By Jacob Wolinsky. Originally published at ValueWalk.

The Results are in: Global Investors and Directors Respond to Climate Change Issues

Q3 2020 hedge fund letters, conferences and more

Millstein Center & LeaderXXchange Global Climate Survey Reveals

Investors Respond To Climate Change Issues – Introduction

Changes in the global climate are having profound impacts on business operations, governance, and organizational management around the world. Boards of directors are searching for ways to account for these changes as they help guide their organizations, and investors are increasingly concerned about how these changes might impact their portfolios.

According to some, climate change is “on the top of investors’ 2020 sustainability agendas for engaging with boards of the companies they invest in.”2 A key component of this competency, likely to be a significant question of corporate governance in the coming years, is climate risk management. Companies, investors, regulators, and other key market players must all be part of the conversation around how climate risks should be managed, disclosed, and incorporated into business strategy.

About the Survey

This global survey, conducted by a team of researchers at the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School and experts at LeaderXXchangeⓇ, seeks to understand how—if at all—institutional investors and board directors incorporate climate-related issues in their investment decision making and their oversight responsibilities, respectively. It is the first global survey of its kind targeting both investors and directors to probe their responses on climate risk management using two tracks aggregated in a single survey.3 You can find the full report on our findings here.

One of our goals in conducting the survey was to understand and assess how environmental, social, and governance (ESG) issues impact investment and boardroom decisions. The survey collected data on a broad range of topics, including demographic information of respondents and their views on:

- materiality of climate change issues

- extent of training on climate change issues

- disclosure of climate risks

- climate risk management and board oversight

- engagement and proxy voting on climate-related issues

The survey was conducted over three months in Summer 2019, during which the Millstein Center and LeaderXXchangeⓇ each contacted relevant organizations within their networks to help disseminate the survey to directors and investors globally. Both organizations also invited individual investors and directors within their networks to anonymously complete the survey. Most respondents were based in Europe and North America.

Demographics of Survey Respondents

- There were more than 130 respondents: approximately 40% directors and 60% investors from Europe (including UK) and North America.

- A high level of disclosure by respondents provided excellent demographic insights: over 90% of respondents shared their age and gender. The survey responses also exhibited near gender parity with 53% female respondents, as well as a broad age distribution with 19% of respondents under 35 years of age, 34% of respondents between 35 and 50 years of age, 33% of respondents between 50 and 65 years of age, and 11% older than 65 year of age.

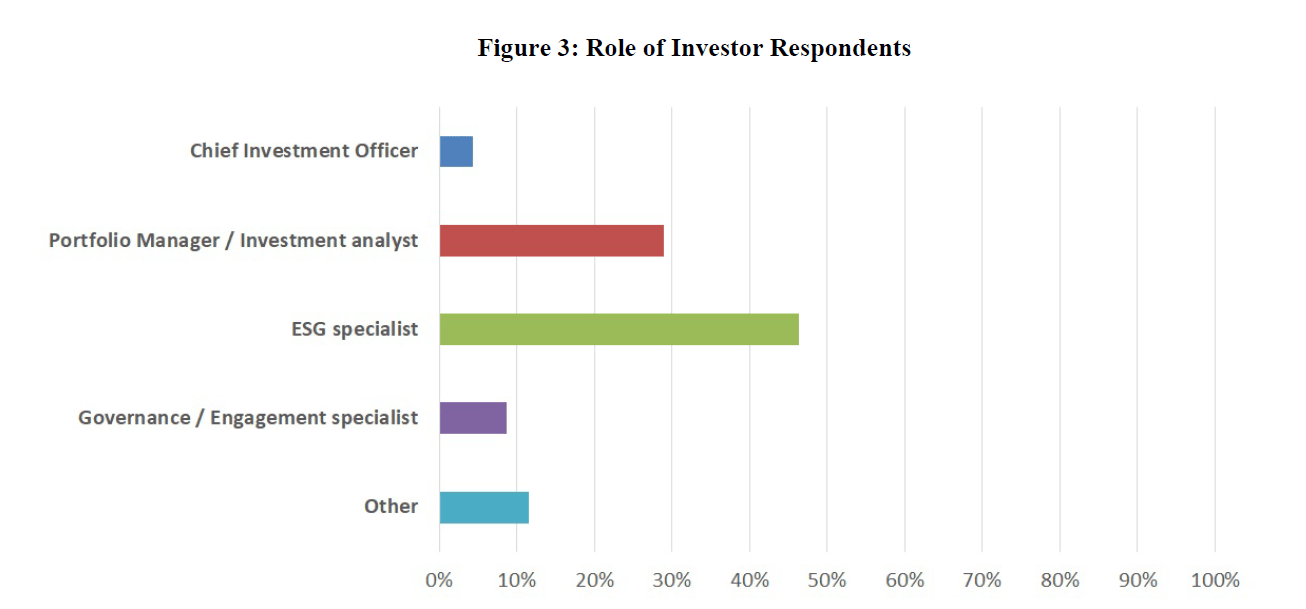

- A diverse range of investor roles is represented among the survey respondents: from analysts, ESG specialists, governance / engagement specialists, and portfolio managers to Chief Investment Officers.

