By Jacob Wolinsky. Originally published at ValueWalk.

Arquitos Capital Management commentary for the fourth quarter ended December 2020, discussing the risk of permanent capital loss.

Q4 2020 hedge fund letters, conferences and more

“Remember that you are a Black Swan.” – Nassim Nicholas Taleb

Dear Partner:

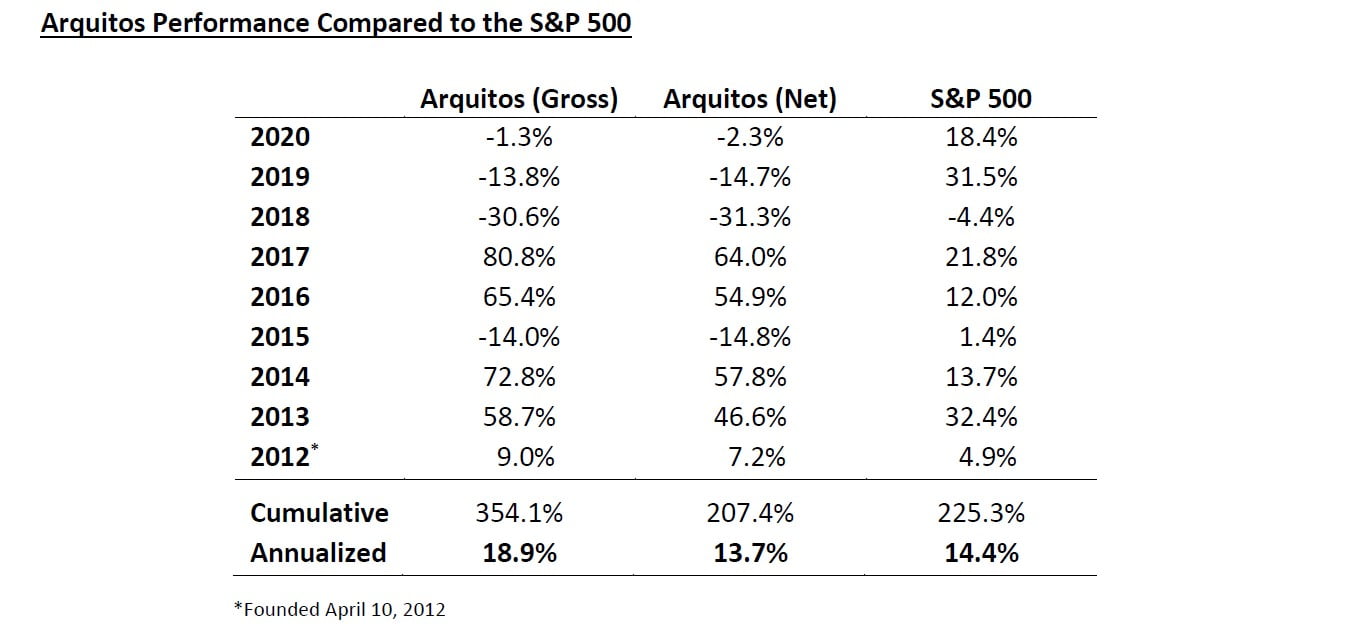

Arquitos recorded a strong fourth quarter, returning 28.0%. Unfortunately, it wasn’t quite enough to pull us positive on the year, as we ended 2020 with a return of -2.3%.

A Heads I Win; Tails I Don’t Lose Much Situation

In last quarter’s letter, I discussed the need to be more nimble with the portfolio. Since writing that, we have opened a sizeable position in a new company. This investment involves a special situation where I expect a resolution by April, and hopefully sooner. Shares have run up about 35% since I opened the position, but I believe there is much more room to run. We also own a small number of call options that have cumulatively returned 145%. Most of these gains occurred in January.

Since I would like to continue to increase the position size, I am going to keep the name of the company under wraps for now. At a high level, this investment involves a significantly undervalued real estate company going through an activist situation. While it was a company I had casually followed for the better part of a decade, I was introduced to the current situation by a fellow portfolio manager in early November.

