By F.A.S.T. Graphs. Originally published at ValueWalk.

Introduction

On January 26, 2018, I wrote an article titled: “Owens & Minor Inc.: Irresistible Yield, Irresistible Valuation” where I offered the company as an extremely undervalued Dividend Contender research candidate. I also pointed out that the company was in transformation. However, I underestimated what that transformation meant, at least over the short run.

Q2 2020 hedge fund letters, conferences and more

where I offered the company as an extremely undervalued Dividend Contender research candidate. I also pointed out that the company was in transformation. However, I underestimated what that transformation meant, at least over the short run.

I also pointed out that Owens & Minor was a reader’s request, and I quote: “Recently, I have had several requests to write an article about Owens & Minor Inc. (OMI). I had not looked at this company in a while, and boy oh boy, was I surprised at what I found. Owens & Minor is on the “Dividend Contender” list produced by David Fish. Owens & Minor has raised its dividend for 20 consecutive years, which leaves it only five years away from “Dividend Champion” status. Therefore, I consider Owens & Minor a classic dividend growth stock that’s extremely undervalued.”

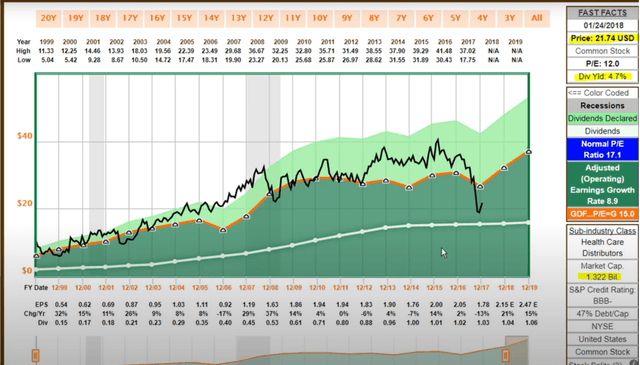

Additionally, this is what the company looked like based on FAST Graphs on January 24, 2018. The company’s operating history was decent, and as stated above, the dividend had increased for 20 consecutive years and the stock appeared extremely undervalued based on the forecast earnings estimates at that time.

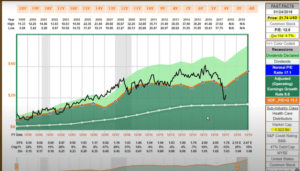

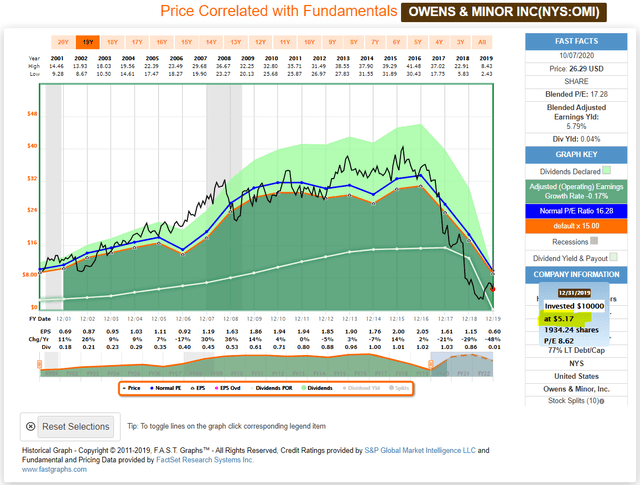

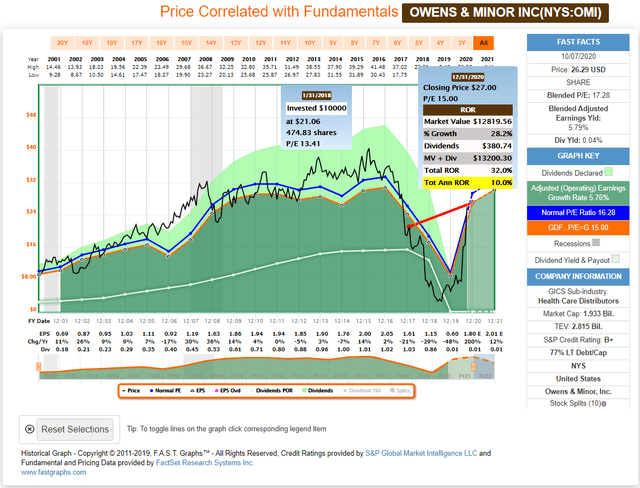

However, when I fast-forward to January 31, 2019, here is what actually happened to both Owens & Minor Inc.’s actual earnings and stock price. Instead of growing as the forecast showed on January 24, 2018, earnings fell precipitously by 21% in 2017, followed by 29% in 2018 and finally by an additional 48% in 2019. As a result, the stock price fell from the $21.74 it was trading at on January 24, 2018 to only $5.17 by December 31, 2019. This represented more than a 70% price decline at that point. However, the stock went on to hit a low price of $2.43 in 2019, which represented approximately a 90% loss from the date I published the original article. Not my finest hour.

