By David Pinsen. Originally published at ValueWalk.

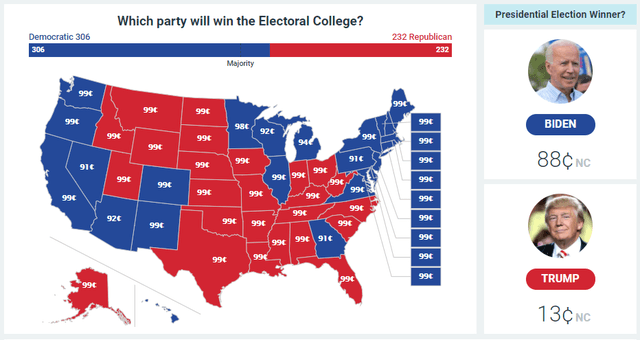

PredictIt odds on the Presidential election, as of Tuesday night.

Q3 2020 hedge fund letters, conferences and more

Two Weeks Later

It’s been two weeks since Election Day, and more than a week since the major networks called the election for Joe Biden. Nevertheless, President Trump has not conceded. As of Tuesday night, PredictIt gave Trump a 13% chance of winning reelection in the Electoral College. In other words, we have a contested election.

The Market Doesn’t Mind

At the end of September, the New York Times warned about the prospect of a contested election. After reading their warning, I posted the YouTube video below showing investors how to hedge against that risk.

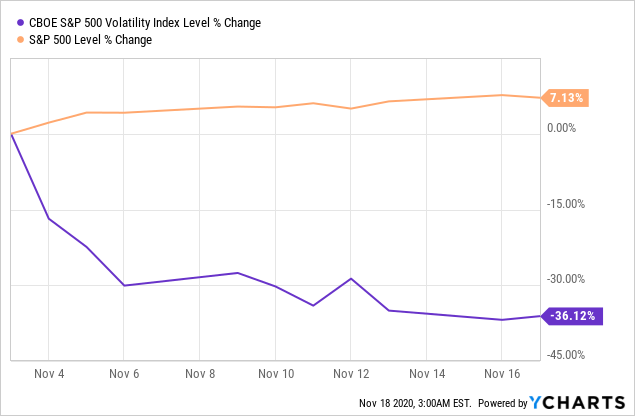

And yet, since the election, the S&P 500 is up and its volatility has plummeted.

Neoliberalism Versus Populism

In hindsight, the market reaction since the election is understandable. There are significant differences between Biden and Trump on immigration and foreign policy, for example, but both are basically corporate-friendly. President Trump may be a populist, but the first major legislation he signed included a cut in the corporate income tax rate. Joe Biden may have been endorsed by the socialist Senator Bernie Sanders, but as Jacobin Magazine lamented this week, Biden has no plans of offering him a cabinet spot.

Joe Biden is signaling he has no intention of offering cabinet slots to Bernie Sanders or Elizabeth Warren. It’s the latest sign that the Biden team is planning to govern from the extreme center—and that we’ll have to push him to win any progressive gains. https://t.co/OM8sl8bwuo

— Jacobin (@jacobinmag) November 17, 2020

Instead, Biden’s transition team, as Nathan Robinson points out below, includes executives from such socialist outposts as Lyft (LYFT), Amazon (AMZN), Uber (UBER), JP Morgan (JPM), Visa (V), and Capital One (COF).

unsurprisingly Biden’s transition team includes executives from Lyft, Airbnb, Amazon, Capital One, Booz Allen, Uber, Visa, JPMorgan https://t.co/AW1fXm1Nue

— Nathan J Robinson (@NathanJRobinson) November 10, 2020

Capital Won

It’s notable that Biden has tapped executives from Uber and Lyft, in particular. His running mate Senator Kamala Harris‘s sister works for Uber, and Senator Harris’s brother-in-law led the fight against California’s Proposition 22, which would have given labor protections to Uber and Lyft drivers, along with other gig workers.