The company has consistently traded higher than its current price over the last four years, and intrinsic value has increased over that time period. Insiders seem to believe that the value is much higher, as well. The controlling shareholder initiated and participated in a private placement just four months ago at a price 35% higher than today’s current price. Shares should trade at that price at an absolute minimum, and realistically should trade much higher, no matter the outcome from the activist situation. In fact, that same shareholder bought a block of shares nearly three times higher than today’s price in mid-2017, spending more than $100 million.

The activist investor believes shares are worth six times where they currently trade. They are challenging the recent private placement. A trial to attempt to resolve the matter is set to commence in late January. There is a range of positive outcomes. A buyout offer from any of the large shareholders would be much higher than today’s price. A win by the activist would put upward pressure on the stock price, as the activist would gain leverage for greater board representation. Even a loss by the activist in court would remove uncertainty and should cause shares to approach the level of the recent private placement.

This is a classic, “heads I win; tails I don’t lose much.” In fact, if we can be flexible with our holding time period, the risk of any loss in this situation is extremely low. We already have a nice gain in the position, and I believe there is much more to come.

*******************************

Learning The Right Lessons

Every once in a while, we have a short time period that is seared into investors’ brains for the rest of their lives. In my investing career, we had the housing crisis in 2008, and the tech bubble from 1999-2001. Prior to that, there was the real estate crisis of the early 1990s and the 1987 crash. Older investors were scarred by the 1970s.

It can be a challenge for investors who go through these experiences to learn the right lessons. That is not an easy thing. Often these scars have negative ramifications on future decision-making. In this instance, there is a significant disconnect between the economy and the stock market. The dramatic and quick V-shaped recovery in the stock market was unprecedented. This increase assumes wildly optimistic future results. I am not prepared to assume that optimism for the overall stock market, nor for the economy in the near term.

The stock market has become more and more affected by indexation over the past decade. In-flows and out-flows into index funds and passive strategies have unduly inflated the value of some companies. In other cases, retail-investor enthusiasm has pushed up the value of some companies far beyond what they may reasonably be worth. Unfortunately, many retail investors are learning the wrong lessons from this crisis. Going long (currently) exciting companies at stratospheric valuations is going to prove to be problematic at some point.

People have talked about traditional value investing being out of favor for some time. Actually, it is fundamental investing that is out of favor. Retail investors have pushed up the prices of some companies with no analysis at all. Some institutional investors have contorted their valuation opinions to justify nearly any price for some companies.

This has caused a large bifurcation in the markets. Companies that have exciting stories, yet weak fundamentals, are pushed to extreme valuations. More boring companies with stronger fundamentals trade at the other extreme. I have found more companies that trade below liquidation value today than I have seen since early 2009.

The Possibility Of Permanent Capital Loss

This is an opportunity for us. Fundamentals do matter and will matter in the future. Those investors chasing companies with extreme valuations are taking on extreme risk. We won’t do that. Risk is the possibility of permanent capital loss. While performance results in the portfolio have been weak the last three years, our risk of permanent capital loss is extremely low. These cheap valuations also are the seeds for future outperformance.

I expanded on these thoughts during a roundtable discussion with several of my fellow Willow Oak-affiliated portfolio managers. You may view a video of that discussion at: Willow Oak Asset Management Roundtable Discussion.

I continue to be impressed with my fellow Willow Oak managers. I greatly appreciate their insights, as well as the insights from our directors at Willow Oak’s parent company and our advisors. They have assisted me with analysis, background on specific companies and industries, idea generation, and risk management. The future is bright at Willow Oak, and the valuation of Enterprise Diversified (SYTE) is still reasonable.

Thank you for your continued support during this unprecedented time. We have started 2021 off strong, and we are excited about the prospects for the year.

Best regards,

Steven L. Kiel

The post Arquitos Capital Management 4Q20 Commentary “A Heads I Win; Tails I Don’t Lose Much Situation” appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.