Owens & Minor January 2018 to Current: 10% Annualized Shareholder Returns

Frankly, I received a lot of snide remarks and criticism on this article even though I was fulfilling readers’ requests. On the other hand, I cannot say that I blamed anyone for being upset considering the results, or lack thereof, that occurred after the article was originally published. Nevertheless, both the company and its stock price have subsequently accomplished a remarkable recovery. Had the stock been purchased the day I published the article and held until today, investors would have earned a 10% annualized rate of return based on a $27 stock price which is approximately where the stock is trading.

As I stated in the title of this article, this might be the most treacherous path to double digit returns that I have yet to see. However, I have not written this follow-up to gloat or as a feeble attempt to justify my original work. Instead, I offer this update as a clear example of how operating results drive stock prices over time. In this case, the stock price action since I wrote the first article seems perfectly justified both up and down. Clearly, the stock price moved in almost lockstep tandem with the operating results good and bad that the company achieved. To me, this represents continuing evidence that operating results (fundamentals) are ultimately more important than price action.

So, What Happened and What Has Changed Since?

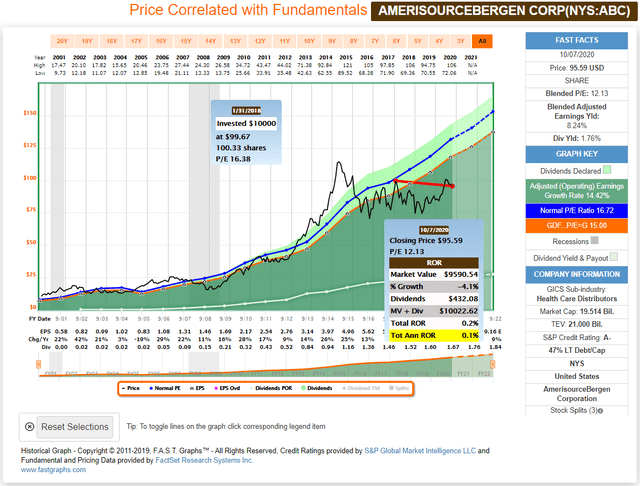

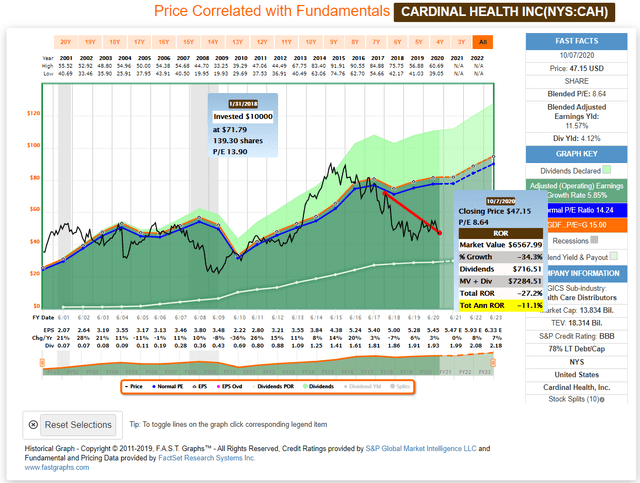

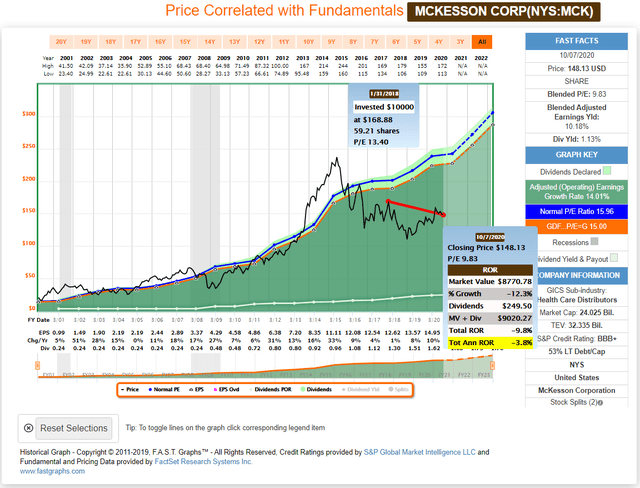

Since I wrote my original article, the healthcare distribution sector overall faced many challenges which has affected the stock values of the entire sector. Even blue chips like AmerisourceBergen, Cardinal Health Inc., and McKesson Corp. saw their stock prices plummet in 2016, 2017 and 2018. However, these companies saw their operating results hold up quite well in contrast to the losses we saw with Owens & Minor.

