By ActivistInsight. Originally published at ValueWalk.

Hello from Insightia, and welcome to your new Tuesday newsletter. Below you will find everything you loved about What’s New in Activism, along with new additions on the latest in proxy voting, and more essential statistics presented by Insightia.

Q3 2020 hedge fund letters, conferences and more

What’s New In Activism: Pershing Square Holdings Rises 70.2%

Some activists celebrated market-beating returns in 2020, likely ensuring they will enter the new year with fresh confidence. Bill Ackman’s publicly listed fund Pershing Square Holdings enjoyed its best-ever return for the second year in a row, rising 70.2% net of fees and gaining access to the FTSE 100. Activist Insight understands there was also cause for celebration reported at Glenn Welling’s Engaged Capital which returned 51% and Blackwells Capital, which broke out its activist fund returns for the first time and registered 32%.

Meanwhile, Daniel Loeb’s Third Point Offshore Investors fund completed a turnaround to end the year with a 23.7% return, after being down 6.6% in June 2020. Loeb reinstated himself as chief investment officer in May and immediately put in place a recovery strategy. The fund’s activist positions were flat for the year, according to a fact sheet on its website.

Sachem Head Capital Management was reported to have notched a 45.6% return by Reuters, while Bloomberg said Elliott Management was up 12.7%.

Activism chart of the week

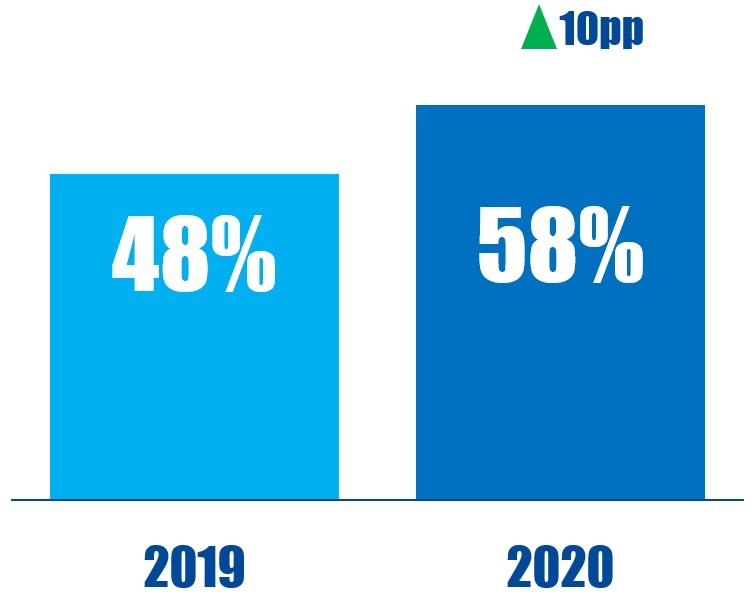

In 2020, 31 (58%) of the 53 board seats gained by activist nominees at Canada-based companies were won in shareholder meetings, compared to 22 (48%) out of 46 board seats in 2019.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting

BlackRock has updated its global proxy voting guidelines for 2021, targeting board diversity in the U.K., director nominations in Asia, and overboarding in the U.S.

Regarding overboarding, U.S. directors are expected to sit on no more than four outside public boards, whilst public company executives and fund managers are expected to sit upon no more than two outside public boards. U.S. directors and committee members will also be opposed by the asset manager, where a director has poor attendance in a single year with no disclosed rationale.

In the U.K., BlackRock will expect companies to meet or be on path to meeting targets of the Hampton-Alexander Review and the Parker Review to ensure appropriate diversity at board level. A full breakdown of BlackRock’s policy changes can be accessed here on our profile page for the asset manager.

Proxy chart of the week

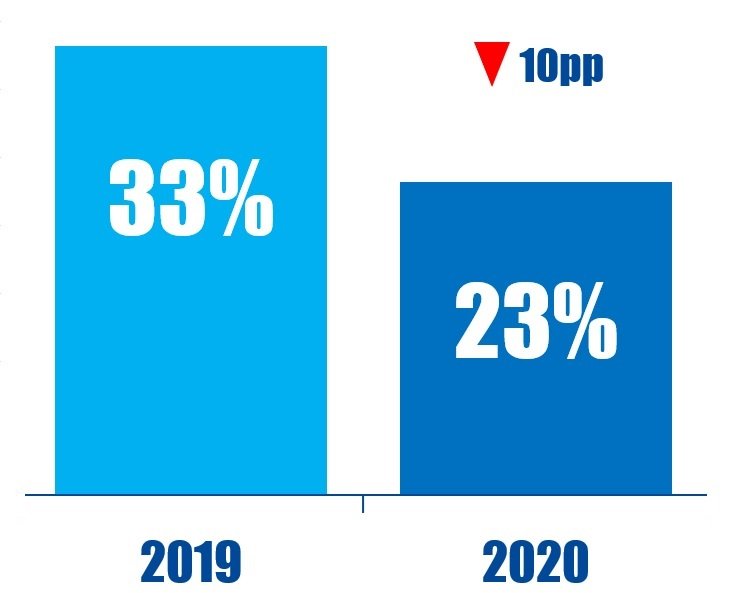

In 2020, average support for environmental shareholder proposals at U.S.-based companies was 23% compared to 33% in 2019.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts

Spruce Point Capital Management accused advertising platform Magnite of inaccurate financial reporting to mask financial struggles and called for CEO Michael Barrett and Chief Financial Officer David Day to resign.

The two companies that merged to form Magnite in 2020, Telaria and Rubicon, were struggling with business and accounting issues prior to the combination, according to Spruce Point. In a Thursday report, it noted the merger was “predicated on cost, and not revenue synergies,” and claimed Telaria’s capex reporting was “mathematically impossible” prior to the merger. Magnite’s share price had fallen over 12% by 11.33 a.m. EST Thursday morning, upon publication of the report.

Shorts chart of the week

In the whole of 2020, there were 158 public activist short campaigns, down from 172 in 2019.

Source: Insightia (Activist Insight Shorts)

Quote of the Week

This week’s quote comes from Jim Rossman, head of shareholder advisory at Lazard. We spoke with him for our recent in-depth article about the impact of the COVID-19 pandemic.

“It’s not just that we know where we stand, it’s that the tectonic plates have shifted. There are new winners, new losers and serious disruptions taking place for business models. If you’re being too conservative in adapting to the new environment, you’re a target that maybe two years ago [you] would never have been.”

The post Ackman’s Pershing Square Holdings Rises 70.2% appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.