By Jacob Wolinsky. Originally published at ValueWalk.

Blue Tower Asset Management commentary for the third quarter ended September 2020, discussing their new position Berry Global Group Inc (NYSE:BERY).

Q3 2020 hedge fund letters, conferences and more

Our strategy composite had another solid quarter in Q3 2020, recording a 10.44% gain, net of fees (10.78% gross). The biggest contributor to our performance this quarter was Cornerstone Building Brands which reported an excellent quarter where demand exceeded their capacity for window production and revenues far exceeded analyst consensus. Our bullish thesis described in our Q2 2019 letter on Cornerstone and the US construction sector in general appears to be playing out as expected. New housing starts for June, July, and August were all higher year-over-year than in 20191.

This quarter we exited our long-held positions in Sto AG and Fonar. While they are both great companies, we needed to free up capital for other opportunities currently presenting themselves. Fonar has been a successful investment for us, and we closed out our position at $24.99 per share, a significant appreciation from our average purchase price. In the five weeks since our liquidation, Fonar stock has fallen almost 20%. If it falls to a sufficiently attractive price, we may repurchase it.

The upcoming US national election is less than a month away. While the outcome could lead to significant policy changes, it is important to remember that our portfolio is robust due to the competitive advantages of our holdings as well as the portfolio’s overall diversification across industries and geographies. Most of our portfolio at the end of the third quarter was outside the US, and some of our US companies have significant international revenues.

Four areas of potential policy changes to pay attention to are 1) increased regulatory restrictions on consumer lending, 2) healthcare policy changes, 3) stimulus measures for dealing with the fallout from the Covid-19 pandemic, and 4) corporate tax rate changes.

Financial regulations on consumer credit could affect our two consumer finance portfolio holdings, EZPW and ENVA. We do not currently have any healthcare stocks in the portfolio, but we may add some when we get better clarity on what healthcare policy changes will result from the election. If we have a divided government between congressional houses and the presidency, a fiscal stimulus is less likely to occur. This would have a macroeconomic depressive effect on the US and to a lesser extent the rest of the world economy. The Democratic presidential nominee, Joe Biden, has campaigned on reversing many of the corporate tax reductions carried out during the Trump presidency, which would reduce the earnings of US corporations.

We expect the elevated market volatility from the pandemic and election uncertainty to continue for at least another two quarters. As new information relevant to holdings in our portfolio or companies on our watchlists come in, there is always the possibility that the market does not respond correctly or in a timely manner. There will also be irrational sentiment-driven swings in share prices. We will endeavor to trade prudently in response to these changes.

As I do periodically in these letters, I would like to introduce our investors to a new holding which entered the portfolio this year, Berry Global, with an overview of the business and our investment rationale for holding it.

Berry Global Group Company Overview

In the current volatile investing environment created by the potential policy changes from the 2020 US elections and the ongoing coronavirus pandemic, one safe harbor for investors can be found in recession-proof consumer staples companies. Berry Global (formerly Berry Plastics) is one of the largest plastics manufacturers is in the world with 293 production facilities in 39 countries. The customer base of Berry is extremely diverse with over 13,000 different customers which includes multinationals companies such as Procter & Gamble and Unilever. The company’s diverse collection of currently produced products is comprised of approximately 100,000 unique SKUs. Their business is extremely recession resistant as evidenced by their persistent revenues and margins throughout the 2008 global financial crisis.

Part of the reason for the current investment opportunity in Berry Global, is that some investors see it as being a commodity business lacking competitive advantages. However, Berry Global is well into the process of building these. Berry has a wholly-owned packaging design studio, Blue Clover Studios, to help smaller customers design packaging solutions for their products. For larger customers, they have embedded design teams to help integrate customer products with the newest plastics engineering technologies at Berry. While investors in businesses that have competitive-advantage moats have been well-rewarded, the even greater advantage goes to investors in businesses that are in the process of creating new moats.

Growth through Acquisition

Berry Global has been ignored by investors who are deterred by their very high debt levels (currently 4.5x net debt to non-GAAP adjusted EBITDA) and the belief that plastics manufacturing is a low-barrier to entry commodity business. They ignore the changing dynamics of the industry and Berry’s success at executing their acquisition strategy to grow the business.