How involved were Kamala Harris’

brother-in-law Tony West & niece Meena Harris through Uber with Prop 22?Asking due to Harris’ pro-organized labor stance during her Campaign. pic.twitter.com/dOdOdFne4x

— hopeful but realistic (@DumbTweetsDumb1) November 17, 2020

June 4th Cohort: Putting Money To Work Now

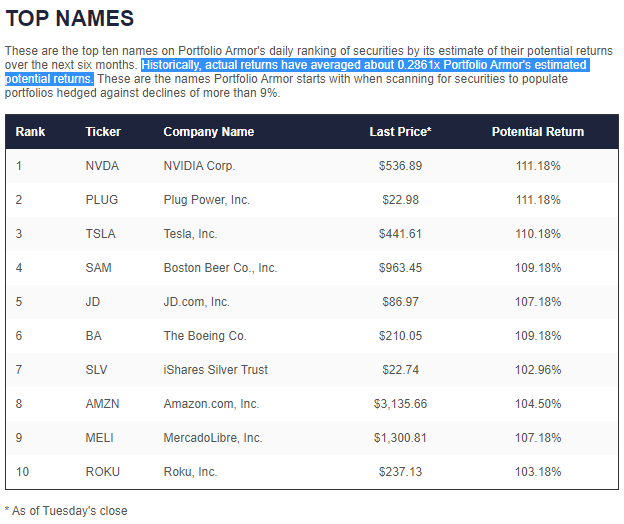

Below are Portfolio Armor‘s current top ten names, as of Tuesday’s close.

Our Top Names as of November 17th.

Those are the securities our site estimates have the highest return potential over the next six months, net of hedging cost. It estimates returns by analyzing past returns as well as forward-looking options market sentiment.

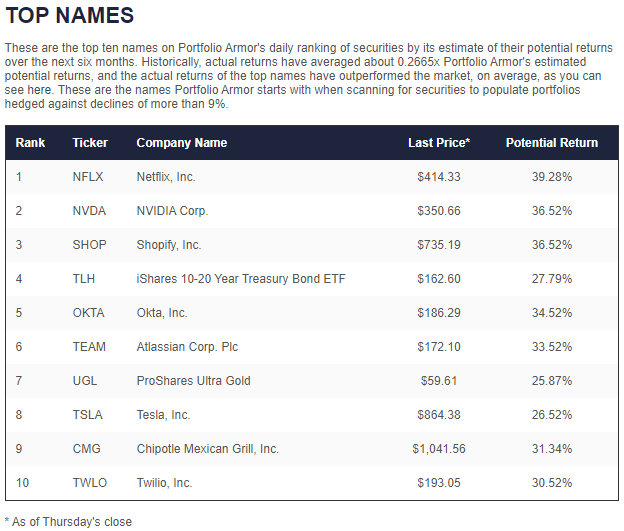

Two of Tuesday’s top names, Nvidia (NVDA) and Tesla (TSLA) were also top names in our June 4th cohort.

Our Top Names as of June 4th.

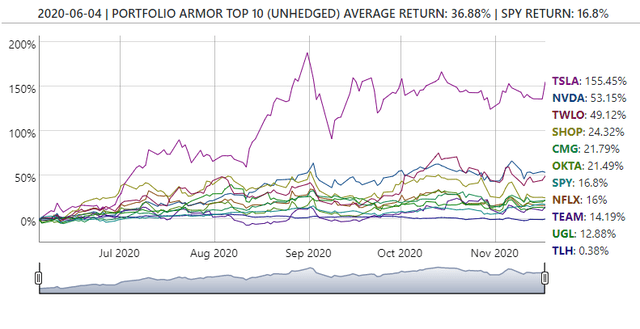

Here’s how that June 4th cohort has performed since.

As you can see, Tesla and Nvidia were the top performers from our June 4th cohort. You can use our app to scan for optimal hedges for Tesla and Nvidia in case we’re wrong about them this time.

The post Post-Election Update appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.