By Jacob Wolinsky. Originally published at ValueWalk.

Whitney Tilson’s email to investors discussing the market melt-up; more bull-bear debate on Tesla Inc (NASDAQ:TSLA).

Q3 2020 hedge fund letters, conferences and more

The Market Melt-Up

1) Stocks had an incredible November…

The Dow Jones Industrial Average was up 11.8% – its best month since early 1987 – while the S&P 500 Index and Nasdaq Composite Index rose 10.8% and 11.9%, respectively – their best gains since April.

I wasn’t surprised by the market’s post-election reaction – in my October 27 e-mail, I wrote:

All eyes are focused on the election a week from today… and a lot of people are losing their minds – panicked at the consequences if their candidate/party loses.

This fear isn’t entirely irrational, as this election will indeed have major, lasting implications for many important issues.

But when it comes to the stock market, I urge you not to panic – either today or after the election – because I think stocks are going to do fine, no matter what happens…

I was surprised, however, by the magnitude of the gains. But my colleague Enrique Abeyta wasn’t – he’s been pounding the table on his melt-up theme ever since the webinar he and I did right at the market bottom in the third week of March, when we said it’s “the best time to be an investor in more than a decade.”

Bull-Bear Debate On Tesla

2) After its extraordinary run over the past year, electric-car maker Tesla (TSLA) closed yesterday with a market cap of $538 billion – making it the sixth-most valuable company in the U.S. – trailing only tech giants Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB).

For any company to warrant such a high valuation, it must be extremely profitable or extremely rapidly growing – ideally both.

Tesla certainly fails the first test, as it’s barely profitable – and not from making cars, but rather selling zero-emission vehicle and other regulatory credits.

But at least it’s growing super fast, right?

Well, as with seemingly everything about Tesla, bulls and bears disagree…

The bulls argue that even with its main factory in Fremont, California, closed for two months and its new Giga Shanghai one shuttered for a month, Tesla is on track to sell a half a million cars this year, up 36% from 2019. Plus, the company is likely to sell 867,000 cars in 2021, up another 73% (estimates from @TroyTeslike – his full spreadsheet is here).

On the other hand, Tesla bears argue that this growth is driven by launching new models and opening new factories, which is masking the reality that sales of Tesla’s “mature” products – the Model S, X, and 3 – are declining in its most mature markets: the U.S. and Europe.

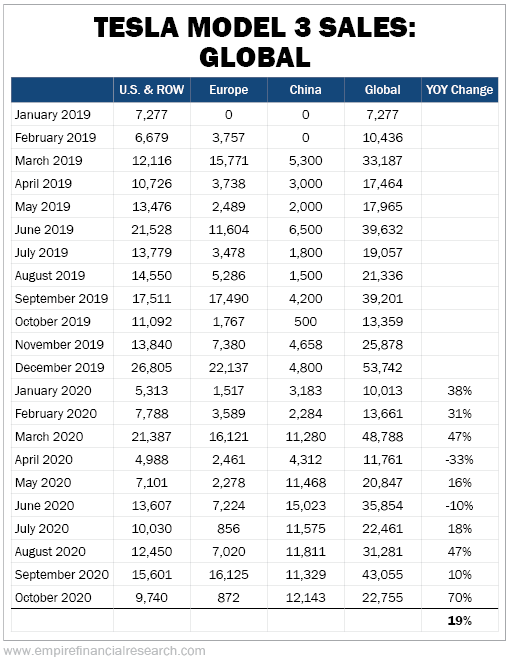

Let’s look at the data for the Model 3, which accounted for 73% of the cars that Tesla sold in the first three quarters of this year. This table (provided to me by a friend – here’s his source) shows unit sales, broken down by region, from January 2019 through October of this year (the latest period available). Note that U.S. data are hard to get, so those numbers are lumped in with the rest of world (“ROW”):