Berry Global acquires companies using primarily debt and then integrates them into their business with significant margin improvement. On average, Berry has managed to achieve cost synergies that are roughly 5% of the annual revenues of the targeted company. These synergies will vary depending on the prior scale and efficiency of the target. 2/5 of the cost synergies (2% of revenue) is from superior prices on resin purchases. Berry Global has significant scale and purchases 3.2 billion kilograms per year, making it the largest purchaser of plastic resins in the world among plastic manufacturers. They are able to use their scale to gain considerable price concessions from resin producers reducing the production costs after acquisition. The other 3/5 of cost synergies (3% of revenue) comes from manufacturing economies of scale and more efficient business practices. These additional acquisitions only make their scale advantage greater going forward.

The growth of hydrofracking in the United States and the current cheap price of oil have been to their benefit. The number of resin suppliers in the marketplace has been growing, weakening the negotiating ability of resin suppliers when dealing with plastic manufacturers like Berry.

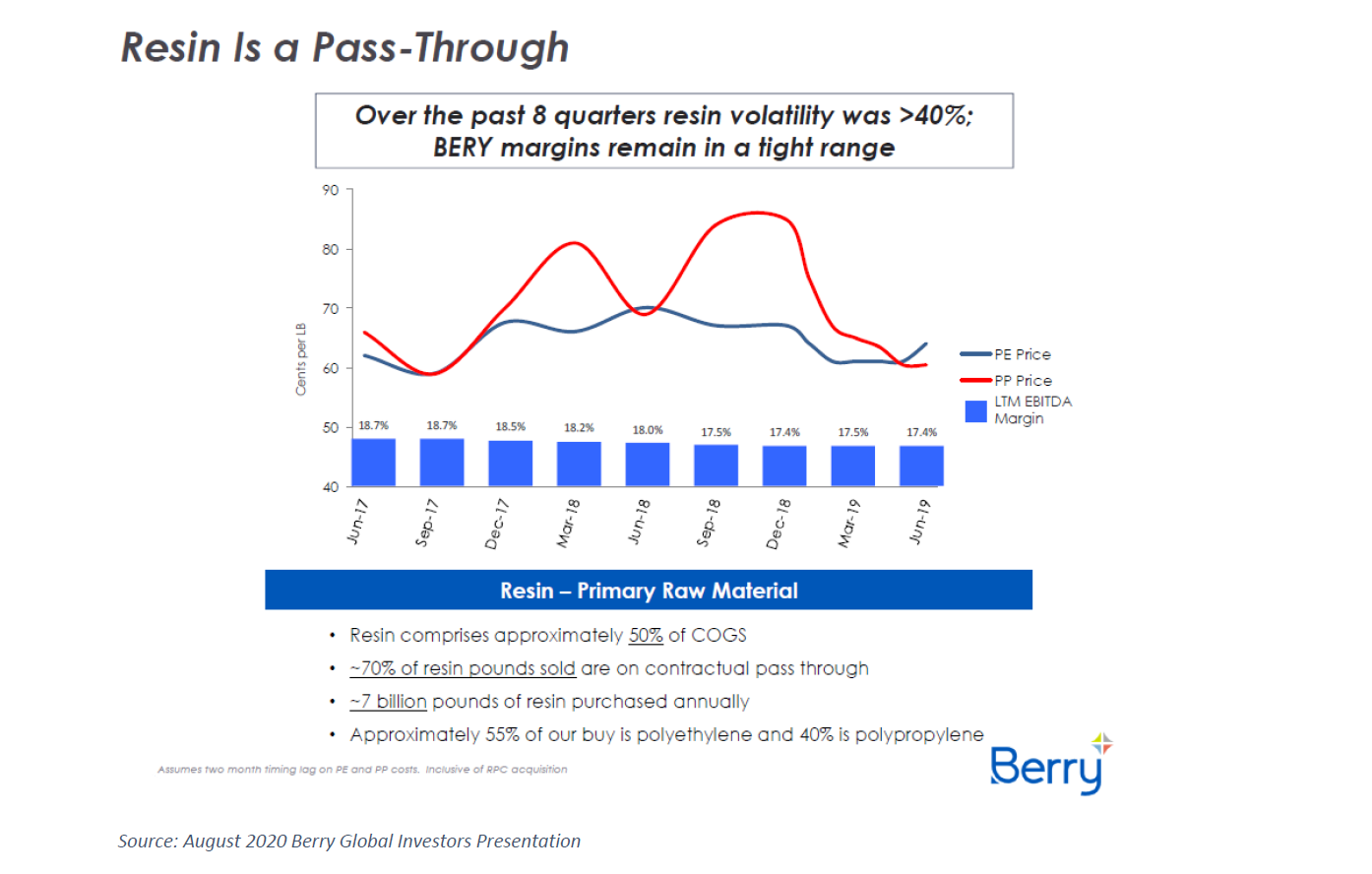

This cheaper cost of resin is a benefit in making plastic products more attractive as roughly half of the current manufacturing cost of food containers comes from the resin price. For the vast majority of Berry Global’s manufacturing contracts, the cost of resin material is contractually passed through to the customer, reducing the variability in the operating margins of Berry. This can be seen in the chart below from the company demonstrating their consistent margins in the face of heightened resin price volatility.

Recent Acquisition/Divestiture History

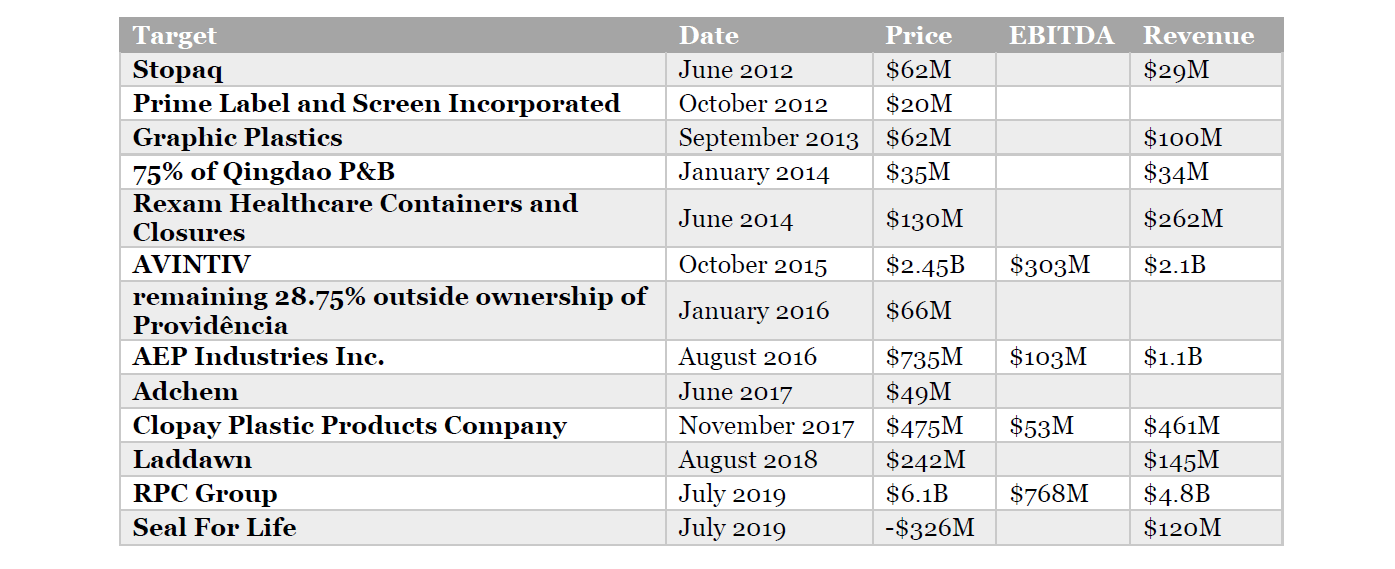

Berry Global has made many major acquisitions since their IPO which are summarized in the table below. For many of the acquired targets, figures were not publicly available for their revenues or EBITDA at the time of acquisition and are left blank in the table. Seal For Life is also included as the sole major divestiture of the company in this time period.