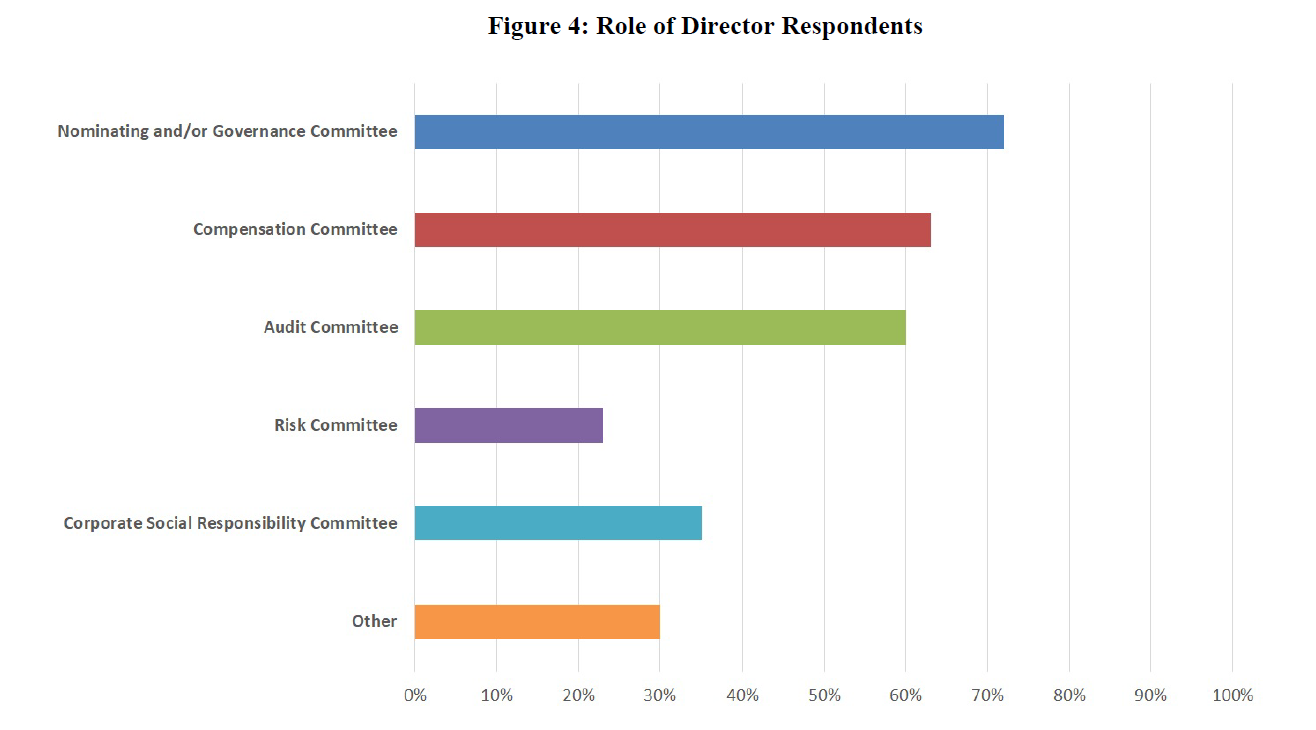

- There is also a broad range of director roles and committees represented in the survey respondents: from Board Chairs and Lead Independent Directors, to members of the audit, risk, compensation, nominating, and/or governance, and CSR/sustainability committees.