Despite their operating results staying strong, all 3 of these blue chips ended up underperforming Owens & Minor over this timeframe. On the other hand, if fundamentals are truly more important as I believe they are, then each of these 3 healthcare distributors may represent strong opportunities going forward. (see graphs below):

AmerisourceBergen (ABC)

Cardinal Health (CAH)

McKesson Corp. (MCK)

Nevertheless, the whole industry was beset with falling prices, the opioid epidemic and general negative sentiment towards the whole industry. As a result, Owens & Minor, who is one of the smallest players, lost their Kaiser Permanente contract on top of the normal challenges facing the industry. Below is how management discussed this in the 2018 annual report.

Taken directly from the 2018 annual report

“During 2018, we faced a range of challenges, both external and internal, across our distribution business. While we have made great progress in meeting these challenges, we recognize we have to

earn our customers’ trust by meeting their service needs every day. This is a key message that we are driving throughout our organization and a critical focus for our teams across the enterprise. Our customers depend on us for exceptional service, and we will provide it.”

Then management went on to talk about the actual financial results as follows:

“Net income (loss) per diluted share was $(7.28) for the year ended December 31, 2018, a decline of $8.48 compared to 2017. Adjusted EPS (non-GAAP) was $1.15 for the year ended December 31, 2018, a decline of $0.46 over the prior year.

Global Solutions segment operating income was $104.1 million for 2018, compared to $141.1 million for 2017. The declines were a result of a decline in distribution revenues, continued pressure on distribution margins, warehouse inefficiencies in certain of our facilities, increased expenses incurred for the development of new customer solutions, and higher severance and restricted stock expense which were partially offset by positive contributions from Byram Healthcare (acquired in August 2017). Global Products segment operating income was $75.7 million for 2018, compared to $38.5 million for 2017. The increase was a result of the contributions from Halyard (acquired in April 2018).”

Owens & Minor – A Company On The Move

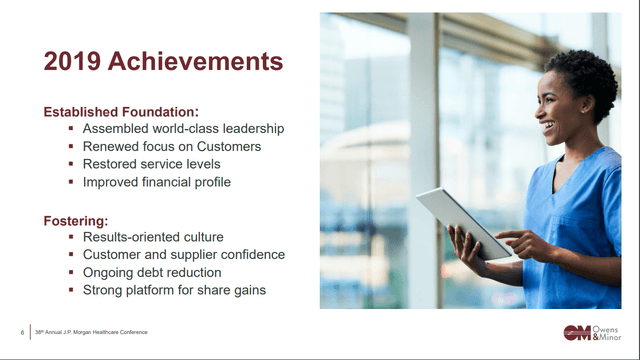

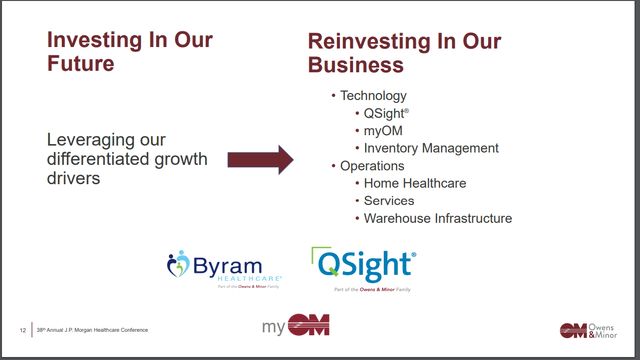

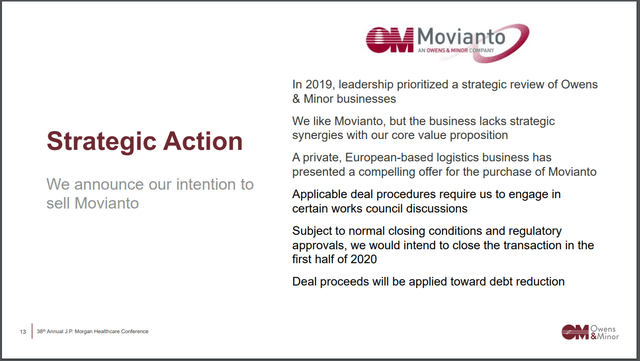

The following slides taken from Owens & Minor’s presentation at the 38th annual J.P. Morgan healthcare conference on January 16, 2020 showcase the company’s strategic initiatives towards improvement.