Berry Global purchased Avintiv, which was a portfolio company of the private equity wing of Blackstone, in 2015. Avintiv received most of their revenues from health and hygiene markets, and had a significant business in specialized industrial products. This gave them exposure to international markets and access to new market sectors in healthcare. These healthcare products have higher gross margins than Berry’s other products. At the time of acquisition, the company expected to realize over $50 million per year in cost synergies.

The July 2019 acquisition of UK-based RPC gave Berry Global a dramatically increased scale and a global footprint. RPC had facilities in 33 countries employing 25,000 workers. By revenues and enterprise value, it was nearly half the size of Berry Global prior to the acquisition. The notes offering used to generate some of the funds for the transaction has a maturity of 2026 and no financial maintenance covenants. The company expected $150 million of annual synergies between the two companies and that the transaction will be accretive to earnings and free cash flow generation.

Free Cash Flow Growth

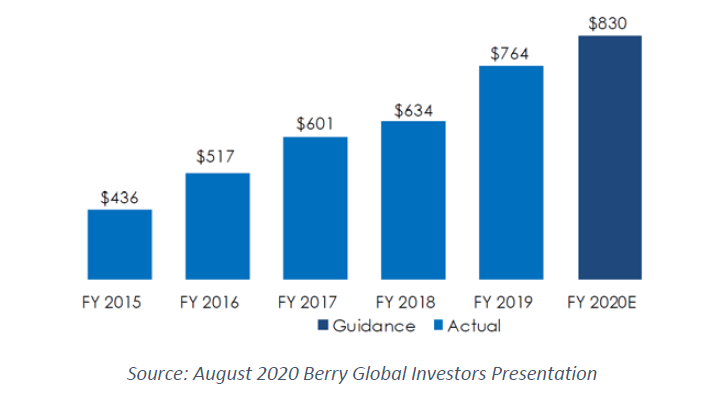

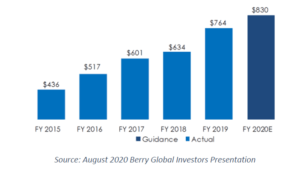

Driven by successful acquisitions, free cash flow per share has grown at the annual rate of 16% over the past 5 years.

Segment Information

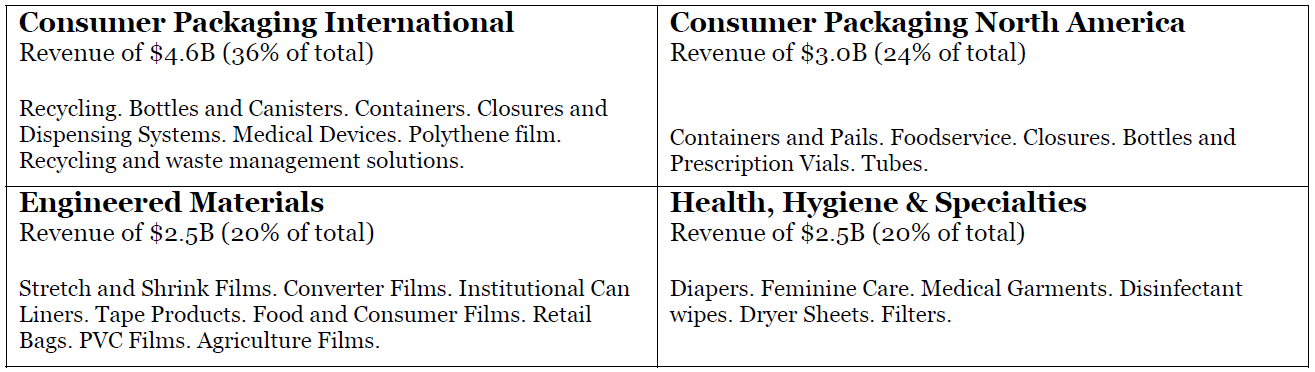

While there are many other plastic goods manufacturers, Berry Global focuses on product lines where they can maintain a dominant position. Berry considers themselves the market leader in the majority of their portfolio of product lines. Since the acquisition of RPC Global, they have been divided into 4 business segments seen in the chart below. The operating margins of the segments differ with the highest margin business being the Health, Hygiene & Specialties segment. Despite only being 20% of revenues, this segment was 49% of operating income for FY2019.

