By Jacob Wolinsky. Originally published at ValueWalk.

According to a newly released analysis from 451 Research, M&A multiples have never been higher for a flashy few. However, most tech targets are facing a four-year low in valuations, since many acquirers have yet to fully recover their buying power.

Q3 2020 hedge fund letters, conferences and more

Tech M&A: A Steep Drop From The Top

By Scott Denne, Senior Research Analyst covering Tech M&A

451 Research, part of S&P Global Market Intelligence

A surging US stock market, a cadence of IPOs with double- and triple-digit revenue multiples, and record valuations in 10-figure acquisitions create the impression that prices are rising throughout the tech market. Indeed, multiples have never been higher for a flashy few. However, most tech targets are facing a four-year low in M&A valuations, since many acquirers have yet to fully recover their buying power.

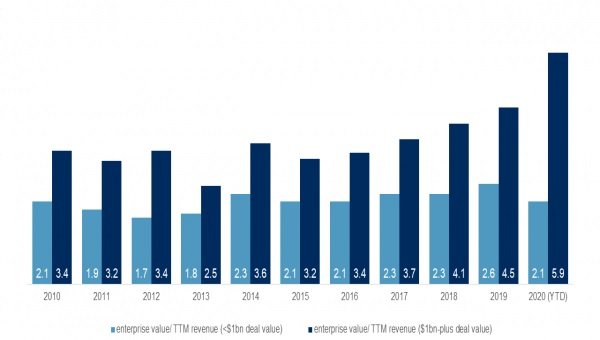

According to 451 Research’s M&A KnowledgeBase, the median multiple for tech acquisitions worth less than $1bn (97% of all tech M&A) fell to 2.1x trailing revenue this year, half a turn lower than 2019. By contrast, deals above that mark fetched a median 5.9x, the highest level we’ve recorded. Just as COVID-19 has struck unevenly – restaurant workers and the elderly have had a harder time of it than most – certain categories of buyers haven’t recovered as well as tech’s top names.

Valuations Sink in Sub-$1Bn Tech M&A Deals

Source: 451 Research’s M&A KnowledgeBase, S&P Global Market Intelligence

Strategic acquirers that trade on the Nasdaq and NYSE are paying roughly the same this year (3x median) as 2019 on all their sub-$1bn trades. This group continues to pay occasional premiums, highlighted by two recent deals at premium prices, as their own valuations continue to rise:

- Electronic Arts topped Take Two’s bid for gaming company Codemasters, valuing the target at more than 6.5x. The typical video game developer would have gotten 1.6x over the last 24 months, our data shows. Both would-be buyers’ share prices are up more than 30% in the year, according to S&P Market Intelligence.

- PTC paid $715m, or 14x this year’s revenue, for Arena Solutions in its largest-ever deal. The acquisition follows a 52% surge in PTCs stock price over the last 12 months, according to S&P Market Intelligence.

Yet acquirers that trade on other exchanges are dragging down prices for most other sub-$1bn tech deals. And those acquirers print almost as many tech purchases as their Nasdaq- and NYSE-traded counterparts. According to 451 Research’s M&A KnowledgeBase, buyers from international exchanges printed 745 tech acquisitions so far this year, 20% more than they did in all of 2019 and just 50 fewer than buyers on the major US exchanges. Despite the increase in prints, those purchasers more often lack the ability or inclination to pay up for their targets.

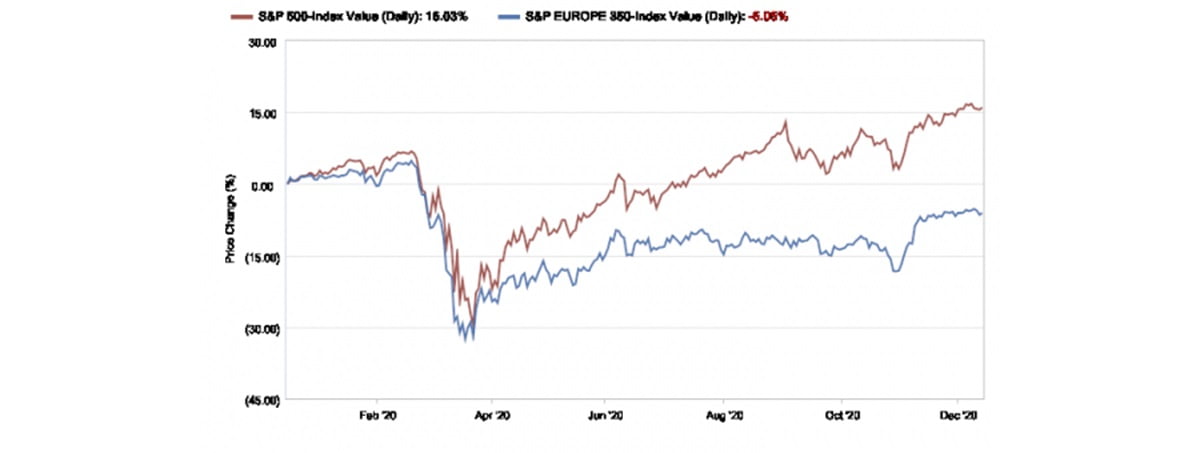

The recovery in US-listed stocks has bolstered M&A valuations by giving those buyers additional currency for M&A and helping them justify higher prices. But that recovery hasn’t extended to all global markets and all acquirers. According to S&P Market Intelligence, the S&P 500 is up 16% from its year-ago level, while the S&P Europe 350 index, for example, has lost 6% and still sits below its pre-pandemic level.

Stock Surge in US Markets

Source: S&P Global Market Intelligence

The post New S&P Tech M&A Review Analysis: A Steep Drop From The Top appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.