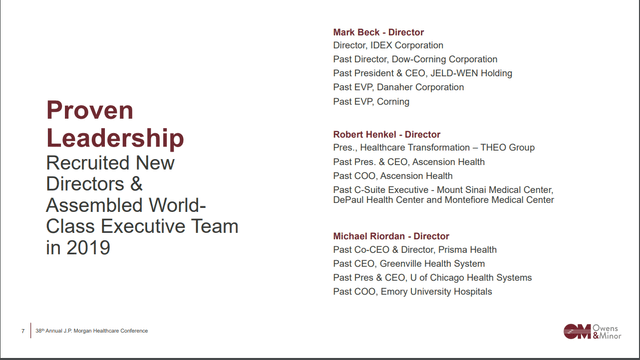

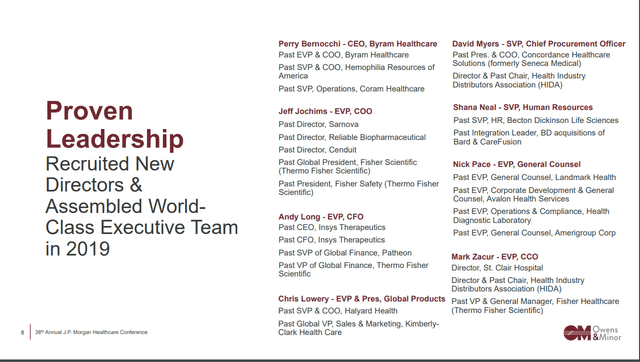

Perhaps most importantly, the company started at the top by completely revamping their leadership to include recruiting new directors and assembling a world-class executive team in 2019:

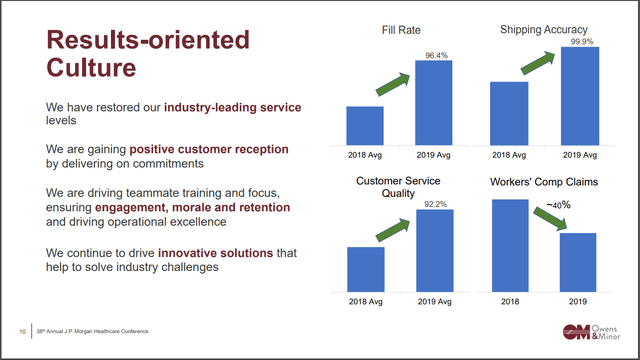

As evidenced by the FAST Graphs above, Owens & Minor’s actions are already bearing very positive results. First by generating a results-oriented culture, the company has shown steady improvement in key areas:

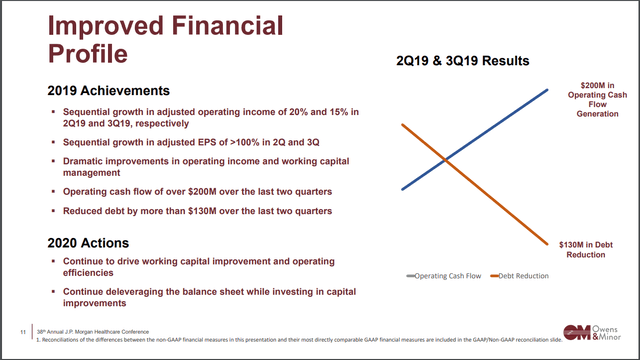

These improvements are already manifesting into improved financial results as evidenced below:

Finally, the company has made very beneficial strategic acquisitions as well as the announcement of strategic divestitures:

FAST Graphs Analyze Out Loud Video: The Resurrection of Owens & Minor

In the video I will illustrate the remarkable financial transformation that Owens & Minor has accomplished over the last few years.

Summary and Conclusions

I hope the reader found this transformation of Owens & Minor Inc. as interesting and as informative as I did. As I stated earlier, my primary purpose for revisiting this extraordinary story is to illustrate how important fundamentals are in the long run. When fundamentals weakened, shareholders suffered, and when fundamentals strengthened, shareholders were rewarded. As a result, I personally found this one of the most fascinating double digit returns stories I might have ever witnessed. This is a true feast to famine to feast story.

Although Owens & Minor is no longer an interesting dividend growth stock, it could reemerge into one again. However, for now the company has morphed from a dividend growth stock to a turnaround, to potentially the long-term high growth opportunity. Perhaps the future might be even more interesting than the recent past has been. Nevertheless, if long-term growth is your objective, you might want to take a deeper look at the reemerging Owens & Minor Inc.

Try FAST Graphs for FREE Today!

Disclosure: Long ABC, CAH

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

The post Owens & Minor: A Treacherous Path To 10% Returns appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.