Key Findings

Views of Investors and Directors on the Materiality of Climate Change Issues

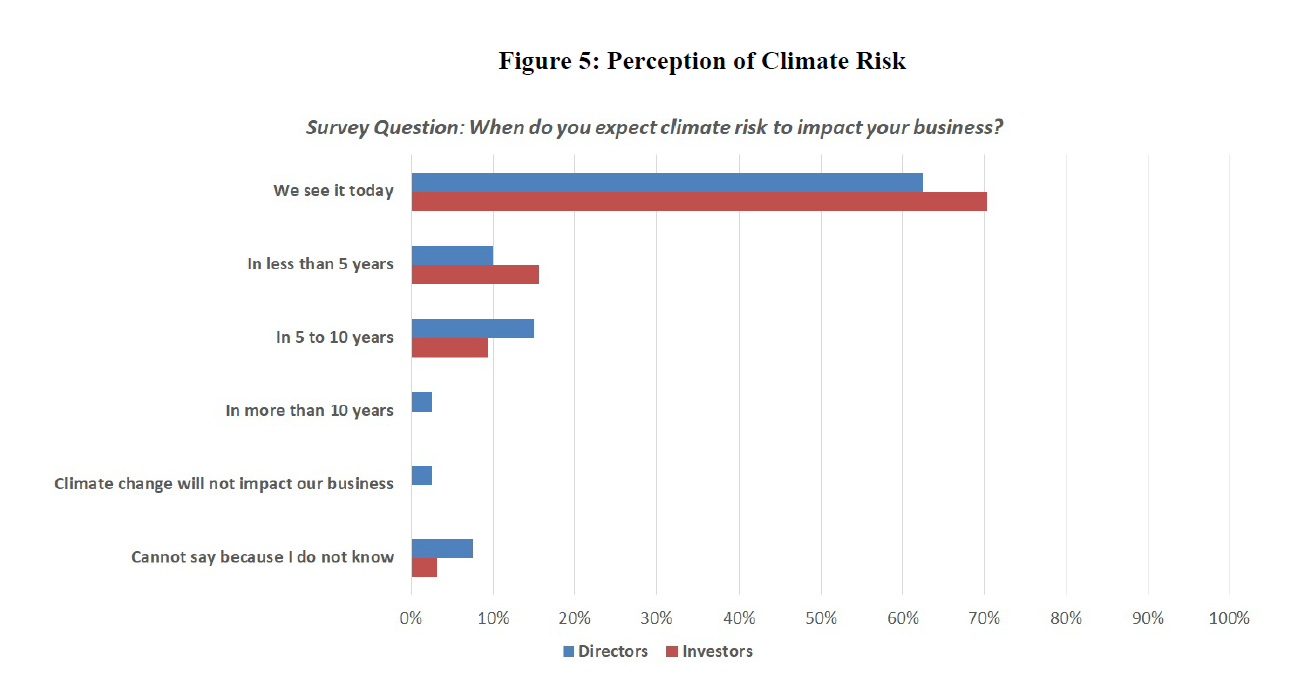

- Responses suggest that both investors and directors believe climate change issues are material, with more than 60% of directors and 70% of investors indicating that climate risk is already impacting their business today.

- According to survey respondents, the main reasons for incorporating climate risks into strategy and investment decision making are that doing so: (i) helps identify business and investment opportunities, (ii) helps manage risk, and (iii) is the right thing to do.

Views of Investors and Directors on Training on Climate Change Issues

- A majority of both investors and directors developed expertise on climate change by following current events and news reports in the media, reviewing publications by scientists and think tanks, and reading company CSR or annual reports. However, more so than directors, investors also turned to sell-side reports and reports from ESG rating agencies as their preferred source of information.

- The results show that investors and directors obtain their knowledge and expertise through both internal and external sources. Not surprisingly, investors were more heterogeneous than directors in the variety of means through which they receive information about climate change (including internal trainings organized by their investment firms and external trainings).

Views of Investors and Directors on Climate Disclosure

- Very few respondents considered climate risk reporting to be more important or much more important than financial reporting.

- Investors seem to find more value in receiving climate-related disclosure than Moreover, they appeared less receptive to boilerplate climate change disclosure, preferring that companies explain why climate change is material and how it affects their business operations, quantify its impacts, and disclose specific targets they set themselves.

- The TCFD (Task Force on Climate-related Financial Disclosures) recommendations are gaining traction among investors: more than 50% of investor respondents in both North America and Europe are already asking companies to follow them.

Views of Directors on Climate Risk Management and Board Oversight

- Climate appears to be an important topic for boards as well, with more than 40% of director respondents indicating climate-related topics are discussed annually by the Board, while 30% of directors indicated they are discussed Moreover, nearly 30% of director respondents believe boards need to have a non-executive director with climate expertise.