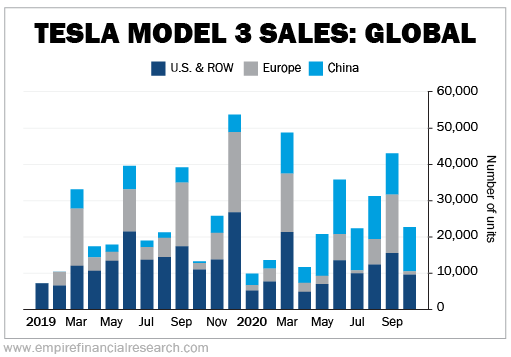

Here’s a chart of this:

At first glance, the numbers look decent: Tesla sold 19% more Model 3s in the first 10 months of this year relative to the same period last year. Then, add in rapidly growing sales for the new Model Y, and the growth story gets even more exciting, right?

But when you break down sales by the three regions, you can see that Model 3 sales are actually declining in the more mature markets (U.S./ROW and Europe), and this is being masked by China sales as the new Giga Shanghai factory ramps up.

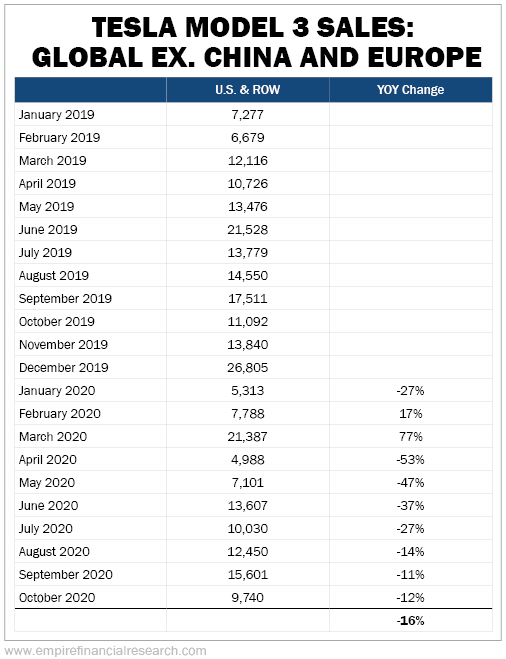

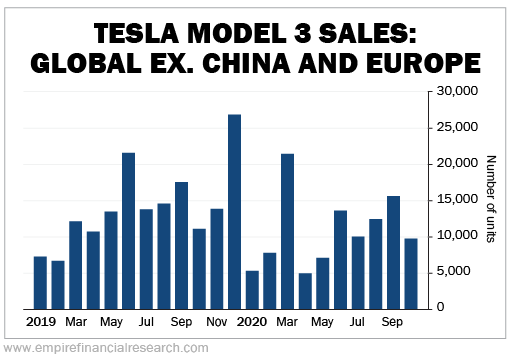

Let’s first look at the U.S./ROW (the U.S. accounts for roughly 80% of this):

Here’s the chart:

As you can see, total sales are down in eight of the 10 months this year, for a total of negative 16%.

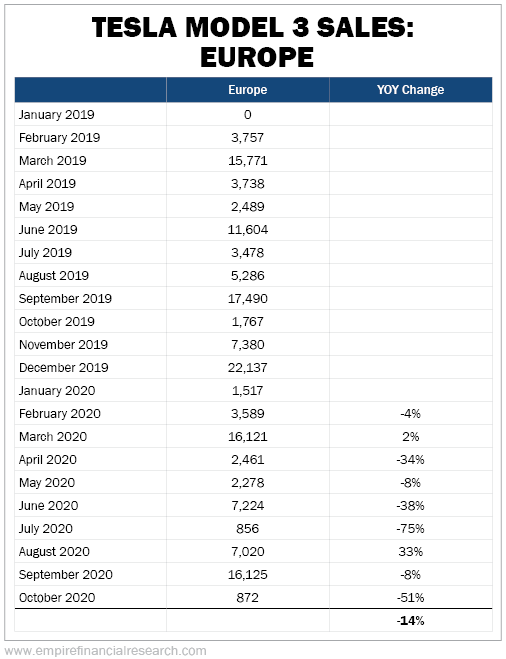

In Europe, it’s almost as bad:

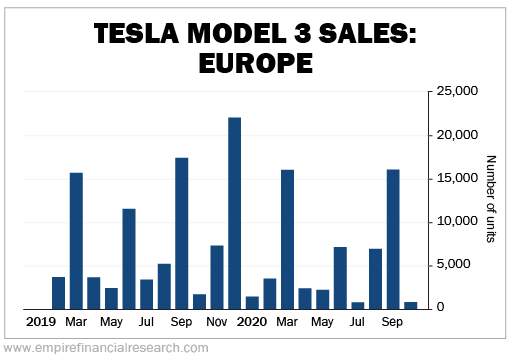

Here’s the Europe chart:

Sales are down in seven out of the nine months, for a total of negative 14%.

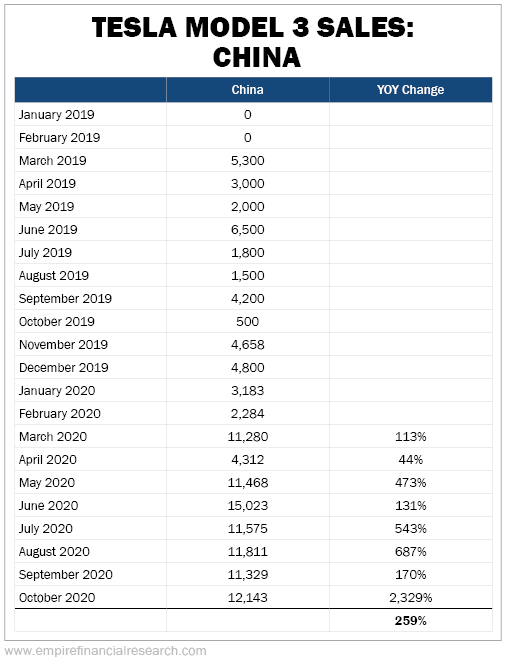

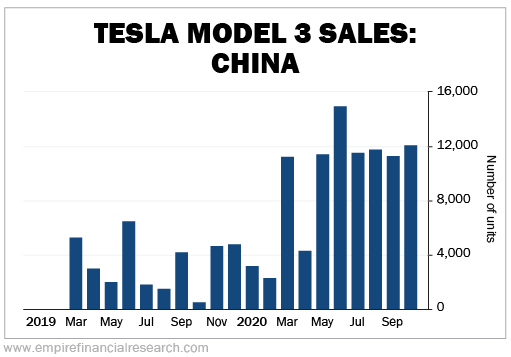

The only growth area is China, which isn’t surprising given that Tesla was starting from zero:

And here’s the China chart:

It will be a challenge for Tesla to maintain growth in China when it has competition from literally hundreds of local companies.

In conclusion, Tesla has become one of the most valuable companies in the world due almost entirely to its growth story – and indeed, at first glance, its growth has been impressive.

However, the most impressive kind of growth comes not only from new products in new markets, but also from steadily increasing “same-store sales,” to use a metric common among retailers.

Costco Wholesale (COST) is a great example. Though it’s been around for more than 37 years, in the past five years, the bulk retailer has grown revenue at a healthy 7.9% annually in two ways: growing store count by 3.2% annually, while at the same time increasing same-store sales by an average of 6% each year. Investors wouldn’t value Costco’s stock nearly as highly if sales at its mature stores were stagnant (or, worse yet, declining).

Yet that appears to be the case with Tesla. Sales of Tesla’s primary car, the Model 3, are actually in double-digit decline everywhere in the world except for China.

I am not advocating shorting the stock – I’ve seen too many of my friends get run over – but those who’ve had a wonderful ride on this rocket ship might want to bank some profits, especially if it’s in a tax-free account…

The post More Bull-Bear Debate On Tesla Inc (TSLA) appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.