variety of clients in the energy, manufacturing, healthcare, financial services and communications industries. The company’s LiveFire breach and attack simulation testing service utilises real-world cyber threats to identify gaps in security processes and monitoring, as well as staff operations and technologies.

A few months prior, Accenture bought 250-person consultancy Context Information Security for $139 million, aiming to help government organisations and financial institutions respond to the threat of advanced cyberattacks; and announced plans to purchase Symantec’s Cyber Security Services business from Broadcom to help organisations address cyber threats. The Symantec business has more than 300 employees and is anchored by the company’s managed security services practice.

Beyond Revolutionary Security, Context and Symantec, Accenture has made several acquisitions focused on cybersecurity including Déjà vu Security, iDefense, Maglan, Redcore, Arismore and FusionX.

Tech Services & Support

Sub-sector overview

With 173 transactions in 1H2020, transaction volume in the Tech Services & Support segment is consistent with previous years. Though they are generally the highest across the IT Services sector, valuation multiples have continued to dip since the latter half of 2018, falling to the lowest level since 2014. Revenue multiples have remained stable.

Notable deals include WESCO’s January acquisition of Anixter for $3.5 billion. Anixter, an American company, provides supply chain management (SCM) services and distributes wire, cable and communication and security components for a variety of manufacturers, OEMs and telecoms globally. The deal aims to create a premier electrical and data communications distribution and supply chain services company and is expected to double the size of WESCO’s employee count and revenue. Anixter International, another distributor of networking infrastructure, was also subject to buying competition, agreeing first to be purchased by an affiliate of private equity firm Clayton, Dubilier & Rice and then switching to a bigger offer from multinational distributor Wesco.

Catering to public sector needs for digitalisation

In February, SAIC, an American systems engineering and integration service provider, purchased Unisys Federal from publicly traded company Unisys for $1.2 billion.

The asset in question provides infrastructure modernisation, cloud migration, managed services and other tech support services for US federal civilian agencies and the US Department of Defence (DoD).

According to The Washington Post, for decades the DoD has relied primarily on local computer networks set up by individual agencies – an impediment to the sharing of sensitive intelligence and to the adoption of new technologies. As a result, the DoD is now shifting towards cloud computing. While the cloud storage technology itself is being provided by Microsoft, SAIC will be responsible for providing skilled services and support to “lift and shift” the department’s older computer systems onto the cloud.

SAIC is seeking to become the leading provider of digital transformation services: in 2019, the company took private Engility, a provider of engineering andlogistics services to several US military and civilian agencies, for $2.5 billion. In January, SAIC was awarded an Air Force contract worth up to $727 million to move 800 of the service’s applications onto the cloud.

Cognosante extends outside realmof health In May, health IT consulting giant Cognosante acquired Enterprise Information Services (EIS) for an undisclosed amount. Founded in 1994 and based in Virginia, EIS provides cybersecurity, biometrics, application development, cloud migration, IT operations and support to numerous government agencies including the DoD,

Homeland Security, and major civilian agencies such as State, Energy and the US Postal Service.

IT Outsourced Services

Sub-sector overview

IT Outsourced Services continues to be the best valued segment in this technology sector. Trailing 30-month median multiples remained stable in 1H2020, as the EBITDA multiple came in at 9.7x and the revenue multiple at 1.3x. Deal volume remained squarely in line with the lower volumes of 2019: the segment saw a total of 120 transactions, down from 129 deals in 2H2019.

The segment saw a significant number of large deals, particularly involving payment processing firms. In March 2020, Fiserv acquired MerchantPro, a provider of transaction processing services and point of sale (POS) systems. Headquartered in New York state, MerchantPro Express is an Independent Sales Organization (ISO) that provides state-of-the-art processing services, advanced POS equipment and merchant cash advances to businesses across the US. MerchantPro leverages technology, analytics and consulting to grow its clients’ business by driving down processing costs, providing a wide variety of value-added services. The deal seeks to bring together market-leading payment solutions from Fiserv, including CoPilot, CardPointe and Clover, with the proven and sophisticated onboarding and service of MerchantPro Express.

Magic Software Enterprises invests in outsourced software development

In June, publicly traded company Magic Software Enterprises, an Israeli low-code integration and application development SaaS provider, acquired Dutch companies Magic-Hands and Knowledge & Solutions Software B.V – two software development firms based on the MAGIC programming language.

Magic Software Enterprises, a global provider of end-to-end low code integration and application development platforms solutions and IT consulting services, will thus expand its footprint in the Western Europe market. The collaboration between Magic Software, Magic-Hands and Knowledge & Solutions Software will increase development power across Europe as Magic-Hands’ team develop, manage, and deliver software solutions. Different types of software include “Magic4Business” (the finance and billing solution) and Magic4Trade (for supply chain businesses and custom-made software solutions).

Conclusion

So far in 2020, the IT & Business Services sector has seen stable M&A activity. At the same time, valuations have come in somewhat lower and deal-making was more regionally oriented, especially in Q2, as global travel was impacted by travel restrictions.

In general, industry deal drivers remain the same: digital transformation and continued transition to the cloud drive demand for IT services and capable resources. Specifically, desktop virtualisation and remote working integration has been crucial for all types of businesses this year.

Overall, we anticipate M&A activity in IT Services to remain stable the rest of this year and to accelerate in 2021 as market dynamics continue to drive larger service companies to acquire specialised capabilities.

See the full report here.

The post Rapid shift to online puts IT & business services onto frontline appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.