- Our survey supports LeaderXXchangeⓇ prior findings that the board receives climate-related information primarily from the head of CSR/Sustainability, to a lesser extent from the General Counsel/Corporate Secretary, and almost never from Investor Relations. Approximately a quarter of directors indicated that no one reports to the board on climate- related topics.

- According to director respondents, investor engagement on climate-related issues takes place primarily at the CEO level and Investor Relations level. This finding is also in line with prior LeaderXXchangeⓇ findings showing that engagement does not take place on the CFO More than 20% of directors indicate that engagement also takes place at the board level, mainly with the lead independent director.

Views of Investors on Stewardship

- The survey suggests a shift in investor interest on climate topics. Investor respondents said that engagement with companies on climate topics is increasingly done not only by ESG or investor engagement specialists, but also by mainstream portfolio managers and analysts.

- Even the Chief Investment Officers of asset managers and asset owners (such as pension funds) have begun to engage companies, suggesting the importance of climate topics for the investment industry.

- Investor respondents communicate the importance of climate-risk issues with their portfolio companies in various ways, mainly by (i) engaging with management, (ii) submitting or supporting shareholder proposals and/or voting against management, and (iii) engaging board directors in a Almost 65% of investor respondents indicated they engage directly with board directors.

Variation by Age and Gender

- Our survey suggests that interest in climate-related issues is correlated to age: the younger the respondent, the greater the interest in climate-related issues.

- Our survey results support findings of other academic research studies that suggest that women are more engaged on climate-related issues than men. However, the gender gap narrows as respondents get younger, particularly under the age of 35.

- The younger the directors, the higher their expectations in terms of corporate disclosure on climate-related issues according to our survey findings. Younger directors appear to prefer standardized and mandatory reporting on climate, would like to have climate risks and opportunities incorporated in an integrated report, and believe that companies should conduct a climate scenario analysis.

- Our survey also identified a gender gap in terms of corporate disclosure on climate-related issues, with female directors expressing higher expectations for climate disclosure as compared to their male peers.

- On the investor side, however, the gender gap appears to be smaller or even nonexistent. One potential explanation is the relatively larger proportion of young respondents among male investor respondents. As younger investors tend to be more engaged in climate-related issues (across the board), gender effects seem to abate substantially for this group.

Variation by Region

- Our survey suggests the interest in climate-related issues is dependent on the region. Investors in Europe seem to have a higher interest in climate-related issues.

- When comparing the findings on the regional level, we find that European investors have higher expectations than North American investors in terms of corporate disclosure on climate-related issues. They more strongly prefer standardized and mandatory reporting on climate as well as integrated reports showing both climate risk and opportunities, and they believe that companies should conduct a climate scenario analysis.

Conclusion

This global survey of directors and investors by LeaderXXchangeⓇ and the Millstein Center supports prior research findings by LeaderXXchangeⓇ and others that there are several demographic and regional differences in directors’ and investors’ expectations around climate-related issues and disclosure. Generally speaking, younger respondents, European respondents, and female respondents appear to have greater interest in climate issues and/or expectations for corporate disclosure. The survey also provides insights into how boards and companies are engaging on climate issues internally and externally. We believe that these findings deepen our understanding of how directors and investors take climate- related issues into account in their boardroom and investment decision making, respectively, and how their views may differ across demographic and regional groups.

We hope to be able to augment this survey in the months and years ahead to consider how investor and director views are evolving, particularly with the onset of the worldwide COVID-19 pandemic (which has spawned a lively debate about whether to accelerate or rein in the reconsideration of stakeholder governance).

Authors

Kristin Bresnahan, Jens Frankenreiter, Sophie L’Hélias, Brea Hinricks, Nina Hodzic, Julian Nyarko, Sneha Pandya, and Eric Talley1

Acknowledgements

We thank the LeaderXXchange Investor-Director ESG Working Group members for their contributions to the survey. Led by Sophie L’Hélias and Nina Hodzic, the Group was comprised of Investor members Matt Christensen, Natacha Dimitrijevic, Sonia Fasolo, Michael Herskovich, Lee Qian; and Director members Isabelle Azemard, Florence von Erb, Eliane Rouyer-Chevalier, Diane de Saint Victor, and Ulrike Steinhorst.

Note: The results presented above represent a selection of findings based on observational survey data. They do not represent a comprehensive discussion of the survey results, and it can also not be excluded that they are at least partly the result of decisions by LeaderXXchangeⓇ and the Millstein Center in designing and evaluating the survey. Lastly, due to the open nature of the survey, the representativeness of the sample of survey participants is not guaranteed.

The post Global Investors Respond To Climate Change Issues appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.