Segment Information – FY2019

It is instructive to examine the relationships between Berry Global, its suppliers, and customers through a Porter’s Five Forces framework. Porter’s Five Forces is a framework for analyzing the competitive position of a company. Plastic goods are produced from polymer resins, and these polymer resins are produced from petrochemical intermediates. The growth of hydrodynamic fracking has dramatically decreased the cost of oil and gas production in the United States and has led to an increase in the number of resin producers that supply Berry. On the customer side, small startup consumer brands are able to use online advertising and distribution in order to take market share from the supermarketdistributed mega-brands. These smaller brands will have less bargaining power against container manufacturers like Berry. At the same time, increases in mergers of plastic producers have created more concentration and an oligopoly dynamic among major manufacturers. As the bargaining power of their suppliers and customers weaken and the competitive rivalry in their industry weakens, the ability of Berry to earn outsized economic returns strengthens.

Valuation

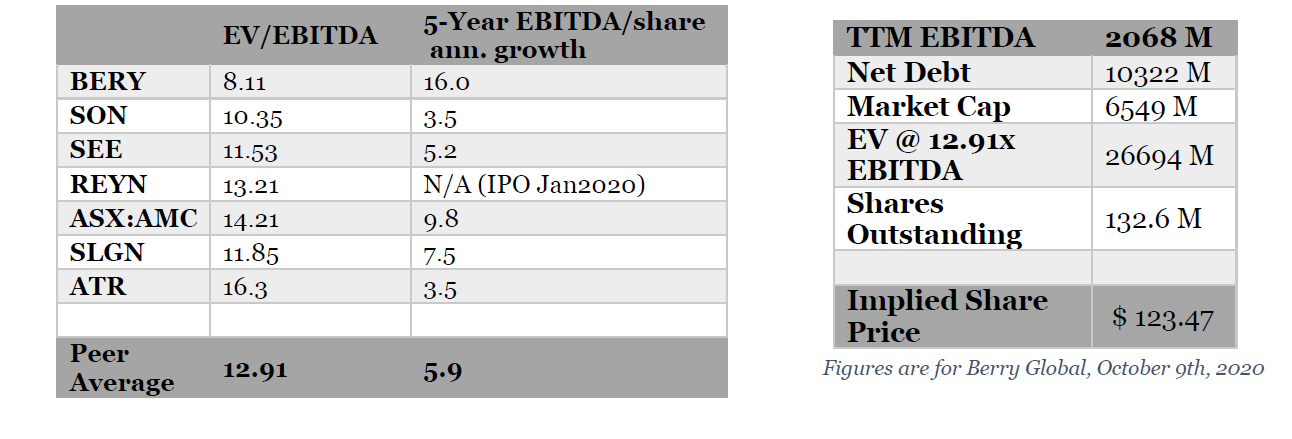

To get an idea of comparable valuation, we can take a look at several similar plastics and packaging companies. If we were to hold BERY at the same average EV/EBITDA of this selected peer group, the implied share price would be $123.47. EV/EBITDA is more appropriate to use than valuation ratios that do not take debt into account due to the widely varying leverage levels among this group. Berry Global trades at this discount despite its earnings growth being significantly higher than the averages for this peer group.

Several Potential Future Capital Allocation Paths

There are multiple possible paths for Berry that will all result in good investor outcomes. The best result would be if the company is able to continue successfully acquiring and integrating smaller plastics companies into their corporate structure. Over the past five years, this acquisition strategy has allowed the company to grow EBITDA/share by 16% annualized. If their acquisitions slow down and BERY reaches their deleveraging target of <4x debt-to-EBITDA, investors can still have a great outcome from a deleveraging that causes a market rerating of the stock to a multiple of EV/EBITDA similar to comparable companies. If the company remains at a cheap valuation after the company reaches their deleveraging target, the company can begin buybacks and compound investor capital in that manner. Considering all of the above, Berry Global should give excellent returns to investors at today’s prices.

I hope this analysis of Berry Global has been informative about our position in the company and the investment process we use in constructing our portfolio. Please do not hesitate to contact me with any questions during these interesting times.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager

The post Blue Tower Asset Management 3Q20 Commentary: Berry Global Group appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.